2022 Invesco Real Estate outlook: road to recovery

Key takeaways

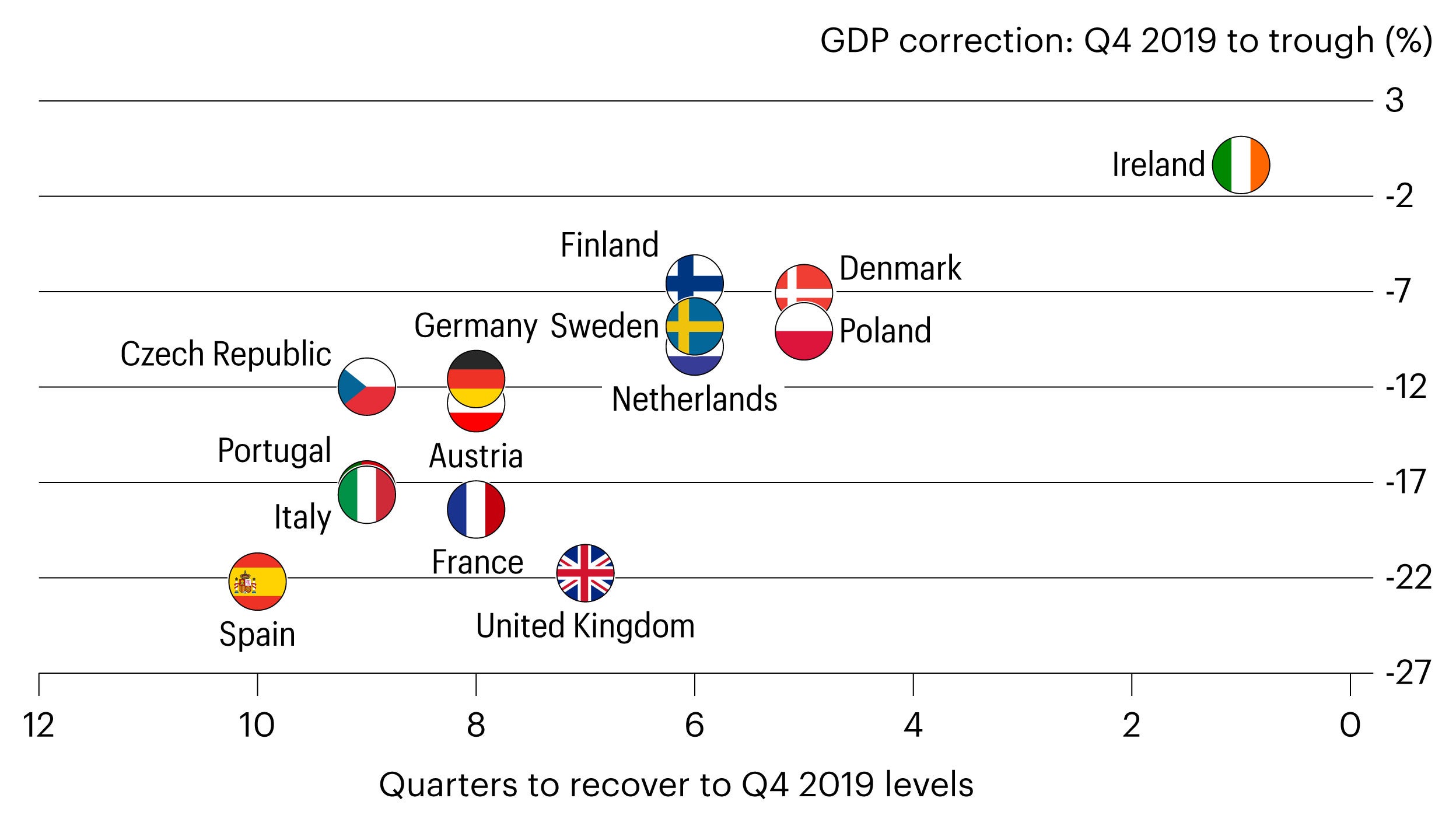

The first half of 2021 saw European states rolling out COVID-19 vaccines and easing back on lockdown restrictions, leading to a gradual return to economic normality. Forecasts have been brought forward, with key European countries expected to return to 2019 GDP levels between Q2 2021 and Q3 2022.

Despite the rebound in economic activity, tenants continue to navigate the uncertainty with caution. The result is that, in the near-term, we expect market-level rental growth to be limited to certain sectors and sub-sectors. Therefore, for most assets, real estate returns will be driven by asset management initiatives and the ability to drive operational improvements. Longer-term, we remain focused on opportunities to meet post-pandemic demand and areas which benefit from structural tailwinds.

Source: Invesco Real Estate, as of September 2021

Investor demand

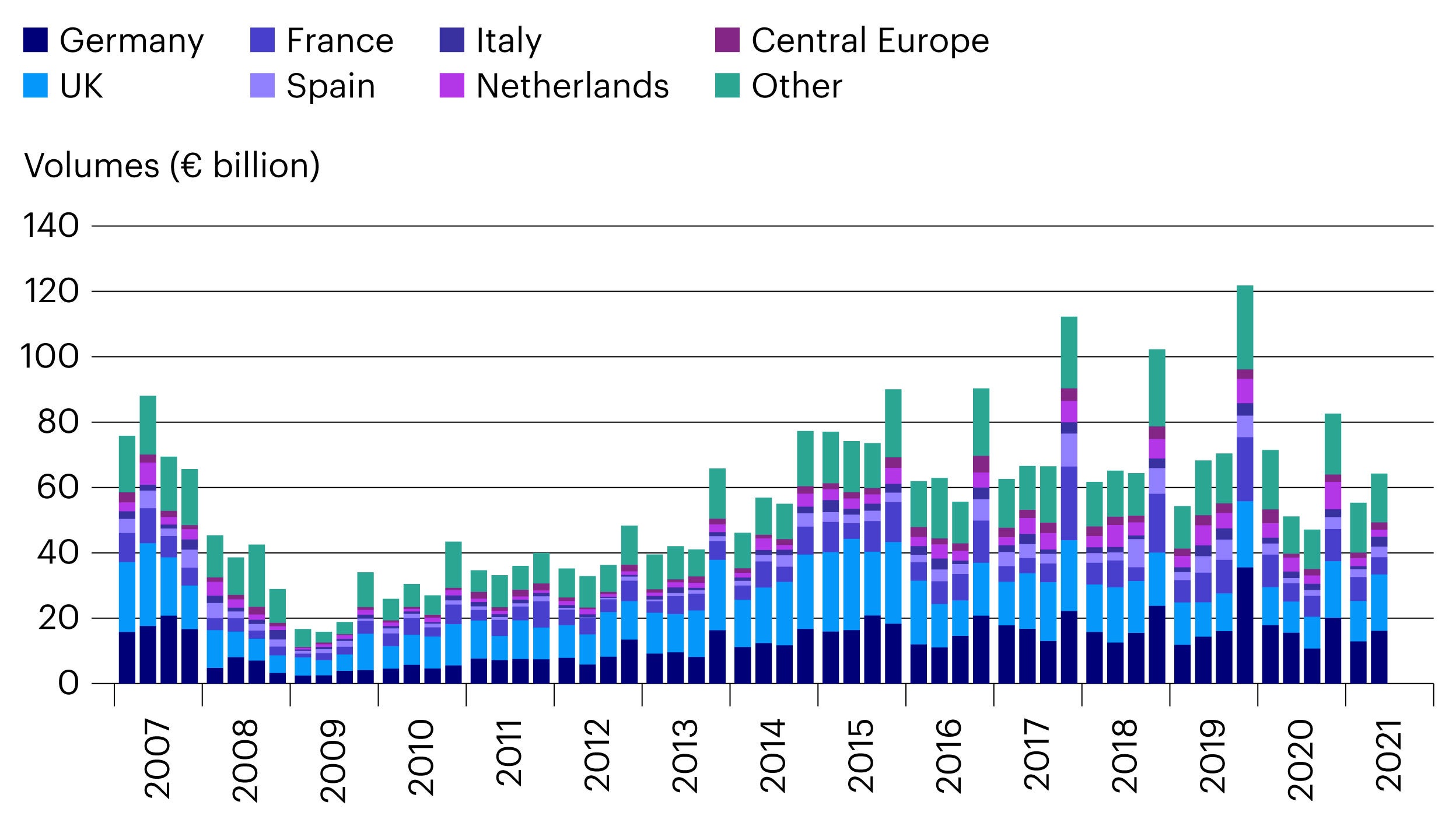

In the first half of 2021 European real estate transaction volumes were lower than a year earlier, according to data from Real Capital Analytics (Figure 2). Commercial real estate assets were 11% lower year-on-year, while the overall figure was boosted by a 25% increase in development sites.

There was clear variation by sector, with significant investor demand for logistics. This saw volumes fall just shy of the long-term average for full year volumes. Meanwhile, office and retail transaction volumes remain down, both year-on-year and relative to long-term averages. Interestingly, hotel transactions recovered over the first half of 2021, albeit against a weak comparator from 2020.

Of the major geographical markets, the UK rebounded 32% during the first six months. Meanwhile, Germany and France saw volumes decline – largely as a result of limited product being brought to market.

Looking into 2022, we believe that investors will focus on the following areas:

1. Quality, income and security.

2. Opportunities to reposition assets for the post-COVID recovery.

Note: Includes property or portfolio sales US$10million or greater.

Source: Invesco Real Estate, based on data from Real Capital Analytics, as of August 25, 2021

A green foundation: ESG+R

Environmental, Social, Governance (ESG) credentials are an increasingly important consideration for both real estate investors and occupiers across Europe. ESG + R (ESG and Resilience) investing is a fundamental commitment at Invesco Real Estate.

Our ESG+R philosophy is based on our belief that ESG aspects can deliver both competitive financial returns and opportunities for business growth and innovation. To support this, we have set global targets:

- 3% annual reduction in energy and emissions by 2030 from a 2018 baseline.

- Net zero carbon emissions by 2050.

- 1% annual reduction in water consumption and 1% annual increase in waste diversion.

Planning the route ahead

European real estate markets have shown positive momentum throughout 2021. They have benefitted from increased confidence as a result of the global roll-out of COVID vaccines, despite the rising concern from the spread of the delta variant. Barring further economic impacts from significant COVID containment efforts, European GDP growth forecasts show steady recovery through 2021-22, with most markets returning to 2019 output levels by late 2021 or early 2022.

For European real estate markets, the investment considerations at present focus on the medium-term outlook for sectors, and the extent to which these may have changed as a result of COVID-19.

We remain clear in our view that the pandemic caused significant short-term disruption, without directly changing any of the longer-term structural influences on real estate.

However, for certain sectors, the reaction to COVID-19 accelerated structural changes which were already occurring, such as the increase in online retailing. Meanwhile, other sectors have seen a short-term disruption, such as global travel patterns, but we reasonably expect them to return to previous trends as activity normalises.

Related insights

Risk warnings

-

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested.

Important information

-

This is marketing material and not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.