Structural trends

This year’s Black Friday reflects changing consumer behaviour

As retailers entice consumers with plenty of deals on Black Friday, we take a look at consumer trends, and ask ourselves: can inflation spoil Christmas?

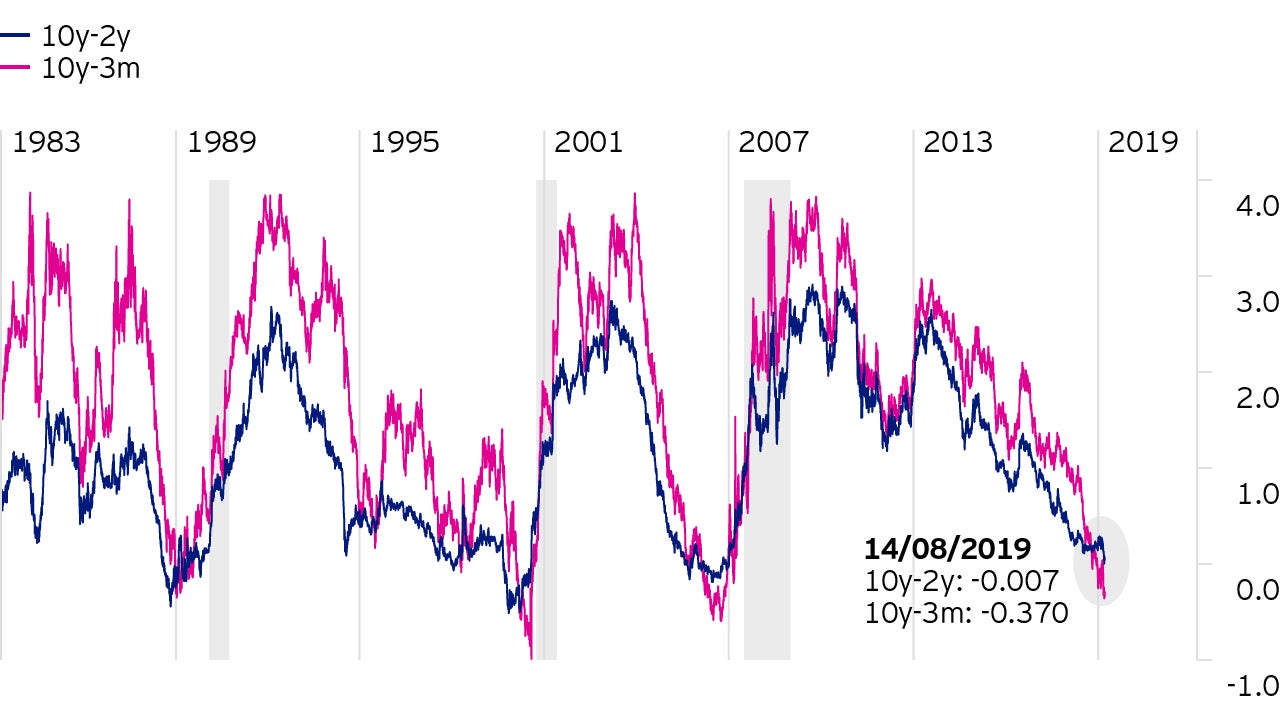

One widely followed and conventional measure of the US yield curve inverted last week for the first time since 2007 with the 10-year US Treasury yield falling below the yield on the 2-year maturity. This attracted widespread focus across the investment community and media.

Evidence on yield curve inversions is mixed. While they have often preceded recessions in the past, there have been some false signals such as 1998 during the Asian crisis when investors rushed for the safety of long dated US Treasuries. When it has predicted recession - e.g. in the early 1990s, 2001, 2008, etc - the time lag between inversion and recession has varied between one to three years, with the average being 22 months.

Evidence on yield curve inversions is mixed. While they have often preceded recessions in the past, there have been some false signals such as 1998 during the Asian crisis when investors rushed for the safety of long dated US Treasuries. When it has predicted recession - e.g. in the early 1990s, 2001, 2008, etc - the time lag between inversion and recession has varied between one to three years, with the average being 22 months.

Some parts of the US economy have certainly been on a weakening trend, particularly those sectors that are more exposed to escalating trades tensions such as investment and export orders. Against, that, the consumer sector remains buoyant, as does small and medium-sized business confidence which is more attuned to domestic economic conditions. Furthermore, credit growth to corporates is holding up well and there is no real sign of worrisome imbalances or bubbles in housing or the banking sector than have been the harbinger of previous recessions.

The recent inversion has mainly been driven by a rally in 10-year yields rather than a rise in 2-year yields which has characterised many previous inversions and that would ordinarily suggest that Fed policy had become too restrictive. The more likely explanation is that the rally in longer-dated US Treasuries has been driven by global influences such as global trade concerns and the reach for yield that seems to pervade all bond markets these days. Put simply, when the German 10-year government bond is yielding -0.6%, a yield of 2% in the US against a backdrop of global economic concerns looks attractive. Add to that concerns that central banks don’t have sufficient tools to fight the next recession and it is plain to see how bond markets end up in a self-fulfilling vortex lower bond yields and increasing concerns over growth.

A short-term correction could just come down to a tweet from the US President on trade, better data, or market positioning. A bigger and more durable gamechanger would be a more permanent thawing in US-China trade tensions or extensive trade deal complete with a rolling back of tariffs; significant China stimulus; or, a relaxation of fiscal constraints in Europe. Headlines recently suggest that Germany may be prepared to loosen the purse strings to counter recession risks.

In conclusion, while there is certainly some value in observing relative moves in the yield curve, an actual inversion event does not in and of itself signal imminent recession. Economic risks are growing, mainly as a consequence of escalating trade tensions but the US economy for the most part remains in good shape. We believe it is not a time to chase ever lower yields which justifies some caution when it comes to duration exposure. In this environment, there is still good value to be found in selective EM markets where real yields (once inflation expectations are stripped out) look, on the whole, quite attractive in my opinion.

This year’s Black Friday reflects changing consumer behaviour

As retailers entice consumers with plenty of deals on Black Friday, we take a look at consumer trends, and ask ourselves: can inflation spoil Christmas?

Risk & Reward - 1st issue 2021

As with all things new, factor investing in China holds a special appeal. Other articles in this issue address fixed income investing in times of low market yields, real estate sector investing, the merits of estimating the covariance matrix and how to capture multi-asset class factor premia.

European Equities: What does ESG mean to us?

Our focus as active fund managers is on finding mispriced stocks. We are open to buying companies whose qualities and future potential are not properly reflected in their share prices. Equally, we look for companies whose willingness and efforts to change have yet to be recognised by the market. Correctly anticipating change for the good and the scope for market perceptions to catch up with reality can generate strong investment returns. The key is identifying the issues and focusing on the path to improvement.