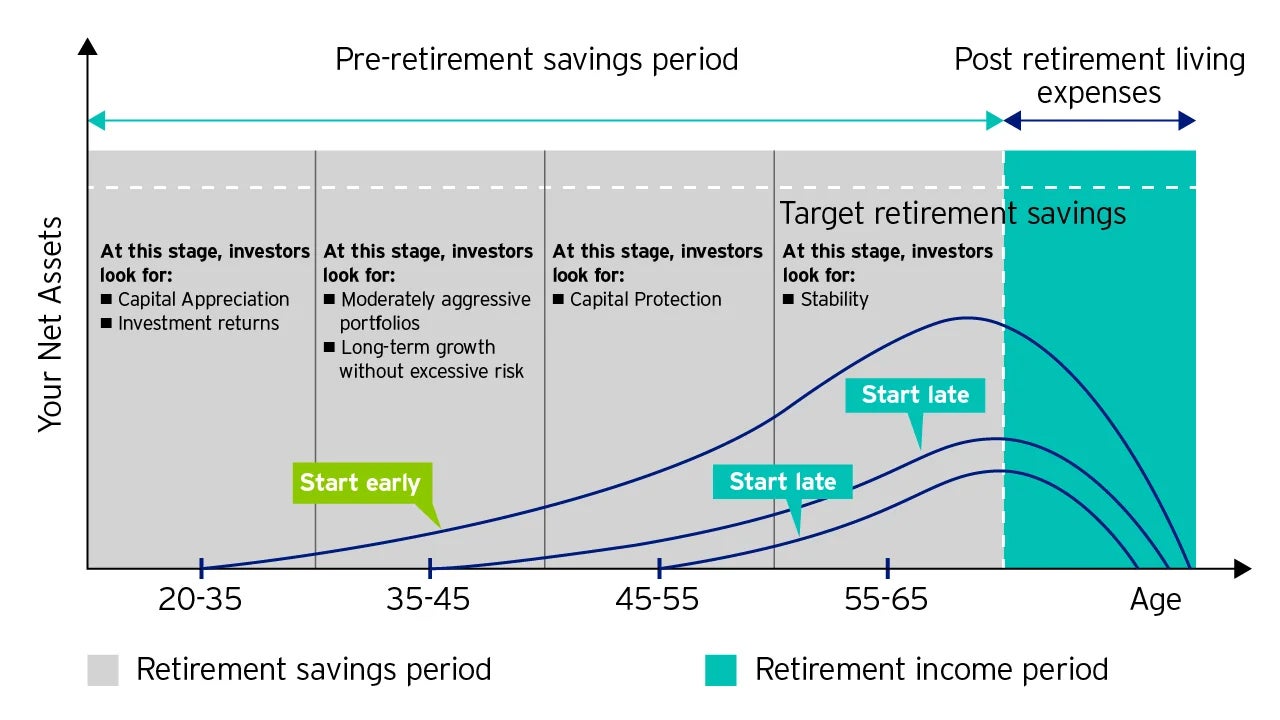

Mandatory Provident Fund (“MPF”)

We understand that every investor has different investment needs and goals throughout their life journey. Therefore, we offer a range of diversified investment solutions, allowing each investor to choose the investment portfolio that best suits them.