Russia-Ukraine war update – The impact on commodity prices and economic growth

A humanitarian crisis is brewing, and economic headwinds are growing from the outbreak of war in Ukraine.

The two biggest questions for investors are how long the military incursion will last and whether this will lead to a sustained period of high commodity prices that could drag global growth down.

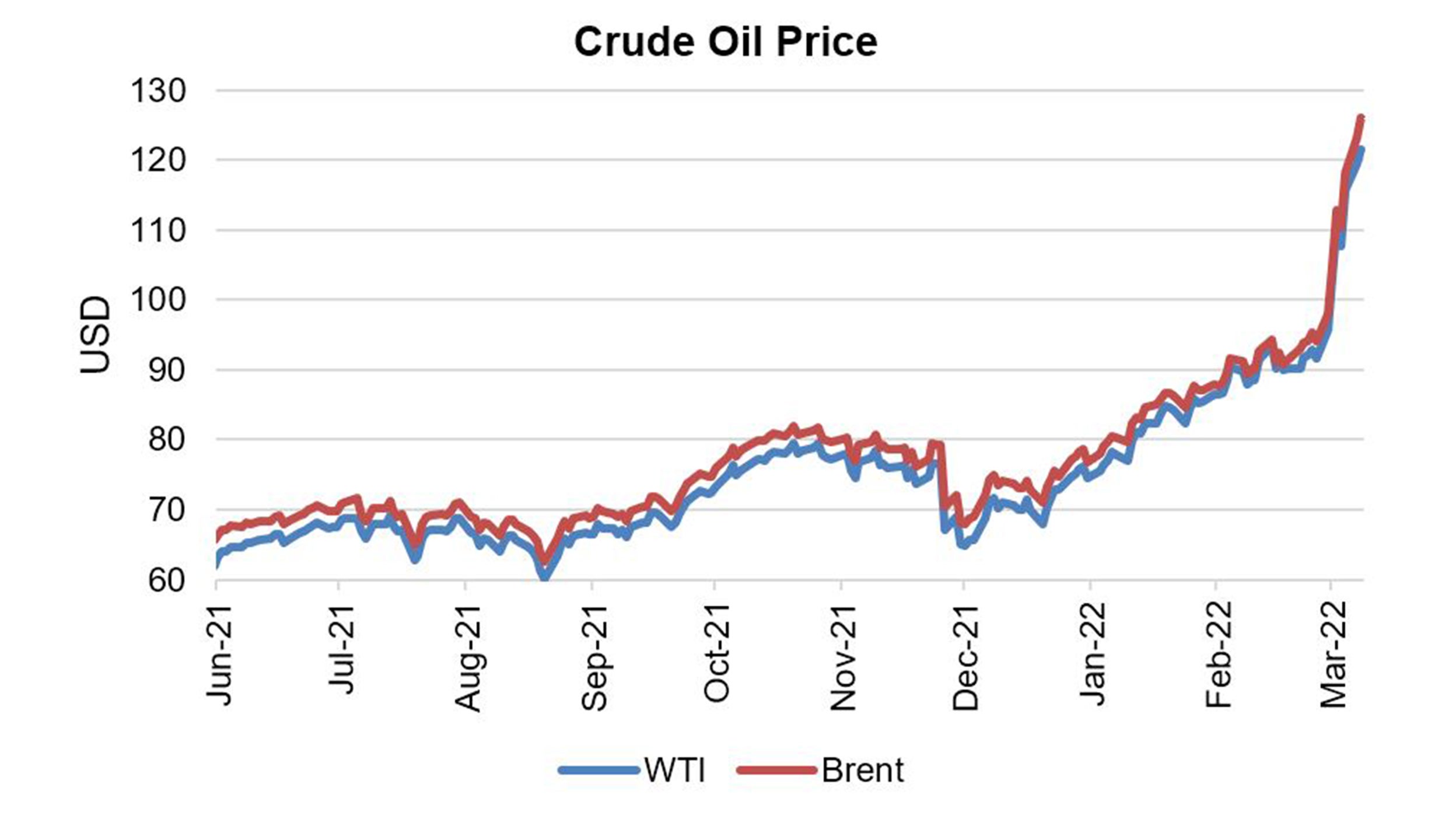

Oil prices are likely to remain high until further supply becomes available or global growth experiences some form of “demand destruction” as consumers balk at prohibitively high gasoline prices.

Source: Bloomberg. 8 March 2022.

Although I am not calling for a global recession, risks have certainly risen. Major central banks around the world (except for China) will soon embark on a tightening monetary policy schedule just as an energy supply shock could fuel already high levels of consumer inflation that could further dampen global growth.

Investment Implications

The risks of a Fed policy mistake have become more pronounced: tightening too quickly that causes a hard landing or on the flipside, not tightening enough that results in inflation expectations to become unmoored.

There couldn’t be a more appropriate time than now for investors to remain well-diversified across assets to weather this storm.

In light of the continued geopolitical uncertainties, it makes sense to be overweight in natural resources and those countries that are the biggest commodity exporters in energy, agriculture and metals. As a diversifier, investors may also want to think about alternatives, such as gold, real estate, market neutral, long-short strategies.

EMEA

European stocks have taken the brunt of the recent sell-off as the region is the most exposed to Russian energy. Although there are no sanctions yet from the region targeting Russian energy, considerable supply has already been sidelined, leading to soaring energy costs.

The price of Brent is currently trading at levels anticipatory of an EMEA sanction, though European leaders are loathe to sanction Russian energy due to the region’s reliance on Russia and OPEC+ signaling that the bloc does not intend to increase output in response to the war.

I am keeping a close eye on the outcome from the ECB’s meeting later this week. European equities could continue to face downward pressure due to the uncertainties over future energy supplies.

The US

The US is weighing sanctions on Russian crude oil, though it only imports around 3% of its total crude oil from the country, and the move would be more symbolic. Still, the war in Ukraine is likely to lead to further upward pressure on consumer price inflation that could result in a supply side shock.

In the near-term, inflation in the US could trend up towards 8.5% - 9.0% y/y due to rising food and energy costs. In response, the Fed is expected to fight these inflationary shocks and is expected to raise the policy rate by 25bps next week. It’s possible that the Fed could slow down or even temporarily pause its policy rate hike and asset tapering schedule this year due to the uncertainties in Ukraine.

I think US equities could be in a holding pattern with higher levels of volatility as investors assess the impact of the Ukraine conflict on inflation and possible Fed actions.

APAC

There could be uneven performance in APAC assets as their economies stand to handle the crisis in Ukraine differently. Energy exporters such as Australia and Malaysia stand to benefit.

I am keeping a close eye on APAC energy importers such as India and the Philippines - as higher oil prices could encroach on their current account deficits, fuel inflationary pressures at a time that investors are closely watching EM assets in light of Fed tightening.

China on the other hand, is probably the best insulated as the PBoC embarks on a more robust monetary loosening schedule and has low oil imports.