What would negative sterling interest rates mean for UK money market funds?

Laurie Brignac. Chief Investment Officer, Head of Invesco Global Liquidity

The unprecedented impact of COVID-19 on the global economy has led both governments and central banks to take unprecedented action to support economies and markets. In the UK, the Bank of England (BoE) cut its Bank Rate to an historic low of 0.1% on March 19. At the time, the BoE viewed this as the “effective lower bound” (ELB) below which any further reduction in interest rates would be deemed ineffective, or even counterproductive.

There have been many discussions at the European Central Bank (ECB) about its ELB (currently -0.5%) and whether it could move lower? Since the COVID-19 outbreak it has been noteworthy that the ECB has not cut rates further, instead focusing on purchasing government and corporate Debt while providing cheap funding to banks to support the real economy.

However, at the BoE, in recent months, there has been a subtle change in emphasis around the ELB, culminating in the minutes from the September Monetary Policy Committee (MPC) meeting which stated “the MPC had been briefed on the BoE’s plans to explore how a negative Bank Rate could be implemented effectively, should the outlook for inflation and output warrant it…the BoE and the Prudential Regulation Authority (PRA) will begin structured engagement on the operational considerations in 2020 Q4.”

What are the chances of a move to negative rates?

Since the release of the September MPC Minutes, the BoE has elaborated on timelines suggesting that its investigations into the operational impact of negative rates will likely take several months to complete. Currently, there also appears to be little consensus within the among MPC members about the efficacy of negative rates.

When asked for their thoughts on the subject, responses have been mixed. Some suggest that further rate cuts could potentially do more harm than good while others are reviewing their original thoughts on the ELB and in a recent press interview, MPC member Silvano Tenreyro, has commented that “the evidence (on negative rates) had been encouraging and that in jurisdictions where negative rates had been adopted banks had adapted well.”[i]

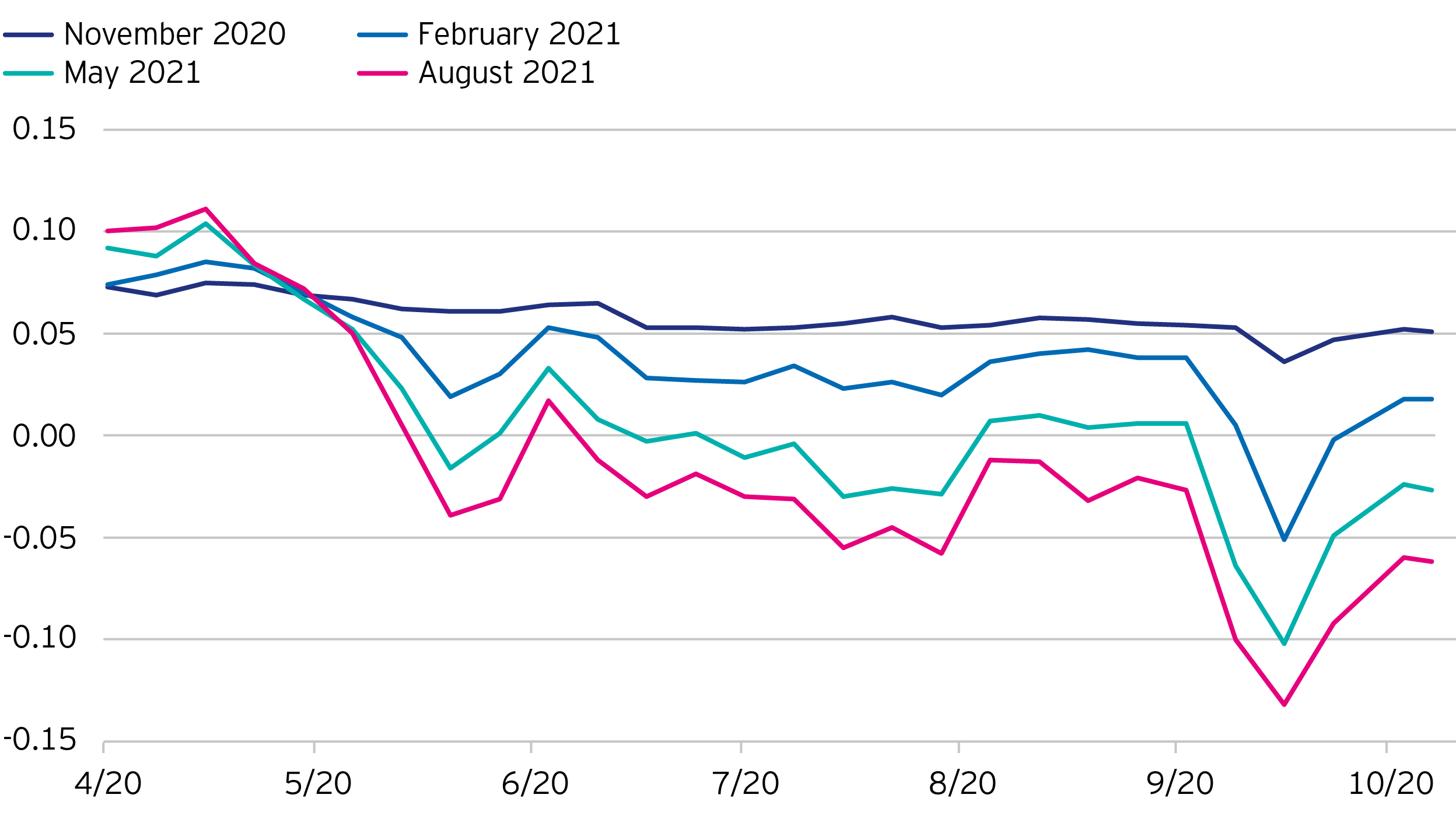

Market pricing has been sensitive to the ebb and flow of MPC comments as well as COVID-19 and Brexit developments. This market reaction is represented in one way by the pricing of forward SONIA (sterling overnight deposit rate) contracts at various upcoming MPC meetings, as shown in Figure 1.

There is an inter-relationship between SONIA and the Bank Rate, making forward SONIA prices a good proxy for market expectations of policy. We therefore look at the forward SONIA market as one indicator to predict potential changes in the Bank Rate

Figure 1 shows that over the last six months that the forward SONIA market has begun pricing in some probability of a move toward a negative Bank Rate at MPC meetings from Feb 2021 onwards. It is important, however, to recognize that the market will seek to price not only the chance of a move to a negative Bank Rate but also the extent of that move.

Factoring all of this in suggests to us that the market sees the likelihood of a negative Bank Rate as relatively low, perhaps 10-15%. This may seem surprising considering the numerous headlines we have seen in the press, however this has been partly due to the high degree of uncertainty as to how the UK economy will evolve with both the development of Covid-19 and any final outcome on Brexit at the end of this year; both of which could have a positive or negative impact on where growth goes from here.

Invesco Fixed Income’s view

We believe it is hard to dismiss the possibility of negative interest rates, as long as the BoE MPC maintains that negative rates remain a live policy option and there continues to be a high degree of uncertainty as to how either Covid-19 or Brexit will develop over the coming months.

Although, officially, the MPC continues to maintain that the lower bound for interest rates is above zero, the fact that negative rates are being discussed implies that a number of policy makers perhaps now see the effective lower bound potentially below zero.

Could an alternative approach be taken?

Another way to loosen financial conditions and bolster the economy without lowering the Bank Rate would be to lower the cost of the Term Funding Scheme (with additional incentives for lending to small and medium size enterprises, known as TFSME).

The TFSME currently allows banks and building societies, subject to certain conditions, to borrow from the BoE at the Bank Rate. Rather than lowering the Bank Rate, the BoE could supply TFS funding at a margin below the Bank Rate.

For example, it could set the TFS at the Bank rate less 0.4%, i.e. -0.3%. Effectively, this margin does the work of a negative interest rate without the potentially harmful side effects on bank profitability, consumer saving rates, etc.

How could a negative rate impact the yield on sterling money market funds?

Euro-denominated AAA-money market funds were the first to experience negative interest rates when the ECB cut its policy rate to -10 basis points in June 2014 (and ultimately -50 basis points by September 2019).

There were technical issues that had to be addressed and an initial reluctance for Money market funds to buy negative yielding paper, while issuers clearly preferred to borrow at negative yields. As a result it took until the middle of 2015 before yields on MMF’s turned negative following the initial cut to -10bps in June 2014.

We believe the UK experience is likely to be different from the eurozone’s, as negative rates are no longer uncharted territory and pricing systems have adapted to negative yields. Ultimately, the yield on sterling money market funds will likely be a function of the underlying Bank Rate, expected future moves in the Bank Rate and credit risk.

However, over time, and with all things being equal, the yield will likely eventually turn negative and most likely in a shorter time period than it took for euro-denominated money market funds.

Other impacts of negative rates on sterling money market funds

Under new regulations for European money market funds, which went into effect in 2019, the Reverse Distribution Mechanism (a process by which money market funds manage a negative yield through the use of share cancellations) is no longer permitted.

As a result, money market funds with a negative yield can effectively only offer accumulation classes. Accordingly, all shareholders would need to be moved to corresponding accumulation classes.

Unlike distribution classes, which typically transact at a price of 1.00 (subject to the regulatory requirements of Low Volatility Net Asset Value funds being met), an accumulation class transacts at a variable price, which factors in the daily yield.

What are the alternatives to avoid negative rates?

Unless investors are willing and able to take additional risk (either higher credit risk, lower liquidity or potentially a combination of both), there are few alternatives to money market funds for those who have operational cash where capital preservation and T+0 liquidity remain paramount.

For investors who can segment their cash into longer-dated “buckets”, there is scope for investing cash that is not needed for at least three-to-six months into alternative pooled funds, including Exchange Trade Funds (ETF’s). Understanding how these funds are managed will be important, in our view, when identifying products that suit an investor’s particular needs.

In addition to pooled funds, segregated mandates are another option that enable investors to create a more bespoke product to meet their needs. These tend to work best where investors have larger sums of cash to manage (at least £100 million) and where they allow the portfolio manager enough flexibility in the guidelines to achieve investment diversification together with the desired return.

Conclusion

Invesco has nearly 40 years’ experience managing MMF’s and we continue to be committed to the support of your liquidity management needs. Our credit research team have extensive experience assessing credit risk throughout different economic and interest rate cycles.

During recent market volatility Invesco’s MMFs operated normally, continuing to provide clients with capital security and liquidity. Furthermore, we have been managing Euro denominated MMF’s which have been operating with negative interest rates since June 2014.

As a manager of MMF’s, the view on interest rates is only one part of the investment process, the more critical aspect being the focus on capital preservation and the ongoing provision of daily liquidity. With the increased potential for negative UK rates it is important that investors are fully aware of this and in turn they consider what steps to take in order to be prepared should this situation arise.

If you would like more information on this topic or our range of liquidity solutions, please contact your relationship manager or the Liquidity management team.

Sources

-

1 Telegraph Interview “Men set the rules of the game – that must change” published 26th September 2020

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important Information

-

The opinions referenced above are those of Invesco as of October 5, 2020. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.