What could a divided government mean for US stocks?

Kristina Hooper. Chief Global Market Strategist, Invesco Ltd. and Brian Levitt. Global Market Strategist

As we wait for the votes to be counted, and perhaps recounted, in some key states, we’ve gotten some questions about the potential for a divided government and what it could mean for markets if the White House and Congress are split between parties.

Senate implications

Kristina Hooper: Chief Global Market Strategist: 'It appears all but certain that the Senate will remain Republican. This means that:

1. Government will likely be divided, regardless of who wins the presidency. The stock market has historically reacted positively to divided government, as my colleague Brian Levitt explains below. I expect stocks to rise in this environment. This is especially so given that markets had feared a Democratic sweep. For example, as of Oct. 28, 34% of companies in the S&P 500 Index that had reported earnings mentioned the election – with taxes being the government policy most discussed in conjunction with the election.1 There was real fear about what policies such as higher taxes and a higher minimum wage would do to businesses. Now that those policies are very unlikely even with a Biden win, I would expect stocks to continue with a relief rally.

2. The US is far less likely to get a large fiscal stimulus package, regardless of who is president. This suggests a slower economic recovery for the US, which would likely mean defensives and secular growth stocks could outperform.

3. If Biden wins the presidency, I think we will see a new era of fiscal conservatism ushered in despite being in the midst of an economic recovery, as proposed spending measures would require approval by Senate Republicans. This would be similar to what we saw during the Obama administration with sequestration while the US economy was still recovering from the global financial crisis. This suggests a slower, less robust economic recovery. With lower government spending and borrowing, I would expect to see lower 10-year Treasury yields.

4. If Trump wins the presidency, I would expect to see less of an emphasis on fiscal conservatism by Senate Republicans, although I don’t believe there will be anything close to profligate spending. This suggests more spending and borrowing (though not nearly what we would have expected with a Democratic sweep), and potentially higher 10-year Treasury yields.'

Market implications

Brian Levitt: Global Market Strategist: 'Gracie Allen famously quipped, “This used to be a government of checks and balances. Now it’s all checks and no balances.” Allen’s observation, while funny, is not applicable to the 2020 US election. For all the uncertainty surrounding the outcome of the presidential election, the partisan control of the US Congress was never really in question. For the next president, be it Donald Trump or Joe Biden, there will be balances on their power. The prospect of outsized fiscal support, Allen’s joke notwithstanding, has diminished.

The markets have initially responded favorably to the perception that little will get done in the first two years of the next administration. Incessant hand wringing over the key issues and concerns over the prospects of higher taxes, a Green New Deal, changes to the Affordable Care Act and much more appears to have been for naught.The US system is inherently designed for incrementalism, and gradual progress is about the most either party can now wish for in the coming two years.

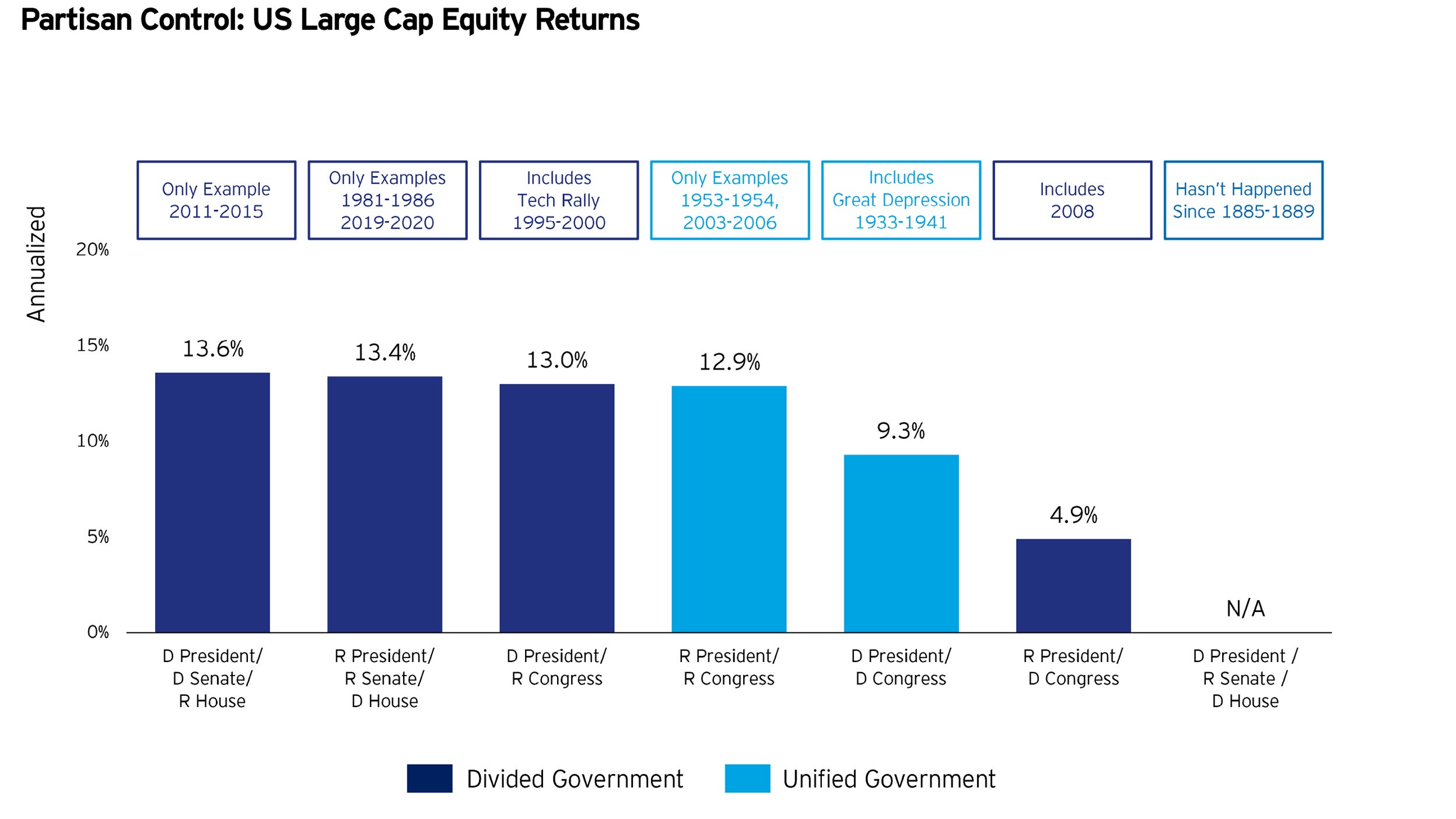

It is said that markets prefer divided government. The numbers bear that out, although I would argue that analysis is not all that statistically significant. Rather, the returns, in most instances, tend to be driven by a handful of notable years.

For example, as illustrated in the chart below, the second-best partisan control outcome for the S&P 500 Index has been when the Republicans have the presidency as well as the Senate, and the Democrats control the House of Representatives. It’s an interesting tidbit, especially for those hoping for a Trump victory, but is less impressive when we consider that combination has only happened during the early Reagan years and in 2019-2020.

As for a potential Biden victory: The combination of Democrats controlling the White House and House of Representatives, and the Republicans controlling the Senate hasn’t happened since 1885-1889, leaving it out of the time period of our analysis below.

The confluence of factors currently supporting equity and credit markets — improving economic conditions, stocks trading cheap compared to bonds,2 and accommodative monetary policy — holds true irrespective of the ultimate outcome of the presidential election. Paradoxically, divided government could set the stage for more-protracted market and business cycles. I believe the recovery will still likely play out in the coming years, but at a more modest pace than had there been additional fiscal support. While that might not be ideal for near-term growth in the real economy, we are also unlikely to experience the inflation pressures that have historically brought forward Federal Reserve tightening and hastened cycles. The economic recovery from 2011 to 2015 amid divided government may be an appropriate analogy. For what it is worth, markets performed quite well during that period, as represented in the chart above.

In short, I believe that investors, at a minimum, can rest easy knowing that meaningful change is probably not forthcoming. And remember, as Gracie Allen said, “The president of today is just the postage stamp of tomorrow.”'

Sources

-

1 Source: FactSet Earnings Insight (Oct. 30).

2 Source: Bloomberg, L.P., Standard & Poor’s, as of Sept. 30, 2020. As represented by the difference between the earnings yield of the S&P 500 Index and the 10-year US Treasury rate.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important Information

-

The opinions referenced above are those of the author as of 5 November 2020, unless otherwise stated. This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.