Invesco Euro Short Term Bond Strategy Insights

Luke Greenwood. Co-Head Global Fixed Income, Invesco Fixed Income and Lyndon Man. Co-Head Global Fixed Income, Invesco Fixed Income

The summer period saw risk markets perform well with corporate bonds outperforming their government counterparts. However in September, rising Covid-19 case numbers in Europe and an increase in mobility restrictions across a number of major European cities were front and centre.

Alongside this, geo-political risk factors, namely Brexit – where negotiations continued to stall – and the prospect of a closely contested US election resulted in uncertainty causing a moderate risk off tone toward the end of the period, though it was short lived, highlighting the desire of market participants to capture yield.

Strategy

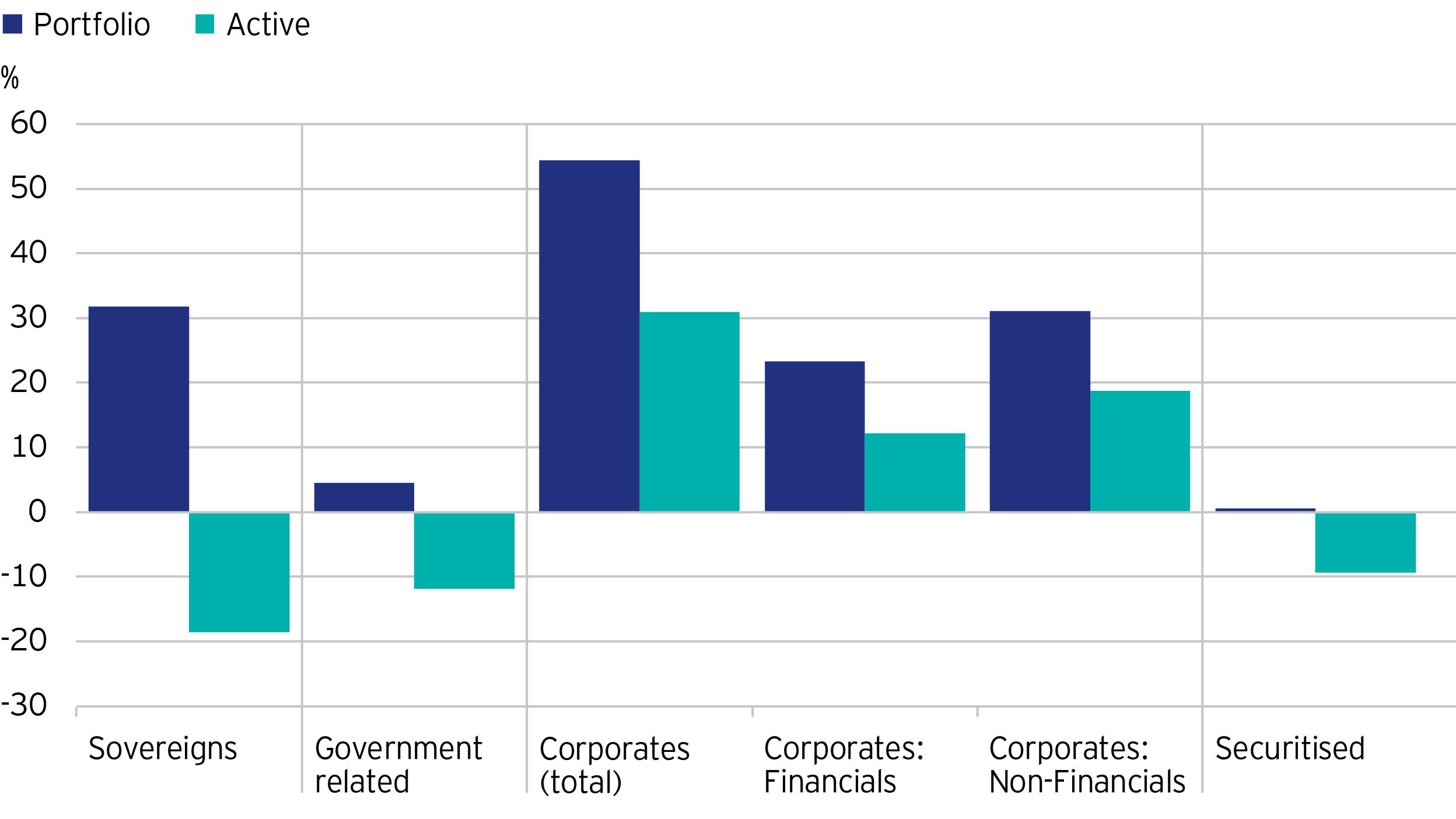

In terms of positioning, we continue to maintain a preference to investment grade corporate bonds versus government and securitised bonds. Despite European investment grade corporate bonds retracing the vast majority of their Covid-19 spread widening, they still offer attractive carry versus government bonds.

Short-dated government bonds are mostly negatively yielding and offer little upside in our opinion. Hence, we prefer to deploy risk capital to high quality corporates whilst enhancing the yield profile of the strategy. Given this, the strategy is carrying positively (around 60bps) versus the benchmark, (Bloomberg Barclays Euro Agg) delivering a gross yield of circa 20bps.

Within the corporate bond allocation, we remain cautious on sectors with significant pandemic exposure (cyclical firms and travel and leisure industries) given lingering demand concerns which could be exacerbated by a potential second wave.

However, given the short-dated nature of the strategy (greater visibility of cashflows within our investment horizon) we are able to capitalise on dislocations here to capture value where our credit research team are positive on specific names. In addition, we continue to see attractive pockets of value in the more resilient sectors as well as the primary issuance market.

We expect technicals to remain the key driver of corporate spreads in European credit markets into year end. The ECB is currently buying around €10 billion of corporate bonds per month, equating to just over 1% of the eligible index. Meanwhile, inflows into the asset class remain positive as investors “follow the central banks” whilst supply should slowdown, all of which will provide ongoing spread tightening support for the market.

Additionally, in Europe, balance-sheet preservation trends remain positive. Therefore, we believe that Europe is now firmly in an early credit cycle phase, where the focus of CFO activity will continue to be on reducing costs, increasing cashflow and reducing leverage rather than focusing on shareholder friendly activity; hence the medium term corporate fundamental picture remains positive in our opinion.

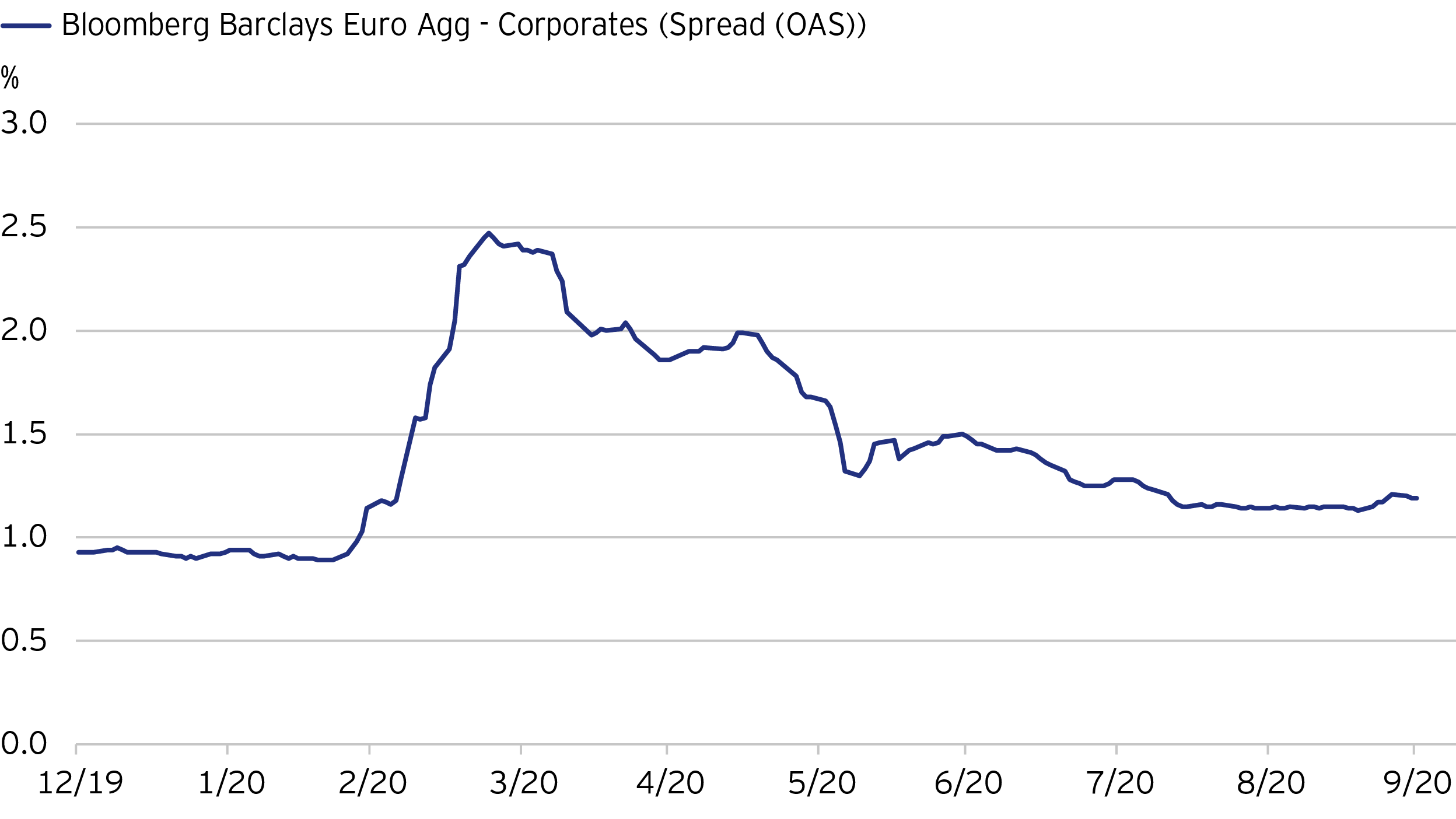

Given this, we believe that risks of a materially re-widening in spreads (see Fig 1 below) remains low, hence the asset class remains one that can benefit as a carry type play especially with interest rates (nominal and real) so low.

With regard to BREXIT, we continue to view the base case to be that the UK and EU will agree a deal in time to avoid a no-deal scenario.

That being said, the risk remains that this is not the case which will result in volatility being introduced into both markets. The strategy does have exposure to UK companies, across both sterling and euro markets, however we are extremely selective in the names we own.

Here, we prefer well diversified global businesses, particularly bank, energy and pharmaceutical sectors, versus more domestic cyclical sectors. These names are well placed to weather any volatility given their robust balance sheets, whilst also offering better value due to the BREXIT premia.

The overall risk of the strategy, as measured by ex-ante tracking error, continued to fall during the third quarter. As with the second quarter, this is being primarily driven by a reduction in market volatility rather than changes to positioning.

Where we have altered the positioning in the strategy, we have used the primary market to add very high-quality corporates at attractive levels. Here, we have also used the US credit market to add names which offer value on a currency hedged basis. Non-euro denominated bonds owned in the strategy have increased from 3% at the beginning of the year to around 5% today, split around two thirds to US dollar denominated debt and a third to sterling (all holdings are currency hedged).

Currently the strategy is around 35% overweight versus the benchmark in Corporate bonds (on a market value % basis), whilst spread duration has fallen slightly to 2.3 years given the compression in spreads. The strategy continues to deliver its attractive yield profile whilst maintaining a very high credit quality of A-.

In terms of interest rate duration, the strategy is in line with the benchmark at 2.0 years. Despite core duration offering less upside at current valuations, we believe rates are well anchored by the ECB, inflation remains extremely weak and we continue to view duration as the most effective hedge to the credit Beta of the strategy should sentiment deteriorate.

Within peripheral government bonds, we remain cautious on Italian government bonds despite the positive outcome from the recent regional elections where Eurosceptic leader of the Northern League Matteo Salvini failed to make any significant headway. Overall, we believe the strategy remains well positioned to deliver compelling risk adjusted returns in the current environment.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

The strategy will invest in derivatives (complex instruments) which will result in leverage and may result in large fluctuations in value.

Debt instruments are exposed to credit risk which is the ability of the borrower to repay the interest and capital on the redemption date.

Changes in interest rates will result in fluctuations in value.

Important information:

-

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

By accepting this material, you consent to communicate with us in English, unless you inform us otherwise.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.