How does a swap-based ETF work?

ETFs replicate benchmark indices in different ways: physically, and synthetically – also known as a swap-based approach. Find out how a swap-based ETF works.

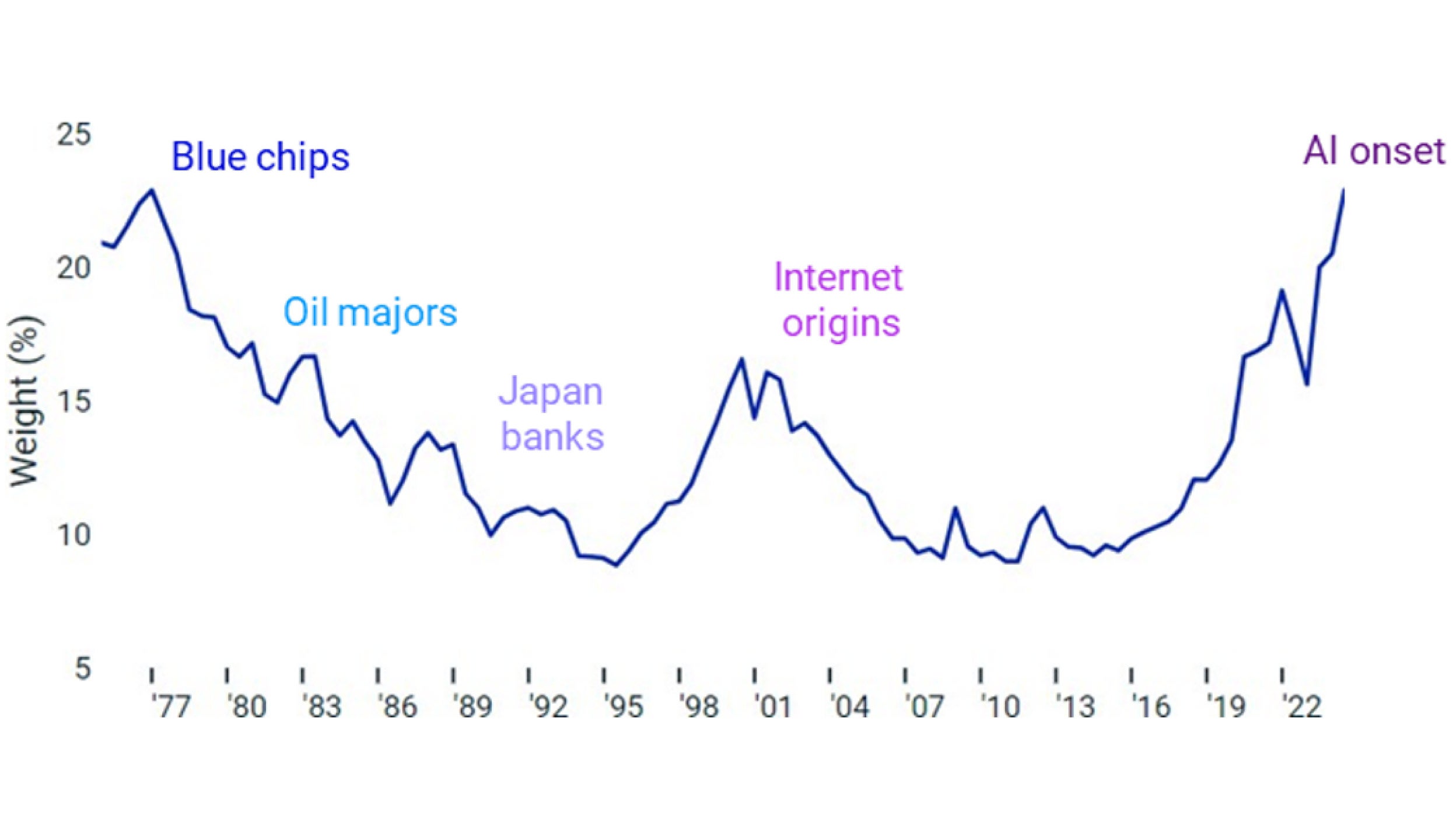

The largest 10 stocks combined currently account for 25% of the market-capitalisation of the standard MSCI World index, the highest concentration in 40 years.

The MSCI World Equal Weight index provides an alternative solution for gaining exposure to developed markets without the concentration risk.

The Invesco MSCI World Equal Weight UCITS ETF is the first ETF in Europe to offer investors access to this index.

For complete information on risks, refer to the legal documents.

The value of investments, and any income from them, will fluctuate. This may partly be the result of changes in exchange rates. Investors may not get back the full amount invested.

The value of equities and equity-related securities can be affected by a number of factors including the activities and results of the issuer and general and regional economic and market conditions. This may result in fluctuations in the value of the Fund.

The use of a representative sampling approach will result in the Fund holding a smaller number of securities than are in the underlying index. As a result, an adverse development to an issuer of securities that the Fund holds could result in a greater decline in NAV than would be the case if the Fund held all of the securities in the underlying index.

The Fund may be exposed to the risk of the borrower defaulting on its obligation to return the securities at the end of the loan period and of being unable to sell the collateral provided to it if the borrower defaults.

The mini stock market correction in July may have been short-lived, but it served as a reminder of just how quickly sentiment and momentum can change. Although subsequent data alleviated some of the economic fears surrounding that event, many investors are still left wondering how to position their equity portfolios. An equal weight version of the MSCI World index may offer investors a compelling solution for broad-based global equity exposure that avoids the concentration risk associated with a standard market-cap-weighted approach.

A standard index weights the constituents by size, with the result being that the largest companies contribute more to the index performance than smaller companies. For example, the top 10 stocks in MSCI World make up less than 1% of the number of stocks in that index but currently comprise 25% of its market capitalisation1. That concentration can be an advantage in a highly momentum-driven market when the largest stocks are performing well, as has been the case over the past year, but can pose a significant risk as was highlighted in July this year.

Source: MSCI, Market capitalisation share of 10 largest stocks in MSCI World, from Dec 1975 to May 2024

The concentrated weight of the top 10 stocks in the MSCI World index is at the highest level for more than 40 years. The above chart also highlights that the types of stocks driving the market – and making up the top 10 – often changed during this time. Many investors will remember the dot.com era, both the hype in the late ‘90s to the bursting of that bubble in the early 2000s.

Combating this concentration risk is where an equal-weight approach can provide a simple solution. These indices will include the same stocks as their market-cap weighted equivalents, but, as you have probably guessed, will attribute the same weighting to each company regardless of their size. An equal weight index will be rebalanced on a regular schedule, e.g., quarterly for MSCI World. During this exercise, stocks that have outperformed the index are reduced and those that underperformed are increased, so that all stocks in the index again have the same weight.

The MSCI World Index includes more than 1,400 stocks across 23 developed markets. The largest single constituent accounts for 4.8% of the standard market-cap-weighted index versus 0.07% of the equal weight version (after each of the quarterly rebalances). Conversely, equal weight investors gain more exposure to smaller stocks, which often have different growth drivers than the mega-cap names at the top of the standard index. The smallest stock in MSCI World has only 0.003% weight but 0.07% of the equal weight version (the same as every other stock).

The difference in geographical exposures is also worth noting. While the US comprises over 70% of the standard index, it’s only around 40% of the equal-weight variant. Japan receives the largest uplift with an allocation of around 15% compared to 5.8% in the standard index. In fact, investors gain more exposure to all other markets through an equal weight approach.

Source: Invesco, Bloomberg, MSCI as at 31 Aug 2024

Our Invesco MSCI World Equal Weight UCITS ETF is the first ETF in Europe offering exposure to this alternatively weighted index, which is constructed from the parent MSCI World Index but equally weighting each company at each quarterly rebalance.

An investment in this fund is an acquisition of units in a passively managed, index-tracking fund rather than in the underlying assets owned by the fund.

ETFs replicate benchmark indices in different ways: physically, and synthetically – also known as a swap-based approach. Find out how a swap-based ETF works.

Gold declined 3.7% in November, as the market factored in the possible implications of Trump’s second term, with some commentators predicting US interest rates remaining higher for longer. The metal subsequently found support and recovered some of its losses in the latter part of the month. Discover insights into the key macro events and what we think you should be keeping your eyes on in the near term.

The most popular way most investors gain exposure to commodities is through exchange-traded products. You can gain exposure to a single commodity’s price via an exchange-traded commodity (ETC) or to a basket of commodities, such as those represented by the BCOM Index, via an ETF.

1 Source: MSCI, as of 9 July 2024, the most recent data available from the index provider.

For complete information on risks, refer to the legal documents.

The value of investments, and any income from them, will fluctuate. This may partly be the result of changes in exchange rates. Investors may not get back the full amount invested.

The value of equities and equity-related securities can be affected by a number of factors including the activities and results of the issuer and general and regional economic and market conditions. This may result in fluctuations in the value of the Fund.

The use of a representative sampling approach will result in the Fund holding a smaller number of securities than are in the underlying index. As a result, an adverse development to an issuer of securities that the Fund holds could result in a greater decline in NAV than would be the case if the Fund held all of the securities in the underlying index.

The Fund may be exposed to the risk of the borrower defaulting on its obligation to return the securities at the end of the loan period and of being unable to sell the collateral provided to it if the borrower defaults.

Data as at 2 September 2024 unless otherwise stated. By accepting this material, you consent to communicate with us in English, unless you inform us otherwise. This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Views and opinions are based on current market conditions and are subject to change. For information on our funds and the relevant risks, refer to the Key Information Documents/Key Investor Information Documents (local languages) and Prospectus (English, French, German), and the financial reports, available from www.invesco.eu. A summary of investor rights is available in English from www.invescomanagementcompany.ie. The management company may terminate marketing arrangements. UCITS ETF’s units / shares purchased on the secondary market cannot usually be sold directly back to UCITS ETF. Investors must buy and sell units / shares on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current net asset value when buying units / shares and may receive less than the current net asset value when selling them. For the full objectives and investment policy please consult the current prospectus.

The funds or securities referred to herein are not sponsored, endorsed, or promoted by MSCI Inc. ("MSCI"), and MSCI bears no liability with respect to any such funds or securities or any index on which such funds or securities are based. The prospectus contains a more detailed description of the limited relationship MSCI has with Invesco and any related funds.

No action has been taken or will be taken in Israel that would permit a public offering of the Fund or distribution of this document to the public. This Fund has not been approved by the Israel Securities Authority (the ISA). The Fund shall only be sold in Israel to an investor of the type listed in the First Schedule to the Israeli Securities Law, 1968, who in each case have provided written confirmation that they qualify as Sophisticated Investors, and that they are aware of the consequences of such designation and agree thereto and further that the Fund is being purchased for its own account and not for the purpose of re-sale or distribution other than, in the case of an offeree which is a Sophisticated Investor, where such offeree is purchasing product for another party which is a Sophisticated Investor. This document may not be reproduced or used for any other purpose, nor be furnished to any other person other than those to whom copies have been sent. Nothing in this document should be considered investment advice or investment marketing as defined in the Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 1995, (“the Investment Advice Law”). Neither Invesco Ltd. nor its subsidiaries are licensed under the Investment Advice Law, nor does it carry the insurance as required of a licensee thereunder. This document does not constitute an offer to sell or solicitation of an offer to buy any securities or fund units other than the fund offered hereby, nor does it constitute an offer to sell to or solicitation to an offer to buy from any person in any state or other jurisdiction in which such offer or solicitation would be unlawful, or in which the person making such offer or solicitation is not qualified to do so, or to a person to whom it is unlawful to make such offer or solicitation.