Investing Made Easy

Don’t miss opportunities by holding too much cash. There is a need to consider other asset classes to grow wealth in the long run. Watch the video to learn more.

Don’t miss opportunities by holding too much cash. There is a need to consider other asset classes to grow wealth in the long run. Watch the video to learn more.

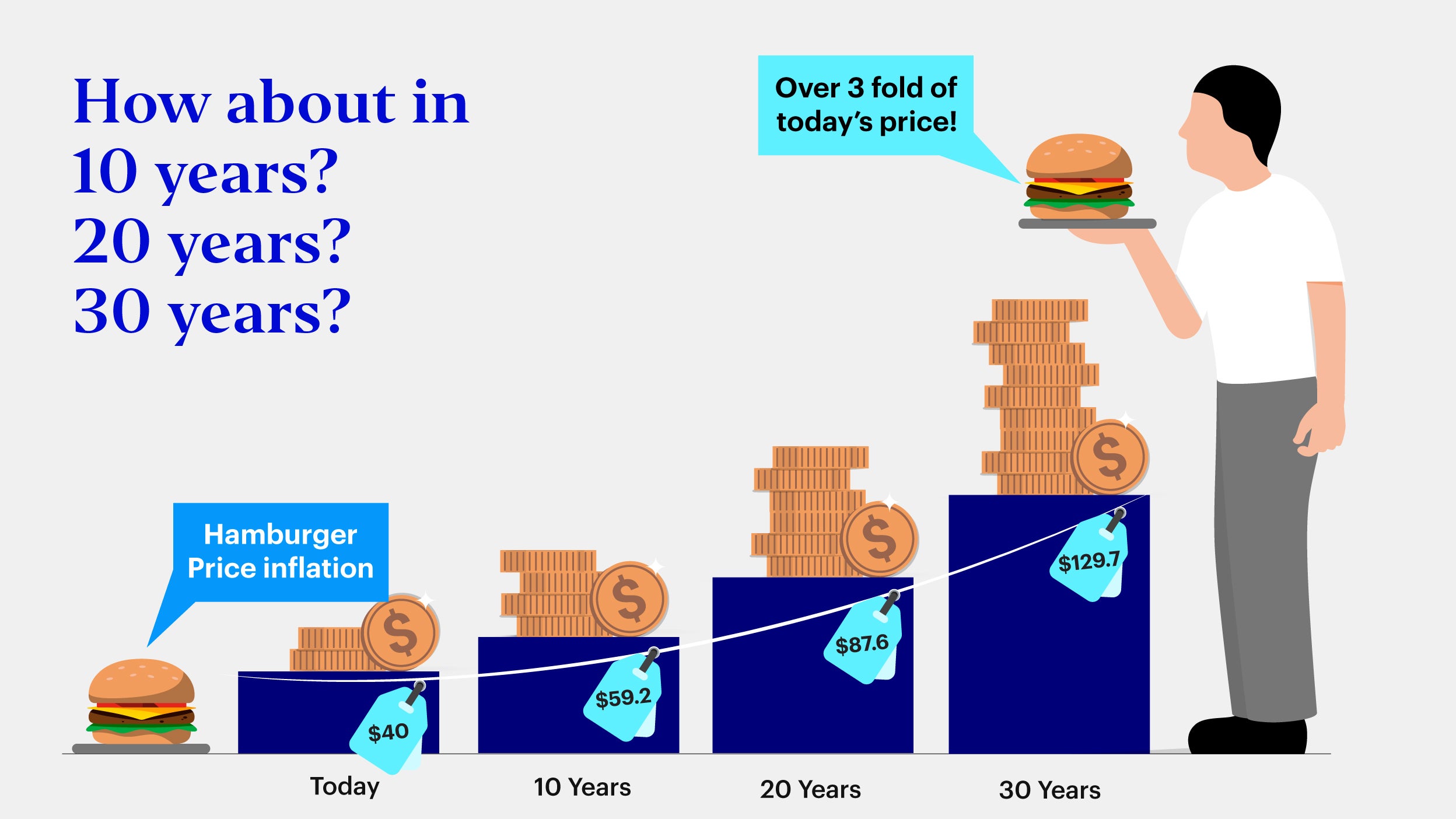

Suppose you can buy a burger set for $40 today and the annual inflation rate is 4%. Next year, the same burger set will cost 4% more at $41.6. It does not seem much, right? But over time, inflation will increase the cost of the burger dramatically.

Source: Invesco, as of July 31, 2024. For illustrative purpose only.

Conclusion: Sitting on too much cash does have risks that we can’t ignore. There is a need to consider other asset classes to grow wealth in the long run.

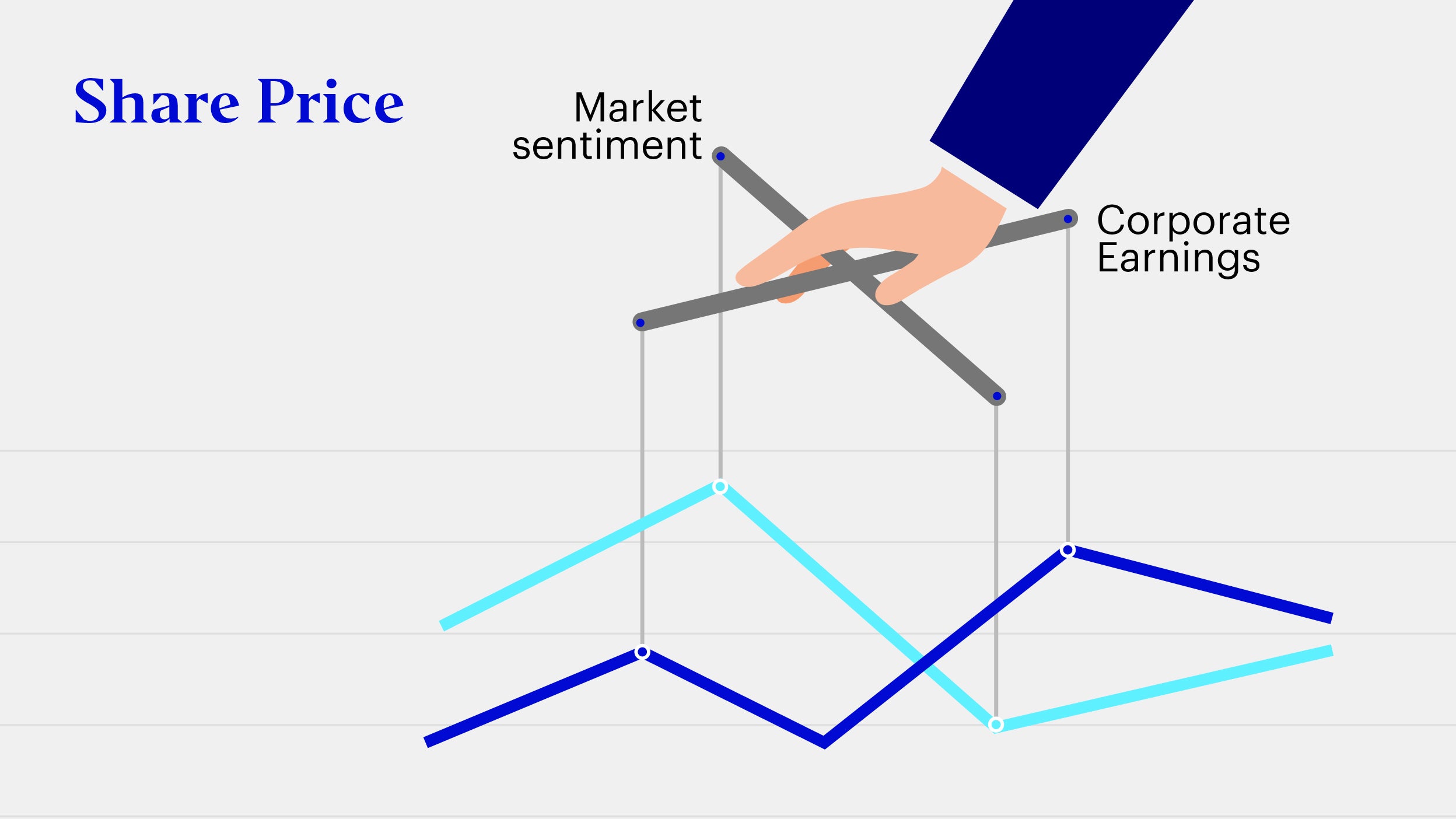

For illustrative purpose only.

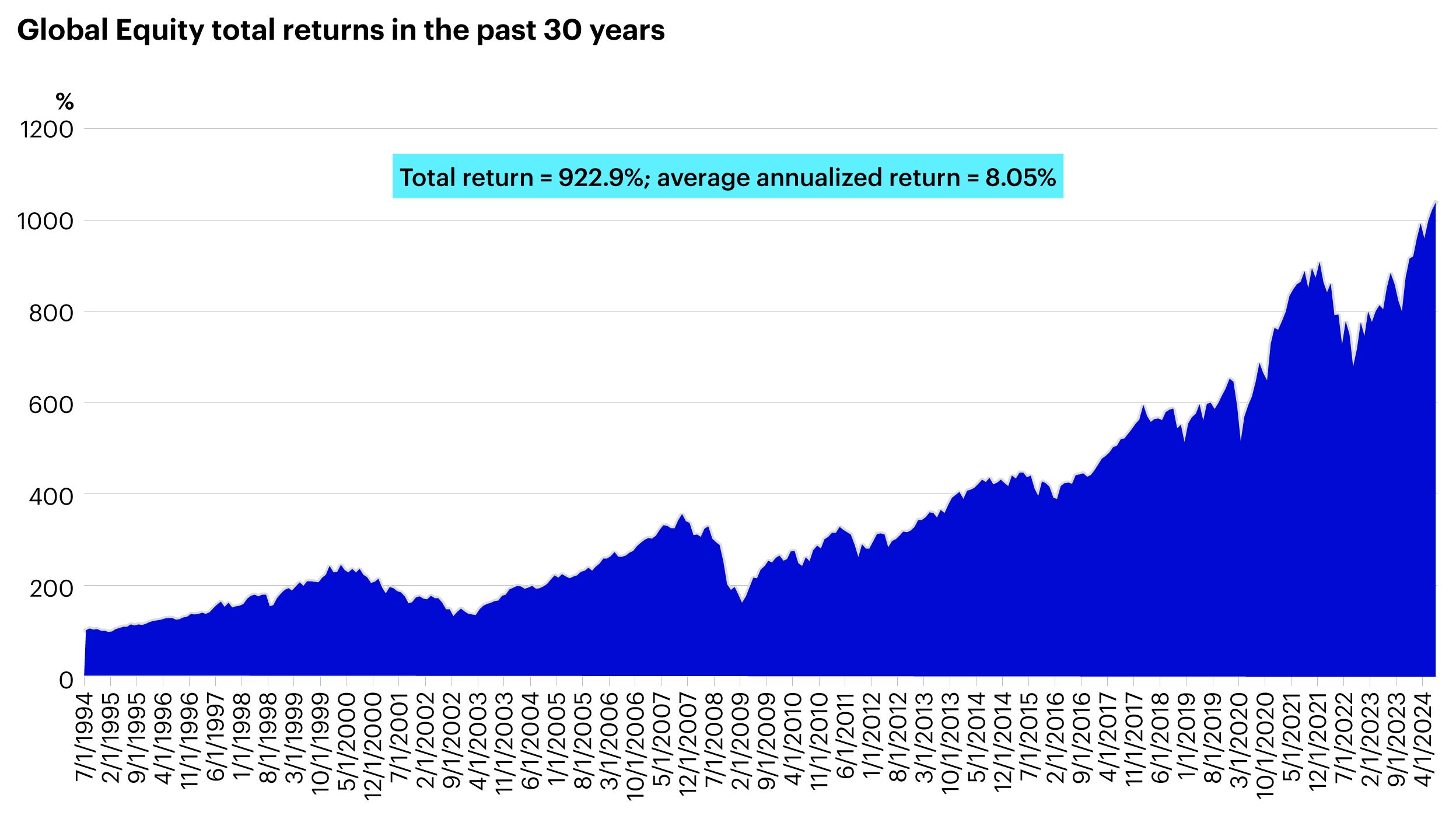

Global Equity is represented by MSCI AC World Index. Indexed performance (base 100).

Source: Bloomberg data, as of July 31, 2024. For illustrative purpose only. Investment cannot be made directly in an index, Past performance is not a guide to future returns.

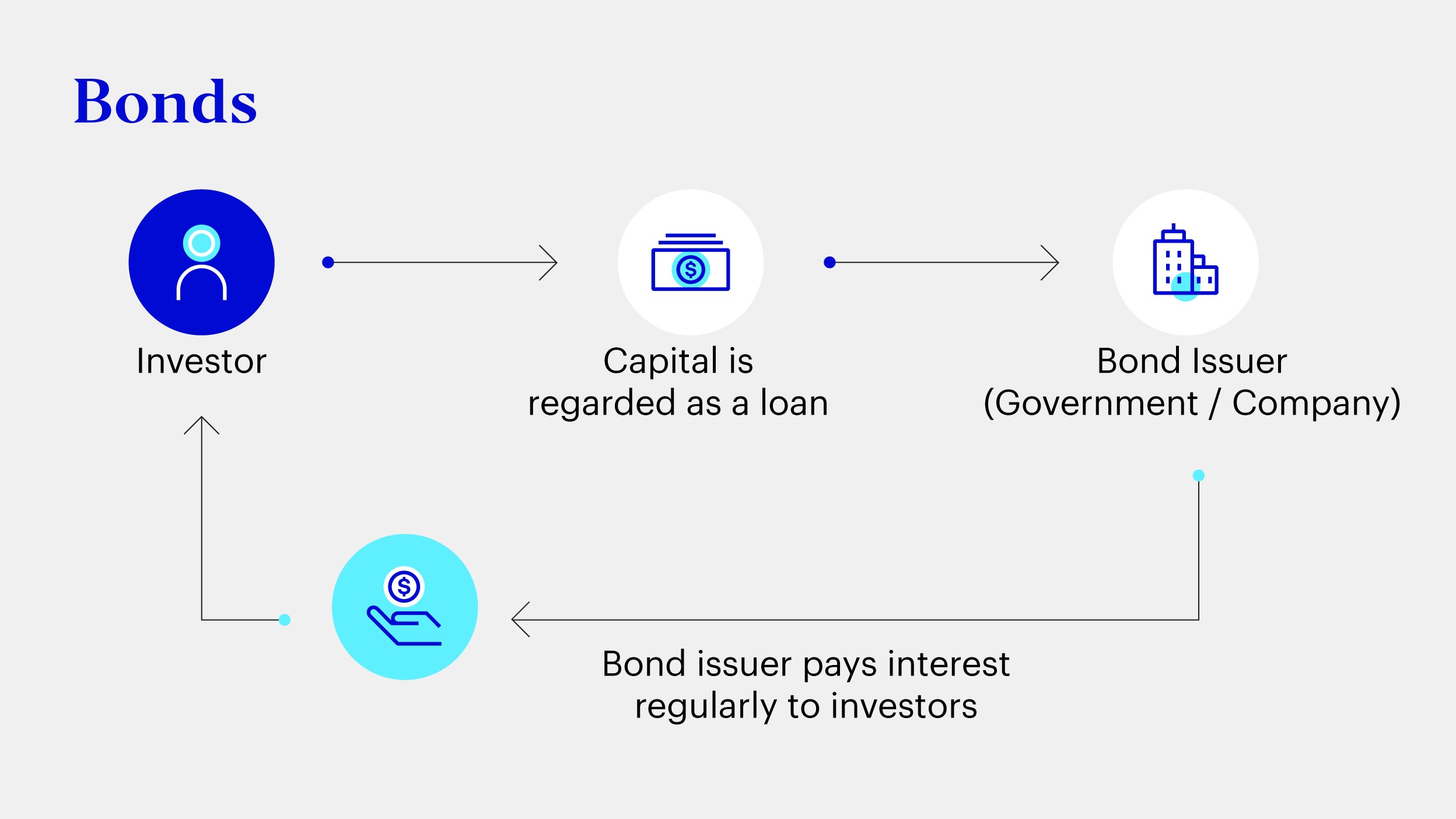

| Factor | How does it impact bond prices? |

|---|---|

| Interest rates | Interest rates and bond prices move inversely – this means that when interest rates go up, in general, current bond prices go down and vice-versa. |

| Market conditions | When the investment market is risk-off, investors typically move to bonds from equities. Current bond price could go up in this environment. |

| Credit Ratings | Bonds are assigned credit ratings by ratings agencies, such as Moody’s and Standard & Poor’s. The rating reflects the agency’s view of the issuer’s ability to pay interest and principal. If a bond’s credit rating is downgraded, the bond price will likely fall and its interest rate will go up (since bond investors will demand more interest for taking on the additional risk of default). |

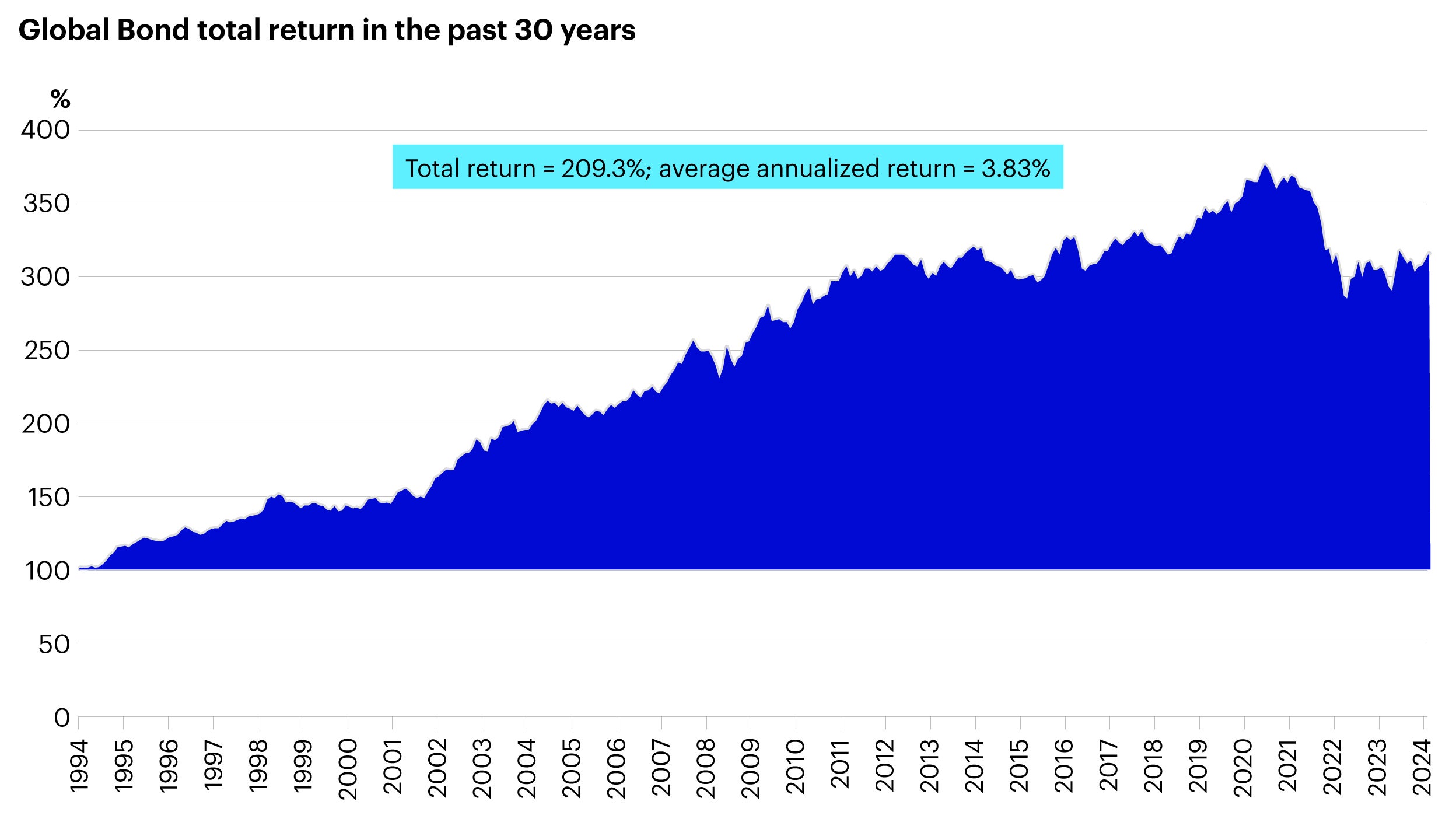

Global Bond is represented by Bloomberg Global Aggregate Total Return Index. Indexed performance (base 100).

Source: Bloomberg data, as of July 31, 2024. For illustrative purpose only. Investment cannot be made directly in an index, Past performance is not a guide to future returns.