Invesco Quantitative Strategies’ investment process identifies factors that drive long-term equity performance. As different factors tend to work in different stages of the cycle, well diversified multi-factor portfolios are built to deliver attractive returns for clients over the long-term.

What drives equity returns?

Equities provide a return for bearing investment risk over the long-term. The question for an investor is, how to identify stocks with the best return potential given their inherent investment risks. While each stock has unique characteristics, it can also share similarities with other stocks. Different processes for stock selection include a fundamental bottom-up approach and factor investing.

Fundamental fund managers tend to undertake company research to identify attractive stocks that they expect to outperform in a given business, macroeconomic and market environment. Their views typically result in high conviction portfolios that aim to benefit predominantly from stock specific drivers of performance.

In contrast, a factor investor analyses the stock market based on return drivers, or so-called factors. These have been identified by academic research and explain the majority of long-term stock performance. To embrace factors, a portfolio manager systematically selects stocks based on a given set of characteristics.

While the fundamental manager aims to construct portfolios of stock specific risks, a factor investor’s objective is to diversify away stock-specific risks by constructing portfolios with exposures to intended factor characteristics.

How do we determine a meaningful factor?

Some transient factors explain return differences between stocks in certain market environments, but do not reflect long-term market behaviour. An example of this could be the share price of a developed market stock with a footprint in the emerging market space being driven higher during short periods of rapid emerging market growth, leading to a widening in return dispersions within developed markets only during those times. Also, there are short-term factors influencing an individual market such as changes in investor sentiment, available market liquidity and the economic environment that can impact security prices.

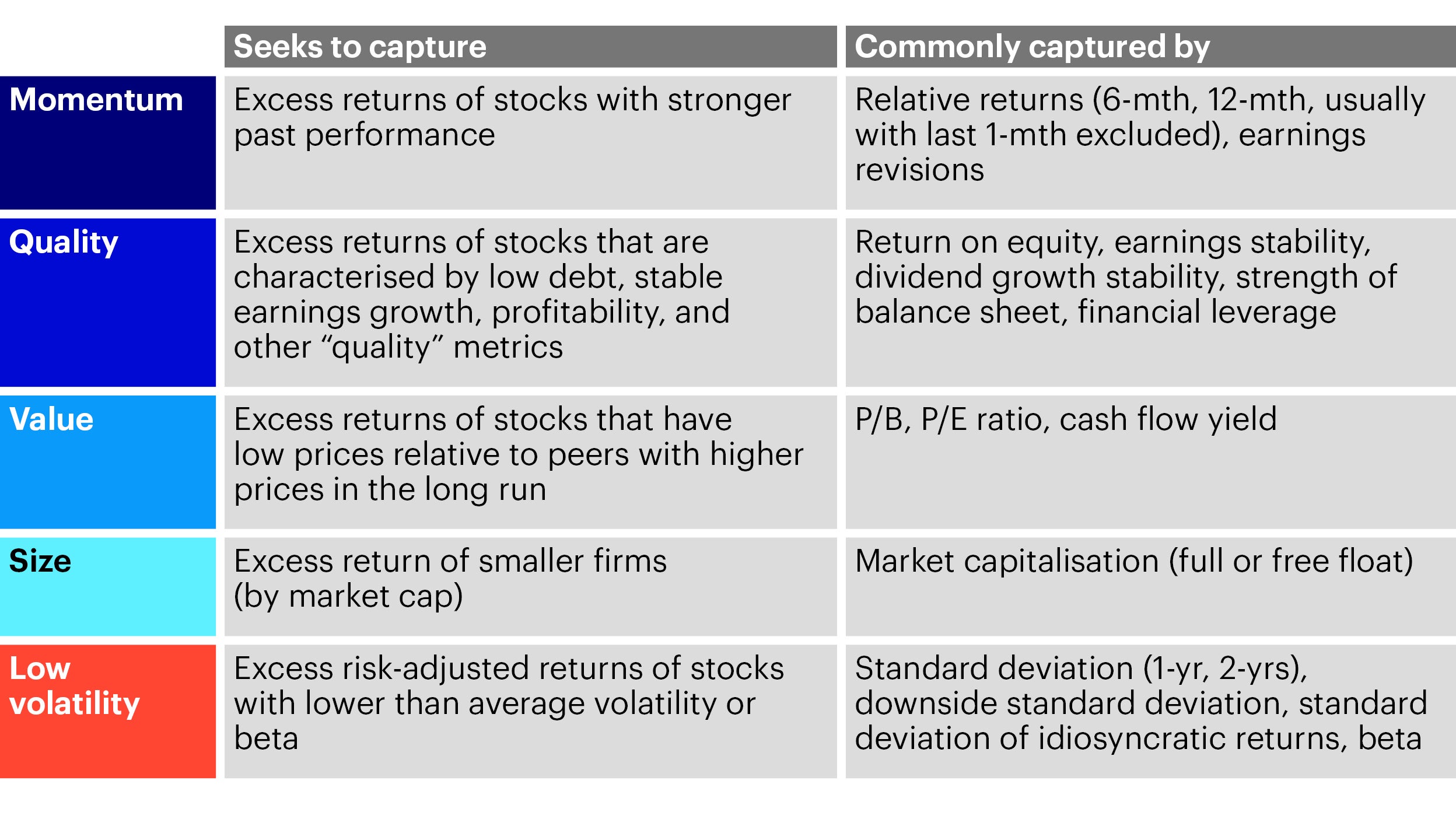

On the other hand, there are long-term return factors which explain return and risk differences between stocks in multiple markets over long periods. The most established ones are Momentum, Quality, Value, Size and Low Volatility. These have been constructed on sound academic research and have proven their potential to improve risk-adjusted performance over time.

Additionally, there are risk factors which help to explain risks in equity markets. The most important ones being sustainability risks: given the increased awareness of societies, regulators and capital market participants, we believe sustainability risks are not adequately reflected in asset valuations. Hence we believe ESG considerations may help to identify risks that may materialise in the future.

What factors should long-term investors focus on?

Within the Momentum factor, there is both price and earnings momentum to consider. Price momentum refers to recent share price movements with stocks being purchased if they have performed well recently and sold if they have performed badly. Similarly, earnings momentum is defined as the trend in recent earnings surprises or changes in earnings expectations.

The Quality factor entails a focus on the shares of high-quality companies. Generally, the shares of highly profitable and/or less leveraged companies achieve better risk-adjusted performance than less profitable or highly indebted companies.

Within the Value factor, the emphasis is placed on stocks that are priced at a discount to other similar stocks. The assumption is that, over the long-term, purchasing stocks on lower valuations will lead to higher returns as these revert back to their true intrinsic value.

Within the Size (i.e. small cap) factor, the focus is on the shares of small companies in the expectation that they will outperform those of large companies.

The (low) Volatility factor (also known as minimum volatility) implies that shares associated with lower volatility perform better on a risk-adjusted basis than those with higher volatility.

Finally, ESG helps to identify stocks that are subject to sustainability risks. Avoiding those companies can help to reduce drawdowns and, as a result, can potentially add value from a risk/return perspective.

All of the above-mentioned factors help to explain risk and return in equities and have outperformed the market over the long-term on a risk-adjusted basis. Possessing different characteristics, each factor performs differently over different stages of the economic cycle.

Why do factors persist over the long-term?

There is significant empirical evidence that factor premia (i.e. returns above the market return), similar to equity risk premia, are an enduring component of markets. Factor returns may fluctuate over the short term, but positive premia are earnt over the long-term.

Research into why factor premia persist in markets highlights several possible reasons. These are often gathered into three different groups: risk premia, behavioural rationales and market structure.

A risk premium is interpreted as the reward for bearing a systematic risk in the same manner that equity investors expect to earn a premium over less risky assets. This means that the return premium associated with that factor can only be accessed if one is happy to accept the risk of that factor. For example, the value (and also size) premium is seen by some as a compensation for the higher default risk in ‘value’ companies.

Behavioural rationales for factor performance are drawn from Behavioural Finance to explain market features which appear to imply irrational behaviour by investors. For example, Momentum factor performance is frequently described as a behavioural phenomenon which can be seen when investors underreact or overreact to news events.

Market structure rationales imply the factor premium is a result of the industry or market structure which can lead to certain classes of investors or investment strategies earning abnormal returns such as a shorting strategy.

While the benefit of using factor strategies can be reduced through crowding effects if a factor gains in popularity, the research evidence supporting the persistence of long-term factor returns indicates that the underlying drivers of these factors are not disappearing. In fact, we believe that the persistence of these factors’ excess returns is so prevalent that even a small tilt toward them is effective.

How do different factors perform over an economic cycle?

During a recovery, smaller companies (size) tend to perform better, as do Value stocks. Later when growth is positive but decelerating, Quality stocks achieve superior performance while momentum strategies show their strength during markets with persistent trends. Quality and Low Volatility factor strategies, on the other hand, tend to perform particularly well during times of crisis.

However, factor timing is difficult and our research has found it was not profitable when transaction costs are taken into consideration. While it is very easy to understand the behaviour of factors when the economic cycle is known, it is much more difficult to predict factor behaviour in the future. Hence, a well-diversified multi-factor model is well equipped to deliver attractive returns over a full market cycle, in our view.

It is worth to keep in mind that every portfolio has certain embedded factor characteristics that impacts its risk and return profile. Hence, the question is not, whether to have factor exposures, it is about being exposed to them explicitly, or implicitly.