Tokenisation: extending beyond cryptocurrencies

Tokenisation is a process for representing a real-world asset, like a building, into a set of tokens. Each represents ownership of a fraction of the asset.

A token can also be the asset itself, e.g. a bond might exist solely as a token on a blockchain, with all its characteristics captured in the token. Or the token can be a digital twin of a bond that exists in the real world outside of the blockchain.

Tokenisation promises to greatly increase the efficiency of trading and settlement. It has the ability to simultaneously settle trades immediately after execution (i.e. atomic settlement through Delivery versus Payment (DvP) with tokenised cash), removing counterparty and settlement risk as a result.

The Metaverse: from virtual assets to virtual worlds

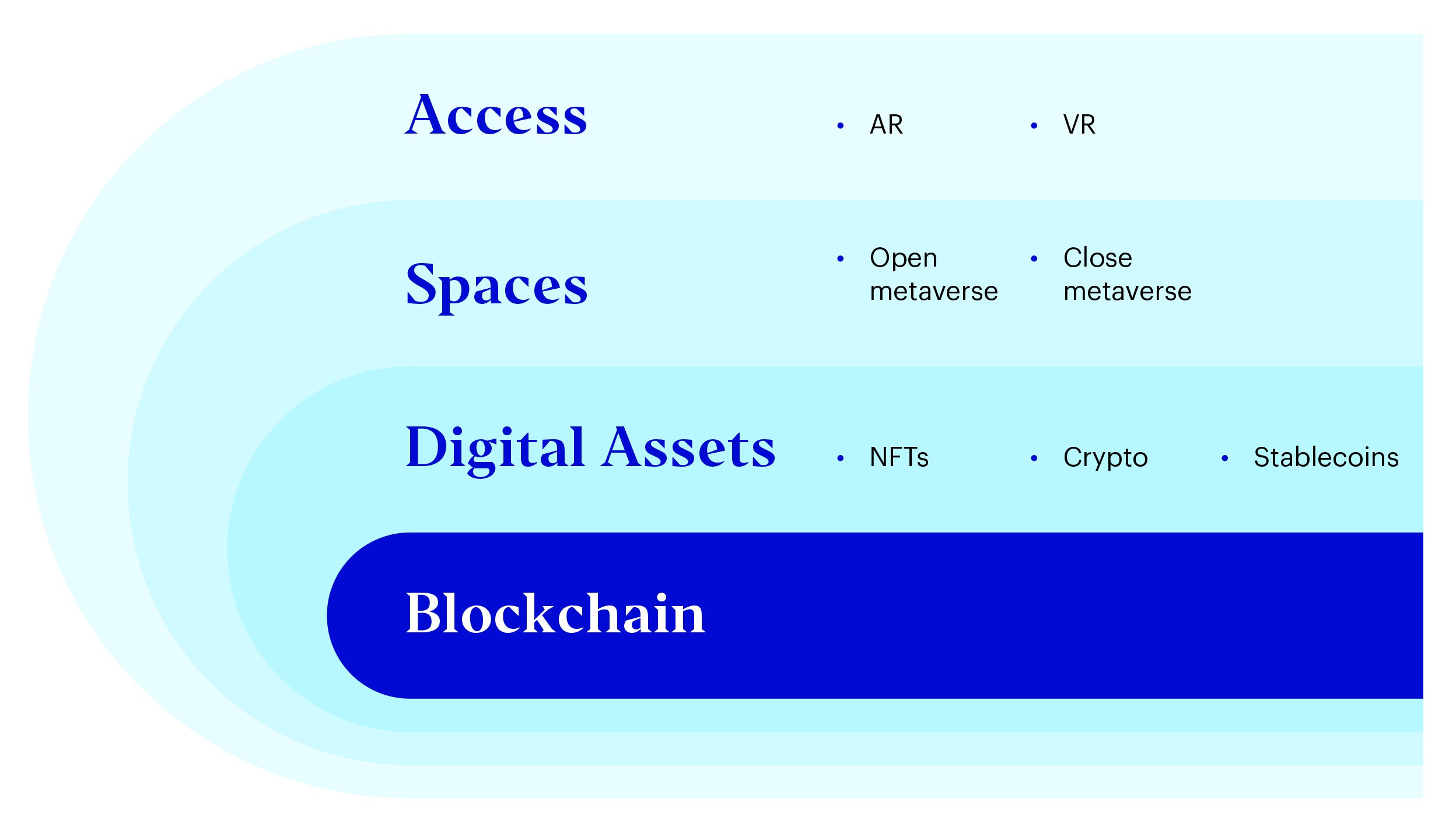

Massive virtual worlds combined with new immersive access via augmented reality (AR), virtual reality (VR) and digital assets gives us the metaverse, or metaverses to be specific.

The metaverse economy’s potential size raises questions about what kind of monetary system will sustain it. Potential solutions may include cryptoassets, stablecoins, traditional fiat or potentially Central Bank Digital Currency (CBDC).

While the use of CBDC in virtual worlds may seem fanciful, the Bank of England commented in a blog: “The importance of cryptoassets in the open-metaverse means that if an open and decentralised metaverse grows, existing risks from cryptoassets may scale to have systemic financial stability consequences.” Of course, one solution to mitigate the risk are CBDCs.