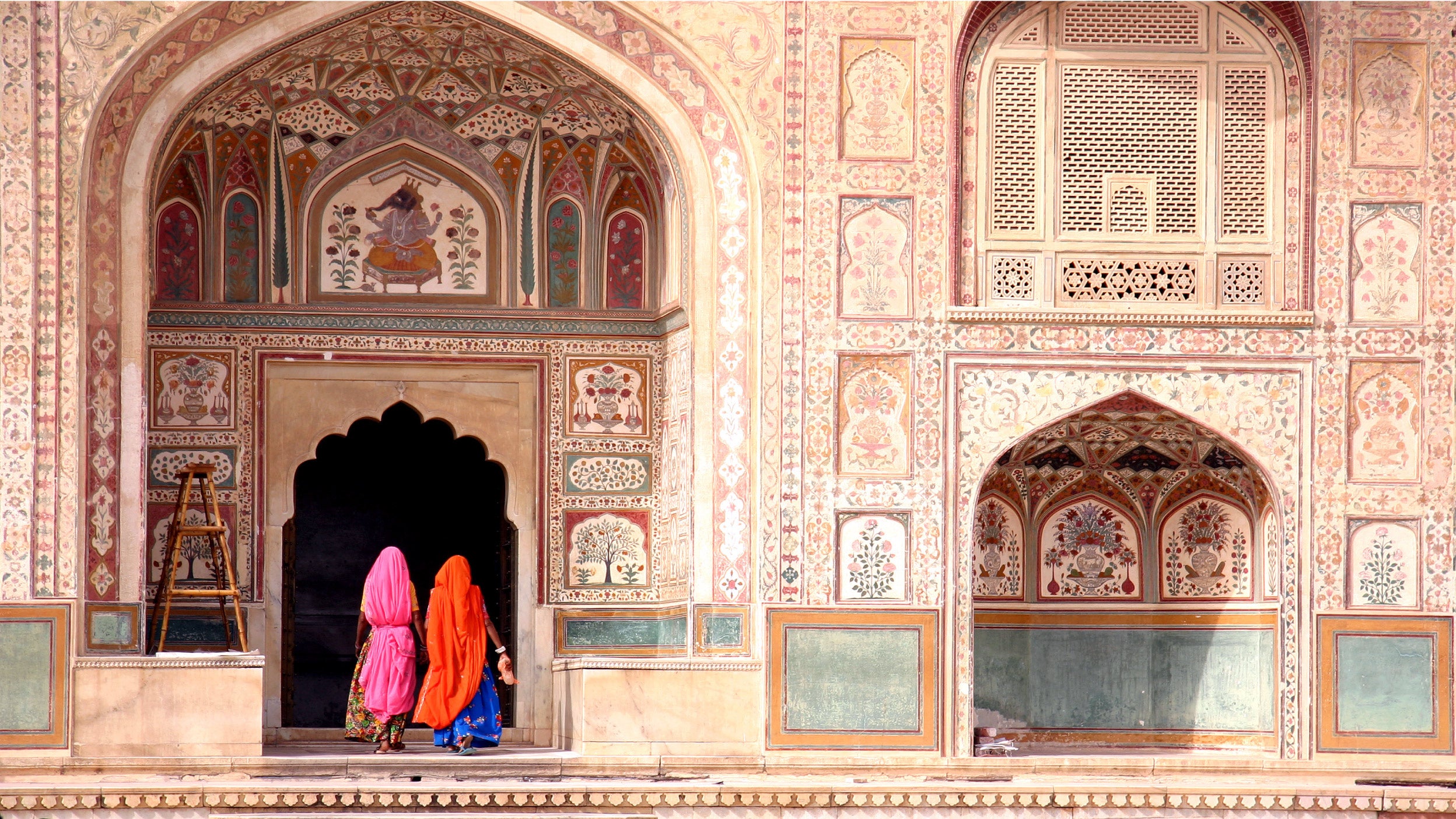

India’s economic growth: Standing out globally

India is one of the strongest growing economies in Asia, driven by digital transformation, robust consumption and expanding exports. Find out more.

In this five-minute video, Invesco Global Equity Income Fund Manager Joe Dowling shares the three key things he believes will impact the outlook for 2025:

00:25 – Implications of the return of Donald Trump

01:22 – Realism setting in around artificial intelligence (AI)

02:57 – ‘Hangover stocks’ – a diverse group of stocks whose share price peaked in the pandemic

Joe closes by assessing the market’s temperature and how positive market sentiment impacts portfolio positioning.

Speaker 1:

Hi, my name's Joe Dowling, I'm the fund manager here on the Invesco Global Equity Income Strategy, and I'm here today to talk to you about our outlook for 2025. So there are three key things I want to talk to you about today, and the first is the return of Donald Trump, the second is AI, and the third is what we are calling Hangover Stocks. So firstly, I think any 2025 outlook would be remiss without thinking about what Donald Trump might have to bring. His promised policies, whether it's immigration, whether it's lowering tax, whether it's reducing regulation, whether it's reforming the healthcare system, all of these things in aggregate look set to be quite pro-inflationary to us, and that has far-reaching implications for US borrowing costs, both for the government and their companies, and perhaps most importantly, it has far-reaching implications for what type of companies might survive and thrive in a bit more of an inflationary backdrop. So we are ensuring that we own companies that we think have strong franchises, strong balance sheets, and are run by management teams we trust to be able to navigate these kinds of environments.

In terms of AI, I think it'd be fair to say 2023 and 2024 was the year where AI, ChatGPT, and Nvidia just exploded onto the scene. We think 2025 is going to be a year where perhaps a bit more realism sets in, and what I mean by that is the hyperscalers who spent hundreds of billions of dollars on GPUs and infrastructure, and we haven't really seen much return yet. And 2025 feels to us like the year where the hyperscalers really need to show attractive profits on that investment. And in the absence of that, it might be that they start pulling back on that AI spend. So we're intrigued to see what happens to those companies themselves, whether the market thinks slowing CapEx is a good or a bad thing. We are also watching out for hidden risks. So a lot of companies, whether it's utilities or electrical suppliers, have done really well because they've been surprising beneficiaries of the AI megatrend. Now, those companies have benefited as the AI tide has lifted their boats, but the inverse could also be true. Those could be surprising dominoes that fall if data center construction or the construction of nuclear reactors falls along with AI spending. So those kind of hidden risks are something we are paying very close attention to.

Thirdly, hangover stocks. Now what do I mean when I say hangover stock? Well, to us, a hangover stock is a company like Danaher or Old Dominion that has not been able to grow its profits from the highs of the COVID-induced boom. So that's a company that profits peaked in 2020 or 2021, and we're still waiting for them to hit bottom and start growing again. The really interesting thing to us about this group of stocks is it comes in such a diverse variety of flavors. You have lots of very traditionally defensive healthcare companies, Danaher, the Med Tech devices business, United Health, health Insurer, Medpace are involved in drug discovery. These are traditionally defensive companies and they have been hurt by a lack of recovery in their end markets. On the other side of that, you've also got lots of cyclical companies, whether that's Canadian Pacific, whether that's Old Dominion the trucking company, whether that's Azelis our chemicals distributor, these companies too have seen a lack of green shoots in their end markets so you can actually build a group of companies that are potentially reaching a bottom in their earnings power.

We hope 2025 brings with it tailwinds rather than headwinds for these companies, and most importantly, they should be entirely uncorrelated to one another over the long term. And of course the risk is that they don't recover as quickly as we might hope. Maybe just taking a step back and taking the market's temperature. We think whether you look at the past couple of years of performance, whether you look at bond yield spreads, whether you look at the performance of IPOs, the market is feeling pretty optimistic at the moment, and for us as more contrarian investors, we are treating that with an appropriate dose of caution. So whilst we're optimistic about many of our companies, we are just trying to make sure we remain aware of the risks that might present themselves and that we are constructing a portfolio that will behave in an all-weather manner no matter what 2025 brings. And we're doing that by having a diverse portfolio of really strong companies with strong balance sheets run by management teams we trust at attractive prices, and we think that that will be a portfolio that's well-placed to thrive no matter what 2025 brings. With that, I'd just like to say thank you very much for listening and hopefully speak to you again soon.

A core global equity fund without significant style or factor biases aiming to outperform in most market environments.

India is one of the strongest growing economies in Asia, driven by digital transformation, robust consumption and expanding exports. Find out more.

The 2025 equities outlook is improving. Balance sheets look healthy, and many stocks are attractively valued, though geopolitical risks remain. Find out more.

The Indian equity market is poised for significant growth, and we believe performance will be supported by strong corporate earnings and GDP figures. Find out more.

For complete information on risks, refer to the legal documents.

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested.

Data as at 16 January 2025 and sourced by Invesco unless otherwise stated.

Views and opinions are based on current market conditions and are subject to change.

This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

For information on our funds and the relevant risks, refer to the Key Information Documents/Key Investor Information Documents (local languages) and Prospectus (English, French, German, Spanish, Italian), and the financial reports, available from www.invesco.eu.

A summary of investor rights is available in English from www.invescomanagementcompany.lu. The management company may terminate marketing arrangements.

Not all share classes of this fund may be available for public sale in all jurisdictions and not all share classes are the same nor do they necessarily suit every investor.

Denmark: The fund is registered in Denmark for professional investors only and not for public distribution.

EMEA4239506/2025