Equities

China’s healthcare sector – the opportunity for equity investors

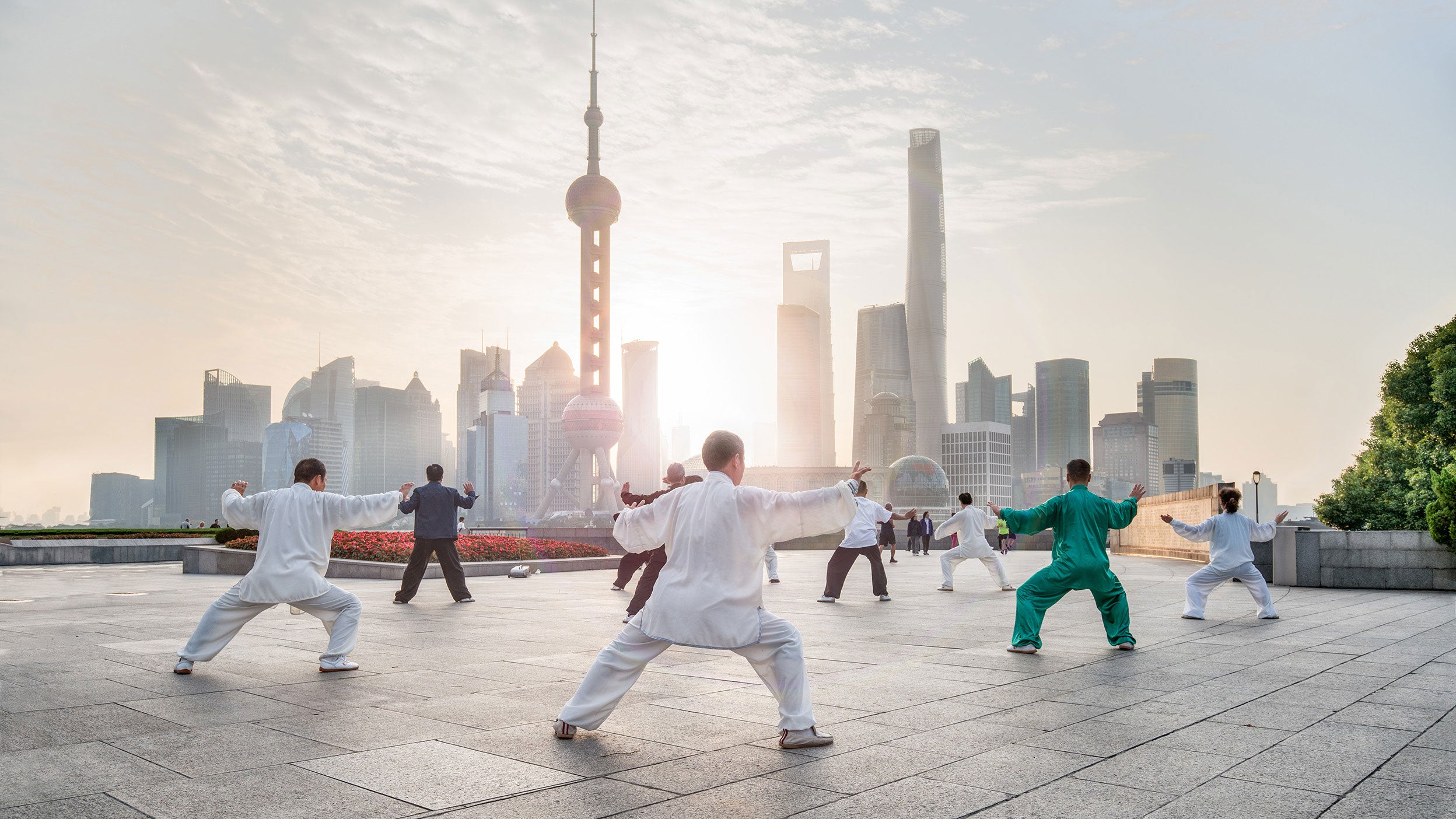

Robust income growth and an ageing population are driving the fastest-growing major healthcare market in the world, according to the Economist Intelligence Unit (EIU).

The Invesco China Health Care Equity Strategy seeks to exploit the investment opportunities emerging in China’s healthcare sector – growing rapidly on the back of an exploding middle class and other key drivers.

Based in Hong Kong and China, Invesco’s award-winning investment team of 80-plus professionals combines local knowledge with a global perspective.

Investors can gain a full understanding of the investment opportunities in China’s healthcare sector, and why the Invesco China Health Care Equity Strategy is best placed to realize the sector’s potential, in the following articles:

Click on one of the articles below to begin the series.

China’s healthcare sector – the opportunity for equity investors

Robust income growth and an ageing population are driving the fastest-growing major healthcare market in the world, according to the Economist Intelligence Unit (EIU).

Invesco – pioneering investment in China

Invesco recognized China’s huge investment potential early, launching its first Chinese equity fund back in 1992, and establishing the first Sino-American joint venture - Invesco Great Wall (IGW) Fund Management Company Limited in 2003.

Our strategy: targeting the unique opportunities in China’s healthcare sector

We focus on Chinese healthcare companies with long-term growth potential based on industry leadership, competitive advantage, clear business strategy and transparent corporate governance.

1 Source: Invesco as at 31 March 2021.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

As a large portion of the strategy is invested in less developed countries, you should be prepared to accept significantly large fluctuations in value.

As this strategy invests in a particular geographical region, you should be prepared to accept greater fluctuations in value compared to a strategy with a broader investment mandate.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

The strategy invests in a limited number of holdings and is less diversified, and therefore this may result in large fluctuations in value.

As this strategy is invested in a particular sector, you should be prepared to accept greater fluctuations of the value than for a strategy with a broader investment mandate.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This article is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

By accepting this material, you consent to communicate with us in English, unless you inform us otherwise.

Further information on our products is available using the contact details shown.