The recent US treasury market volatility

Uncertainty is the word of the moment. Last week brought us another chapter in the tariff wars – not surprisingly, US stocks and US Treasuries (UST) experienced wild swings while gold climbed higher.

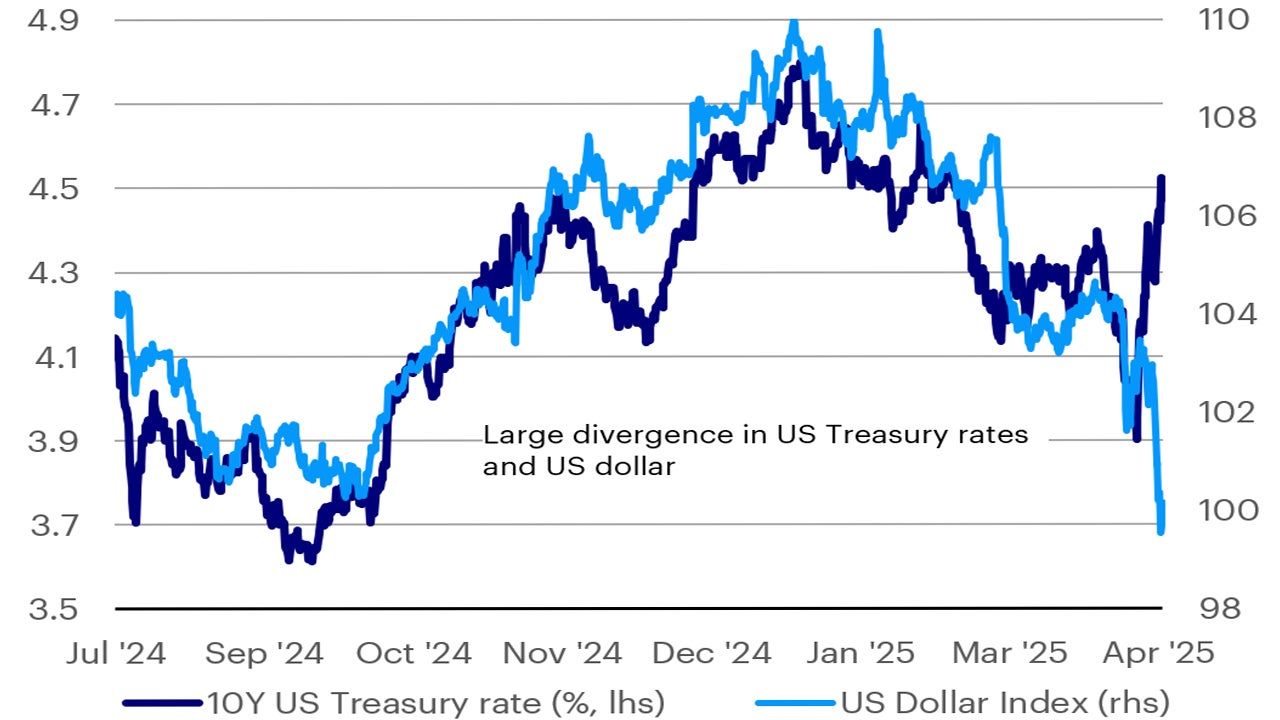

Market participants have also been concerned about the sudden shifts in UST yields as the USD declined.

Sources: Bloomberg and Invesco, daily data as at 11 April 2025.

What’s causing the spike in UST Yields?

It’s possible that last week’s bond market sell-off was the catalyst for the White House to back off its maximalist tariff policy.

But it’s still unclear what the causes and drivers were for the spike in UST yields. There could be a few possible factors, such as the diminishing US growth outlook, rising inflation expectations or foreign capital selling.

Possible driver for US yields - Recession fears

Recession fears are rising in the US, as tariff policy uncertainties eat into both business and consumer confidence. There is a debate right now on how negative this trade war is going to be for US growth and global growth.

The preliminary reading of the University of Michigan consumer sentiment survey for April fell to 50.8 from 57 in March, well below forecasts of 54.5.1 This was the lowest level since June 2022 and marks four consecutive months of decline in consumer sentiment.

A newly released study from industry group Chief Executive shows that 62% of CEOs and business owners expect a recession to occur in the next six months, up from 48% in March.2

Thus, it’s fair to paint a rather dim picture for growth in the US, which would also lead me to think that bond yields would fall in this environment.

Because normally, bond yields rise when growth expectations improve and investors sell bonds to favor riskier alternative assets such as real estate or equities.

I believe that the US equity market is a better barometer of what investors think of US growth prospects. Recently, cyclical stocks have stirred back to life after the 90-day tariff reprieve but remain lower relative to defensives before the tariffs were announced.

Possible driver for US yields - Higher inflation expectations from the higher tariffs

Another possibility to explain for the rise in yields could be higher inflation expectations from the higher tariffs.

Tariffs are likely to put an additional cost on the price of many goods and lead to supply disruptions.

Maybe that would explain why US inflation expectations have surged higher recently. In particular, five-year ahead inflation expectations have continued to surge and suggest longer-term inflation expectations haven’t met the litmus test of being “well anchored” — which policymakers are concerned with.3

Still, overall inflation reading in the US have continued to ease. Both the US Consumer Price Index and Producer Price Index prints for March were lower than expected.

Inflation expectations have actually come down in the bond market – at least what’s already priced in TIPS (Treasury inflation-protected securities) since the Liberation Day tariff announcement.

Possible driver for US yields - Foreign investors are selling off US assets

This takes me to my final possible driver for US yields over the past week. I believe foreign sellers have been the primary driver over the past few days that has caused the USD to weaken and UST yields to spike.

The recent rise in bond yields in the US but not so in Europe, China and Japan – leads me to believe that capital is exiting the US.

There is a strong perception that the US has become an unreliable strategic and economic partner and the impetus for capital flight out of US assets.

The greatest vulnerability for the US in the midst of the current tariff war is likely its relatively high level of debt and foreign ownership of it.

Just last year, the US’s cost to service its debt climbed so high that it exceeded its entire defense budget for the first time.4

The economic historian Niall Ferguson has argued that such a scenario isn’t sustainable for a great power.

Other countries know the high level of US debt is a serious vulnerability; if rates rise, it causes the US to spend significantly more servicing its debt.

We’ll want to follow US Treasury yields as that may very well help dictate the course of tariff wars going forward.

Recall US Treasury Secretary Scott Bessent’s goal of driving down the 10-year US Treasury yield, which has been thwarted in recent days.

With US Treasury yields moving up, the dollar declining, and US equities struggling to reclaim their pre-Liberation Day levels, market commentators have been trying to understand where the selling pressure is coming from. One possibility is an unwind of foreign holdings of US Treasuries.

It’s entirely possible that certain countries may want to find ways to use the US’s debt vulnerability as a weapon in the tariff fight, punishing the US for its tariffs by selling US Treasuries and driving up borrowing costs.

Foreign holdings of US Treasuries

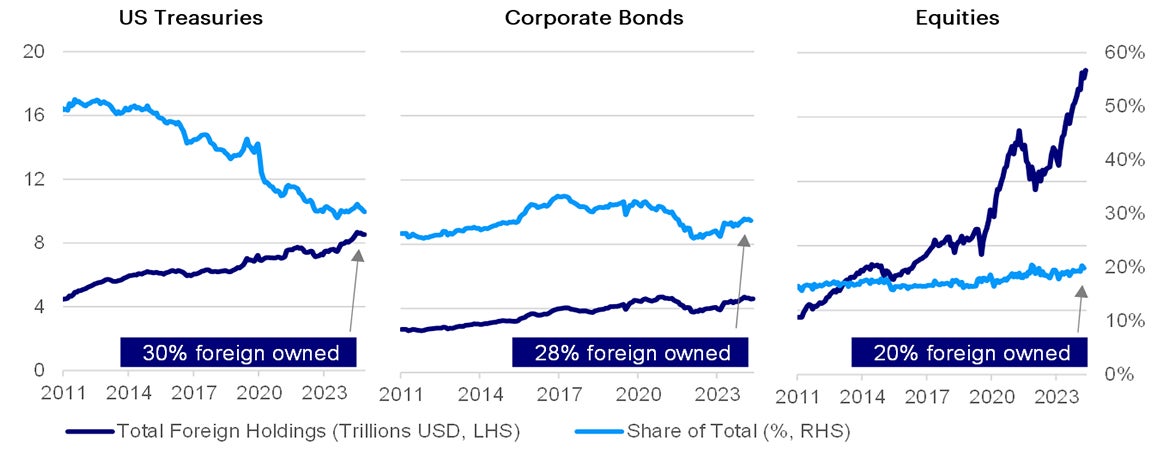

According to US Treasury statistics, foreign holdings of public US financial assets accounts for $32.1 tn in value. (For comparison, US residents hold about $15.8 tn in foreign assets.) Since 2009, foreign investors have allocated $6.6 tn to US Treasury securities, $1.2 tn to corporate bonds, and $0.7 tn to US equities.5

The fear is that investors may now be questioning the reliability of US assets amid sudden and large policy moves.

If foreign investors offload US assets in size, I expect the dollar to continue to weaken alongside rising Treasury yields.

More so, it seems that fewer countries are trusting the US — and therefore US Treasuries as a “safe haven” asset class.

This has resulted in greater buying of gold, which seems to have become the preferred “safe haven” asset class of choice.

Sources: US Treasury, Federal Reserve, and Invesco Global Market Strategy Office. Monthly and quarterly data from January 2011 to January 2025.

Is gold the last safe-haven asset standing? What other assets look attractive?

During times of economic uncertainty and market volatility, Treasury yields typically fall, and the dollar strengthens, as investors seek refuge in perceived ‘safe haven’ assets. The week of 7 April 2025 saw a rupturing of that dynamic.

Source: Bloomberg, as of 11 April 2025.

The simultaneous surge in Treasury rates and selloff in the dollar suggests that, in the current environment, investors may not see US assets as the refuge they once were.

Instead, market participants may be viewing gold as their preferred safe haven asset, considering that as Treasury rates spiked and the dollar weakened last week, the precious metal rallied 9.1%.6

Investment Implications

Markets still view the new trade policies as a mistake. A different trade policy approach will likely be needed for US markets to get some reprieve. Taken together – investors could potentially use gold as a way to hedge the risk of a further rise in US Treasury rates, as well as the risk of a US recession.

Additionally, for fixed income investors, we remain cautious on long-dated bonds in the US and that we prefer modest duration. There could be a relief rally if President Trump starts to announce trade deals with certain countries, but I believe that the longer-term damage has been done.

Plus, there is a significant amount of government bonds that are coming to the market later this year that could also impact market prices.

Our conclusion remains that the key driver for the recent spike in UST yields is the perception that US is undergoing un-exceptionalism. This is driving capital out of the US to other places and that the US is now a source of capital instead of a destination for capital.

With contributions from Kristina Hooper, James Anania, Thomas Wu and Ashley Oerth.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Reference

-

1

Source: University of Michigan Survey of Consumers, preliminary April survey, Apr. 11, 2025.

-

2

Source: Chief Executive poll, Apr. 14, 2025.

-

3

Source: University of Michigan Survey of Consumers, preliminary April survey, Apr. 11, 2025.

-

4

Source: Committee for a Responsible Federal Budget, May 10, 2024.

-

5

Figures quoted are based on flows and do not account for capital appreciation. Note: Figures are as of January 2025, which is the latest available data as of 11 April 2025. Figures for US Treasuries are based on marketable securities. Sources: US Treasury, Federal Reserve, and Invesco Global Market Strategy Office. Monthly and quarterly data from January 2011 to January 2025.

-

6

Source: Bloomberg, daily data for the 10-year US Treasury rate, US Dollar Index, and gold spot US dollar price as of 11 April 2025. The 9.1% gold return is measured from its low on 7 April 2025 to market close on 11 April 2025. Past performance does not guarantee future returns.