All eyes on China’s 20th Party Congress

Currently, all eyes from investors in this part of the world are on the 20th National Party Congress meeting.

President Xi is expected to move to his third term as the leader, and investors are hoping to get answers on key issues, including policy directives such as how and when China will relax its Zero COVID policy, and the extent of fiscal and monetary support.

China's reopening will have substantial implications for the rest of the world and for the companies’ performance within China.

Significance of the 20th Party Congress

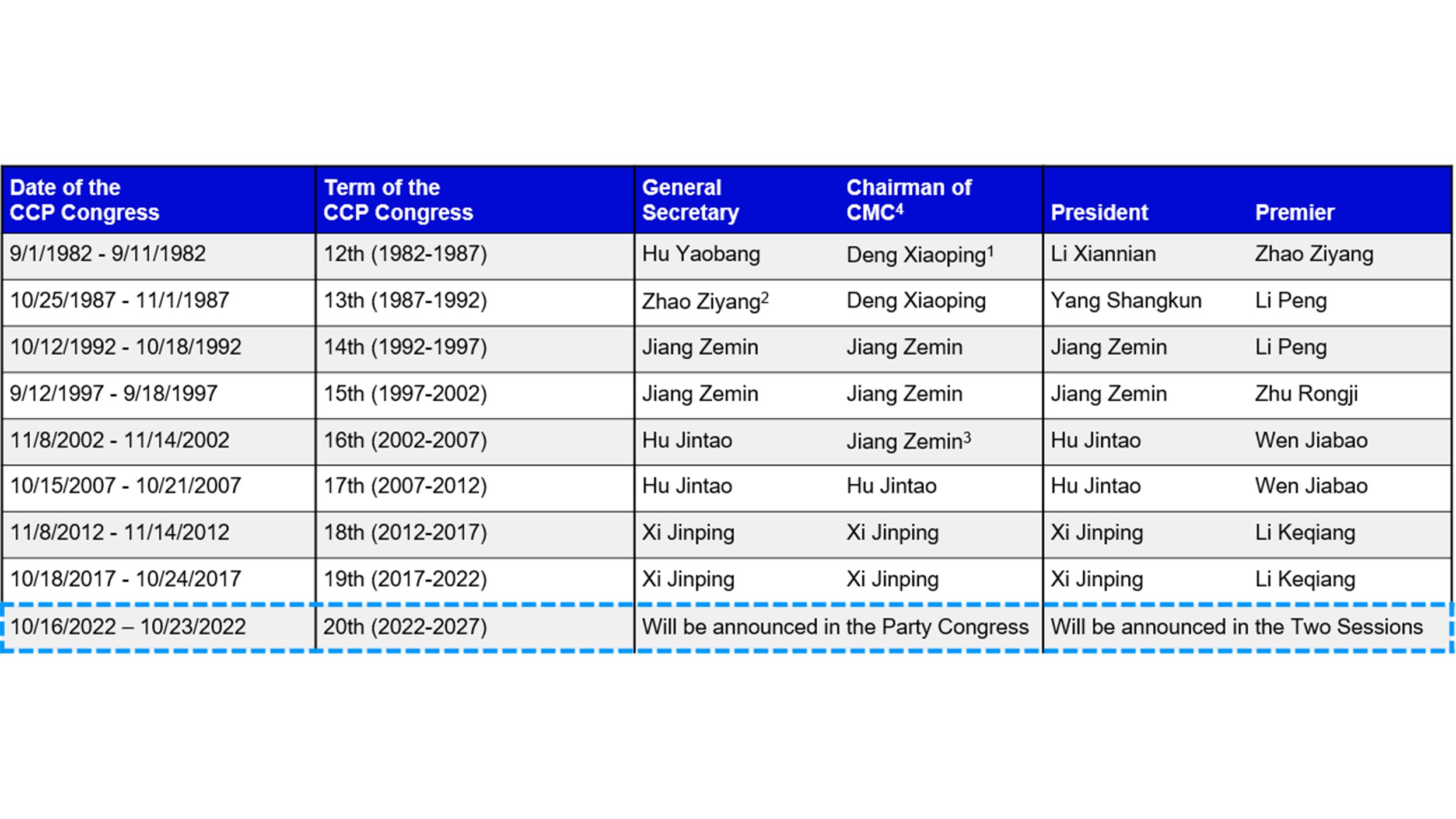

- The Communist Party of China will hold the 20th Party Congress from 16 to 23 October 2022.

- This is the most important political event every 10 years, as the new leadership of China, including the Politburo Standing Committee and the General Secretary will be elected.

- Market expects President Xi to move to 3rd term as the General Secretary of the Party.

- Investors hope to see more clarity of policy directives, including the COVID policy and the extent of the fiscal and monetary policy.

- All eyes are on this Party Congress as it’s never been as important, given the zero COVID policy and softening global growth.

1 Zhao Ziyang held the position from 1987-1989, Jiang Zemin took the position from him in 1989.

2 Deng Xiaoping held the position from 1983-1990.

3 Jiang Zemin held the position from 1990-2005, Hu Jintao took the position from him in 2005.

4 CMC – China Central Military Commission.

President and Premier were appointed at the “Two Sessions” in the next year of the Party Congress.

Source: Goldman Sachs Global Investment Research, September 2022

Potential Reopening

- China’s reopening could be an extra driver for growth, both internationally and domestically.

- It’s unlikely that there will be significant changes ahead of the Party Congress although the exact reopening timeline is still uncertain.

- Apart from Party Congress’ confirmation of leadership being a pre-requisite for reopening, there are several conditions that we need to keep an eye on the reopening timeline:

- Adequate vaccination rate: Currently, 85%1 the elderly have been fully vaccinated and only 66% have injected the booster vaccine. A higher vaccination rate of the elderly will be a major prerequisite for reopening.

- International events: China will host marathon in Beijing next month and Asian Games in Hangzhou in September 2023.

- Extra health care facilities: There are more field hospitals completed in major cities for treatment purpose.

Potential China reopening has a profound impact on global growth

- We expect China’s reopening will have significant implications for global investors as Chinese consumers boost spending.

- The pent-up demand after the border reopens will likely result in a strong rebound in trade, exports and growth in Asian countries.

- ASEAN countries would benefit from China residents’ outbound travel, while Taiwan and Korea would benefit from exports of tech products.

Domestic corporate earnings could get a much-needed boost from potential reopening

- We believe Chinese companies will benefit from reopening which could lead to potential uplift in earnings.

- Key beneficiaries may be contact-based services and discretionary spending-related industries, including healthcare, consumer staples and consumer discretionary sectors.

- When social distancing measures are lifted, more conferences and gatherings will be held, benefitting food and beverage companies and hotels.

- Demand for discretionary products, such as sportswear and electric vehicles, may also ramp up as consumption recovers.

- We expect healthcare companies are also beneficiaries as the number of surgeries and operations will be normalized back to pre-COVID level.

Chinese equities may offer attractive diversified opportunities

- The reopening of China, with over 1.4 billion population, may be a growth driver, a key catalyst for the stock market. China, the second largest economy in the world, always provides ample bottom-up opportunities.

- Chinese equities may also offer opportunities for global investors to diversify the market risk amid turmoil in equity markets in western countries.

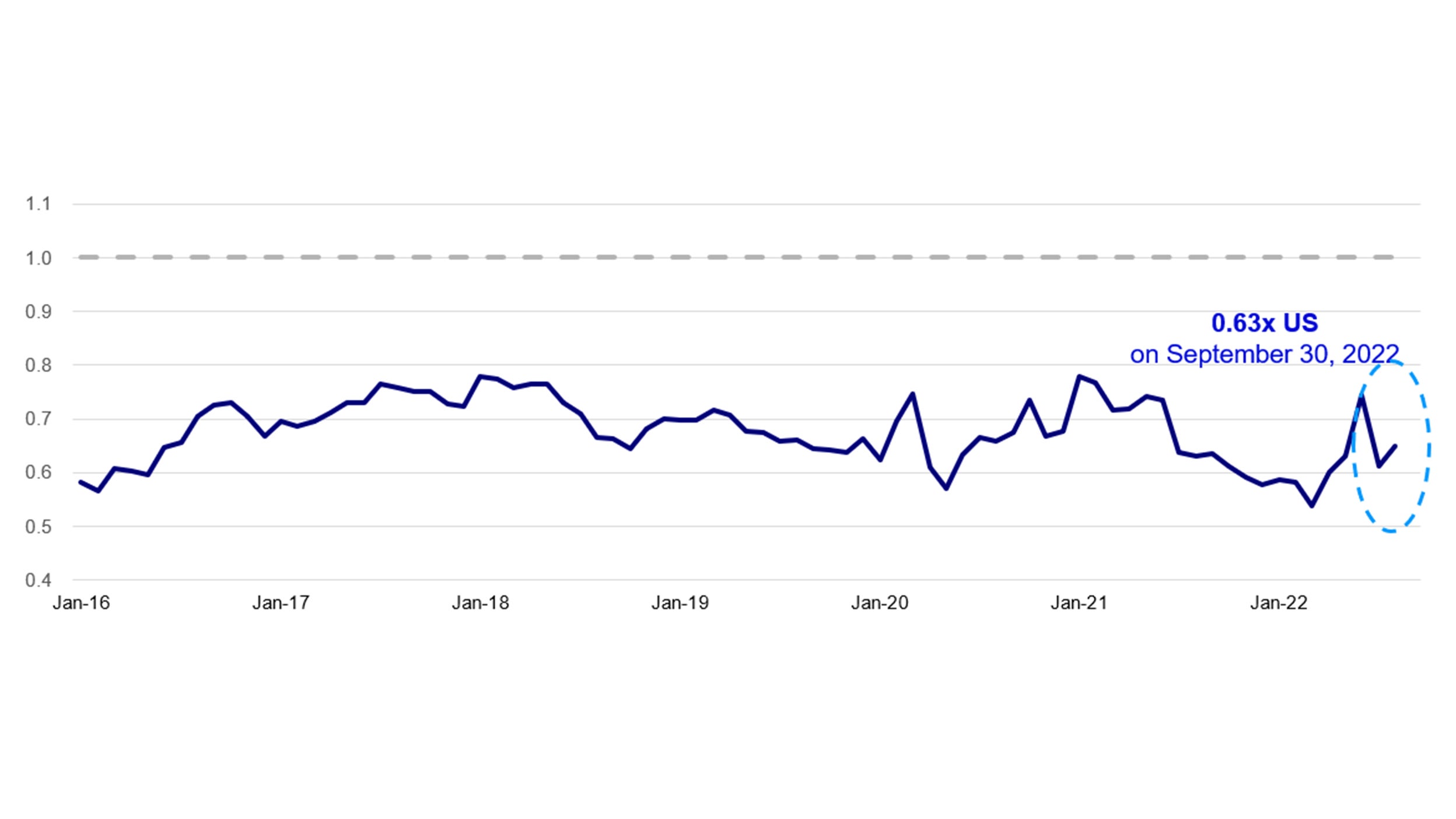

- On valuation, MSCI China was trading at an attractively low level at around 10.5x price-to-earnings as of September 20222, a 5-year low.

- The forward P/E of MSCI China was trading at 37% discount compared to MSCI US.3

Source: FactSet, data as of 30 September 2022.

Relative P/E of China vs. US refers to Price-Earnings ratio for the next 12 months of MSCI China vs MSCI US.

Past performance is not a guarantee of future results.

Reference

-

1

Source: Morgan Stanley, September 2022

-

2

Source: Factset, October 2022

-

3

Source: Factset, October 2022