How is technology helping investors rethink asset allocation processes?

In recent years, market volatility and shifting asset correlations have highlighted the importance of effective asset allocation. Technology has significantly impacted how we form asset views by improving our ability to analyze and predict asset class returns. As part of Invesco’s China Investment Forum, Chris Hamilton, Head of Client Solutions, Asia Pacific, shared his thoughts on how technology is helping investors rethink asset allocation processes. Below are some excerpts from this insightful session.

Q: How does technology aid in the construction of portfolios from expected asset class returns?

A: Technology plays a pivotal role in constructing balanced portfolios by optimizing the mix of assets to achieve desired risk-return profiles. Portfolio optimization tools and platforms, like Invesco's Vision platform1, enable efficient portfolio construction across numerous asset classes. These tools integrate various data points, including public and private assets, and utilize sophisticated algorithms to balance risk and return effectively.

Q: Can you provide specific examples of how Invesco’s Vision platform has been used to improve strategic and tactical asset allocation?

A: At Invesco Solutions, within the broader Invesco Multi-Asset Strategies platform, we are focused on constructing customized outcome-oriented investment strategies that leverage multiple investment building blocks within equity, fixed income, and alternatives, deploying both strategic and tactical asset allocation.

For strategic asset allocation, platforms like Vision analyze long-term return drivers across hundreds of asset classes and currencies, enabling the creation of customized portfolios. Vision also calculates risk at various levels—portfolio, asset class, and security—through a factor framework. This allows asset managers like us to analyze exposures through a common lens.

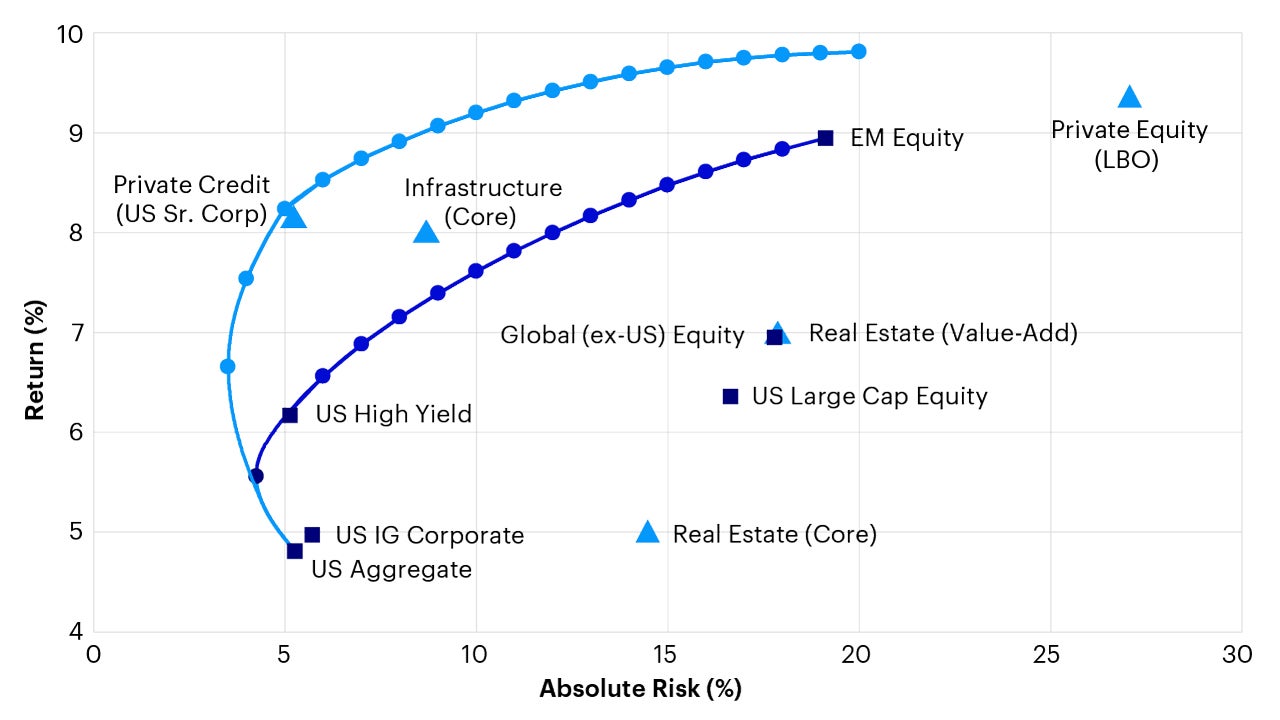

Leveraging our broader research capabilities, we have constructed long-term capital market assumptions (LTCMAs) underpinned by academically accepted return drivers across equities, bonds, and alternatives to identify opportunities across the business cycle. We cover roughly 175 asset classes across our CMA research library in 15 currencies. These assumptions are embedded into Vision, adding a unique “forward-looking” return component to complement the risk-modeling functionality within the platform, and therefore creating an intuitive mechanism to efficiently analyze return and risk trade-offs of asset allocation decisions.

We have also developed a short-to-intermediate term tactical asset allocation framework which involves dynamic portfolio tilts based on proprietary macroeconomic indicators to add alpha within a business cycle. Technology is essential to appropriately scale these capabilities. Tools leveraging machine learning and natural language processing can further enhance security selection and portfolio management by analyzing vast amounts of data efficiently.

Q: How can portfolio management tools aid in constructing an efficient portfolio, and what advancements have been made?

A: Constructing an efficient portfolio involves optimization processes that balance risk and return across multiple assets. Portfolio management tools have advanced from basic spreadsheet models to sophisticated platforms capable of handling extensive data and complex calculations. For example, our Vision platform allows for the optimization of portfolios involving up to 40 asset classes and integrates various factors, including public and private assets, to generate robust efficient frontiers quickly. This has reduced the time required for optimization from hours to minutes.

Source: Invesco Vision. Note: Strategies/indices/proxies indicated here may not be directly investable. For illustrative purposes only. An investment cannot be made in an index. Performance, whether actual or simulated, does not guarantee future results. Expected return, Invesco Solutions Capital Market Assumptions (CMAs) as of Dec 31, 2023. CMAs are forward-looking, are not guarantees, and they involve risks, uncertainties and assumptions. Proxy information as follows: US Large Cap Equity - S&P 500, EM Equity - MSCI EM, Global (ex-US) Equity - MSCI World ex US, US Aggregate - Bloomberg US Aggregate, US IG Corporate - Bloomberg US Investment Grade, US High Yield - Bloomberg US High Yield, Private Credit (US Sr. Corp) - Burgiss Senior Debt, Private Equity (LBO) - Burgiss Buyout, Real Estate (Core), Preqin Real Estate, Real Estate (Value-Add) - Preqin Real Estate Value-Add, Infrastructure (Core) - Preqin Infrastructure.

It is becoming increasingly important for investors to consider both public and private assets in portfolio construction. Our platform can de-smooth the risk of private assets and treat them similarly to public assets, leading to a more unbiased view of the former. We believe this integrated approach is unique in the industry.

Vision can also tailor optimizations for specific client types, such as insurers, who are governed by risk-based capital (RBC) regimes. The platform incorporates major RBC regimes enabling us to create custom portfolios for insurers globally in an efficient and scalable manner.

Beyond portfolio construction, Vision stress tests portfolios under various hypothetical and historical scenarios, providing practical insights for decision-making. The platform also includes ESG scoring and climate analytics, which are valuable for addressing investor concerns beyond risk and return.

Q: How can Invesco’s Vision platform benefit Asian investors in particular?

A: Vision’s ability to customize portfolios across geographies has proven especially beneficial among Asian investors. It supports a “global + local” approach to portfolio construction, allowing for the integration of local securities (both equities and bonds) with global assets, both public and private. This functionality helps investors understand the trade-offs and benefits of these decisions in real time, catering to diverse regional needs.

Our platform is also equipped with multi-currency capabilities, allowing users to value global assets in various local currencies. This is crucial for investors that need to analyze portfolios in their home currencies or benchmark against different currencies. Additionally, the platform can analyze hedging costs and strategies, providing flexibility for clients with local currency return targets or hedging needs.

Q: What role does artificial intelligence (AI) play in asset allocation and how do you expect this to change as the technology develops?

A: AI has the potential to transform asset allocation by running complex simulations rapidly and analyzing large datasets. One challenge is that AI is still nascent, and while it is developing rapidly, there are impediments to effectively scaling the technology while ensuring highly consistent outcomes. However, we do leverage current AI applications such as natural language processing for sentiment analysis and machine learning for factor scoring, and there is significant potential for AI to enhance optimization processes and long-term return forecasts as the technology evolves.

With contributions from Monica Uttam, Thought Leadership and Insights, Asia Pacific

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Invesco Investment Solutions develops CMAs that provide long-term estimates for the behavior of major asset classes globally. The team is dedicated to designing outcome-oriented, multi-asset portfolios that meet the specific goals of investors. The assumptions, which are based on 5- and 10-year investment time horizons, are intended to guide these strategic asset class allocations. For each selected asset class, we develop assumptions for estimated return, estimated standard deviation of return (volatility), and estimated correlation with other asset classes. This information is not intended as a recommendation to invest in a specific asset class or strategy, or as a promise of future performance. Estimated returns are subject to uncertainty and error, and can be conditional on economic scenarios. In the event a particular scenario comes to pass, actual returns could be significantly higher or lower than these estimates.