Expectations diverge for economic recovery in the US and China

Kristina Hooper. Chief Global Market Strategist, Invesco Ltd.

Last week, we saw increases in both the Chinese and US stock markets. But that’s where the similarities end — there is currently a meaningful difference in market confidence for the prospects for longer-term economic recovery.

Government support and COVID containment help boost Chinese stocks

The Shanghai Composite Index rose 7.3% last week (despite a drop on Friday), capping off a more than 13% increase since the start of July.1 Chinese stocks were helped by government support — on July 6, the state-owned China Securities Journal published a front-page piece advocating the importance of a “healthy bull market.” This indicates that Chinese authorities are keen to support continued flows into the stock market and intend to support that while avoiding a repeat of the stock market surge in 2014-2015. There are myriad reasons why: Chinese companies need capital to increase their competitiveness in a variety of areas including finance and technology. In addition, given the pandemic and ongoing trade tensions between the US and China, self-reliance has become a higher priority to ensure the country may have more control over its destiny. That includes encouraging citizens to benefit from “the wealth effect of capital markets.” Now that doesn’t mean that China will give up its role as a key cheerleader for globalization, but I believe it will advocate for globalization at the same time it is working to becoming stronger and more independent.

Chinese stocks were also helped by improving confidence in China’s ability to control COVID-19 — there are currently only 623 active cases in China.2 This not only increases confidence in China’s ability to control a second wave, but it suggests China could execute a relatively robust economic recovery. For example, the June Caixin services Purchasing Managers’ Index for China clocked in at 58.4, up from 55 in May.1 Now, it’s unlikely that the recovery for the Chinese manufacturing sector will be as strong as the services side of the economy given China’s reliance on foreign trade. However, China’s overall economic recovery could still be very solid, and I believe that sentiment is likely to continue to support Chinese equities.

Concerns grow regarding the virus’s spread in the US

It is a different story in the United States. Yes, US stocks also rose last week (the S&P 500 Index was up 1.75%).1 And yes, they have also been helped by government encouragement (more specifically the Federal Reserve and its very accommodative monetary policy which has created an upward bias for stocks). However, there is growing concern about the US’s inability to control the spread of COVID-19. New infections are rising in many parts of the US; on July 11 alone, there were 62,918 new cases reported.3

Atlanta Fed president Raphael Bostic articulated those concerns in comments last week: “There are a couple of things that we are seeing and some of them are troubling and might suggest that the trajectory of this recovery is going to be a bit bumpier than it might otherwise.”4 He talked about the high level of uncertainty and explained, “We’re watching this very closely, trying to understand exactly what’s happening.”

I believe those disturbing health statistics are responsible for the significant divergence we have seen recently in US stock market performance, with tech stocks dramatically outpacing other parts of the market. This suggests that markets are troubled by the health statistics in the US, and this is informing their expectations about the shape of the recovery. It’s clear to me that stocks are expecting a slow, uneven and halting recovery in the US, which is driving investors to larger-cap, secular growth stocks which have historically outperformed in such environments.

The good news is that these views can change. The two near-term catalysts that could inspire more optimistic views on the US economic recovery are: 1) the US’s ability to control the spread of the virus, and 2) more fiscal stimulus from the government, especially for parts of the economy hard hit by the virus. Making face masks ubiquitous will be critical in achieving the former. (This past weekend, the US took an encouraging step when the president of the United States publicly wore a face mask for the first time, which could presumably encourage others to do the same). Achieving the latter could happen this month as Congress contemplates more fiscal spending. We will be following both closely.

Footnotes

-

1 Source: Bloomberg, L.P.

2 Source: Statista, as of July 9. 2020

3 Source: Centers for Disease Control and Prevention

4 Source: Financial Times, “Federal Reserve official warns US recovery may be ‘levelling off,’” July 6, 2020

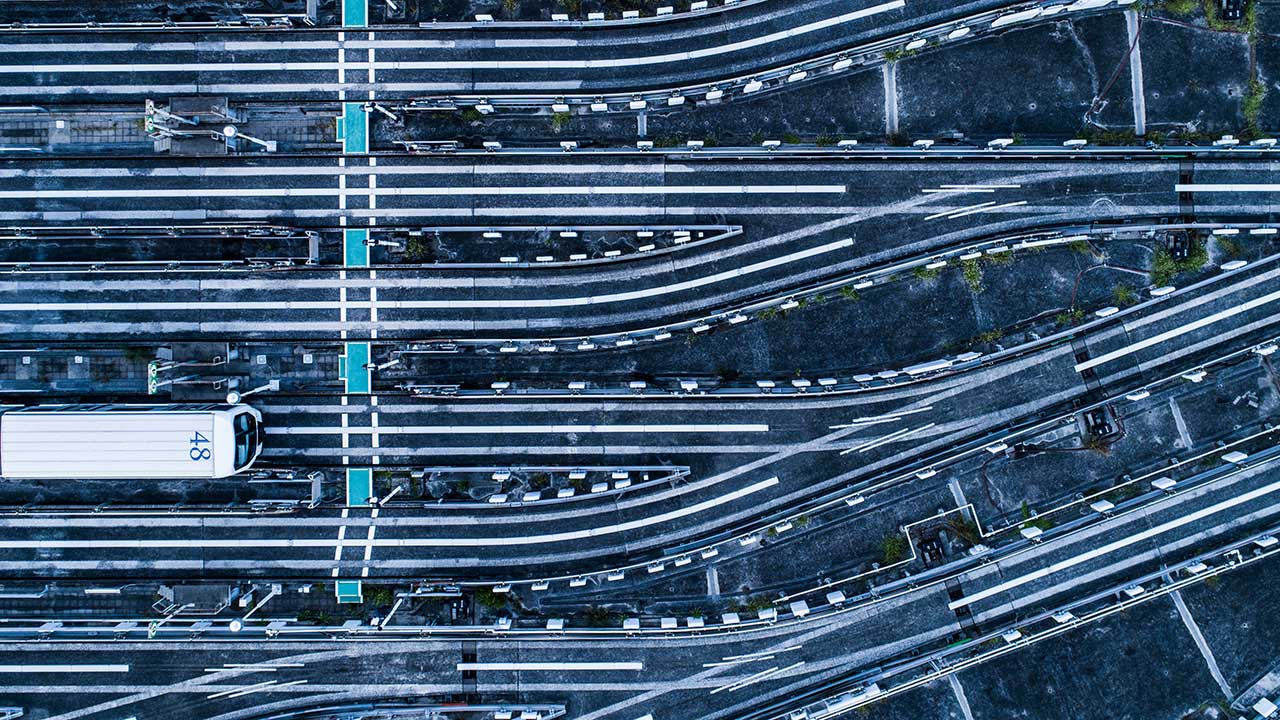

Blog header image: Michael H / Getty

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors.

Important information

-

The opinions referenced above are those of the author as of 13 July 2020.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.