Client Portfolio Manager, Invesco Global Debt Gerald Evelyn

MBA, BA degree

Though not a novel asset class, we believe that emerging markets local currency debt (EMLD) warrants a new, fresh look by investors. It has benefitted from continued growth and improving country credit profiles over the years, while the current elevated term premiums are enticing in today’s low yield environment.

Additionally, with the exceptionally accommodative stance of many developed countries and meaningful global output gaps, which should temper inflation concerns, we believe the environment is ripe for EMLD to shine.

A global recovery is well underway, with growth estimates for 2021 being raised across the board. Our own growth estimates for the US, eurozone and selected emerging market countries have moved toward the top end of our forecast ranges.

This indicates our growing confidence that this year’s global growth could be the best in over a decade. While the initial upswing will likely be led by the US and emerging markets (and Asia in particular), an expected upswing in Europe will probably extend the recovery to a true, global reflationary boom.

In our view, the value proposition presented by this US$17 trillion asset class is immense: it can provide diversification to a portfolio and is supported by a compelling valuation and growth story.

How can exposure to this asset class complement my existing portfolio?

EMLD generally exhibits low correlation to both global bonds and global equities. This signifies the potential diversification benefits of adding EMLD to a global bond or global equity portfolio. This should, in turn, lower the volatility of the overall portfolio.

What about income and returns?

Given the regional variance in economy growth rates and development, no two markets are the same within emerging markets. This translates to a greater dispersion of returns and income by country within emerging markets fixed income. In order to tap into the potentially high income and returns, significant due diligence and attention to country-specific risks are required. For this reason, we believe this asset class to be better suited to actively managed strategies.

What about the ESG impact of EMLD?

The continued expansion of emerging markets fixed income has a naturally positive impact on governance-related factors as well as progress towards climate and social equity objectives. The scrutiny of global investors leads to both improved transparency and impact engagement financial tools, which help meeting country level sustainability goals.

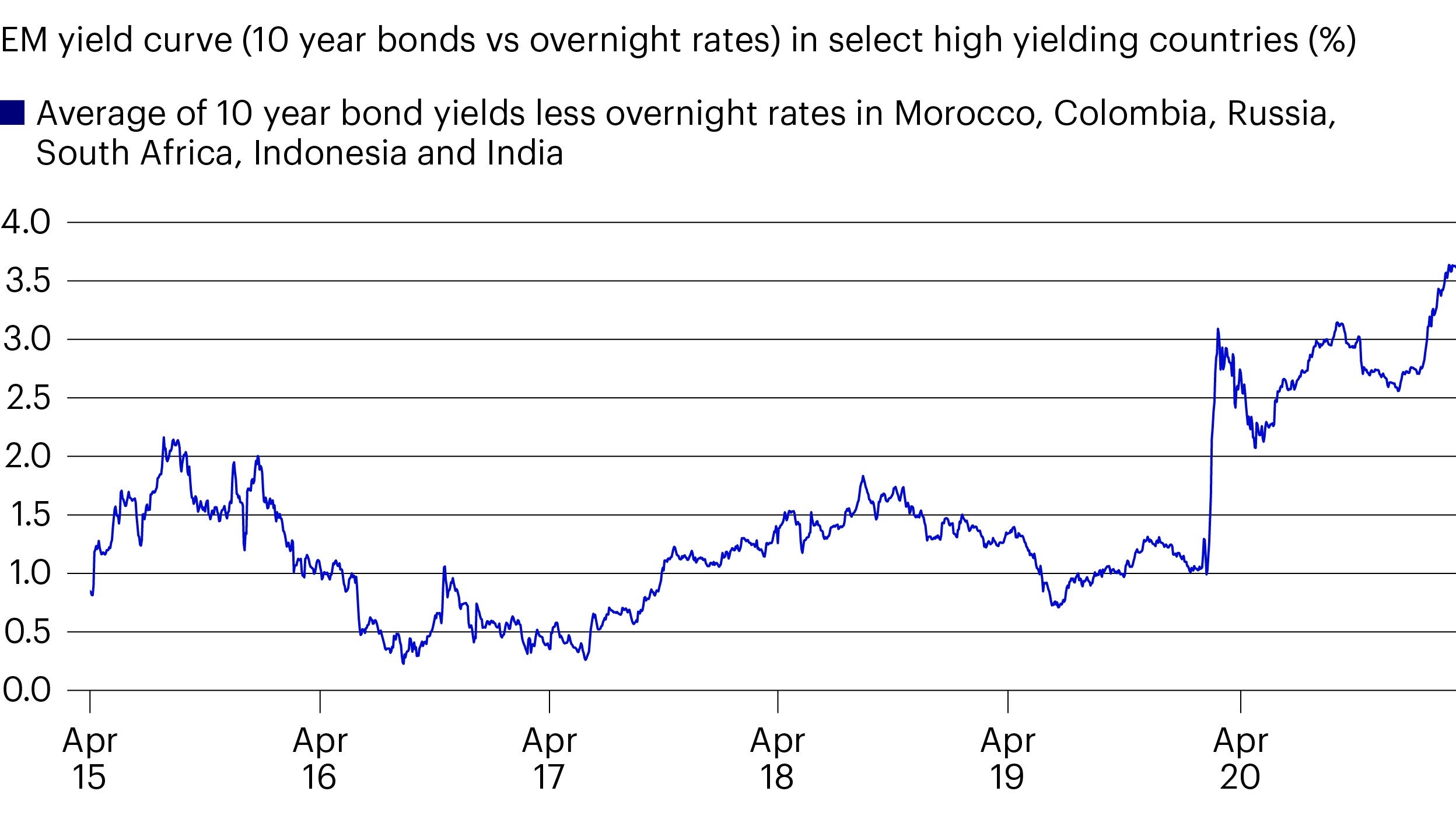

The aggregate pricing within emerging market rates remains compelling. After the recent wobbles, led by US interest rates and matched by most emerging market rates, yield curves have steepened to decade highs and offer exceptionally attractive carry and roll down.

While the steepening of yield curves in developed markets is required and welcome, emerging market yield curves were already very steep, and this latest steepening has created an attractive entry point.

We believe the market narrative will shift as it becomes clear that there will be no near-term policy response to higher global growth from developed market central banks. This shift will likely be accelerated by the tightening policy response in certain emerging market countries such as (but not limited to) Brazil and Russia.

This double-edged response will likely reduce the real premium embedded in emerging rate markets.

EMLD is a dynamic asset class. Emerging economies generally have more restrictive financial constraints than their developed peers, which creates structural growth drivers for the asset class.

Alas, demand begets supply, and so its continued growth self-reinforces, increasing both regional market depth and overall asset performance. For context, emerging market debt is approximately 16x larger now than in 2000.

It currently accounts for over 20% of the global bond market, yet emerging economies account for up to up 50% of global GDP. There is evidently room for further market expansion. Continued market growth matched with higher relative country return dispersion provides a fertile country level opportunity landscape for actively managed portfolios.

Our expectation of accommodative fiscal policy, but with declining magnitude, has been altered by the massive US fiscal stimulus announced in March. We continue to anticipate a positive fiscal impulse to global growth, led by the US, but with an added boost from countries like India that have emphasized growth in the near term over fiscal discipline in an effort to grow out of their deficits.

Within this framework of global growth recovery, supported by accommodative monetary and fiscal policy, the market pricing of risk and the path of interest rate increases will likely be critical in generating excess returns going forward.

Our investment theme for the next nine to 18 months (our investment horizon), is reflation and growth. In the absence of tightening financial conditions, all growth will remain ‘good’ growth for reflationary assets, in our view. Reflationary assets include emerging market equities, currencies, rates, and to a lesser extent, credit.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This document is marketing material and is not intended as a recommendation to invest or sell in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.