Asset allocation

Capital market assumptions

Invesco Investment Solutions develops capital market assumptions (CMAs) that provide long-term estimates for the behaviour of major asset classes globally.

Emerging markets (EM) have always been at the mercy of global macro trends. However, idiosyncratic economic and political factors have also always driven individual market performance and formed the basis for differentiation among countries, especially when faced with an external shock.

This year, a negative shock dominating EM economies has been the onset of trade wars, with its resulting hit to investor sentiment and dramatic fall in global trade volumes. Another key driver has been the return of monetary easing by major global central banks.

Improvements in EM fundamentals since 2013 has given EM policy makers space to combat the negative impact of trade uncertainty with monetary and fiscal policy. Many EM countries have begun to cut monetary policy rates, but some countries face constraints like rising debt and poor fiscal positions.

Others suffer from high inflation or are sensitive to the risk of currency devaluation. Along with political considerations, a key differentiating factor among EM economies is the extent to which policy makers can provide sustained monetary and/or fiscal stimulus without endangering macro stability.

Easier financial conditions can also create pitfalls - while they can support asset prices and reduce financing pressures, they can also mask highly differentiated EM fundamentals and lead to unwise policy choices if countries rush to follow global stimulus when their focus should be on making tough policy choices.

It remains to be seen if policy easing can offset global trade shocks - recent global trade and survey data point to the risk of a further slowdown. We are monitoring several factors as potential harbingers of economic recovery in EM, including signs of an organic recovery in developed market manufacturing and capital expenditure, a durable improvement in US/China trade talks and more aggressive Chinese economic stimulus.

Amid this uncertainty, getting key idiosyncratic markets right this year will likely remain a critical driver of EM investment performance. Turkey is an example of a major EM economy in which domestic policy choices have made its asset prices vulnerable to global market sentiment.

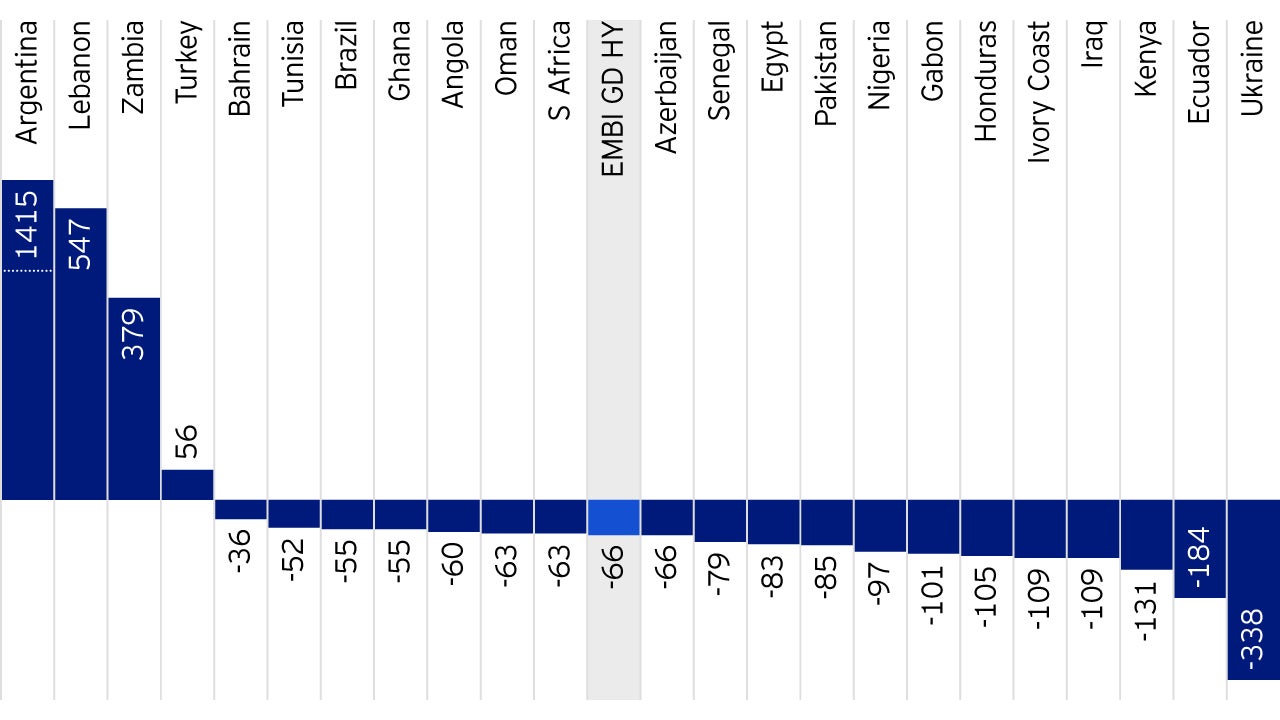

Argentina is highly idiosyncratic due to its difficult-to-call macro story in the aftermath of unexpected political events.

And in Ukraine, economic crisis and political developments have led to the formation of strong policy anchors, improving the macro picture and helping to insulate Ukrainian assets from global developments.

Frontier economies such as Ukraine, with strong macro momentum and newly found political consensus around reform remained resilient during the August EM selloff. All three types of markets will likely remain important for EM returns in the near term.

The surprising defeat of President Mauricio Macri by leftist politician Alberto Fernandez in the recent presidential primary created a crisis of confidence leading to a material depreciation of the currency and repricing of Argentina’s debt. Uncertainty over a Fernandez presidency will likely continue to drive volatility until there is greater clarity on his potential economic team and policy framework.

Campaign speeches ahead of the first round of presidential voting on October 27 may not be a credible basis for judging potential policy, and rhetoric could harden if there is a second-round of voting on November 24. Although he is considered a moderate Peronist, and we expect him to be pragmatic, Fernandez would likely need to convince markets of his pragmatism early on in his administration. The primaries bode well for governability, given the strong representation of Fernandez’s party in both chambers of the legislature.

Fernandez will likely have two important decisions to make early on: the country’s fiscal path and the way forward with the external debt in the context of an overall economic and International Monetary Fund (IMF) program.

We believe Argentina is currently facing a liquidity crisis, not a solvency one and its capacity to pay debt service is a key vulnerability. The likelihood of a debt reprofiling, including IMF debt, has risen, in our view. As markets reprice, they may remain skeptical given policy uncertainty, especially if more moderate policies fail to deliver positive and timely economic results.

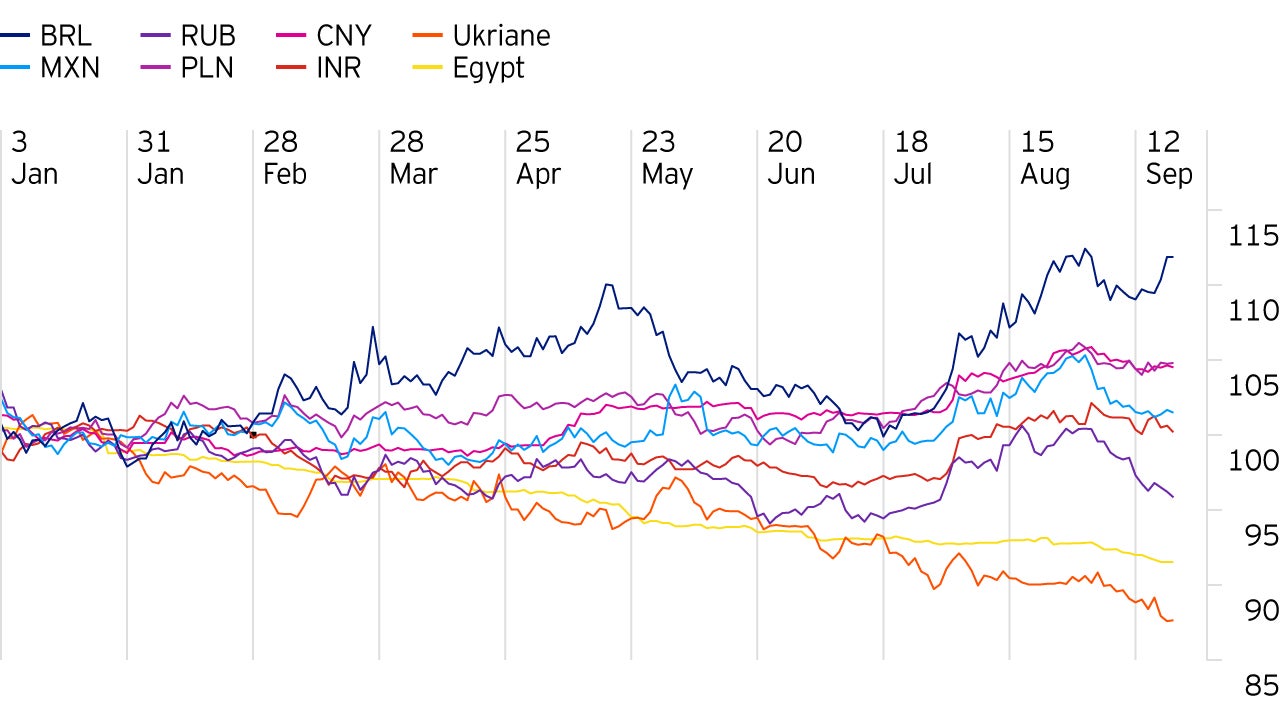

Despite high nominal interest rates relative to peers, Turkey’s high inflation, dollarization and low real interest rates expose its bonds and currency to sharp sell-offs. Headline inflation has declined in recent months, but high and persistent core inflation and heightening inflation expectations suggest that underlying inflation is entrenched in the double digits. Despite price pressures, the central bank has begun an aggressive rate cutting cycle. On the fiscal front, budget deficits are rising as growth has slowed. The Treasury has avoided issuing longer-term bonds to avoid paying higher interest rates, but bond supply is likely to increase at some point, putting pressure on interest rates. The combination of high and entrenched inflation, eroding real interest rates, fragile confidence in the currency, as implied by dollarization, and emerging funding pressures lead us to be cautious on Turkish local rates and the currency.

On a wave of strong anti-establishment sentiment, political novice, Volodymyr Zelensky, became Ukraine’s new president in the spring of this year. In the summer, Zelensky’s freshly formed party, People’s Voice, gained a majority in parliament. This is the first time in Ukraine’s post-Soviet history that its parliament is dominated by a single party aligned with the president, which could mean a positive sea-change for reform prospects, if used wisely.

While a neophyte president and relatively inexperienced parliament may cause concern, the fundamental shift in the county’s orientation toward the European Union (EU) and away from Russia is unlikely to change in the near term. The trade deal with the EU, the visa-free regime and support of the international financial institutions toward the funding and rebuilding of Ukraine’s institutions all help to form a powerful anchor for long-term reform prospects.

Economic momentum is strongly positive with growth surprising to the upside. Inflation has slowed to high single digits and the currency has appreciated sharply, bucking global and domestic seasonal trends. The fully reformed National Bank of Ukraine has repeatedly proved its independence in setting its inflation targeting regime and stabilizing the banking sector. Inflation should gradually fall toward the bank’s 5% target, allowing it to continue with its cautious rate cutting cycle from a current policy rate of 16.5%.1 A credible Ministry of Finance is expected maintain conservative fiscal policy.

Ukraine’s external credit profile is also improving. The debt to gross domestic product ratio has fallen below 60% from around 90% in 2015 and should decline toward 50% next year.2 The government is currently in talks with the IMF regarding a long-term structural adjustment program to succeed the expiring stand-by agreement.

Structural reforms such as land reform and long-delayed privatization should help support investment growth going forward. We believe valuations are attractive compared to the direction of travel of the country’s fundamentals, which are largely driven by domestic factors, and policies appear to be well anchored.

Capital market assumptions

Invesco Investment Solutions develops capital market assumptions (CMAs) that provide long-term estimates for the behaviour of major asset classes globally.

Monthly Market Roundup cov. October 2022

Invesco’s Monthly Market Roundup is back. This month, teams reflect on mixed fortunes for global stock markets. Europe, the UK and the US bounced back, while Asia continued to struggle.

Mike Bessell – A market update from Invesco Real Estate Europe

From his home office, Mike Bessell, European Research Strategist for Invesco Real Estate responds to the evolving macro-economic outlook, and the short-term impact of COVID-19 on European real estate markets.