China continues monetary easing with cuts to the loan prime rate

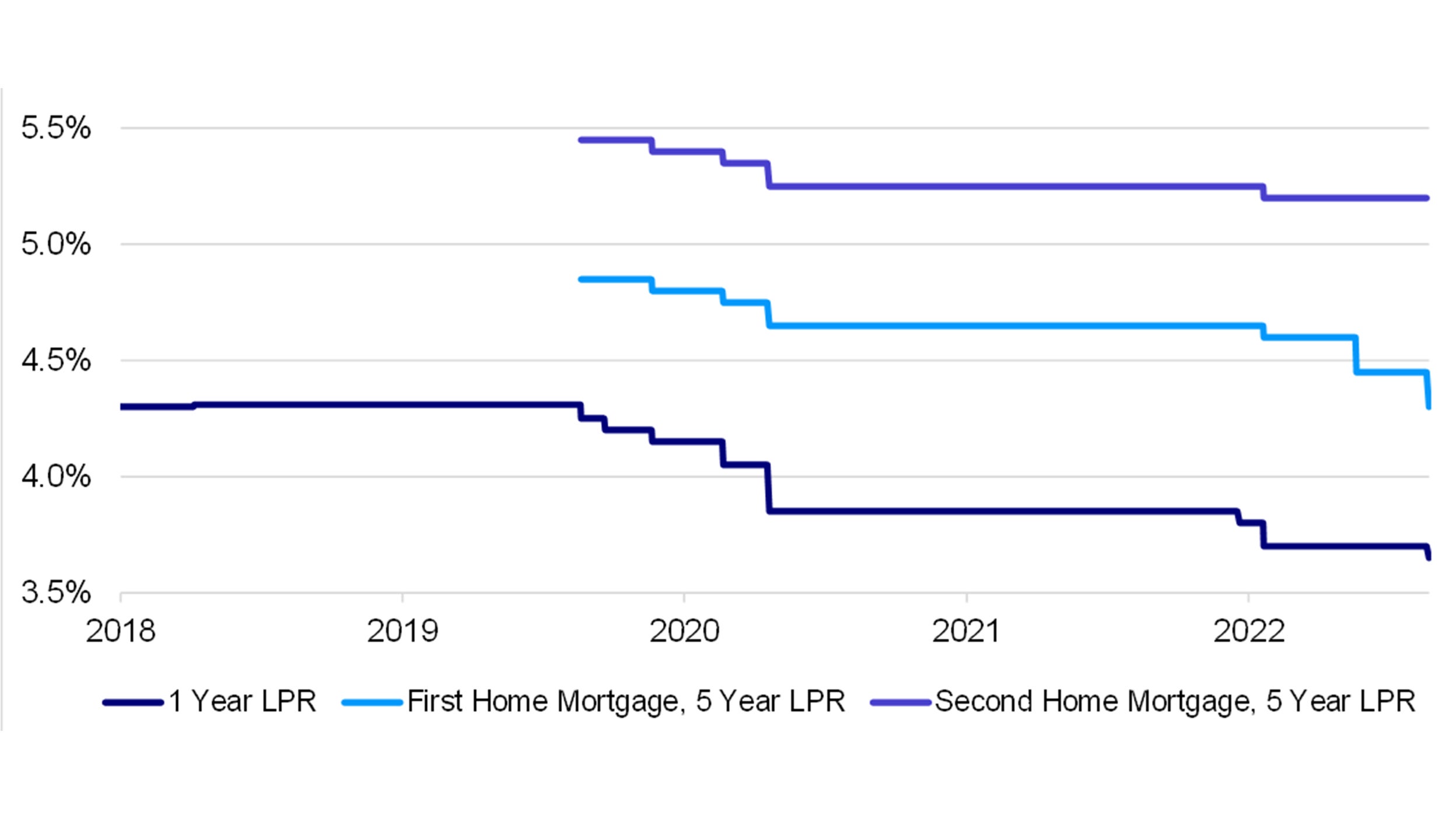

Taking guidance from the PBOC’s surprise cut to the medium-term lending facility (MLF) last week, Chinese banks lowered the 1-year loan prime rate (LPR) by 5bps to 3.65% and 5-year rate by 15bps to 4.30%.1

A 5bps cut to the 1-year isn’t going to move the needle though a 15bps cut to the 5-year - the benchmark used for mortgage rates - reflects the seriousness of the property market downturn and sends a strong message that policymakers are willing to take more forceful actions to stabilize the ailing market.

Source: The People’s Bank of China, as of 22 August 2022.

Implications

Though the LPR cut may provide near-term relief, easing liquidity alone is unlikely to lead to a turnaround to the property market.

So far, lower mortgage rates haven’t translated into higher property sales due to the lack of confidence in large developers and the presales model.

Policymakers may need to implement more non-traditional measures or even some kind of intervention in order to restore faith in the property market.

Going forward, I expect more policy measures to solve the property market riddle. For example, official news recently broke that 3 policy banks will offer special loans to housing projects in trouble.

I believe that the central and local governments have the financial tools to provide an excess of RMB 3 trillion in funds to combat the market downturn and to prevent risks from spreading to other sectors.