ETC Why invest in gold with Invesco?

Get in touch with Invesco to find out how those who invest in gold can profit from diversification benefits and learn more about gold investment.

Gold has been treasured by people for thousands of years, whether as a means for bartering or as a symbol of wealth, but questions are still being asked particularly around its investment characteristics. Is gold an inflation hedge? Is it suitable for ESG investors? And where does it fit in a diversified portfolio?

Today, gold is held by a range of investors for a variety of reasons, from central banks wanting to diversify their reserves to individuals wanting physical assets that may retain value over time. Gold held by retail and institutional investors has increased substantially over the past 20 years, due mainly to gold-backed exchange-traded products making it easier for them to gain exposure.

Source: Bloomberg, as at 30 June 2022.

As investors are adding gold to their portfolios, they naturally want to know more. Here we look at five of the most asked questions and provide insight to understand the truth.

Gold can be useful in times of high and rising inflation, particularly when other factors such as economic slowdown or uncertainty also support risk-off assets.

Since 1971, gold has returned an average of 15% per annum when inflation has been above 3%, compared to a 6% annual return when inflation has been below 3%1. Of course, the answer is not so simple. Gold tends to be less desirable by investors when inflation pressures come from demand “pulling” prices higher, as the market prices in an expectation that central banks, particularly the Federal Reserve, will control rising costs through conventional monetary policy. A strong US Dollar and rising bond yields – both often accompany rising interest rates – are also generally seen as headwinds to gold because the former makes it more expensive for non-US buyers and the latter increases the opportunity cost of holding non-yielding assets such as gold.

However, when inflation is “pushed” higher, for instance from a sudden unexpected event or crisis, gold tends to be a more effective hedge. We saw this in the ‘70s when oil prices spiked, and wage growth and other inflation pressures meant simply raising interest rates was less effective. This and again in the early ‘80s were the only periods over the past 50 years when inflation was at the sort of levels we’re now experiencing, albeit we’re still a little way off those double-digit highs.

Over these past 50 years, gold has produced positive real and nominal growth during periods of high inflation, stagflation and recession, as well as small positive returns in more balanced growth phases.

Source: Invesco, Bloomberg, from 1970 to 2020. Past performance is not a reliable indicator of future returns.

It’s worth highlighting from this analysis that the greatest real returns for gold have been during times of stagflation, which is the most worrying economic scenario for most investors in the current market climate. The prospects for gold in 2022 will depend largely on the impact of Fed tightening (which is currently estimated to take the Fed Funds rate to upwards of 3.5% by the end of the year2) on inflation, unemployment and economic growth. Recession and stagflation risks are real concerns.

The question is whether ethics can be safeguarded across the entire gold supply chain, from mine to vault in the case of bullion held on behalf of physical gold exchange-traded products.

The gold mining and refining industries are focused on improving sustainability, accountability and transparency. The goal is to provide investors and consumers with more clarity and confidence that the gold they are buying has been sourced and processed according to a high set of standards. As a provider of one of the largest physical gold ETCs in Europe3, we aim to ensure all the bullion stored in the custodian’s vault on behalf of the ETC meets those industry standards. The biggest concern for most investors until around a decade ago was stopping the amount of gold used to fund or support unlawful armed conflict, particularly involving oppressive regimes in frontier economies. The World Gold Council launched the Conflict-Free Gold Standard (SFGS) in 2012, putting in place processes for mining companies to guard against this risk. The CFGS has now been incorporated in the Council’s more comprehensive Responsible Gold Mining Principles, issued in 2019, for its 32 member firms (mining companies). This framework establishes what constitutes responsible gold mining.

Likewise, the London Bullion Market Association (LBMA) has a mandatory Responsible Sourcing programme for any refiner wanting to trade with the London Bullion market. The LBMA issued its Responsible Gold Guidance in 2012 and has updated the document multiple times since then to incorporate incrementally improving guidelines and auditing guidance around relevant issues. They continue working with mining companies to develop best practices across the industry.

The World Gold Council and LBMA have been issuing separate guidance to their members since 2012 and are now working together on a combined framework, trialling a blockchain solution for tracking gold from the mine all the way through the supply chain. We will comment as details are released, and on critical areas such as recycled gold and artisanal and small-scale mining (ASM).

Mining is an energy-intensive process that often impacts the local ecology and, while it may never be totally environmentally neutral, improvements can be made to reduce the negative impact.

The source of the power generation will make an enormous difference in the environmental impact of a particular mine, from low if hydro power is available to high if the mine relies on a coal-fired power plant. The overall impact of the mining industry should improve over time if countries transition to more sustainable energy sources. Responsible mining companies are also required to monitor and report on the management of tailings to ensure the local ecology is not compromised.

At Invesco, these environmental issues are generally top of our agenda when we engage with the senior management of the mining companies in which we have equity holdings. We seek to better understand their views, steps they are taking to mitigate risks and reduce their carbon footprint.

Mining companies must also have plans for restoring the ecology at the end of the mine’s lifetime. Ethics extend beyond the environment, of course, and mining companies can make a positive impact on addressing socio-economic issues. Given that a productive mine may be in operation for many decades, mining companies will often help develop local housing, transportation, schools and medical infrastructure. This can have long-term material benefits for emerging economies.

Find out more about what we’re doing to make gold more sustainable and responsible.

Gold has tangible value, although many investors point to it being a non-yielding asset and, therefore, difficult to assign fair value by conventional methods.

While much of gold’s value is linked to its investment characteristics and cultural significance in major jewellery markets such as India and China, gold’s physical properties also make the precious metal valuable for use in a range of high-end technology applications including from the medical and aerospace industries.

Total demand from this sector accounts for just under 10% of annual gold demand, but the amount used has been fairly steady over the past decade, according to data published by the World Gold Council. The electronics sector consumes around 80% of this demand, with gold a critical element in the manufacture of semiconductor chips. In health care, gold nanoparticles are used in many of the diagnostic testing kits such as those relied on throughout the covid pandemic.

Sources: World Gold Council, Metals Focus, Refinitiv GFMS.

Gold has low correlation with many of the riskier assets you’re likely to have in your portfolio, meaning it could be a useful diversifier.

Some investors consider gold to be like an insurance policy. Although it offers no guarantees and can go down even when you expect it to behave differently, gold historically has held up well during sharp equity market downturns.

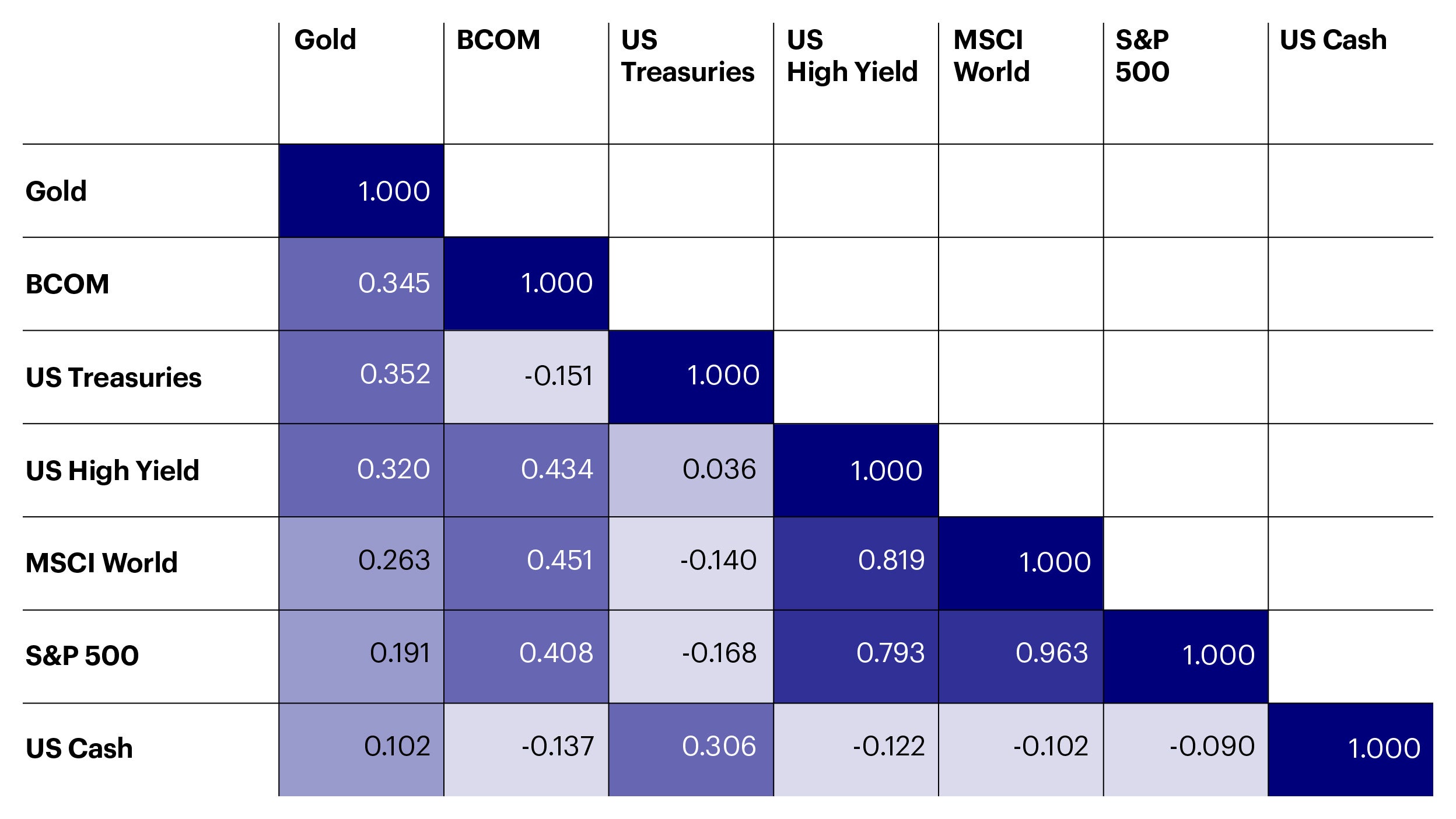

As shown in the correlation matrix, the gold price tends to move more in line with other defensive assets, particularly US Treasuries, but the low correlation with risk assets make it more useful to include in portfolios with significant equity exposure. Investors may typically allocate up to 5% to gold, often as a ‘cushion’ for the rest of the portfolio.

Sources: World Gold Council, Bloomberg, COMEX. Correlations are based on weekly returns over six years to 25 July 2022. All benchmarks in USD.

Gold kicked off 2025 with a 6.6% gain in January, supported by increasing economic and geopolitical uncertainty particularly related to the impacts of potential trade tariffs. Discover insights into the key macro events and what we think you should be keeping your eyes on in the near term.

In this second part of the Gold Report, we explore the various sources of supply and demand to further explain recent movements in the gold price.

1Source: World Gold Council

2Source: Bloomberg, based on Fed Fund Futures as of 29 July 2022.

3Invesco Physical Gold ETC, assets under management of $14.8 billion as of 29 July 2022.

For complete information on risks, refer to the legal documents.

The value of investments, and any income from them, will fluctuate. This may partly be the result of changes in exchange rates. Investors may not get back the full amount invested.

If the issuer cannot pay the specified return, the precious metal will be used to repay investors. Investors will have no claim on the other assets of the Issuer.

Instruments providing exposure to commodities are generally considered to be high risk, which means there is a greater risk of large fluctuations in the value of the instrument.

Data as at 25 July 2022, unless otherwise stated.

All investment decisions must be based only on the most up to date legal offering documents. The legal offering documents (Key Information Document (KID), prospectus, annual & semi-annual reports, articles & trustee deed) are available free of charge at our website etf.invesco.com and from the issuer.

This communication is marketing material and is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This communication should not be considered financial advice. Persons interested in acquiring the fund should inform themselves as to (i) the legal requirements in the countries of their nationality, residence, ordinary residence or domicile; (ii) any foreign exchange controls and (iii) any relevant tax consequences.

Any calculations and charts set out herein are indicative only, make certain assumptions and no guarantee is given that future performance or results will reflect the information herein.

For details on fees and other charges, please consult the prospectus, the KID and the supplement of the product.

For the full objectives and investment policy please consult the current prospectus.

RO 2312703