Has gold proven its mettle for its perceived safe haven status?

David Scales. Senior ETF Content Strategist

An asset that has risen by more than 30% in seven months1 may seem at odds with the term “safe haven” but this characteristic of gold has helped firm its place in investor portfolios. This year’s performance is a continuation of the precious metal’s strong run in 2019, when its 17.4% return made it one of the year’s best performing assets.2

Last year’s surge in the gold price was due largely to fears around trade wars, Brexit uncertainty and potential recession, while this year has been the impact of the pandemic. Fear, uncertainty and turmoil are often the intangible fuels that propel gold and, for anyone thinking these conditions are still relevant today, there are also more tangible supports that could make gold even more valuable for investors.

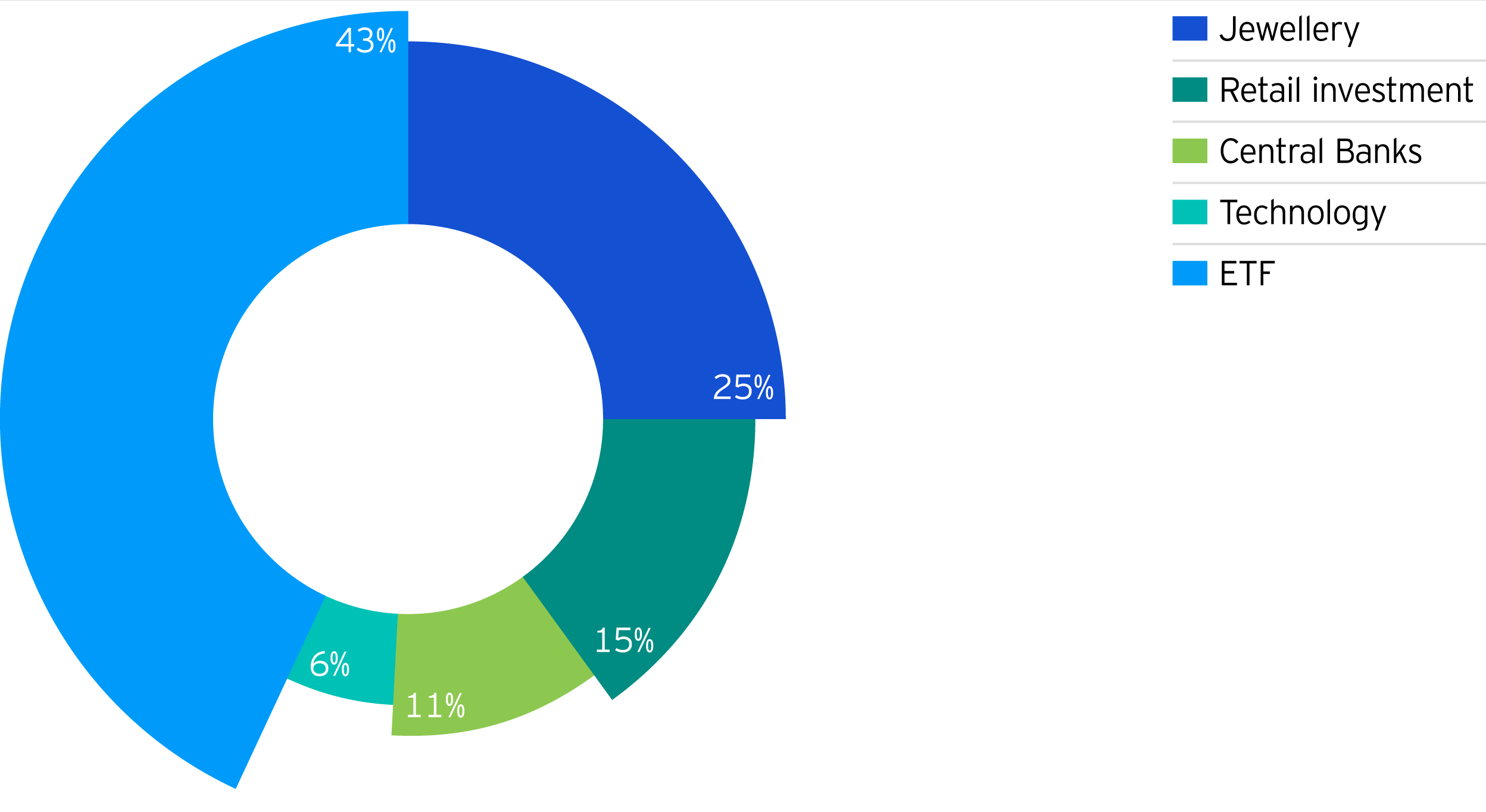

First of all, it’s worth remembering that gold is a finite commodity, so supply and demand drivers can be important. The pandemic impacted almost every one of them, with lockdown measures resulting in the temporary closures of mines (which normally accounts for 75% of total gold supply each year) and a sharp reduction in demand from the jewellery industry, to 25% of gold demand in the second quarter compared to an average of around 50%. Central banks have been net buyers of gold in every quarter for the past 10 years and although the Russian Central Bank stated its intention to halt purchases, these institutions have continued to use gold as a way of diversifying their reserves and hedge risks.3

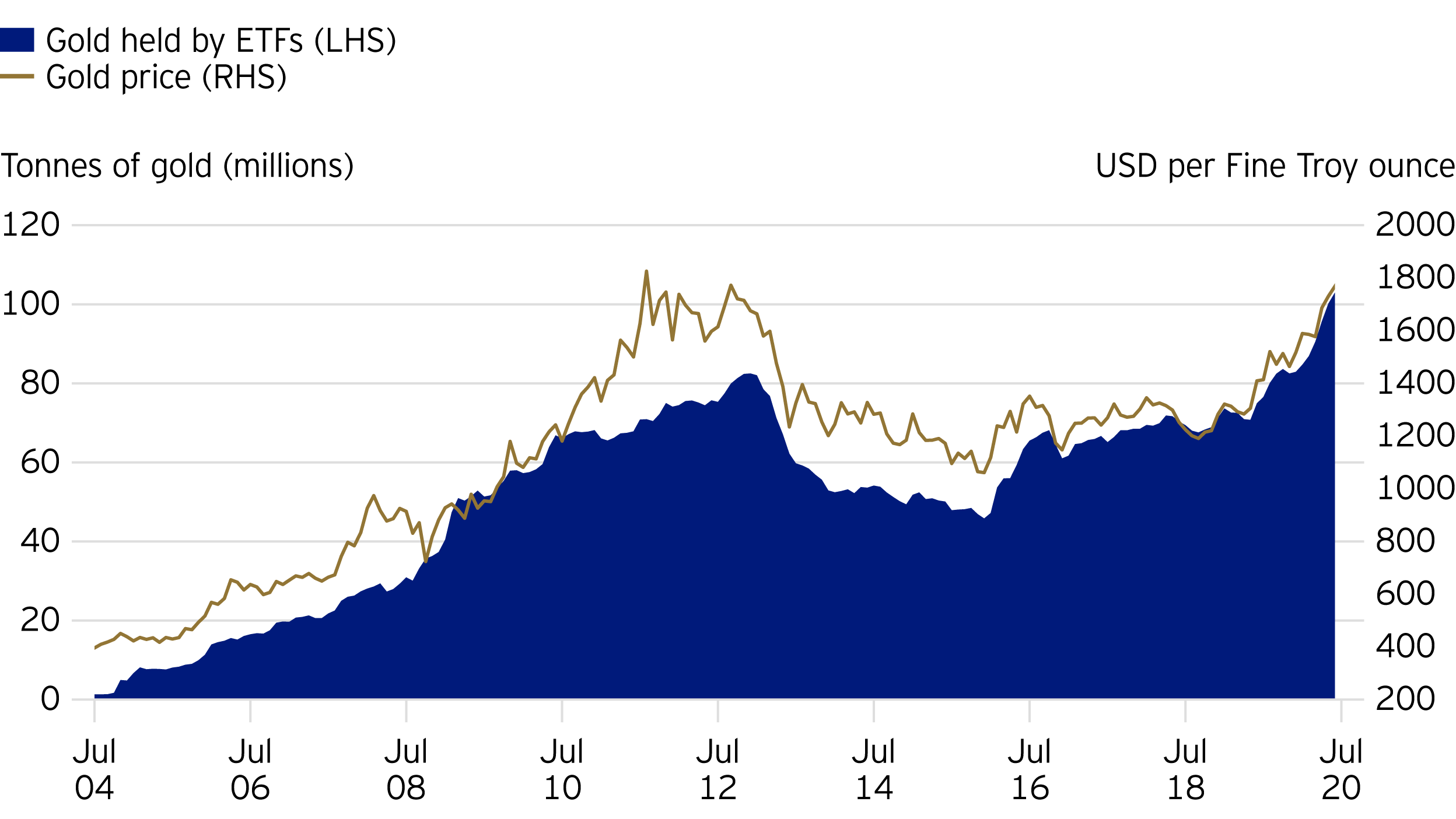

Gold investment at record highs

Other investors also look to gold for the same reasons, and the biggest support for the gold price this year has been the demand for gold ETFs in North America and Europe. These and similar exchange-traded products aim to provide investors with the performance of the gold price. They do this by using the proceeds of the investment to buy an equivalent quantity of gold bullion, which is then stored securely in designated bank vaults. The amount invested in gold ETFs so far this year has already surpassed the entire amount from last year. Bullion held by gold ETFs is at record levels.4

Demand for gold is also impacted by a number of macro factors, including economic growth forecasts, interest rates, bond yields, currency valuations and inflation expectations. While central banks in developing economies have been the main ones buying gold for the past decade, many of the more recent actions of those in developed economies are indirectly supporting the gold price. Keeping interest rates near zero, together with the mountain of negative-yielding debt around the globe, effectively reduces the opportunity cost of holding a non-yielding asset such as gold. Should such loose policy trigger inflation if the economy rebounds quickly, this would also be positive for a real asset such as gold.

How investors can gain exposure to gold

Until around 50 years ago, anyone wanting exposure to gold would simply buy gold bars or coins. However, buying gold as an investment wasn’t really that simple. You would have to source it – hoping you get it for a reasonable price – then arrange and pay for transportation, storage and insurance. These costs of course add up, and then you have the costs involved with selling it.

In 1974, COMEX launched a series of gold futures contracts, enabling investors to take delivery of physical gold at a set future date. However, most investors don’t want to take delivery due to the costs mentioned above, so they “roll” the contract. This means selling before it expires and, at the same time, buying the contract for the next month out. These roll costs make the process more expensive and adds to the administrative burden of maintaining the exposure.

The introduction of gold ETFs (in Europe, the products tend to be structured as “exchange-traded commodities”) has made it much easier for investors to gain long-term exposure. They can be bought and sold throughout the day and are backed by physical gold bars, which are stored securely in bank vaults and audited regularly. Find out about gaining gold exposure by downloading our latest Q2 Gold Report.

Footnotes

-

1 Data: Bloomberg, for the period 1 January to 31 July 2020

2 Data: Bloomberg, for the 12 months to 31 December 2019

3 Data: World Gold Council, long-term supply and demand trends, as at 30 June 2020

4 Data: Bloomberg, World Gold Council, Invesco, as at 31 July 2020

Investment risks

-

Investment strategies involve numerous risks. Investors should note that the price of your investment may go down as well as up. As a result, you may not get back the amount of capital you invest.

If the issuer cannot pay the specified return, the precious metal will be used to repay investors. Investors will have no claim on the other assets of the Issuer.

Instruments providing exposure to commodities are generally considered to be high risk, which means there is a greater risk of large fluctuations in the value of the instrument.

Important information

-

This document contains information that is for discussion purposes only, and is intended only for professional investors in Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden and the UK, Qualified Clients in Israel, and Qualified Investors in Switzerland. Marketing materials may only be distributed in other jurisdictions in compliance with private placement rules and local regulations.

By accepting this document, you consent to communicating with us in English, unless you inform us otherwise. Data as at 11 August 2020, unless otherwise stated.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

In Israel, this document may not be reproduced or used for any other purpose, nor be furnished to any other person other than those to whom copies have been sent. Nothing in this document should be considered investment advice or investment marketing as defined in the Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 1995 (“the Investment Advice Law”).