C

hinese ADRs1 have a specific set of risks, but we’ve worked hard to make sure we understand them. This is important given many major Chinese internet companies are only listed in the US. Alibaba’s decision to list its shares in Hong Kong as well as New York represents a significant milestone for holders of Chinese ADRs, particularly given the threat of US-China trade tensions spilling over into capital markets. NetEase are actively considering a secondary listing, while JD.com and online travel agency Trip.com are also reported to be doing so.

Alibaba’s H-share is fully fungible with the ADR and according to Credit Suisse over 20% of outstanding shares are now held in Hong Kong. This allows Asia-based investors to trade the shares during business hours, but also provides a solution should the US authorities seek to block investment into Chinese companies. Even more significantly, it reduces the risk of being ‘squeezed out’, given that ADR holders have little to no recourse to challenge lowball management buyout offers, prior to a relisting elsewhere.

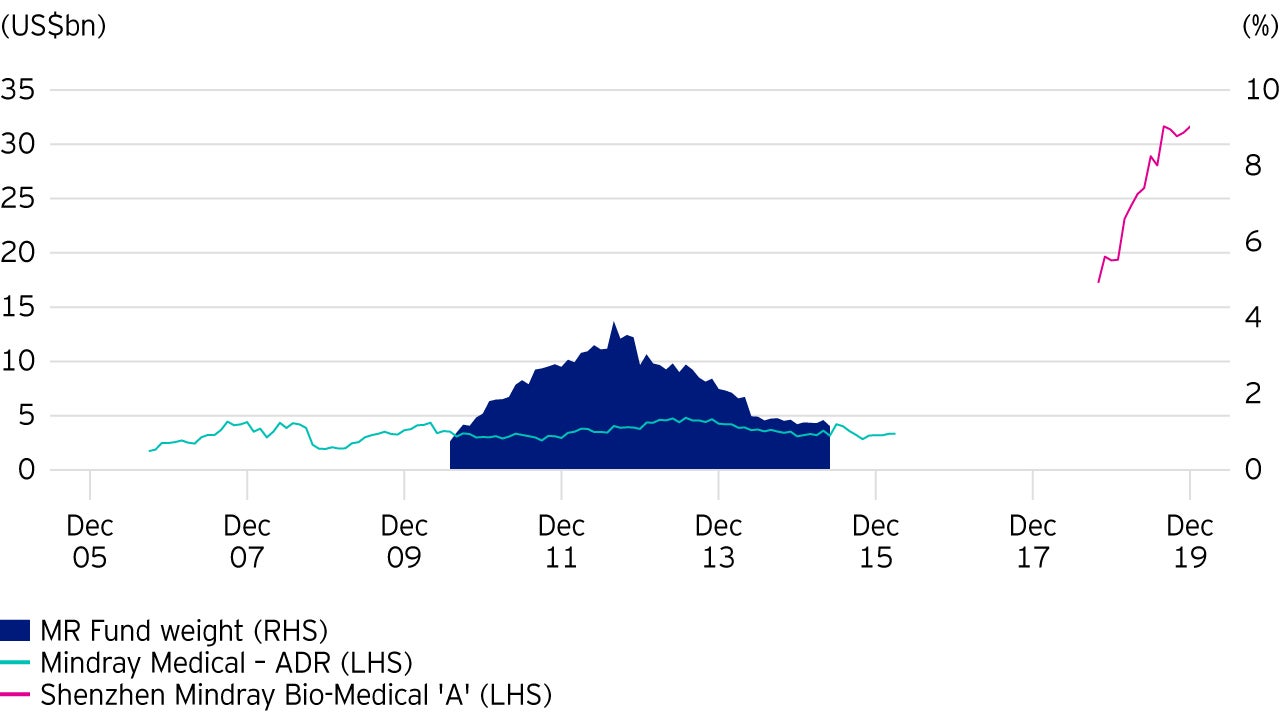

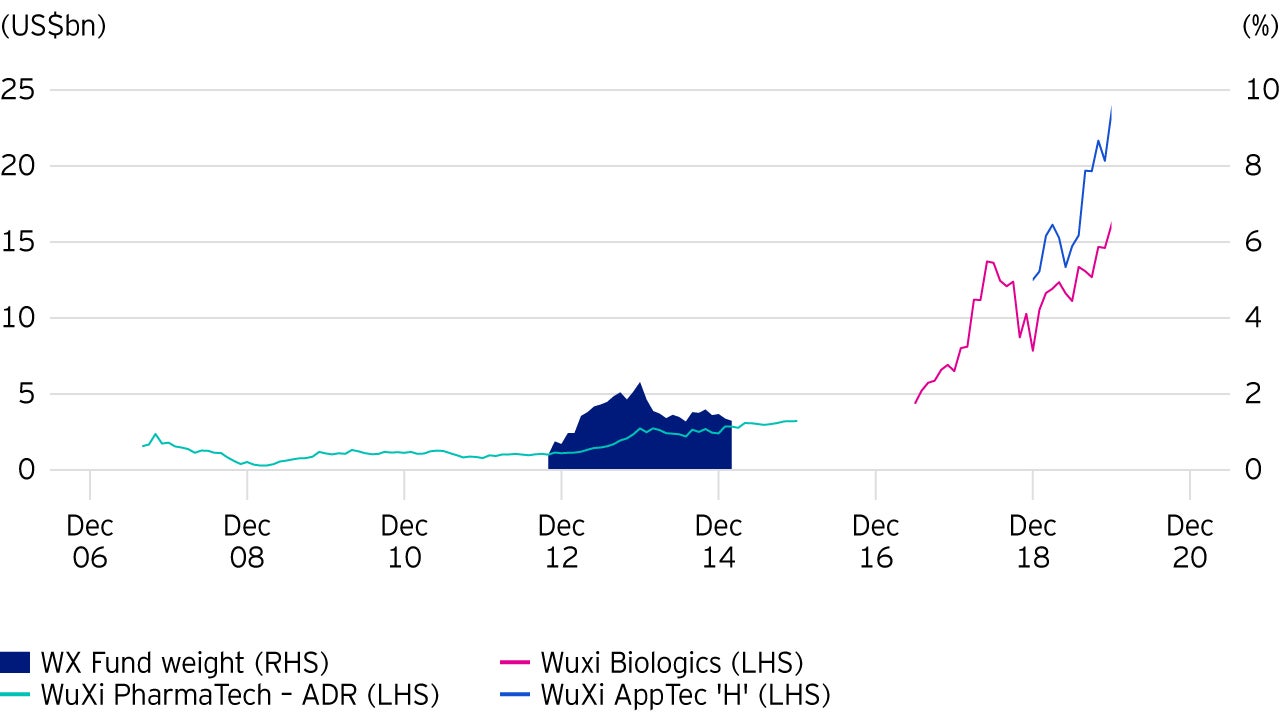

This is a course of action we have first-hand experience of. The charts below illustrate a couple of full examples, using stocks which have made the move from the US to HK/China, both of which have been part of the Asia Pacific strategy.