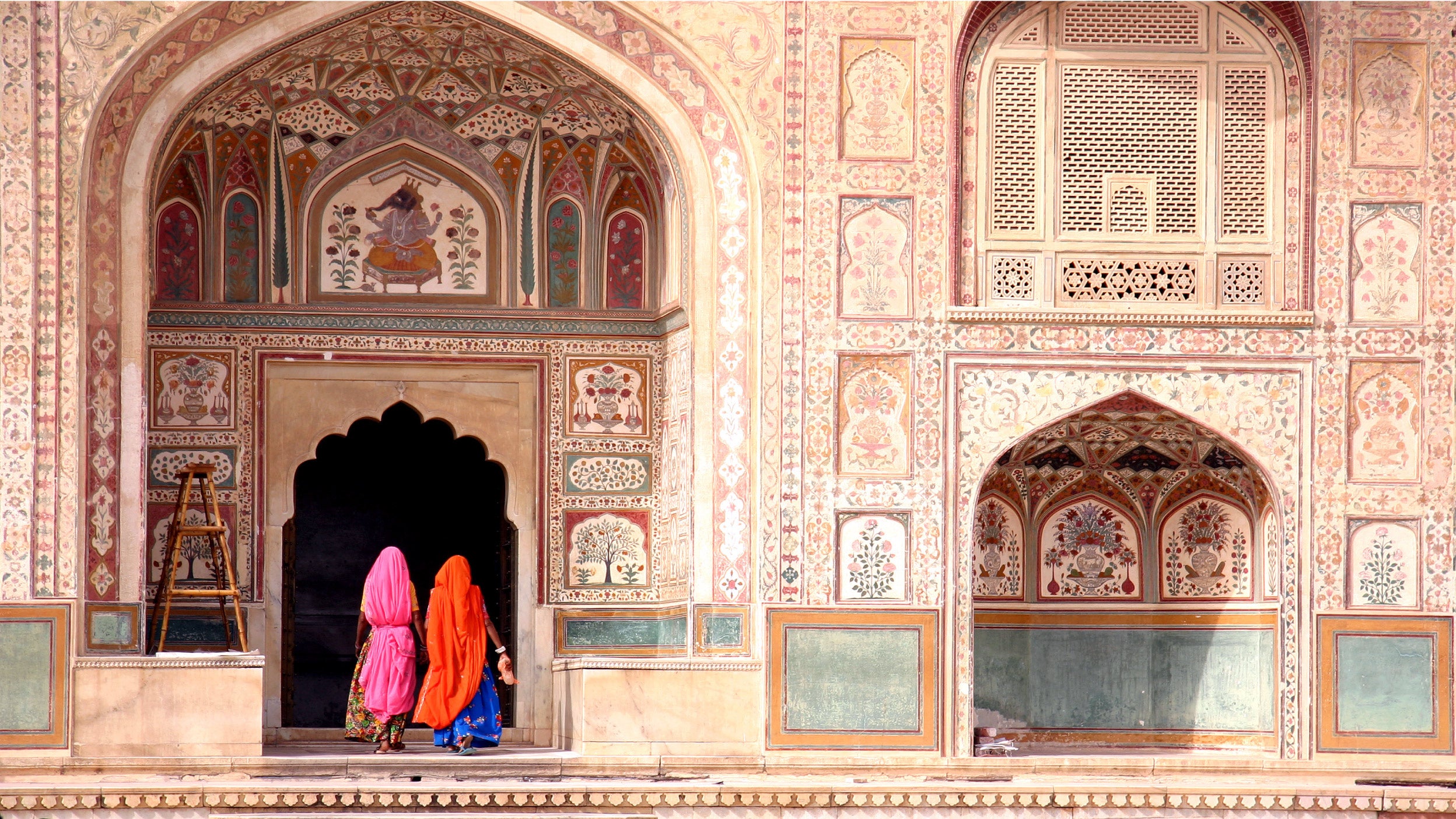

Emerging markets equity India’s economic growth: Standing out globally

India is one of the strongest growing economies in Asia, driven by digital transformation, robust consumption and expanding exports. Find out more.

Our global investment teams outline their views across the asset class spectrum.

India is one of the strongest growing economies in Asia, driven by digital transformation, robust consumption and expanding exports. Find out more.

The 2025 equities outlook is improving. Balance sheets look healthy, and many stocks are attractively valued, though geopolitical risks remain. Find out more.

The Indian equity market is poised for significant growth, and we believe performance will be supported by strong corporate earnings and GDP figures. Find out more.

We believe the case for investing in bonds is the strongest it has been since the GFC. Invesco’s experts from across Fixed Income teams and asset classes share their views on the outlook and opportunities.

After having to endure many years of meagre yields in fixed income, and one of the worst total return performances in 2022, we believe 2023 presents us with as generous an outlook as we have seen in ten years.

We share our scenario analysis to help clients navigate an uncertain landscape. Our base case is that inflation has peaked – in which case we favour high yield credit and emerging market assets. Should inflation prove more persistent, with a deeper recession on the cards, then cash and government bonds are the order of the day. Read on for details – and for why we favour investment grade credit in both scenarios.

Invesco Real Estate’s value-add team discusses its approach in a challenging market highlighting a disciplined, local team-based execution programme and strategic investments in sectors like logistics and living.

Significant focus on the uncertainty of the US macroeconomic backdrop and its potential headwinds on the market remain top of mind for investment opportunities globally. Against this cautious outlook, we asked the experts from Invesco’s bank loan, direct lending and distressed credit teams to share their views as the first quarter of 2025 begins.

How Collateralised Loan Obligations (CLOs) offer portfolio diversification and an attractive potential return profile in today’s evolving financial landscape.

Sign up to receive the latest insights from Invesco’s global team of experts and details about on demand and upcoming online events.