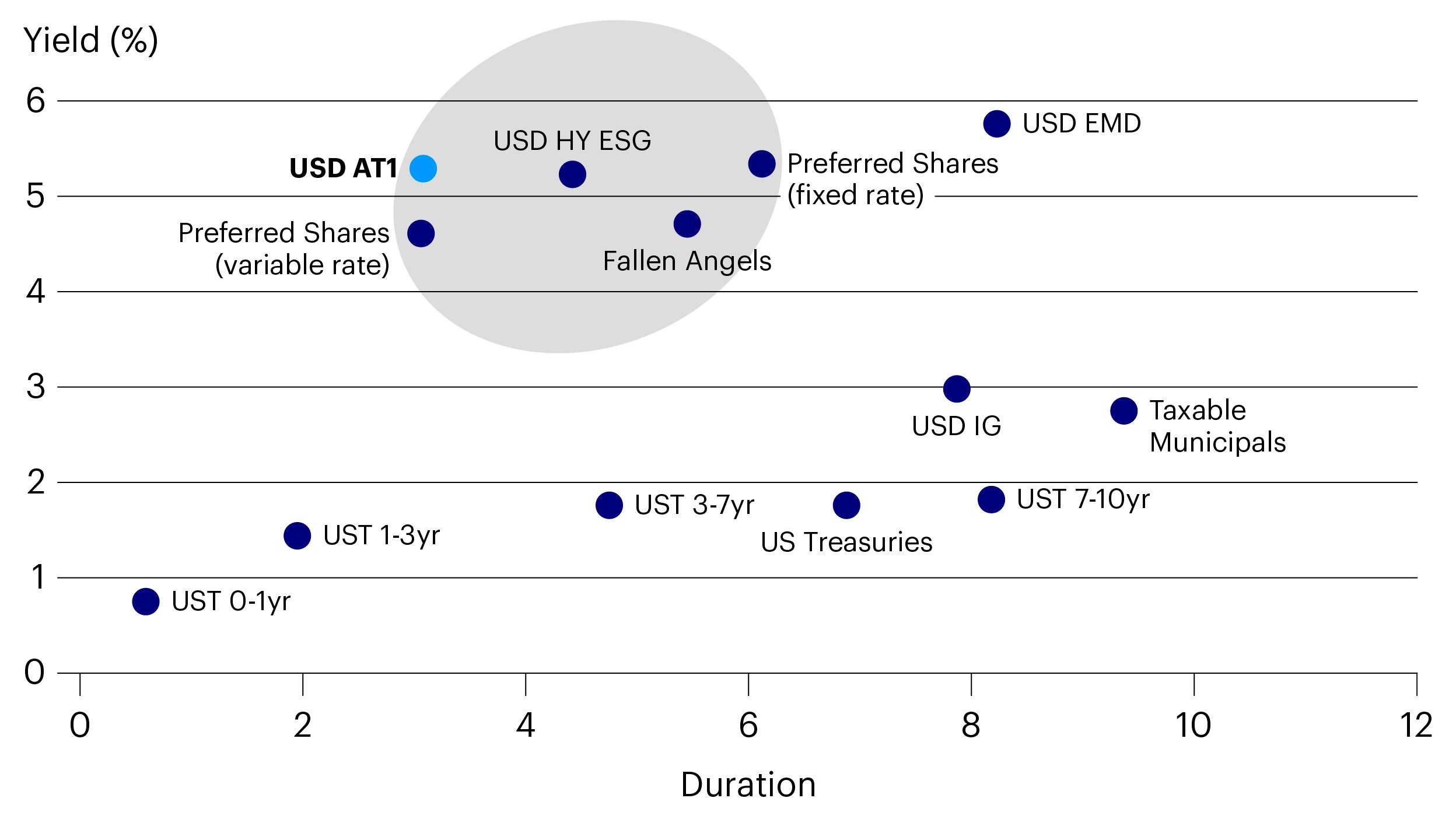

The interest rate risk (duration risk) is typically lower for AT1s versus a basket of traditional high yield bonds, because AT1s have a call date usually after five years of issuance. Almost every AT1 that’s been issued so far has been called on the first call date, partly because it would be uneconomical for the bank to not call them. While this is not guaranteed in future, history may provide a degree of expectation that feeds through to the AT1’s market pricing and associated duration risk.

Corporate Hybrid Bonds are similar in some ways to AT1s but, instead of being issued by banks, they’re issued by the likes of energy companies, utilities, telecoms and pharmaceuticals. They are often issued by investment-grade companies as a more flexible way to borrow and support their credit ratings, as agencies consider hybrids to be part debt / part equity, as the name suggests.

Just like AT1s, corporate hybrids are senior only to common equity. This subordination factor is what drives their high yield. Issuers have a significant deterrent (via coupon step-up) to encourage them to call the bond on the first call date, generally after five years, which accounts for their low duration.

Preferred Shares are technically equities, but we can include them in this discussion because they share traits with bonds. In the US, some banks issue Preferred Shares to fulfil similar capital funding requirements as European banks do with AT1s. Preferred Shares are typically from investment-grade issuers and the high yields are driven by their subordination, not the riskiness of the issuer. They are issued either with fixed or variable rates.

So, again, if you’re concerned about rising interest rates and need to maintain a reasonable level of income, you may want to consider an allocation to AT1s, Corporate Hybrids or Preferred Shares. We have the largest AT1 ETF by some distance2, while we are the only ETF provider in Europe to offer focused access to Euro Corporate Hybrids, Preferred Shares and Variable-rate Preferred Shares.

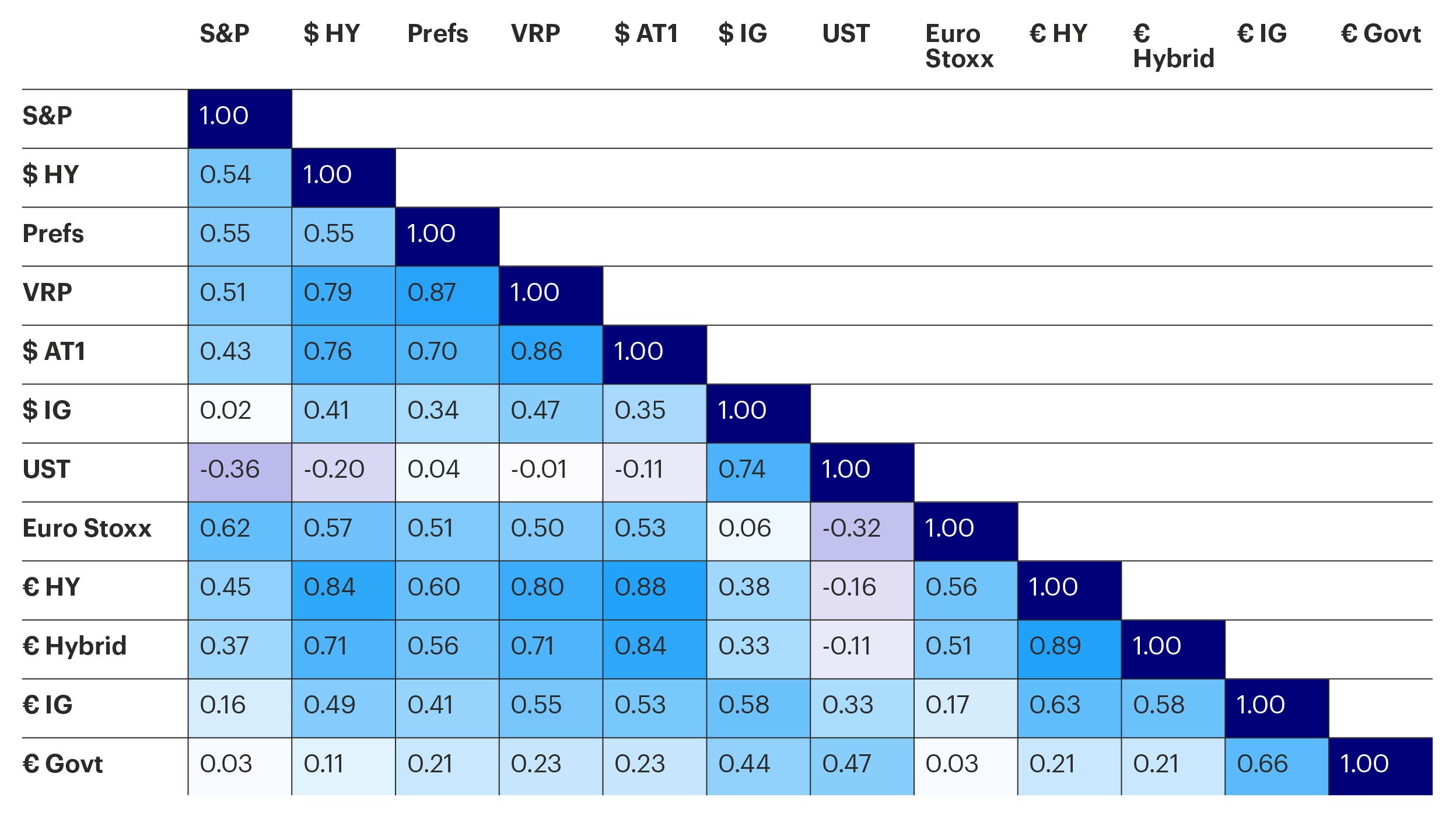

Correlations3