2022 Invesco Investment Solutions private market outlook: bouncing back

Key takeaways

Our alternatives platform invests in, and advises on, allocations to a variety of private markets. Our purview means we are well-positioned to analyse across and within alternatives, utilising our expertise in this space and the vast dataset available to us.

For all alternative assets, we look at a combination of qualitative and quantitative measures. This includes valuations, fundamentals, and regime which all help determine a level of attractiveness ranging from very attractive to very unattractive.

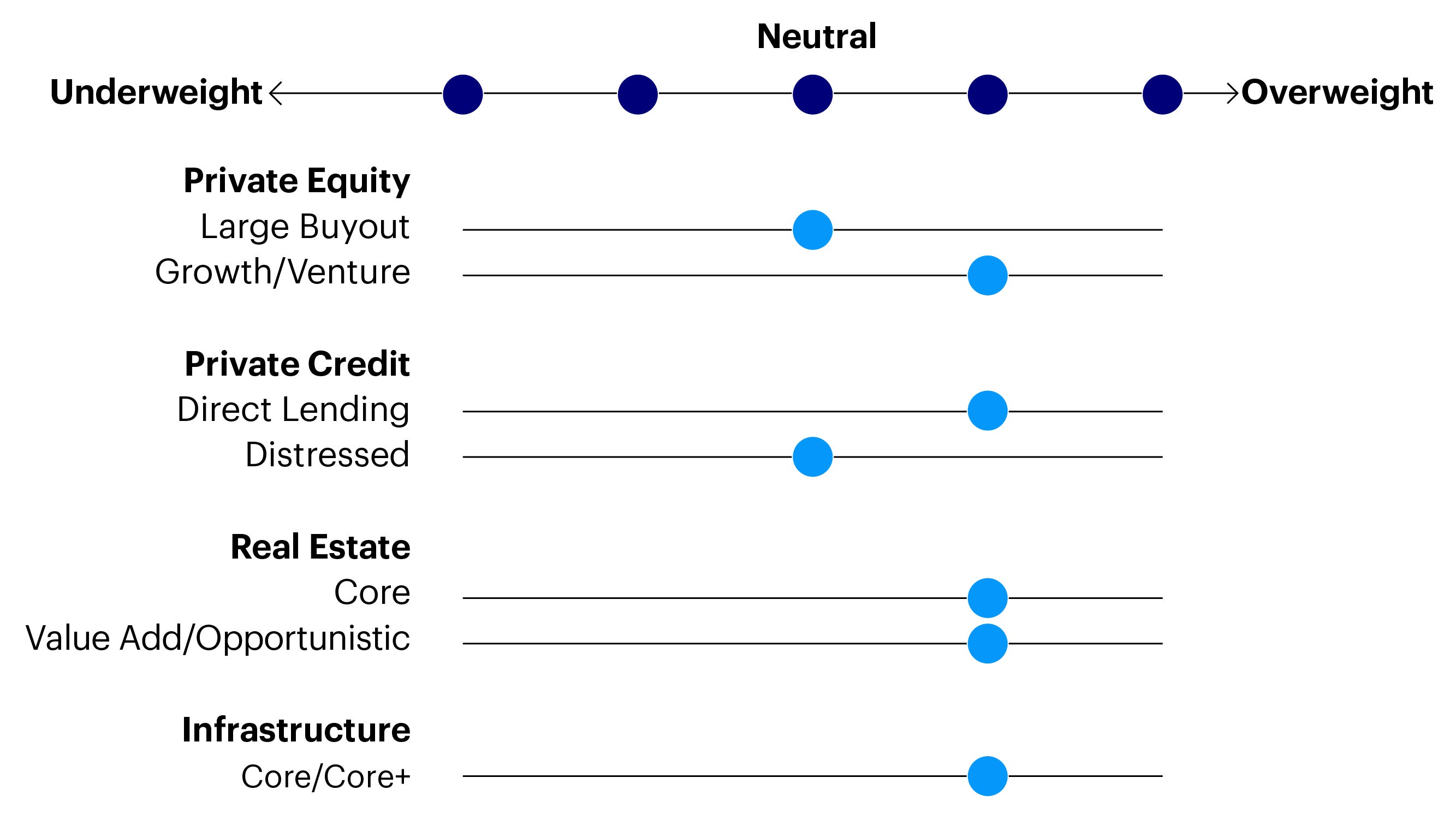

Tactically, we are overweight private credit and real assets; positive on real estate and infrastructure; and neutral on private equity (as shown in the figure below). Overall, we are optimistic despite slower growth, higher valuations, rising inflation, and tighter spreads. We also believe there are still opportunities in the riskier portions of the market.

Source: Invesco Investment Solutions, 31 Oct 2021. Alternatives tactical asset valuations represent our view of which asset classes are likely poised to outperform over an approximate 3-5-year timeframe.

Direct lending demand could spike

Direct lending strategies should continue to benefit from strong credit fundamentals and have the potential to take advantage of increasing interest rates given their floating rate structure.

While many common metrics, such as credit spreads and leverage, were skewed by rapid dislocations in the credit space during the height of COVID-19, they are now returning to pre-pandemic levels. Liquidity premiums remain high, and creditor-friendly covenants exist for private market loans, which means direct lending is attractive relative to its public counterparts.

In addition, the supply/demand balance continues to support direct lenders. This is partly driven by record levels of private equity ‘dry powder’ and a robust mergers and acquisition environment. In addition, a continued post-global financial crisis retrenchment from the middle-market lending space, led by global banks, bodes well for demand that favours private lenders. This should encourage attractive spreads relative to the high yield or syndicated leveraged loan markets.

Lighting the fuse on ‘dry powder’

Within the private equity space, we favour growth and venture categories which are expected to outperform across a range of macroeconomic scenarios. Although buy-out strategies may face headwinds driven by relatively high valuations and an increasing supply of ‘dry powder’ competing for deals, private equity remains an asset to consider as a growth investor.

Our neutral conviction in private equity is justified, as these assets still command a significant return premium to their public market counterparts, despite facing headwinds from valuations. Investors seeking larger equity returns could potentially fund private equity using challenged public equity, notably within the US. We are monitoring rising debt levels on target firm balance sheets within the leveraged buyout market, as these could prove to be a headwind to prospective returns.

While there are risks around the post-pandemic recovery, high valuations, and the tax and regulatory environment, we remain bullish on the prospects for private equity in 2022.

Deal activity should stay high as private equity firms look to put their record levels of ‘dry powder’ to work. Firms that leverage their war chests could be positioned to excel, taking advantage of new opportunities and managing existing positions through the pandemic-induced turmoil. Finally, existing portfolio exits should benefit from the explosive growth of the special purpose acquisition company market and strong initial public offering conditions.

The winners of higher inflation?

Real assets typically respond favourably to inflation, which is at levels we have not seen in decades. This positive correlation is due to increasing revenue alongside physical asset appreciation. The potential for a continued rebound in global trade, passenger travel and office occupancy, coupled with relatively attractive valuations and inflation protection, results in a positive outlook.

Infrastructure markets are also showing strong momentum into 2022, after proving comparatively resilient amid the pandemic-related headwinds of 2020. While the overall asset class fared well, there was a considerable level of divergence within infrastructure.

Telecom infrastructure was amongst the least affected by the pandemic, as it was supported by robust increases in data traffic. Utilities, and sectors which had regulated or contractual cash flows, were also less exposed than other industries. Passenger transportation, including unregulated toll roads and airports, faced a headwind due to remote work, lockdowns, and travel restrictions.

While valuations for the sectors less affected by COVID-19 remain at pre-pandemic levels, those sectors exposed to global trade and passenger travel have partially recovered, yet still trade at attractive valuations on a relative basis. Looking ahead, this creates the potential for improved future returns, as increasing vaccination rates contribute to economies opening up even more in the latter part of 2021.

Related insights

Risk warnings

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

This marketing communication is exclusively for use by Professional Clients and Financial Advisers in Continental Europe as defined below, Qualified Clients/Sophisticated Investors in Israel and Professional Clients in Cyprus, Dubai, Ireland, Isle of Man, Jersey, Guernsey, Malta and the UK. It is not intended for and should not be distributed to, or relied upon, by the public. By accepting this material, you consent to communicate with us in English, unless you inform us otherwise.

This is marketing material and not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.For the distribution of this communication, Continental Europe is defined as Austria, Belgium, Denmark, Finland, France, Germany, Greece, Italy, Liechtenstein, Luxembourg, The Netherlands, Norway, Portugal, Spain, Sweden and Switzerland.

Issued by Invesco Management S.A., President Building, 37A Avenue JF Kennedy, L-1855 Luxembourg, regulated by the Commission de Surveillance du Secteur Financier, Luxembourg; Invesco Asset Management, (Schweiz) AG, Talacker 34, 8001 Zurich, Switzerland; Invesco Asset Management Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority; Invesco Asset Management Deutschland GmbH, An der Welle 5, 60322 Frankfurt am Main, Germany.

Israel: This communication may not be reproduced or used for any other purpose, nor be furnished to any other person other than those to whom copies have been sent. Nothing in this communication should be considered investment advice or investment marketing as defined in the Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 1995 (“the Investment Advice Law”). Investors are encouraged to seek competent investment advice from a locally licensed investment advisor prior to making any investment. Neither Invesco Ltd. Nor its subsidiaries are licensed under the Investment Advice Law, nor does it carry the insurance as required of a licensee thereunder.