Alternatives

European real estate debt: everything you need to know in 5 minutes

In this short video, Andrew Gordon shares his thoughts on real estate debt. Discover the important role it can play as a diversifier in portfolios.

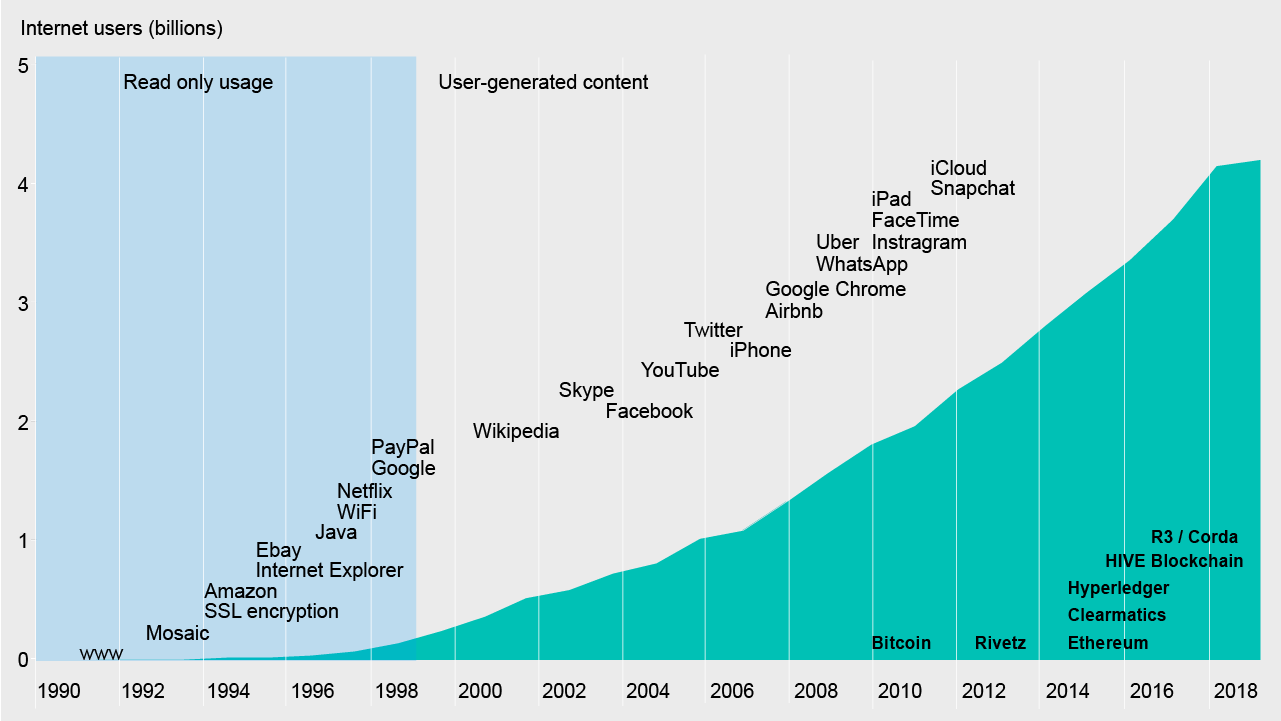

The internet impacts every part of our lives, but the underlying technology was first used simply to share information between two computers. Just imagine if you could have foreseen how that technology would progress and been able to identify companies that would drive global change.

The companies that would find new ways to use the technology are now among the largest in the world: Twitter pioneered a way for us to create information, Dropbox for storing information, Netflix for transmitting information and Apple for consuming information.

You could draw some comparisons between the internet and blockchain. With blockchain technology still in its early days, we think the potential for changing the global economy is underappreciated by the market. This could provide an opportunity for investors who can capture this hidden potential.

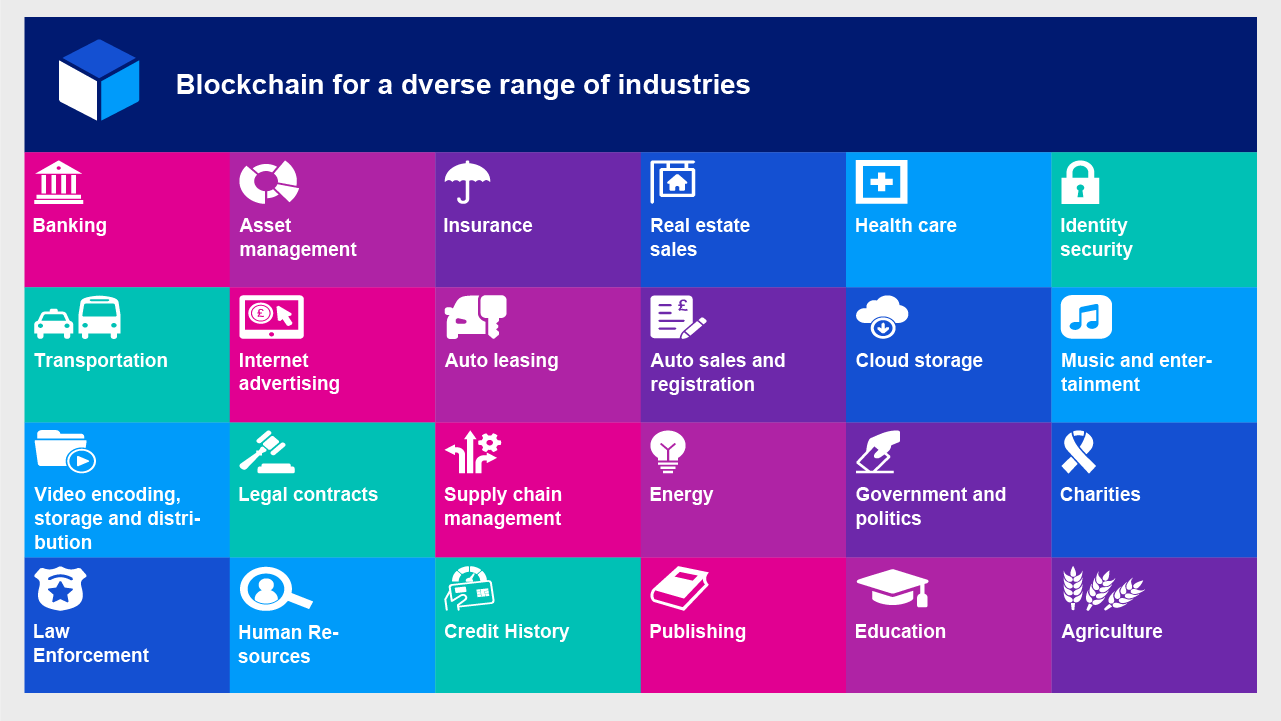

Many companies, particularly in financial services, are already investing millions of dollars in researching and building blockchain infrastructure1. There are numerous other applications for the technology going through testing or in consultation phase.

Blockchain is an innovative technology designed to manage the transfer of value and assets. It was introduced in 2008 as the public transaction ledger for Bitcoin, the world’s first cryptocurrency, but we think the potential for blockchain to change the global economy extends way beyond that initial application.

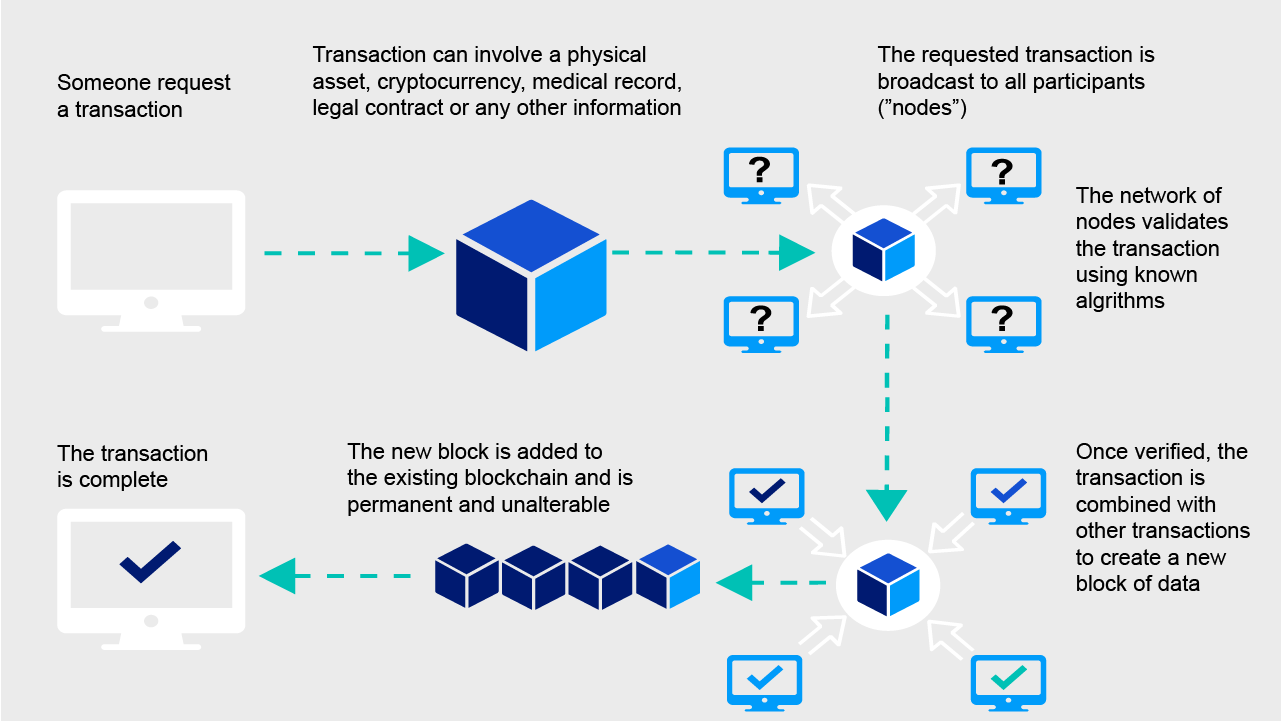

As it did with Bitcoin, blockchain is used to capture and store all the details of all transactions related to a specific asset. The transactions do not have to be financial, and the asset could refer to physical assets, a cryptocurrency, contracts, records or other information.

One attraction of using blockchain is that multiple parties can contribute to and trust a single record of ownership without needing to trust each other.

Some of the other objectives/capabilities:

Every blockchain will have some similarities:

You need a blockchain address to request a transaction. In the example of a cryptocurrency, you may request a payment from your blockchain address to someone else’s blockchain address. The payment would be the transaction that, once verified as legitimate, is then added to the blockchain ledger. It is then a permanent, traceable and unalterable record.

| Open (“permission-less”) | Closed (“permissioned”) | |

|---|---|---|

| Who can access the blockchain? | Anyone can access the blockchain network. Cryptocurrencies are examples of an open blockchain. |

Only a defined group of people can access the network. Corporate or bank blockchains tend to be closed networks. |

| How are transactions added to the blockchain ledger? | Transactions are added to the ledger through a process known as “mining” | A central entity determines which transactions should be added to the ledger. |

Blockchain is an emerging technology, and most of the current opportunities are within existing companies that are not yet realised. We believe the potential for blockchain to generate real earnings for these companies is underappreciated by the market, either because investors are unable to identify it or know how to assign value, or they assume synergies may only be relevant if the blockchain ecosystem continues to grow.

Few pure blockchain plays are available in the market. Instead, most companies with the potential to generate earnings from blockchain have well-established businesses in other areas, and blockchain merely presents an additional source of revenue. This hidden potential may provide an opportunity for investors who can capture it, if they are first able to find it.

European real estate debt: everything you need to know in 5 minutes

In this short video, Andrew Gordon shares his thoughts on real estate debt. Discover the important role it can play as a diversifier in portfolios.

Power of the people: how workforce diversity can boost the bottom line

Unpacking the UN & IPCC Climate Report: Implications for professional investors

While sustainable investing has seen rapidly increasing popularity over the last couple of years, the 'code red' report released this summer has added renewed urgency to this shift. Net-zero commitments may no longer be enough, and professional investors are facing calls for a more stringent approach to increase impact and asset managers must counteract accusations of greenwashing.