At the end of February, it became clear that the financial markets were no longer prepared to overlook the potential global impact of coronavirus. Our initial discussions focused on the short-term risk management of the portfolio and ensuring the diversification in our portfolios remained intact.

For fundamental reasons, we had already constructed what we believed to be a relatively well-balanced portfolio as the heightened level of concern around the outbreak began to impact markets. However, we quickly re-assessed the upside equity exposure in the portfolio as equities tumbled, ensuring these structures were reset as appropriate to avoid an unnecessary hit to P&L.

Our focus then shifted to our central economic thesis and whether the coronavirus had simply accelerated a decline in economic fundamentals, which we believed was already underway before the virus hit.

We had already been concerned about more muted economic growth and, in particular, we had been focused on the risk that corporate profit margins could come under pressure as costs rise (via sticky labour costs) at a time when demand started to slow. A reduction in the mobility of people globally, a break in supply chains and potential hit to liquidity (in a more extreme outcome) could extend/accelerate those risks.

The tough assessment right now is whether economic deterioration is very short lived or whether it persists because of the virus now sitting alongside other broader economic pressures, which had been increasing anyway.

On one hand the economic deterioration promotes a more cautious view, but the worse it gets the more likely a policy intervention could occur, which could stabilise financial markets very quickly. Given volatility will likely increase it is important our strategies are not whipsawed with broad shifts in short-term sentiment.

Therefore, we have also been closely assessing the ideas in the portfolio to revisit their fundamentals and ensure none of the recent news flow changes their supporting thesis.

For example, we have been cautious on the Korean won and Taiwanese dollar for economic and competitive reasons. The currencies have both weakened recently because of the virus-related news flow. However, the fundamental drivers of the ideas remain intact.

Some other ideas have not worked as the equity market fell – for example some of our individual equity ideas or our UK curve steepener. Here, equally, we need to be confident that our two- to three-year investment outlook for these ideas remains valid.

Our strategy has recently been positioned with relatively low equity beta, as we have increasingly relied on more idiosyncratic ideas, which could work regardless of the direction of both equity and bond markets. Some of our ideas remain risk-off or risk-on in a more ‘traditional’ sense.

However, we are very comfortable that we don’t need to change the overall balance of the portfolio because sentiment could change very quickly indeed one way or the other.

One element of our approach that has proved beneficial during previous market sell-offs is our ability to use volatility as a source of returns. We believe the sustained low volatility market environment nurtured by the extraordinarily loose monetary policy of the global central banks has created opportunities in this area.

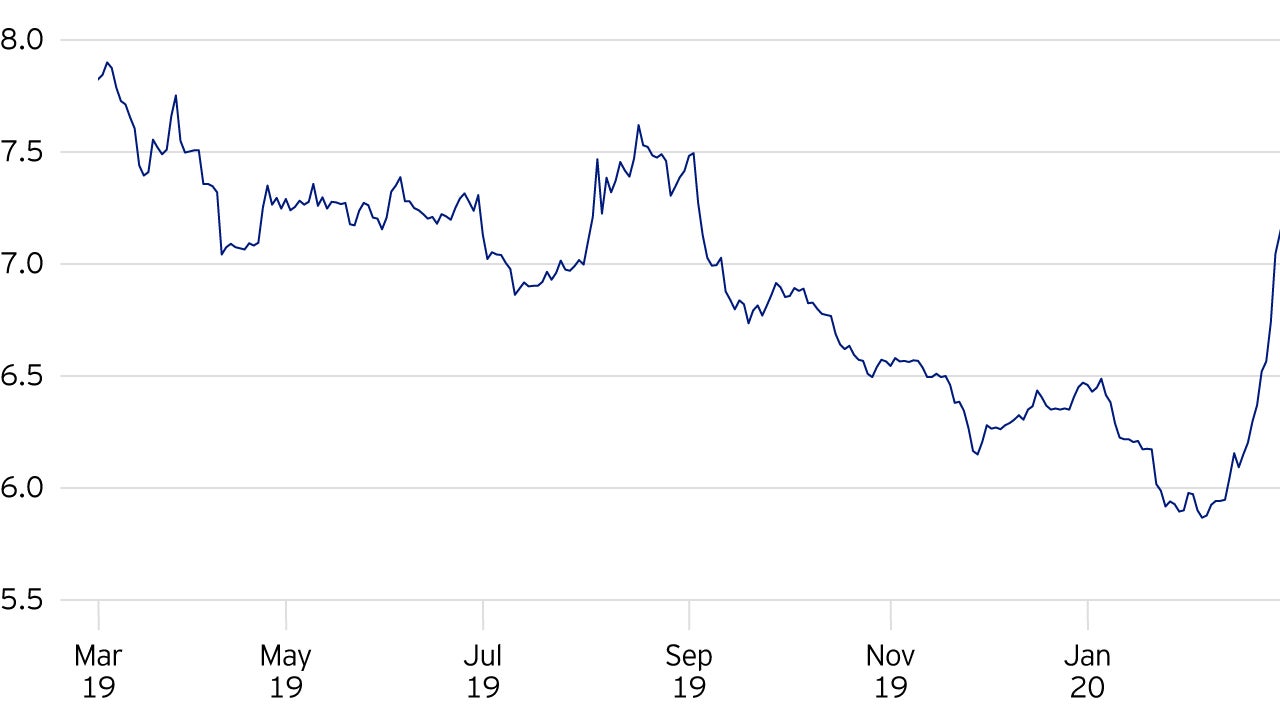

For example, we have been buying volatility in a number of currency pairs including the euro-dollar cross rate. As can be seen below, the volatility of this pair has risen significantly recently, which has helped the portfolio when more traditional sources of return have struggled.