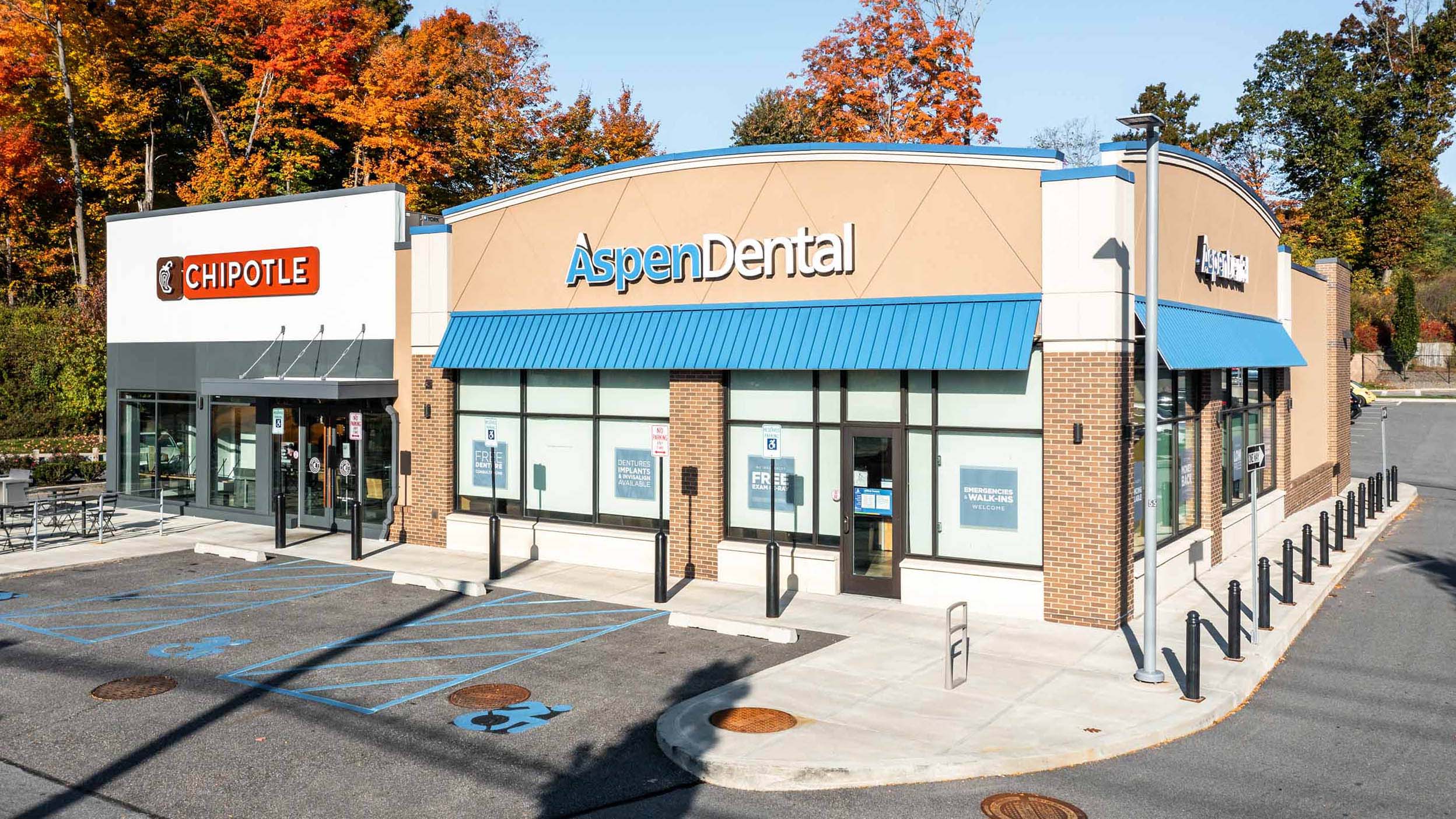

Cortlandt Crossing

The retail center highlights a high-quality tenant mix, anchored by a dominant grocer in the region.

The property is located in a heavily trafficked retail corridor in Northern Westchester County that has high barriers to entry for new retail supply. Over three-fourths of the property is leased to a grocer or investment-grade rated tenants.

Start the conversation

Your questions, comments, and feedback are important to us. We look forward to hearing from you.

Learn more about INREIT

Footnotes

-

Property images shown are current investment properties of INREIT, but do not represent its entire portfolio or a given property type. There is no assurance that the investment properties identified were or will be profitable. Cityscape images are for illustrative purposes and do not represent INREIT-owned properties.

Summary of Risk Factors

Invesco Real Estate Income Trust Inc. (INREIT) is a non-listed REIT that invests primarily in stabilized, income-oriented commercial real estate in the United States. To a lesser extent, INREIT also originates and acquires private real estate debt, including loans secured or backed by real estate, preferred equity interests and interests in private debt funds. INREIT also invests in liquid real estate-related equity and debt securities intended to provide current income and a source of liquidity for its share repurchase plan, cash management and other purposes. This investment strategy involves a high degree of risk and is intended only for investors with a long-term investment horizon and who do not require immediate liquidity or guaranteed income. If INREIT is unable to effectively manage the impact of the risks inherent in its business, it may not meet its investment objectives. You should only invest in INREIT if you can afford a complete loss of your investment. You should read the Prospectus carefully for a description of the risks associated with an investment in INREIT. The principal risks relating to an investment in INREIT include, but are not limited to the following:

- Investing in commercial real estate assets involves certain risks, including but not limited to: tenants' inability to pay rent; increases in interest rates and lack of availability of financing; tenant turnover and vacancies; and changes in supply of or demand for similar property types in a given market.

- INREIT has held its current investments for a short period of time, and you will not have the opportunity to evaluate INREIT’s future investments before it makes them, which makes your investment more speculative.

- Since there is no public trading market for shares of INREIT’s common stock, repurchase of shares by INREIT will likely be the only way to dispose of your shares. INREIT’s share repurchase plan will provide stockholders with the opportunity to request that INREIT repurchases their shares on a monthly basis, but INREIT is not obligated to repurchase any shares and may choose to repurchase only some, or even none, of the shares that have been requested to be repurchased in any month. In addition, repurchases will be subject to available liquidity and other significant restrictions. Further, INREIT’s board of directors may make exceptions to, modify or suspend its share repurchase plan. As a result, INREIT’s shares should be considered as having only limited liquidity and at times may be illiquid. Your ability to have your shares repurchased through INREIT’s share repurchase plan is limited, and if you do sell your shares to INREIT, you may receive less than the price you paid.

- There is no assurance INREIT will pay distributions in any particular amount, if at all. Distributions may be modified and are at the discretion of the board of directors. Distributions are not indicative of profitability, have been in excess of net income and may be funded from sources other than cash flow from operations, including without limitation, the sale of assets, borrowings, return of capital or offering proceeds. There are no limits on the amounts that may be paid from such sources.

- The purchase price and repurchase price for shares of INREIT’s common stock will generally be based on the prior month’s NAV and will not be based on any public trading market. While there will be independent valuations of INREIT’s properties quarterly, the valuation of properties is inherently subjective, and INREIT’s NAV may not accurately reflect the actual price at which its properties could be liquidated on any given day.

- INREIT has no employees and is dependent on Invesco Advisers, Inc. (“Adviser”) to conduct its operations. The Adviser will face conflicts of interest as a result of, among other things, the allocation of investment opportunities among INREIT and Other Invesco Accounts (as defined in the Prospectus), the allocation of time of its investment professionals and the substantial fees that INREIT will pay to the Adviser.

- INREIT is conducting a “best efforts” offering. If INREIT is not able to raise a substantial amount of capital on an ongoing basis, its ability to achieve its investment objectives could be adversely affected.

- Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets.

- There are limitations on the ownership and transferability of INREIT’s shares. No person or group may directly or indirectly acquire or hold more than 9.9% of INREIT’s outstanding common stock in value or number of shares of all classes or series, whichever is more restrictive. An investment in INREIT is not a direct investment in real estate. See “Description of Capital Stock – Restrictions on Ownership and Transfer” in the prospectus for more information.

- INREIT does not own the Invesco name, but is permitted to use it as part of INREIT’s corporate name pursuant to a trademark license agreement with an affiliate of Invesco. Use of the name by other parties or the termination of INREIT’s trademark license agreement may harm its business.

- If INREIT fails to qualify as a REIT and no relief provisions apply, its NAV and cash available for distribution to its stockholders could materially decrease.

- Accurate valuations are more difficult to obtain in times of low transaction volumes due to fewer market transactions that can be considered in the context of the appraisal. There will be no retroactive adjustment in the valuation of assets, INREIT’s offering price of its common stock shares, the price INREIT paid to repurchase its common stock or NAV-based fees INREIT paid to the Adviser and the Dealer Manager to the extent valuations prove to not accurately reflect the realizable value of INREIT’s assets. The price you will pay for shares of INREIT’s common stock and the price at which shares may be repurchased will generally be based on the prior month’s NAV per share. As a result, you may pay more than realizable value or receive less than realizable value for your investment.

Forward-Looking Statement Disclosure

The website contains forward-looking statements about INREIT’s business, including, in particular, statements about its plans, strategies and objectives. You can generally identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue” or other similar words. These statements include INREIT’s plans and objectives for future operations, including plans and objectives relating to future growth and availability of funds, and are based on current expectations that involve numerous risks and uncertainties. Assumptions relating to these statements involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to accurately predict and many of which are beyond INREIT’s control. Although INREIT believes the assumptions underlying the forward-looking statements, and the forward-looking statements themselves, are reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurance that these forward-looking statements will prove to be accurate, and INREIT’s actual results, performance and achievements may be materially different from that expressed or implied by these forward-looking statements. In light of the significant uncertainties inherent in these forward-looking statements, the inclusion of this information should not be regarded as a representation by INREIT or any other person that INREIT’s objectives and plans, which are considered to be reasonable, will be achieved.

Important Information About Other Invesco Real Estate Funds

This website includes information related to prior investments Invesco Real Estate has made, in which INREIT will not have any interest. While the investment programs of other Invesco real estate accounts and INREIT’s investment strategy each involve real estate-related investments and overlapping personnel, each of the accounts and strategies has distinct investment activities, including but not limited to, objectives, costs and expenses, tax features and leverage policies. Invesco Real Estate’s experience in managing other Invesco real estate accounts and other Invesco accounts is not necessarily applicable to INREIT. There can be no assurance that INREIT will be able to successfully identify, make and realize any particular investment or generate returns for its investors.