Invesco Asian Equity Fund

Tap the recovery of Asian markets by investing in under-valued stocks

Important Infomation

-

- The Fund invests primarily in equities and equity related securities with exposure to Asian countries.

- Investors should note the emerging markets risk, liquidity risk, concentration risk of investing in equities and equity related securities with exposure to Asian countries, currency exchange risk, equities risk, volatility risk, and general investment risk.

- Financial derivative instruments (FDI) may be used for efficient portfolio management purposes or to hedge or reduce the overall risk of investments. Risks associated with FDI include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The leverage element/component of a FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund. Exposure to FDI may lead to a high risk of significant loss by the Fund.

- The value of the Fund can be volatile and could go down substantially.

- Investors should not base their investment decision on this material alone.

Find Out More

Why Asian markets?

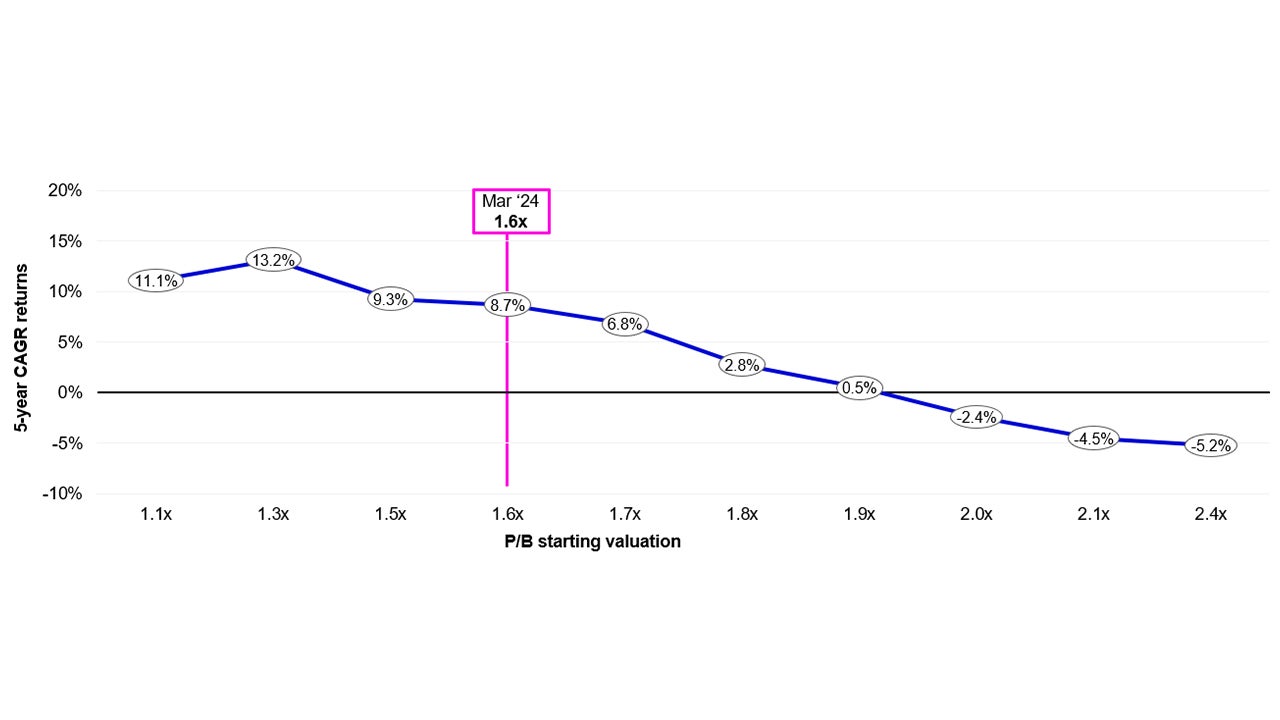

- Asian markets are trading below historical averages at a reasonable 1.6x book value.

Source: LSEG as at 31 March 2024. Past performance does not predict future returns.

- Low valuation levels have historically been a good entry point for future returns.

- The existing P/B starting valuation at 1.6x has historically resulted in 8.7% of 5-year compound annual growth rate (CAGR) return.

*Benchmark index, subject to further change without notice.

Source: Bloomberg, Invesco. Weekly returns and valuation levels of MSCI AC Asia ex Japan index from February 1995 to 31 March 2024. Past performance does not predict future returns.

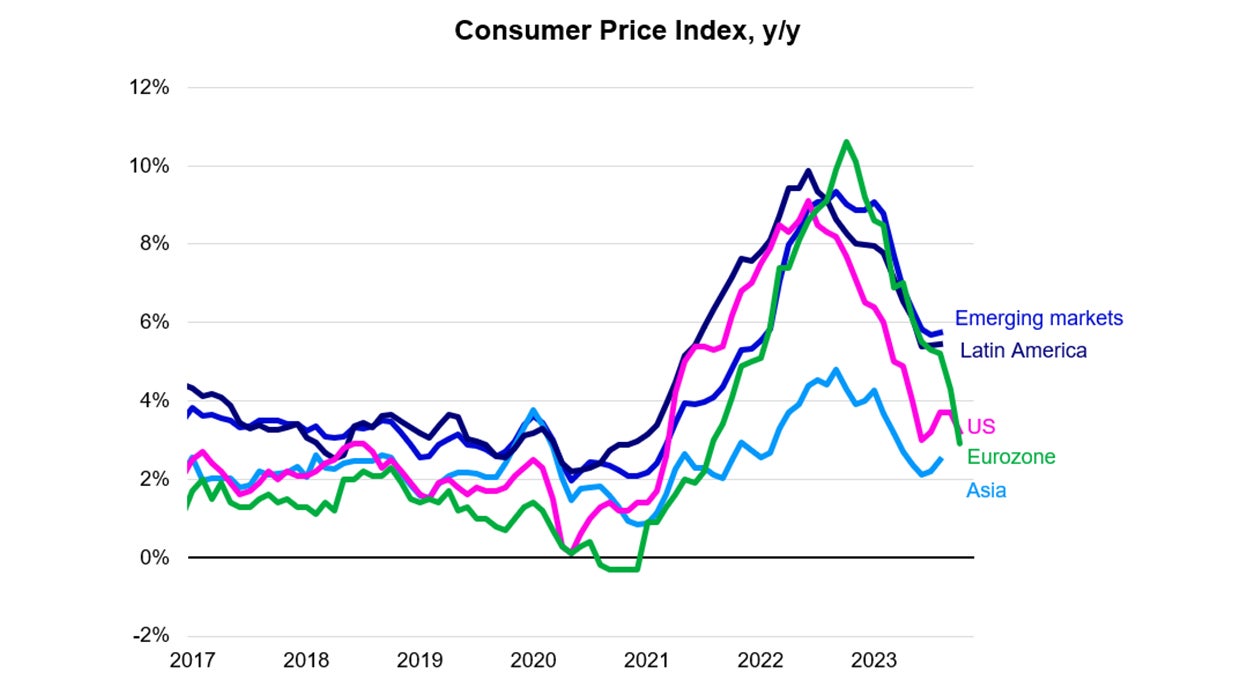

- Global ex-Asia inflation has risen to multi-year highs

- Moderate inflation compared with other markets

Source: EMED, IMF, Haver, CEIC as at 31 October 2023.

Why Invesco Asian Equity Fund?

Key fund features

Diversified sector exposure#

Morningstar 4-star rated fund^

#Diversification does not guarantee a profit or eliminate the risk of loss.

^Any reference to a ranking, a rating or an award provides no guarantee for future performance results and is not constant over time.

Source: Performance is sourced from ©2024 Morningstar, data as of 31 March 2024.

The fund prefers companies trading at a significant discount.

Areas we prefer

Technology

Cunsumer & Internet

Autos

Leading manufacturers

Insurance & South Asian banking

Source: Performance is sourced from ©2024 Morningstar, data as of 31 March 2024. Indexed performance: Performance of an investment of 100 in share class currency. Past performance information is not indicative of future performance. Investors may not get back the full amount invested. The computation basis of the performance is based on the calendar year end, NAV-To-NAV, with dividend reinvested. These figures show by how much the above share classes increased or decreased in value during the calendar year being shown. Performance data of the share class has been calculated in the respective currency stated above including ongoing charges and excluding subscription fee and redemption fee you might have to pay. A (USD)-AD Shares (Year-to-date performance: 0.33%; calendar year performance: 2023: 2.90%; 2022: -9.62%; 2021: 0.10%; 2020: 25.02% and 2019: 15.38%). The inception date of A (USD)-AD Shares is 10 September 2018. The performance data started from 10 Sep 2018 is the inception date of the share class. The historical performance up to 7 September 2018 has been simulated based on the performance of a share class with the same features (e.g. investment objectives and strategy, risk profiles and fee structure) of another fund, which was merged into the Fund on that date. Performance of the share class(es) is calculated based on NAV to NAV, gross income re-invested in share class currency.

©2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is provided for reference purposes only. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Asset allocation data is derived by Morningstar using full holdings data provided by Invesco. Morningstar Licensed Tools and Content powered by Interactive Data Managed Solutions.

Top 10 holdings

1. Taiwan Semiconductor |

9.8% |

6. Alibaba |

2.6% |

2. Samsung Electronics |

7.3% |

7. AIA |

2.6% |

3. Tencent |

6.2% |

8. NetEase |

2.6% |

4. HDFC Bank |

4.2% |

9. Kasikornbank |

2.5% |

5. Samsung Fire & Marine Insurance |

3.4% |

10. Samsung Electronics Pfc |

2.5% |

Total holdings |

57 |

|

|

Source: Invesco as at 31 March 2024. Geographical weightings, sector weightings and portfolio holdings are subject to change without notice.

Source: Invesco as at 31 March 2024.

Geographical weightings, sector weightings and portfolio holdings are subject to change without notice.

Source: Invesco as at 31 March 2024.

Geographical weightings, sector weightings and portfolio holdings are subject to change without notice.