Your Financial Goals and Life-Stage Investing

Investment Education

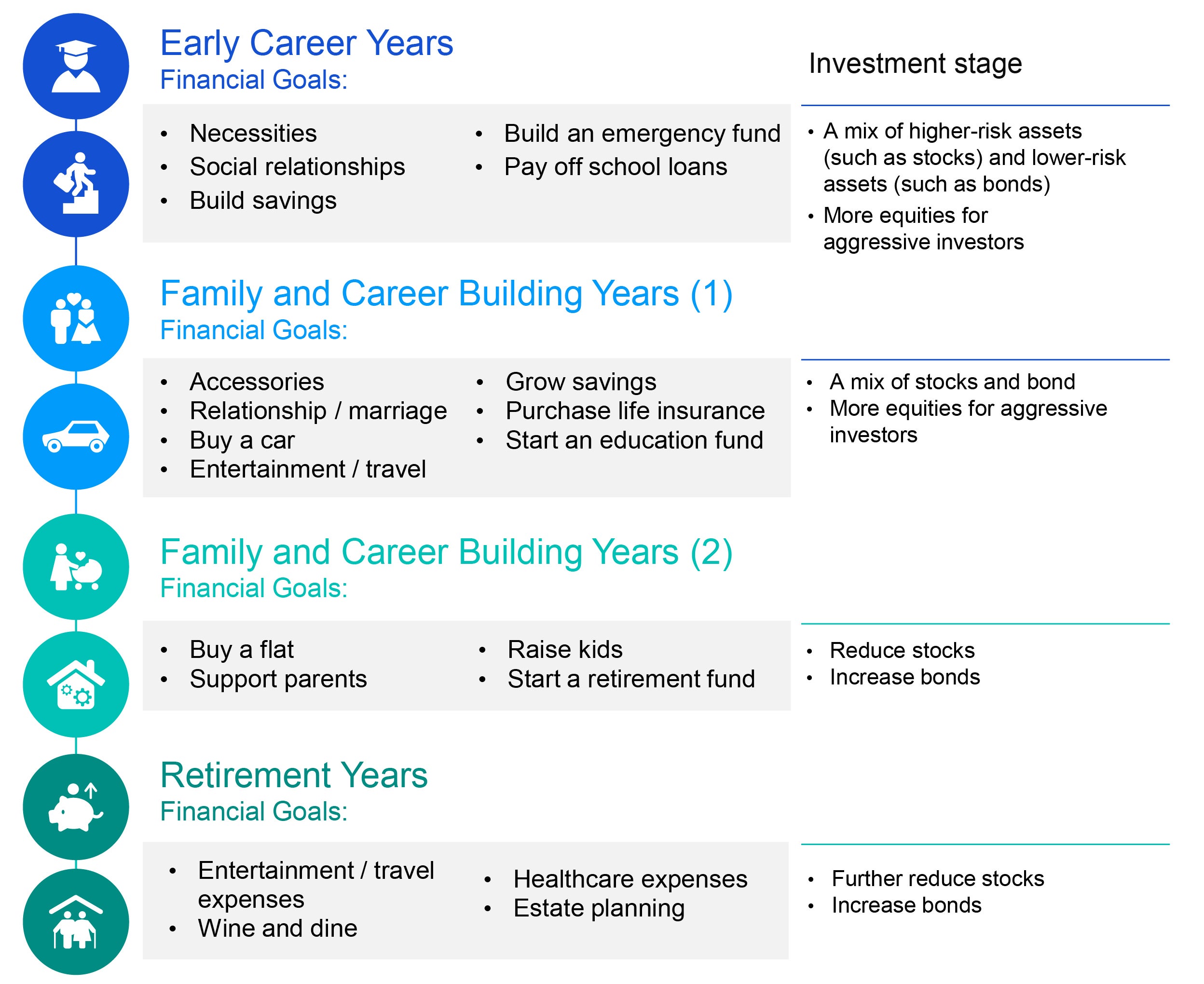

Different Stages of Life

Different Stages of Life

Your Financial Goals and Life-Stage Investing

As life goes on, your financial needs evolve as well:

Wealth Planning to achieve your financial goals

- The concept of wealth management kicks in when we want to make sure we have enough money to finance our spending.

- At the same time, we want to accumulate wealth for ourselves and also the next generation.

- Remember, when we do our wealth planning, inflation is a key factor for consideration!

How to beat inflation?

What is inflation?

There goes a saying that “in this world, nothing can be said to be certain, except death and taxes”. And we can add “inflation” to the list in modern days.

| Average annual inflation | |

|---|---|

| China | 5.1% |

| Hong Kong | 4.2% |

Source: https://tradingeconomics.com, as of 2020.

Inflation Rate in China averaged 5.1% from 1986 until 2020. Inflation Rate in Hong Kong averaged 4.2% from 1981 until 2020.

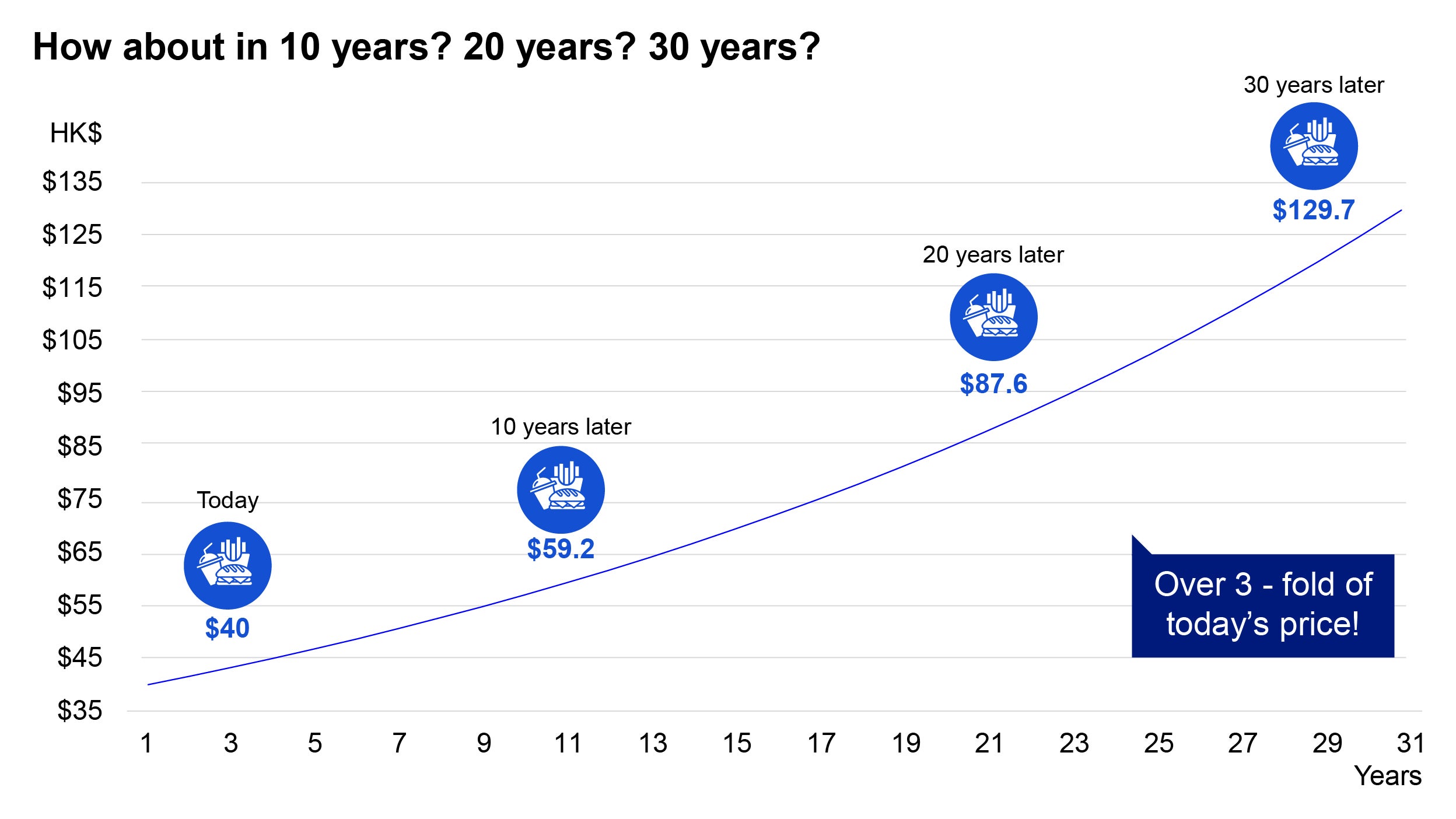

Suppose you can buy a burger set for $40 today and the annual inflation rate is 4%. Next year, the same burger set will cost 4% more at $41.6. It does not seem much, right?

Source: Invesco, as of October 31, 2020. For illustrative purpose only.

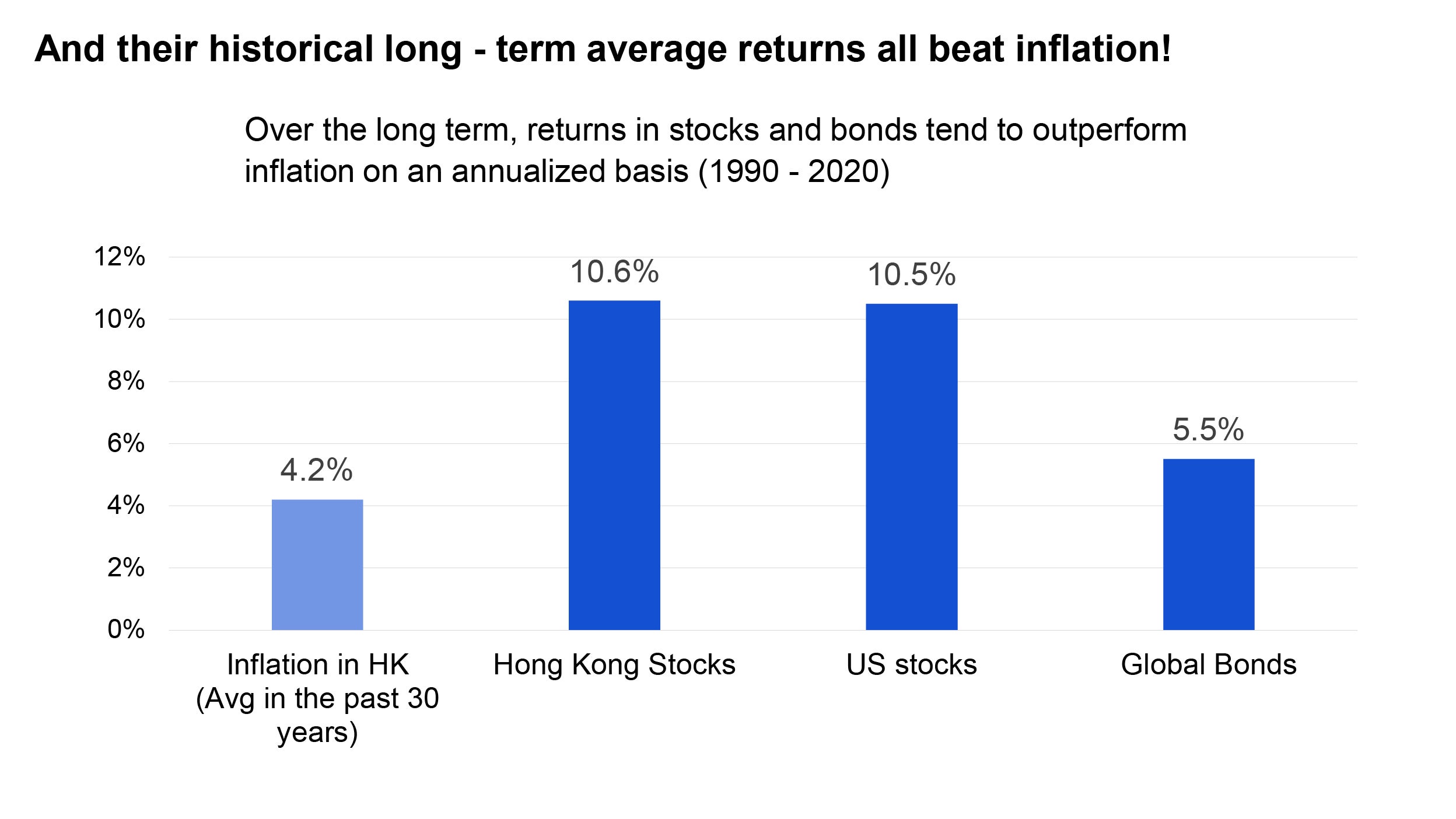

Strive to beat inflation and accumulate wealth

To beat inflation and accumulate wealth, one could consider making investments.

Criterion: Investments that generate returns that could potentially outperform inflation.

Some investments are well known to the general public:

Source: Bloomberg, as of Oct 30, 2020. Data from Oct 31, 1990 – Oct 30, 2020. The representative indices are: Hong Kong stocks – Hang Seng Index, US stocks – S&P 500 Index, Global Bonds – Bloomberg Barclays Global Aggregate Bond Index.

Things to note:

In order to make investments to counter inflation, investors need to have a long-time horizon.

Investment markets experience volatility from time to time.

To put this into practice, you could invest in equities and bonds directly, or you could gain access to these asset classes through mutual funds.