Uncommon truths: Rotating markets and politics

Rotations are happening apace, in markets and politics. In fact, after a bout of volatility, we seem to be back to where we started. I doubt that will last, and expect changes in market leadership to prevail.

This has been a summer of rotations, both in markets and politics. No rotation was as brutal as the unwind of carry trades and the global stock market sell-off of late July/early August. But that was partially reversed within a matter of days. Subsequent further gains give the feeling that all is back to normal, though major indices are still short of mid-July peaks. For example, the Nikkei is 10% below that peak and the NASDAQ Composite is still down 5%, though the S&P 500 is within 2% of the 16 July high. Among currencies, USDJPY is 9% below its early-July peak.

Hence, it may feel as though markets have come full circle but that is not universally the case. The rebound has been partly in response to US economic data that was stronger than feared, after the scares of a few weeks ago. In particular, last week saw encouraging jobless claims data and a rebound in retail sales in July (along with CPI data that suggests to me that inflation will trend lower, based on the run rate in the last three months). Markets are now back to pricing a 25bp Fed rate cut in September (rather than 50bps) and bond yields have rebounded.

However, all is not rosy. Retail sales actually fell 0.2% from March to June (in nominal terms) and housing starts fell 7% in July, suggesting the two-year downtrend in the housing sector continues. I suspect there will be plenty more concerns about the state of the US economy before the year is out.

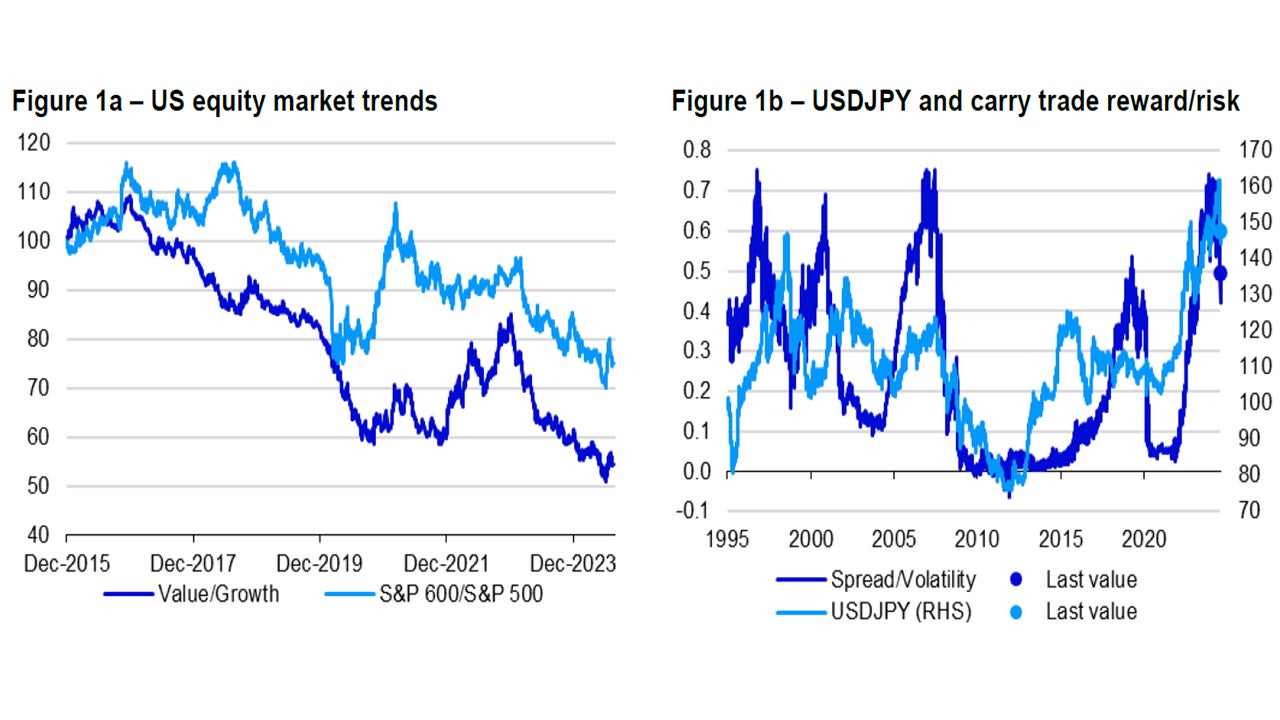

There was, however, much talk of other rotations before the volatility started: the great rotations from growth to value and from large/mega caps to small caps. Figure 1a shows that trend outperformance by growth and large caps had been a feature of recent years, and had many of us speculating about the timing of a reversal. It appeared as though such a rotation had started in the early part of July (in the US equity market), perhaps because it was felt that small caps and value stocks had more to gain from eventual Fed easing (and perhaps because some mega cap and growth stocks had reached challenging valuations).

Well, those nascent rotations ended abruptly. They didn’t survive the onset of market volatility and, more intriguingly, have not recommenced now that volatility has waned and markets have rebounded. Though value and size have not given up all of the relative gains of mid-to-late July, the patterns of the last week or so feel all too familiar (and ominous for those of us expecting a change in leadership). We still expect those changes in leadership to occur but admit that slow economic growth or recession in the US could prolong our suffering.

The other big reversal came in currency markets, with the Japanese yen rebounding from extreme lows (USDJPY peaked at 162 in early July). Figure 1b shows why: the reward-to-risk ratio on carry trades from JPY to USD fell sharply (from elevated levels), as the interest rate spread between the US and Japan started to fall, while the implied volatility on USDJPY options rose. The unwinding of those carry trades contributed to the yen rebound, from what we felt were unsustainably low valuations.

Notes: Past performance is no guarantee of future results. Figure 1a is based on daily data from 31 December 2015 to 16 August 2024. “Value/Growth” shows the Dow Jones US Value Index divided by the Dow Jones US Growth Index. All indices are price indices. The data series are rebased to 100 on 31 December 2015. Figure 1b is based on daily data from 1 January 1995 to 16 August 2024 “Spread” is US 3M deposit rates minus Japanese 3M deposit rates (in percent). “Volatility” is the implied volatility on 3m currency options between the US dollar and Japanese yen (in percent). Source: Dow Jones, Refinitiv, S&P, LSEG Datastream and Invesco Global Market Strategy Office

As with other assets, the panic of late-July/early-August faded rapidly and there has since been a relapse of the yen as the spread/volatility ratio on USDJPY rebounded. As with other assets, the recovery in the spread/volatility ratio and USDJPY has been partial but with the 3M interest rate spread remaining around 5.3%, carry traders may be tempted back (so long as implied volatility remains low).

This could depress the yen in the short term but we suspect that once the Fed eases and the BOJ tightens (thus narrowing the spread), the yen will sustainably appreciate from what we believe is still an excessively cheap level. At that point, we think Japanese stocks will underperform global indices (in local currency terms), as happened during the recent volatility.

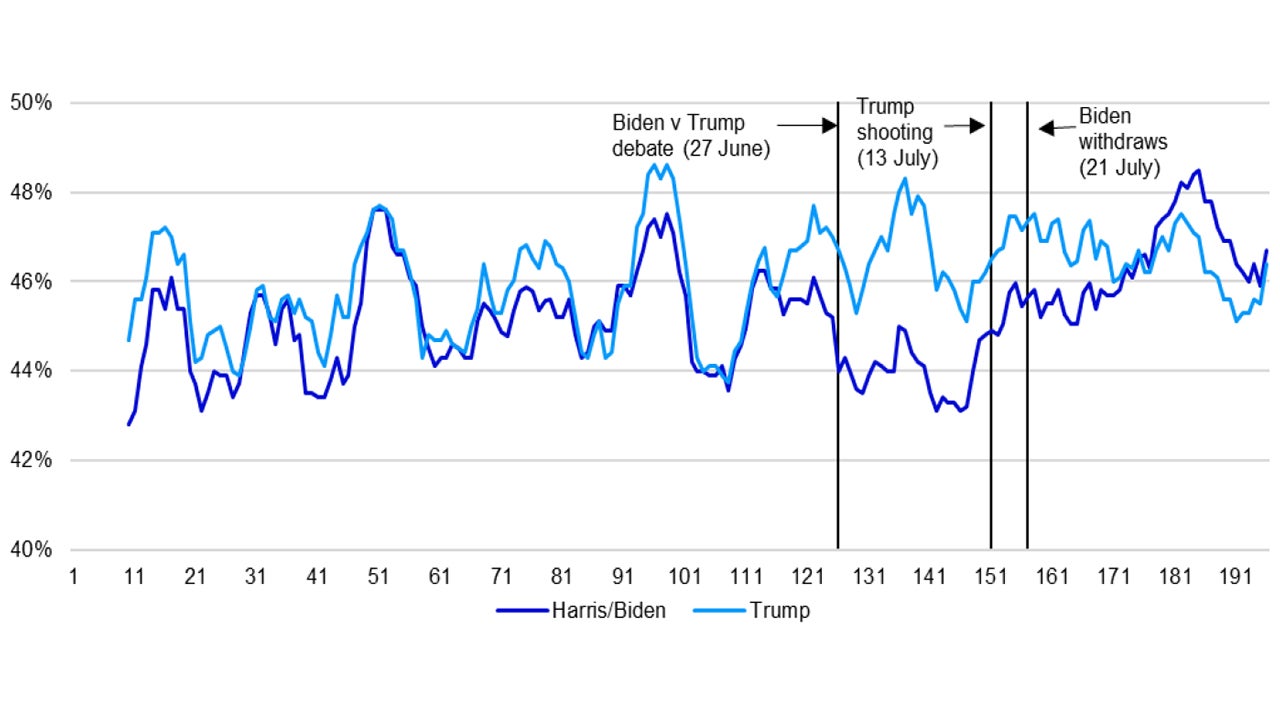

There has also been a big reversal in US politics. Again, this happened towards the end of July. Figure 2 shows that the opinion poll lead enjoyed by Donald Trump over President Biden widened after the 27 June debate. It seemed that the Republican candidate was in the ascendant, though the shooting of 13 July didn’t provide the expected boost.

What really changed matters was the withdrawal of Joe Biden from the race on 21 July and the subsequent installation of Vice President Harris as the Democratic Party candidate. The national opinion poll lead enjoyed by Donald Trump evaporated (his share of vote fell, while that of the opposition rose), and Kamala Harris moved into the lead. VP Harris also appears capable of winning some of the swing states.

All of a sudden, my January prediction that Democrats could win two of the three big election races (White House, Senate and House) felt more credible (see The Aristotle List). However, before getting too carried away, it is worth remembering that the opinion polls remain tight and that the margins are too narrow to draw firm conclusions. Further, there also appears to have been a more recent twist, with Donald Trump making something of a comeback, though the upcoming Democratic National Convention in Chicago could give Harris another bounce. It is all to play for.

Of course, at some stage, Kamala Harris had to get down to specifics (rather than just riding a wave of enthusiasm) and this brings risks (increasing the number of potential attack lines for her opponent). This process started on Friday with the release of her economic programme, though the effect will not yet have shown up in opinion polls.

The package aims to help low and middle income families by boosting child tax credits (and boosting credits for those without children); extending and deepening the ceiling on drug prices and annual drug outlays; cancelling medical debt for some; lowering housing costs (help with down payments and tax credits for purchasers and measures to control rents) and preventing price ”gouging” on essentials.

Of course, this comes at a price. The Committee for a Responsible Federal Budget (CRFB) estimates the plan would increase deficits by $1.7 trillion over 10 years (around 6% of 2023 GDP). This is similar to the CRFB estimate of the cost of Donald Trump’s proposed ending of the partial taxation of social security benefits (one part of his fiscal plan). There seems little desire (from either side) to address fiscal imbalances, which I fear may eventually hurt markets.

Unless stated otherwise, all data as of 16 August 2024.

Note: Based on opinion polls from 31 December 2023 to 15 August 2024. The horizontal axis shows the number of opinion polls, rather than dates (though it is in date order). Source: FiveThirtyEight, Wikipedia and Invesco Global Market Strategy Office.