Episode 4 - What are the risks to look out for when investing

Taking the emotions out of investing

All investment involves risk. In putting your money to work in the markets, there are chances that an investment's actual gains and losses will differ from an expected outcome or return.

Many investors lost money in the long term by making common mistakes, which are frequently driven by emotional rather than rational decision-making. Let’s examine some of these common mistakes and risks.

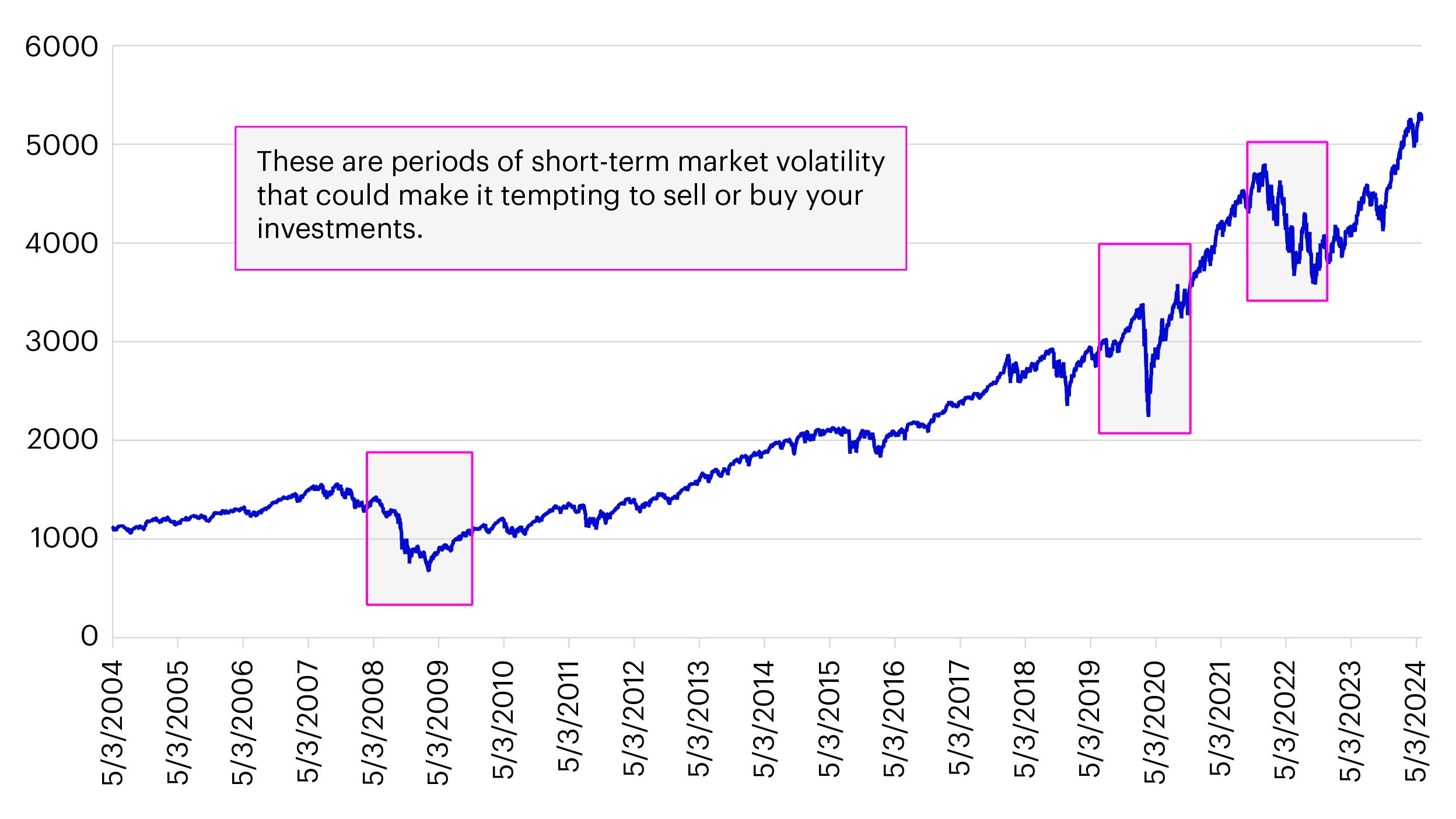

Reacting to short-term market volatility

- Volatility is defined as big price swings either up or down. Higher volatility means that the price of a security can move dramatically over a short time period in either direction.

- The VIX, or Volatility Index (VIX), is a measure of equity market volatility. It provides a quantitative gauge of the implied 30-day volatility of the US stock market. A high reading on the VIX implies a risky market.

- Periods of high volatility are often associated with a sense of anxiety among investors. Watching the stock market swing up and down can be unnerving. The fear of incurring major losses could make it tempting to sell your investments.

Source: Bloomberg, as of May 2024. For illustrative purposes only. Indexes cannot be purchased directly by investors. Past performance does not predict future returns.

- However, instinctive reactions could lead to mistakes. In the investment market, by acting too quickly, investors are more likely to make costly mistakes, like selling low or buying too high.

- If investors, affected by their emotions, sell their securities during short term market volatility, this could easily jeopardize their original purpose of making the investment.

Timing the market

- Market timing is an approach of anticipating market lows and market highs to buy and sell securities at the most theoretically favorable prices.

- Timing the market is about trying to identifying price tops and bottoms to optimize your market entries and exits.

- The risk is that investors could miss opportunities. Historically, missing only a small percentage of those big rally days could cut significantly into your portfolio’s performance. And because the future is unpredictable, it’s extremely hard to call market tops and bottoms.

- What often happens is investors pile into a bull market when it’s well underway, or near the top exit bear markets after prices have plunged to that “I-can’t-take-any-more-pain” point.

- In other words, they buy high and sell low — the exact opposite of what sound investing is about.

Source: Morningstar, as of May 2024. For illustrative purposes only. Indexes cannot be purchased directly by investors. Past performance does not predict future returns.

Investing based on “rumors”

- The “buy the rumor, sell the news” approach operates on the principle of anticipation and reaction.

- Investors buy assets based on rumors or expectations of a positive outcome, such as a strong earnings report that beat analysts estimates or favorable economic data.

- When the actual news is released, regardless of whether it meets, exceeds, or falls short of expectations, investors often sell, capitalizing on the price movement driven by the market’s reaction.

- The main risk lies in speculation: if the actual news does not align with the rumor, it can lead to a rapid decline in stock prices, catching investors off guard.

- Also, this approach often overlooks fundamental analysis of the company or security, focusing instead on investor sentiment, which could change rapidly.

- The “buy the rumor, sell the news” approach often plays on the emotions of fear and greed. Fear of missing out (FOMO) may drive investors to make decisions based on rumors, while greed may lead them to hold onto positions for too long, hoping for even greater gains.

- It is important to note that

- Market reactions to news can be unpredictable

- Rumors may turn out to be unfounded.

- Price patterns may not always follow expected trends, leading to potential losses.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.