Investing Made Easy

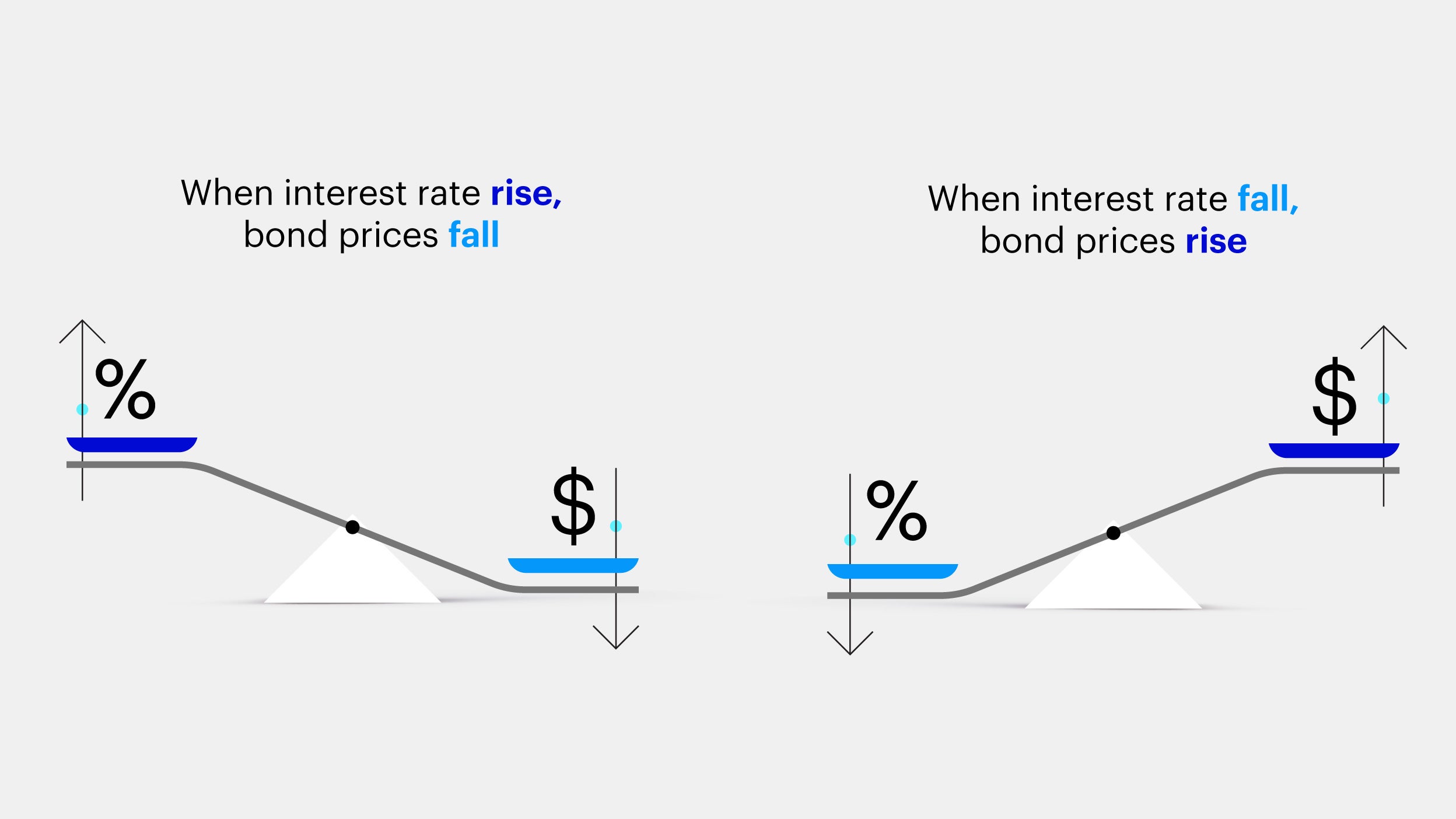

In this episode, we take a deep dive into various economic indicators, central bank actions, and most important of all the impact of all these on asset classes such as fixed income, equities and real assets. Watch the video to learn more.