Gold and the Presidential Elections

Invesco

In one of the closest and most heated Presidential races in recent memory, we turn our attention to the possible implications for gold, which has been the best performing asset class over the past year.1 Will gold remain as strong if Biden wins as it has been in the recent years under Trump, and what would a Trump second term mean for the precious metal? And what happens if the result, once all the votes have been tallied, is then contested?

In this article, we begin by reviewing past elections to see what we can learn. However, as with everything in 2020, nether the election itself nor what may happen with gold is straightforward, and it may be prudent to prepare for the unexpected. We therefore need to consider key factors, various scenarios and try to draw conclusions, while keeping in mind the hefty weight of the pandemic.

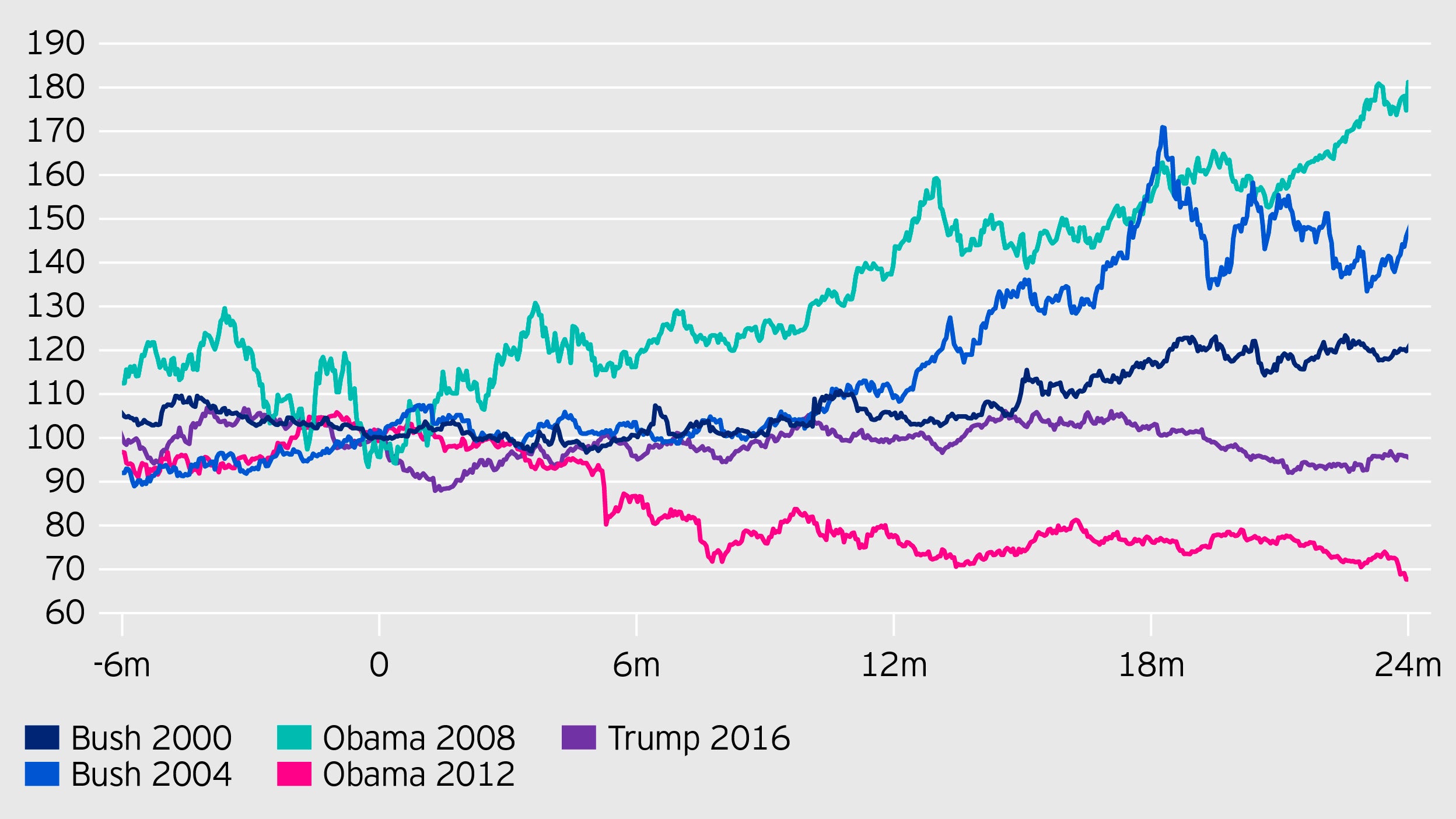

We saw a rising gold price during the first two years of both terms under George W. Bush (Republican) and the first term under Barack Obama (Democrat), but a decline in the price at the start of Obama’s second term in the White House. Gold was around $1,200/ounce when Donald Trump was elected in November 2016, falling by 7% in the aftermath of the result before recovering. Gold then traded within a narrow range ($1,200-1,350) for the next two years.

While it may be convenient to look for links – no matter how tenuous – between gold and past election outcomes, it’s more likely that the path of the gold price was more heavily influenced by other factors, albeit factors that were themselves at least partially dictated by the expected actions of the President. Interestingly, gold declined sharply just ahead of Obama’s first victory, in 2008, before rebounding and continuing to strengthen. This coincided with a marked strengthening of the US dollar.

In fact, the USD often plays a pivotal role in the gold market, so it is important to consider the outlook for the dollar as well as for inflation, interest rates, bond yields and the wider economy.

2020 Election - possible scenarios

| President | The two chambers of Congress | |

|---|---|---|

| Biden | Democrats | Democrats |

| Biden | Democrats | Republicans |

| Trump | Republicans | Republicans |

| Trump | Republicans | Democrats |

| Contested result | ||

We don’t know what would happen if Trump (or Biden) were to contest the election result, other than a likely increase in market volatility. Financial markets generally prefer certainty, so this scenario could support the gold price for at least as long as it takes to find a legally confirmed resolution. In fact, anything other than a clean sweep, by either party, could create an uncertain environment.

Despite this potential near-term uncertainty, the longer-term reaction of the gold price under any of the possible outcomes is likely to be driven by the other factors that are traditionally linked to gold, particularly the US dollar and real bond yields.

The almighty dollar?

As highlighted before, there is generally perceived to be an inverse relationship between gold and the US dollar, in that the gold price tends to rise when the US dollar depreciates versus other currencies, and vice versa. This makes sense when we consider that gold trades in USD so there’s an immediate “cheapening” of gold for all non-USD investors anytime the USD weakens.

Over the past 40 years, we have seen that the USD tends to strengthen immediately after a change in presidency, irrespective of which political party wins, so – all else equal – that would suggest a stronger USD if Biden wins the election. That scenario may be even more likely if it were to be a “blue wave” where Biden not only wins, but the Democrats gain control of both the Senate and the House of Representatives.

On the other hand, assuming Trump doesn’t contest such an outcome, the increased certainty would potentially be negative for gold, at least in the short term while investors reassess the fate of the US economy, debt, inflation and the dollar under the new Administration. One likely implication of a Biden victory would be the freeing up of global trade, which should ease tensions that have elevated the gold price since 2019. A relaxation of trade restrictions should be positive for the dollar, negative for gold.

All else being equal…

While Trump and Biden may have opposing views on tariffs and global trade in general, there may end up being surprising similarities in other areas. Chief among these is spending, with both candidates forced to pursue huge fiscal stimulus packages to combat the deepening financial impact of the pandemic, especially to individuals and small businesses. The current package put forward by Trump is being held up in Congress, which highlights the difficulties a President faces without the backing of both houses. It remains to be seen how soon after the election it will take for the parties to come to an agreement, and what compromises are made to reach that agreement.

If the Democrats sweep the polls, an even larger fiscal package looks to be on the cards, possibly in excess of US$3 trillion (compared to Trump’s proposal, which could be as much as US$1.9 trillion). The details differ between parties in terms of how the funds will be used, but we believe the sheer size of either fiscal stimulus package will have an impact on the US dollar and debt-to-GDP, all of which you would expect to be positive for gold.

Real bond yields

Gold is a non-yielding asset, which makes holding it less attractive when yields on other perceived “safe haven” assets are rising. However, the opportunity cost of holding gold has been dramatically reduced by low Treasury yields. Nominal yields on government bonds are likely to remain low for the foreseeable future, given the Fed’s bond purchase programme.

Bond yields are pushed even lower when you factor in the effect of inflation. Real bond yields hit a record low (-1.1%) at the end of August 2020 and could further weaken if inflation increases. The Fed has stated its willingness to accept inflation moving above 2%, without responding by raising interest rates. On top of this, more than US$15 trillion worth of debt globally has a negative yield.

The high probability and persistence of low-to-negative real bond yields should be a supportive factor for the gold price. We believe this situation is unlikely to change with any election outcome.

Conclusions

You can try to draw conclusions based on each factor we’ve discussed, and how gold would normally behave in those circumstances, but as we know, these are not normal or predictable times. What we do know is that markets like certainty, to the point that a clear election result (for either party) that isn’t contested may be preferred to either a contested result that delays action and creates uncertainty, or a split Congress in which a fiscal package is difficult to agree. Uncertainty would typically be a positive environment for gold.

No matter who eventually wins this election, the President and Congress will still have to deal with the pandemic and ballooning government debt. Arguably, the biggest risk to the gold price would be an economic recovery that is stronger and sooner than predicted, which would possibly only come on the back on an improvement in the pandemic. Until then, investors need to weigh up the impact of government and Fed actions on the US dollar, inflation, bond yields and, in turn, the gold price.

Footnotes

-

1 Data: Bloomberg, gold price in USD, 12 months to end-September 2020.

investment risks

-

Past performance is not a guide to future returns. The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Instruments providing exposure to commodities are generally considered to be high risk, which means there is a greater risk of large fluctuations in the value of the instrument.

important information

-

This document contains information that is for discussion purposes only, and is intended only for professional investors in Austria, Belgium, Croatia, Czech Republic, Denmark, Dubai, Finland, France, Germany, Guernsey, Hungary, Ireland, Jersey, Italy, Luxembourg, the Netherlands, Norway, Portugal, Romania, Slovakia, Spain, Sweden and the UK, Qualified Clients in Israel, and Qualified Investors in Switzerland.

Data as at 30 September 2020, unless otherwise stated.

By accepting this document, you consent to communicating with us in English, unless you inform us otherwise.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

In Israel, this document may not be reproduced or used for any other purpose, nor be furnished to any other person other than those to whom copies have been sent. Nothing in this document should be considered investment advice or investment marketing as defined in the Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 1995 (“the Investment Advice Law”). Investors are encouraged to seek competent investment advice from a locally licensed investment advisor prior to making any investment. Neither Invesco Ltd nor its subsidiaries are licensed under the Investment Advice Law, nor does it carry the insurance as required of a licensee thereunder.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

Issued by Invesco Management S.A., President Building, 37A Avenue JF Kennedy, L-1855 Luxembourg, regulated by the Commission de Surveillance du Secteur Financier, Luxembourg; Invesco Asset Management, (Schweiz) AG, Talacker 34, 8001 Zurich, Switzerland; Invesco Asset Management Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority; Invesco Asset Management Deutschland GmbH, An der Welle 5, 60322 Frankfurt am Main, Germany.