Plan Your Retirement Savings

In addition to fundamental investment knowledge, it’s also important to understand the factors affecting your investment choices. Learn more to craft your investment strategy now!

Read More

Read More

Understand the Stock Market Index

World Market Index

- FTSE Developed Net total return Index

- MSCI* World ESG Universal Select Business Screens Index

- MSCI* World Net Total Return USD Index

Source: MSCI & FTSE, data as of 30 June 2023.

Index performance base as 100. Past performance does not predict future returns. Investors cannot invest directly in an index. For illustration purpose only.

*Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability of fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI's express written consent.

-

The FTSE Developed Index is a market-capitalization weighted index representing the performance of large and mid cap companies in Developed markets. The index is derived from the FTSE Global Equity Index Series (GEIS), which covers 98% of the world’s investable market capitalization (as of Jun 2023).

Source: FTSE, data as of 30 June 2023.

For illustration purpose only.

-

The MSCI* World ESG Universal Select Business Screens Index is based on the MSCI World Index, its parent index, and includes large and mid-cap securities across 23 Developed Markets countries. The index aims to represent the performance of a strategy that excludes companies that are associated with controversial weapons, nuclear weapons, oil sands or recreational cannabis; or derive revenues from conventional weapons, thermal coal, tobacco or civilian firearms; or are involved in very severe controversies pertaining to ESG issues; or have an MSCI ESG Rating of CCC.

Source: Bloomberg, data as of 30 June 2023.

For illustration purpose only.

*Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability of fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI's express written consent.

-

The MSCI* World Index captures large and mid-cap representation across 23 Developed Markets (DM) countries. With 1,512 constituents (as of Jun 2023), the index covers approximately 85% of the free float-adjusted market capitalization in each country. (DM countries include: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the UK and the US.)

Source: Bloomberg, data as of 30 June 2023.

For illustration purpose only.

*Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability of fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI's express written consent.

US Market Index

- Dow Jones Industrial Average NTR

- FTSE USA Index - Net Tax TR EUR

- MSCI* USA ESG Universal Sel Business Screen Net Return USD Index

- NASDAQ Composite Net Total Return

- S&P 500 Net Total Return Index

Source: MSCI & FTSE, data as of 30 June 2023.

Index performance base as 100. Past performance does not predict future returns. Investors cannot invest directly in an index. For illustration purpose only.

*Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability of fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI's express written consent.

-

The Dow Jones Industrial Average is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities.

Sector weightsSource: Bloomberg, data as of 30 June 2023.

For illustration purpose only.

-

The FTSE USA Index is a market-capitalisation weighted index representing the performance of US large and mid cap stocks. The index is derived from the FTSE Global Equity Index Series (GEIS), which covers 98% of the world’s investable market capitalization.

Sector weightsSource: FTSE, data as of 30 June 2023.

For illustration purpose only.

-

The MSCI* USA ESG Universal Select Business Screens Index is based on the MSCI USA Index, its parent index, and includes large and mid-cap securities of the U.S. equity markets. The index aims to represent the performance of a strategy that excludes companies that are associated with controversial weapons, nuclear weapons, oil sands or recreational cannabis; or derive revenues from conventional weapons, thermal coal, tobacco or civilian firearms; or are involved in very severe controversies pertaining to ESG issues; or have an MSCI ESG Rating of CCC.

Sector weightsSource: Bloomberg, data as of 30 June 2023.

For illustration purpose only.

*Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability of fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI's express written consent.

-

The Nasdaq Composite Index measures all Nasdaq domestic and international based common type stocks listed on The Nasdaq Stock Market. To be eligible for inclusion in the Index, the security's U.S. listing must be exclusively on The Nasdaq Stock Market (unless the security was dually listed on another U.S. market prior to January 1, 2004 and has continuously maintained such listing). The security types eligible for the Index include common stocks, ordinary shares, ADRs, shares of beneficial interest or limited partnership interests and tracking stocks.

Sector weightsSource: Bloomberg, data as of 30 June 2023.

For illustration purpose only.

-

The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

Sector weightsSource: Bloomberg, data as of 30 June 2023.

For illustration purpose only.

Hong Kong Market Index

- Hang Seng Index Net Total Return Index

The Hang Seng Index is the most widely quoted gauge of the Hong Kong stock market and includes the largest and most liquid 80 stocks listed on the Main Board of the Stock Exchange of Hong Kong.

Source: Hang Seng Indexes, data as of 30 June 2023.

Index performance base as 100. Past performance does not predict future returns. Investors cannot invest directly in an index. For illustration purpose only.

Source: Hang Seng Indexes, data as of 30 June 2023.

For illustration purpose only.

Features and Investment Guideline of MPF Funds

As a smart MPF investor, it’s important for you to understand the features and investment regulations of MPF funds

5 Major Types of MPF Funds

- MPF Conservative Fund

- Guaranteed Fund

- Bond Fund

- Mixed Assets Fund

- Equity Fund

To protect scheme members’ interests, MPFA has put in place regulations and guidelines for trustees and investment managers to manage the assets of MPF schemes.

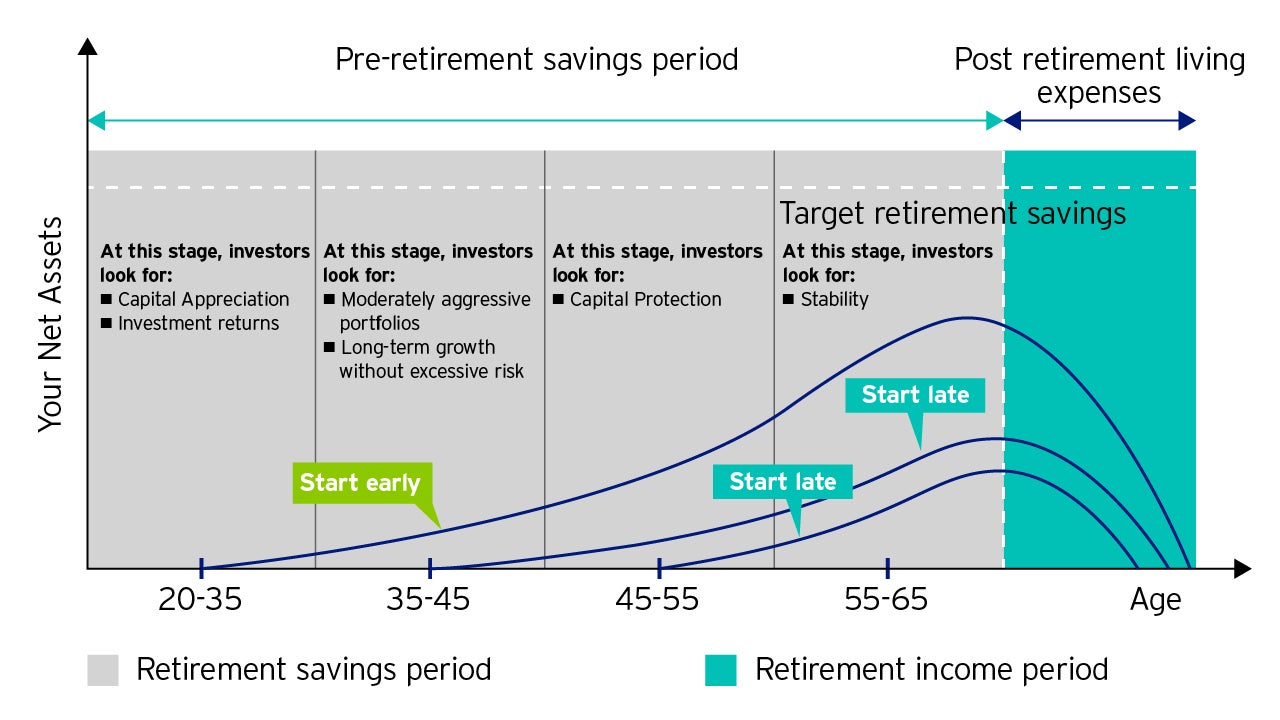

Planning for your retirement

Reflect changes in personal circumstances

Investing in a pension scheme allows you to plan your retirement more effectively. The number of years you have until retirement helps determine the best way to grow your investments. As move into each life stage, your needs and preferences are likely to change along with your investment decisions.

What you need to know

When you change jobs, you also need to take care of the pension investments made during your previous employment, typically referred to as "Accrued Benefits", which may be from MPF or ORSO schemes.

Accrued Benefits are defined as the amount of an employee’s beneficial interest in a retirement scheme at a particular time (such as the statement end-date). The beneficial interest is calculated as the contributions made by the employee and employer, together with any investment return (gain or loss) on the contributions.

If you have changed jobs more than once, you probably have one or more personal accounts with accrued benefits. If you remember how many personal accounts you have and which service providers are managing those accounts you can consolidate.

For Fund transfer form, Personal account membership form, Enrollment form and MPF scheme brochure/ Prospectus, please click here.

Increasing your pension contributions is important to ensure you can enjoy retirement. Many people underestimate the amount they should contribute, leading to a shortfall in pension benefits.

Case study

Name: Edmund Chan

Age: 20

Retirement Age: 65

Current monthly income: HK$10,000

Expected income growth rate: 5% p.a.

Employee's contribution to retirement plan: 5%

Employer's contribution to retirement plan: 5%

Project average return of pension investments: 6% p.a.^

Edmund’s pension amount when he retires = HK$5,891,591

Amount needed by Edmund when he retires = HK$8,230,673

Retirement shortfall = -HK$2,339 ,082

Edmund could avoid the shortfall with an additional monthly contribution of only HK$1,443 per month.

Assume Edmund Chan needs to have 70% of his pre-retirement monthly income every month during retirement years to maintain his current living standard.

^ Assume the investment return to come down to 3% p.a. after retirement because Edmund Chan will likely invest in asset classes with a lower risk/return profile.

Above amounts are shown in today's value.

Flexible Voluntary Contributions (FVC) available under the Invesco MPF Scheme are a great way to avoid retirement shortfalls and easy to start doing!

You can:

- Withdraw your FVCs at anytime

- Mix & match within the Invesco MPF scheme to suit your needs

- Make lump sums anytime or arrange monthly contributions (min HK$1,000) through direct debit

- Simply call or login to manage your account

For Flexible Voluntary Contribution Form, Personal account membership form, Enrollment form and MPF scheme brochure/ Prospectus, please click here