Sustainability-linked bonds: The new, new thing in ESG fixed income

The growth of the labeled sustainability bond segment we envisaged in “Sustainability bonds: Adding more than color to the investor palette (Invesco Fixed Income, March 2021)” is gaining traction across fixed income markets globally. We are also seeing an accelerated evolution in the type of labeled bonds that issuers consider. One of the most interesting and rapidly growing segments of the labeled bond market currently is “sustainability-linked” bonds.

Barclays reported1 that the 2021 volume of sustainability-linked issuance had already reached USD15.3 billion by the end of April, or roughly double 2020’s entire issuance, and that this growth has continued in May. These are bonds where the features (most likely the coupon) change depending on the achievement of certain key performance indicators (KPIs). In other words, the bonds’ features are “linked” to the issuer’s performance on key environmental and social objectives. The analysis of these bonds poses fresh challenges for fixed income investors, as we need to assess the likelihood and consequences of achieving these KPIs as well as default risk. In this piece, we outline Invesco Fixed Income’s (IFI) approach to analyzing sustainability-linked bonds and highlight some of the pitfalls of a “light-touch” approach.

Source: BNEF, Invesco. Data from Dec. 31, 2012 to Dec. 31, 2020

Assessing sustainability-linked bonds

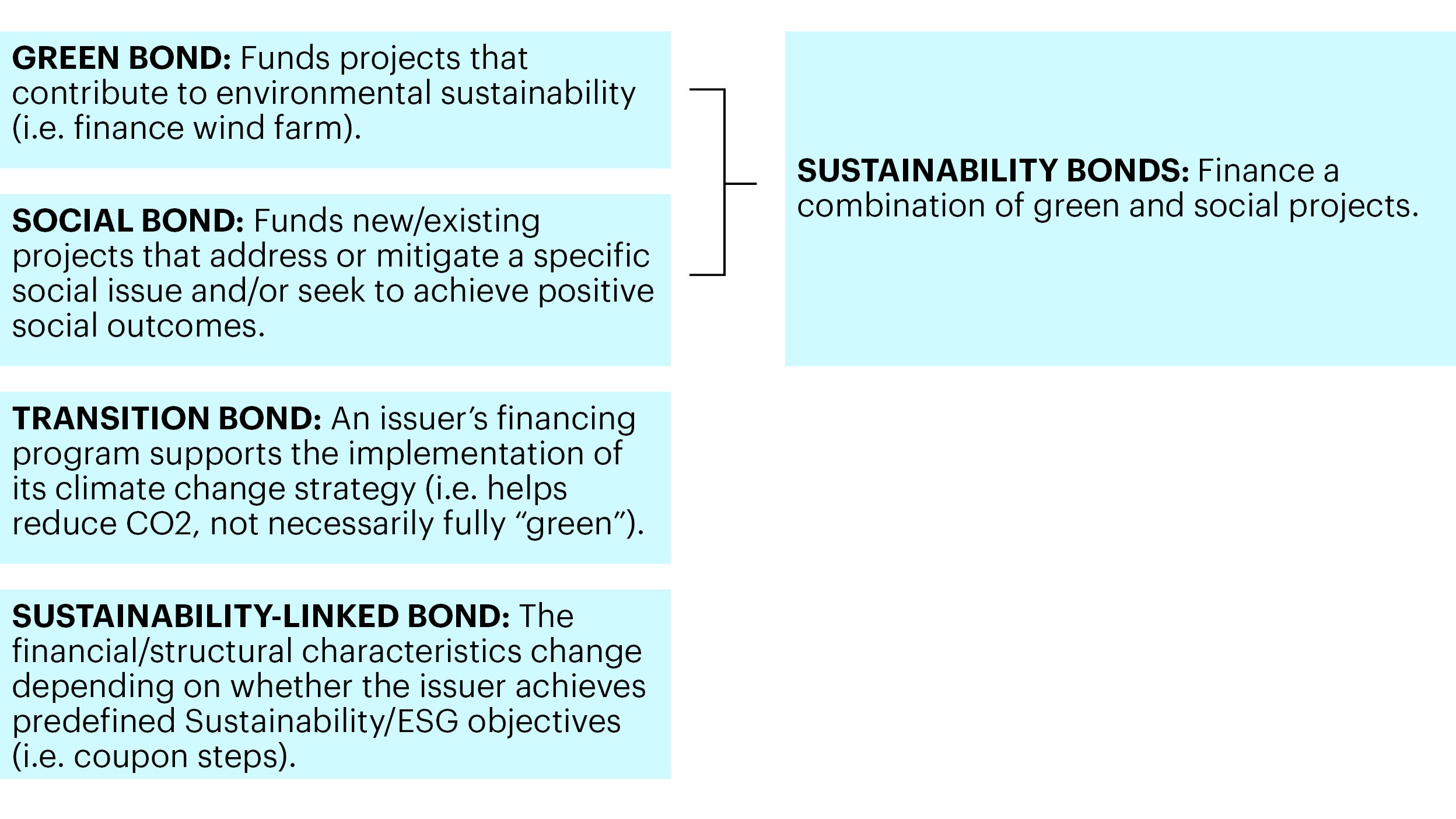

Sustainability-linked bonds are any type of bond instrument for which the characteristics (most likely the coupon, but potentially other features like notional amount or maturity) vary, depending on the issuers’ achievement of pre-defined environmental, social and governance (ESG) goals.

Unlike other labeled bonds (green and/or social), the proceeds of the bond are not allocated to specific projects and can be used for general corporate purposes. However, this means that investors are reliant on the overall ESG credentials of the issuer, and also need to decide whether they value the achievement of these KPIs, the likelihood of this, the financial consequences and how this will be reported to investors.

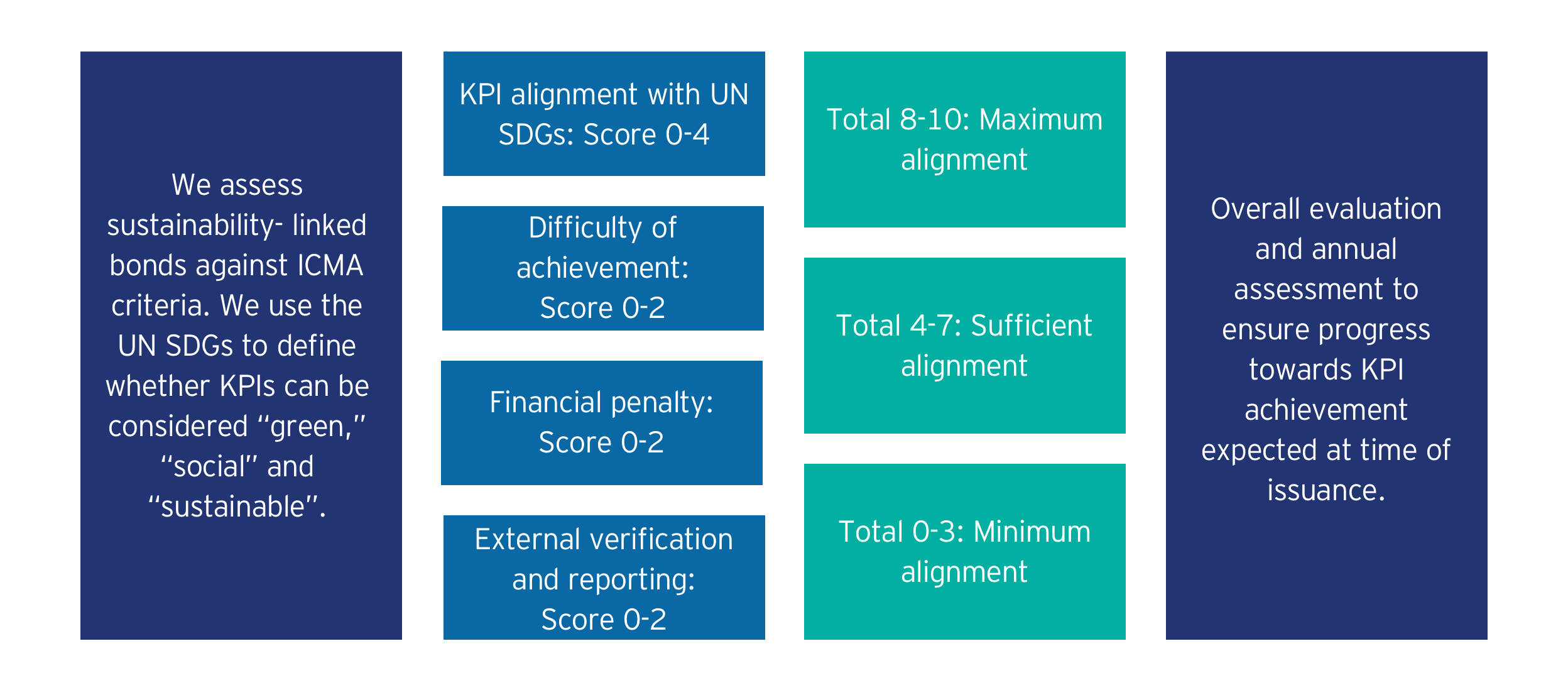

While our usual integrated ESG analysis (looking at an issuer’s ESG characteristics versus sector peers to derive an overall A-E rating with trend) helps influence whether we believe the issuer will achieve its ESG goals, we also need to assess the issuer’s sustainability-linked bond program. To assist with this assessment, we have augmented the IFI Sustainability Bond Framework that we developed in collaboration with Invesco’s Global ESG Team to address sustainability-linked bonds specifically. For sustainability-linked bonds, we have a scorecard approach that looks at factors including the mapping of key performance indicators (KPIs) to United Nations Sustainable Development Goals (UN SDGs), the difficulty of achievement, the financial penalty for failure and external verification to assess the alignment of the sustainability-linked bonds with the UN SDGs (Figure 3).

Given that sustainability-linked bonds are still an emerging area in fixed income, we highlight three potential pitfalls in sustainability-linked bonds and how we treat them:

- KPIs are tested so late in the life of the bond that the cost of failure is irrelevant: If an issuer sets the attainment of a KPI in 2030 for a 10-year maturity sustainability-linked bond issued in 2021, failure to achieve this KPI can only be penalized with one coupon payment. We believe this could create an incentive to set overly ambitious targets because the price of failure is so small when spread over the life of the bond. We penalize this in the ‘KPI alignment with UN SDG’ section.

- KPIs are already effectively achieved: If an issuer sets a backdated KPI, meaning that its KPI has already been, or is very likely to be, achieved by the date of testing, we believe the sustainability-linked bond is having little incremental impact. We penalize this in the ‘difficulty of achievement’ section.

- Cost of failure is too small: If the coupon step-up for failure to achieve the KPI is modest relative to the issuer’s overall cost of debt, we believe the incentive for the issuer to take steps to achieve sustainability KPIs is relatively low. We penalize this in the ‘financial penalty’ section.

From a broader market perspective, we believe sustainability-linked bonds have significant growth potential, as issuers are not constrained by the need to allocate proceeds to specific projects. This makes the bonds more flexible from the issuer’s perspective and open to a much broader group of issuers. However, there is a “free-rider” problem that is more obvious in sustainability-linked bonds than other labeled bond segments. All bondholders (not only sustainability-linked bondholders) benefit from the issuer’s commitment to achieving these ESG targets. In our view, this should limit the “greenium” (the price differential between sustainability and non-sustainability bonds from the same issuer) that investors are prepared to pay for sustainability-linked bonds.

IFI is closely monitoring ESG risks across its portfolios and especially in the sustainability bond space. Having a well-resourced and experienced credit team is important for assessing the issues raised here and to inform our investment decisions. IFI seeks to ensure that credit spreads adequately reflect downside risks, including ESG factors, or, where this is not the case, that “at-risk” names are avoided.

Related article

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

Data as of 15 April 2021 unless stated otherwise.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.