China to see significant growth in responsible and ESG-themed investment

Highlights

- Invesco Fixed Income expects responsible investing to accelerate in China in 2021.

- Recent developments have encouraged Chinese issuers and investors to adopt social investing principles, including growing Chinese government support, large-scale green financing needs, and evidence that ESG-related investments have performed well relative to non-ESG investments.

- Europe and the US have been early adopters of ESG principles, but we expect Asia, and especially China, to gain ground in the coming year.

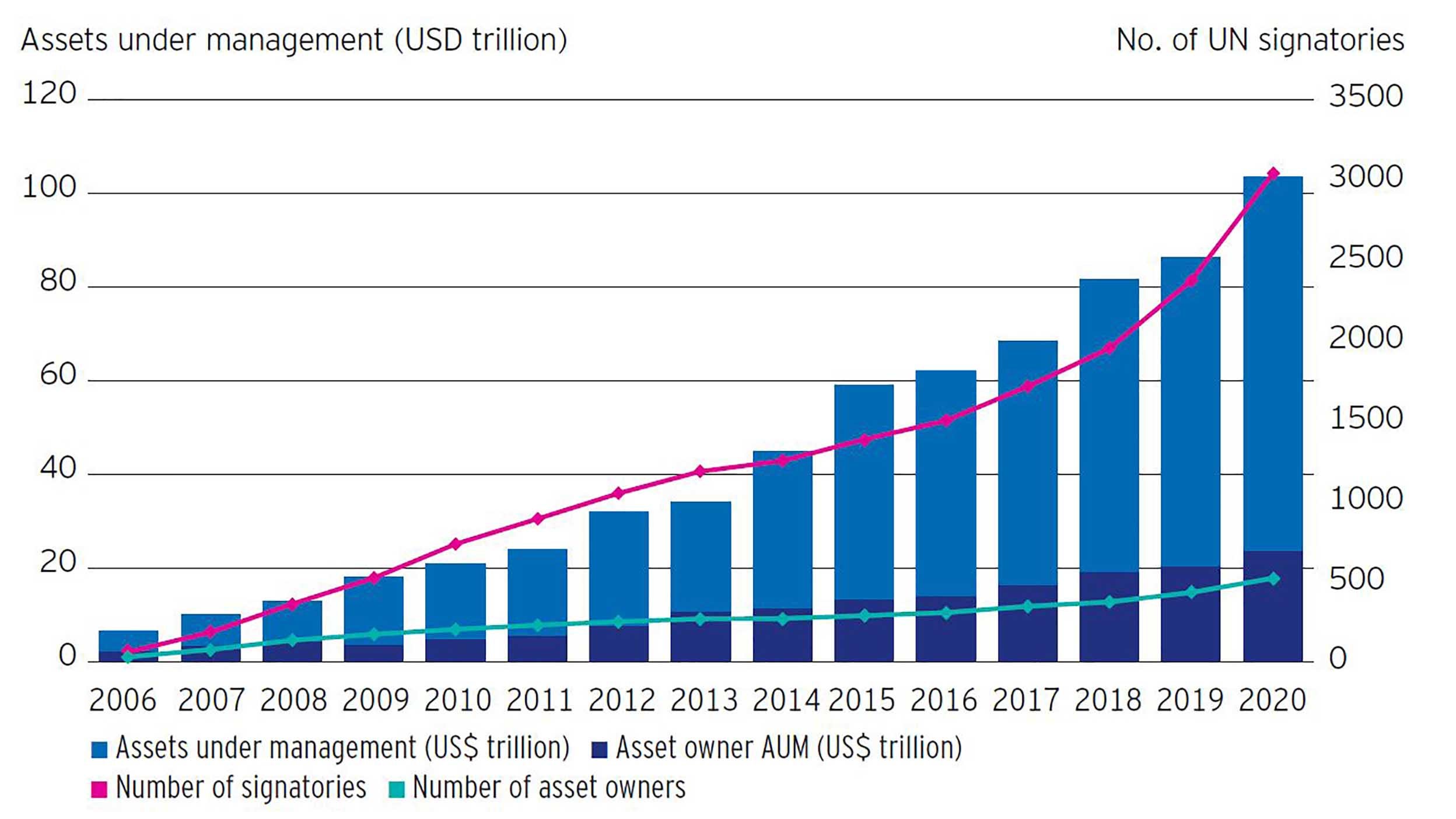

Responsible investment has taken center stage in the global investing and finance arena after years of evolution. The number of global investor signatories to the United Nations Principles for Responsible Investment (UN PRI)1 topped 3000 in 2020, up from 63 in 2006 (Figure 1). Total assets under management represented by the signatories exceeded USD100 trillion in 2020 (Figure 1). We expect responsible investment to grow exponentially in the next few years, reshaping the landscape of the global financial industry. Europe and the US currently play leading roles, but we believe 2021 will be an important year for environmental, social, and governance (ESG) adoption in Asia, especially in China.

In this article, we take a detailed look at the top-down drivers of growth in ESG adoption in China and their potential impact in the coming year.

Key themes for 2021

We have identified three key themes likely to drive momentum in responsible investing in China in 2021:

1. Chinese government and regulator-led efforts will likely gain traction among fixed income issuers and investors.

An estimated USD100 trillion2 of climate-compatible infrastructure investment is required globally between now and 2030 to meet Paris Agreement greenhouse gas emission reduction targets. A large portion of these investments will likely take place in Asia and in China, in particular. We expect 2021 to be an important year in this effort. According to Governor Yi Gang of the People’s Bank of China (PBoC), the value of China’s onshore green lending and green bond issuance reached record levels in the third quarter of 2020, totaling RMB11.6 trillion3 (USD1.8 trillion) and RMB1.2 trillion4 (USD186 billion), respectively.

Chairman Xi Jinping set a key milestone in September 2020 when he announced China’s objective to meet stricter greenhouse gas emission standards by 2030 and intentions to achieve a zero-carbon economy by 2060. This is the first time the Chinese central government has committed to a zero-carbon target. PBoC Governor Yi Gang later stated that China would work to enhance its green finance standards and explore the introduction of mandatory reporting of environmental risks by financial institutions.

These announcements coincided with the government’s mid-year announcement of its economic stimulus package to combat the COVID-19 crisis. It emphasized advancing the adoption of green technology and upgrading urban infrastructure to mitigate the risks of pollutants and contaminants to the general public. Chinese regulators also set a goal for mandatory ESG disclosure by listed companies by the end of 2020, now expected to be 2021 due to the pandemic.

These are major steps toward the development of ESG principles in China and the building of a green financial and clean energy system, especially since China’s state-owned enterprises and central planning play a significant role in the nation’s economic and financial activities. These PBoC and regulator-led efforts could narrow the gap that currently exists between Chinese domestic and international ESG reporting standards, which could attract international ESG investors.

2. Total ESG investment and financing will likely continue to set records globally. The issuance of green bonds will likely overtake the social bond issuance that took place following the impact of COVID-19 in Asia.

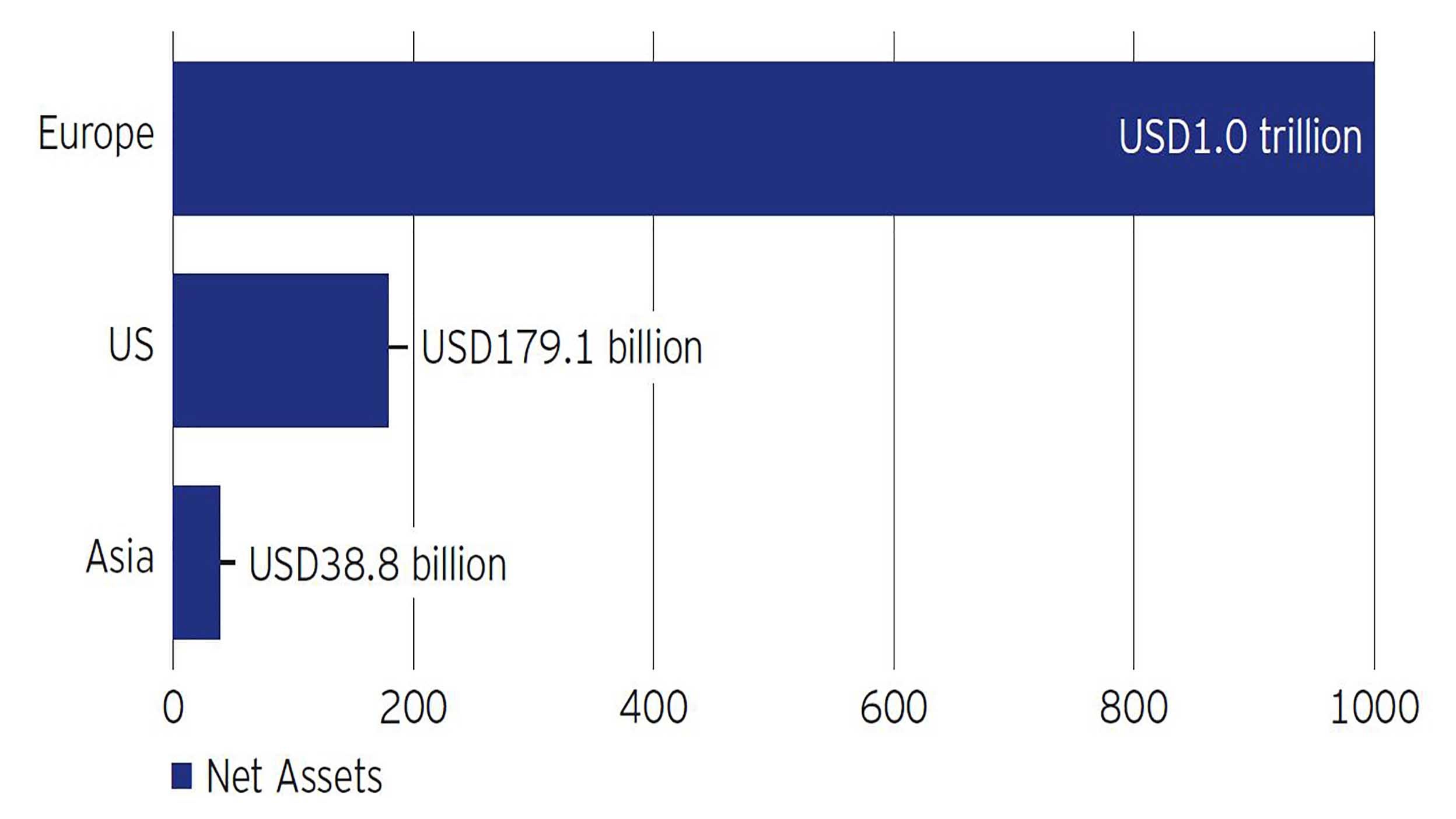

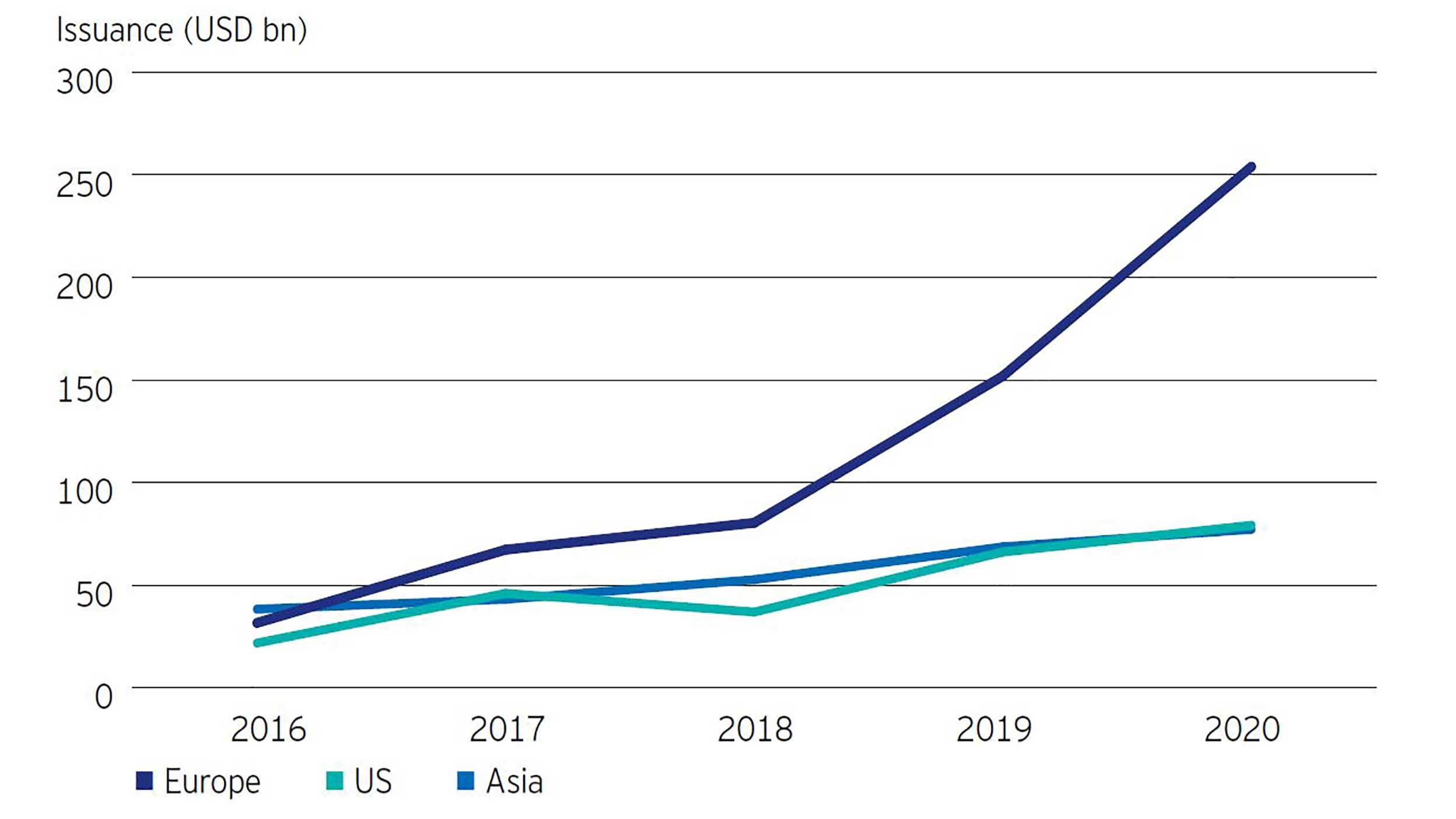

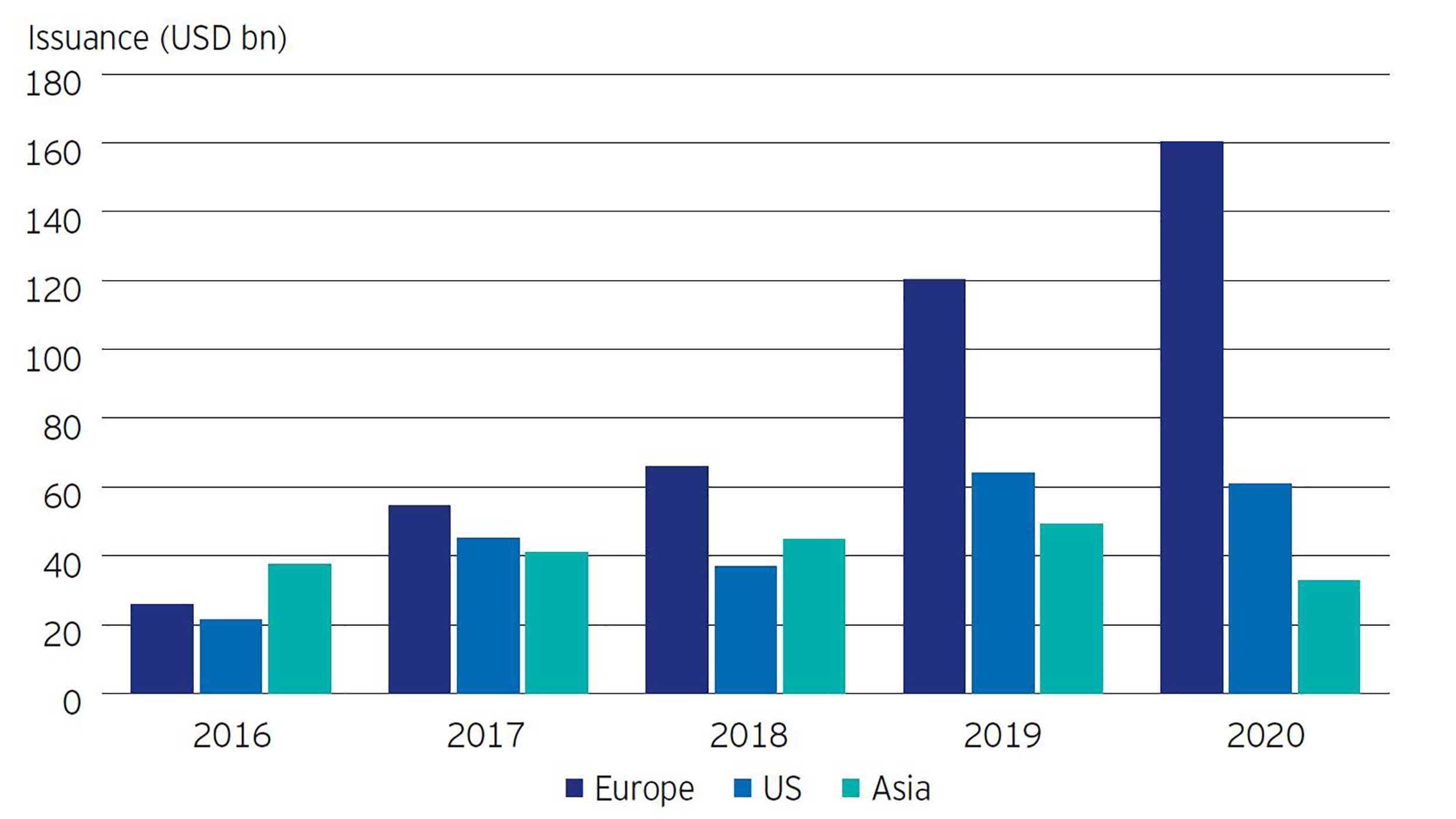

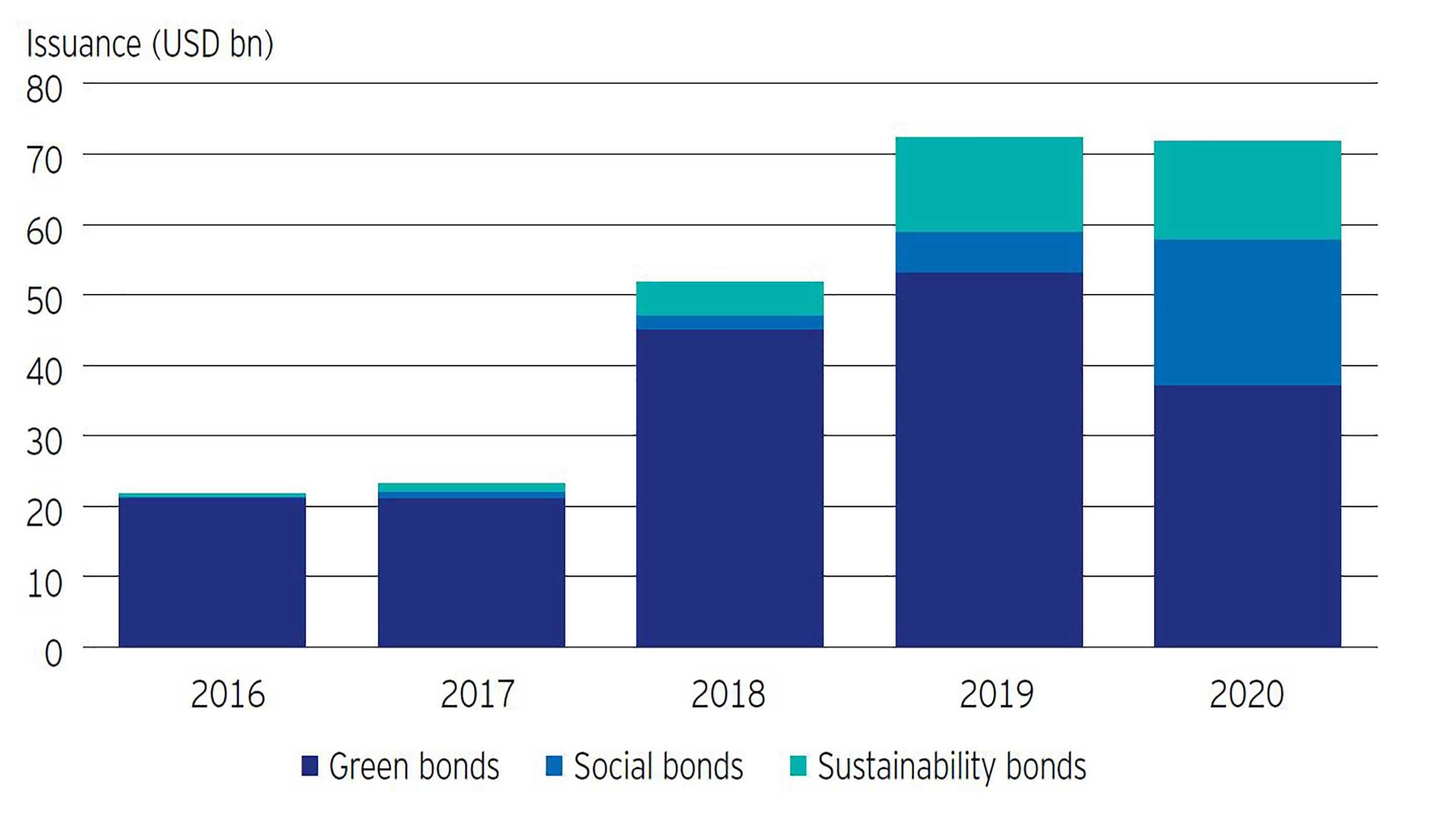

The value of global assets that apply ESG data to drive investment decisions has almost doubled over the last four years to USD40.5 trillion in 2020, according to research firm Optimas.4 Morningstar has reported that sustainable funds broke records in Europe, the US, and Asia in the first nine months of 2020 (defined as ESG integration, impact, and sustainable-oriented funds) in terms of net inflows and total assets under management. Europe and the US attracted USD61.6 billion5 and USD30.7 billion6 in inflows, respectively, reaching USD1 trillion and USD179.1 billion in net assets (Figure 2). In terms of ESG bond issuance (green, social, sustainable, and sustainability-linked securities), the European, US, and Asian markets issued USD254 billion, USD79 billion, and USD77.2 billion, respectively (Figure 3), breaking records in their corresponding regions. These figures demonstrate a strong and consistent global trend in ESG asset growth and the potential for Asian nations, especially China, which is the largest ESG bond issuer in the region, to catch up with global leaders.

In 2020, Asia saw a pause in green bond issuance, largely due to the shift toward social bond issuance, as many countries issued social bonds to finance COVID-19 containment. We expect the decline of green bond issuance to reverse in 2021 as environmental issues and goals return to the forefront of long-term societal objectives. The sustainable investment think tank, Climate Bonds Initiative, expects China to require RMB3 trillion to RMB4 trillion6 (USD462 billion to USD620 billion) in green investment annually by 2030. Over the longer term, we expect China to play a leading role in green financing, especially considering the government’s commitment to carbon neutrality and clean energy in the coming decades.

3. ESG investments will likely be more resilient than, or outperform, non-ESG investments in 2021, based on empirical research.

In a 2020 study, Invesco Fixed Income found that Asian green bonds outperformed the BofA Asian Corporate Bond Index by 120 basis points during the four-month window surrounding the March 2020 market sell-off.7 The general outperformance of green bonds globally has been studied by numerous other institutions as well. The Climate Bond Initiative, which published a quarterly study on green bond markets as early as 2016, found a general green bond premium across corporate bonds denominated in different currencies. A study by MSCI looked at corporate bond data from January 2014 to July 2020 and concluded that companies highly rated for ESG factors outperformed companies with low ESG ratings.8

The outperformance of ESG-themed investments is broad-based and not limited to fixed income investments. ESG equity funds have generally outperformed in the Chinese domestic market, for example. The Ping An Insurance Group found that the annualized returns of ESG and pan-ESG concept equity funds were 47.1% and 56.4%, respectively, both outperforming the average return of 42.2% for overall equity funds.9 In the past 12 months, the MSCI China Environment Index rose 109%,10 driven by its holdings of electric vehicle makers.

We believe the growing empirical evidence of past outperformance of green bond and ESG-based investments will motivate investors to focus greater attention on responsible and ESG-themed investments. PricewaterhouseCoopers has suggested that ESG investment is likely to be the most significant development in money management since the creation of the ETF two decades ago. It forecasts that ESG will reshape finance and make up 41%-57% 11 of total managed investments by 2025. Given Asia’s potential to catch up to global peers, we believe ESG investing and finance will present a particular opportunity in Asia, and especially China.

Conclusion

We expect the trend toward responsible and ESG investment to accelerate globally, especially in China, over the next five to 10 years due in part to the world’s large-scale green financing requirements and a growing investor base and awareness. A high growth phase of responsible and ESG investment in China will likely be fueled by Chinese government policy support, substantial green financing requirements and the growing empirical evidence that ESG investments may be more resilient than and potentially outperform non-ESG investments.

^ 1 The UN PRI is the world’s leading proponent of responsible investment. The UN PRI developed six principles of responsible investment – a voluntary and aspirational set of investment principles that offer a menu of possible actions for incorporating ESG issues into investment practice. Signatories of the UN PRI agree to the set of principles and aim to incorporate ESG factors into their investment and ownership decisions.

^ 2 Source: Climate Bonds Initiative and Syntao Green Finance “China’s Green Bond Issuance and Investment Opportunity Report,” October 2020.

^ 3 Source: Reuters, “China to improve green finance standards to support carbon neutrality goal,” December 2020.

^ 4 Source: Optimas, “ESG Data Integration by Asset Managers: Targeting Alpha, Fiduciary Duty & Portfolio Risk Analysis,” June 2020.

^ 5 Source: Bloomberg Green, “U.S. falls further behind Europe in fast-growing ESG market,” December 2020.

^ 6 Sources: Climate Bonds Initiative and Syntao Green Finance, “China’s Green Bond Issuance and Investment Opportunity Report,” October 2020.

^ 7 Source: Invesco, “Asian green bonds may offer resilience in volatile markets, Maynard Xu, June 2020.

^ 8 Source: MSCI, “Here are MSCI’s 5 ESG trends to watch in 2021,” January 2021.

^ 9 Source: Ping An Research, “ESG investing showing dramatic growth in China in 2020, outperforming market average,” December 2020.

^ 10 Source: Bloomberg L.P., MSCI China IMI Environment 10/40 Net Return USD Index. Data from Nov. 3, 2020, to Nov. 3, 2021.

^ 11 Source: PwC, “Asset and wealth management revolution: The power to reshape the future,” 2020.