Bank loans in the time of higher for longer

In Focus: Bank loans in the time of higher for longer

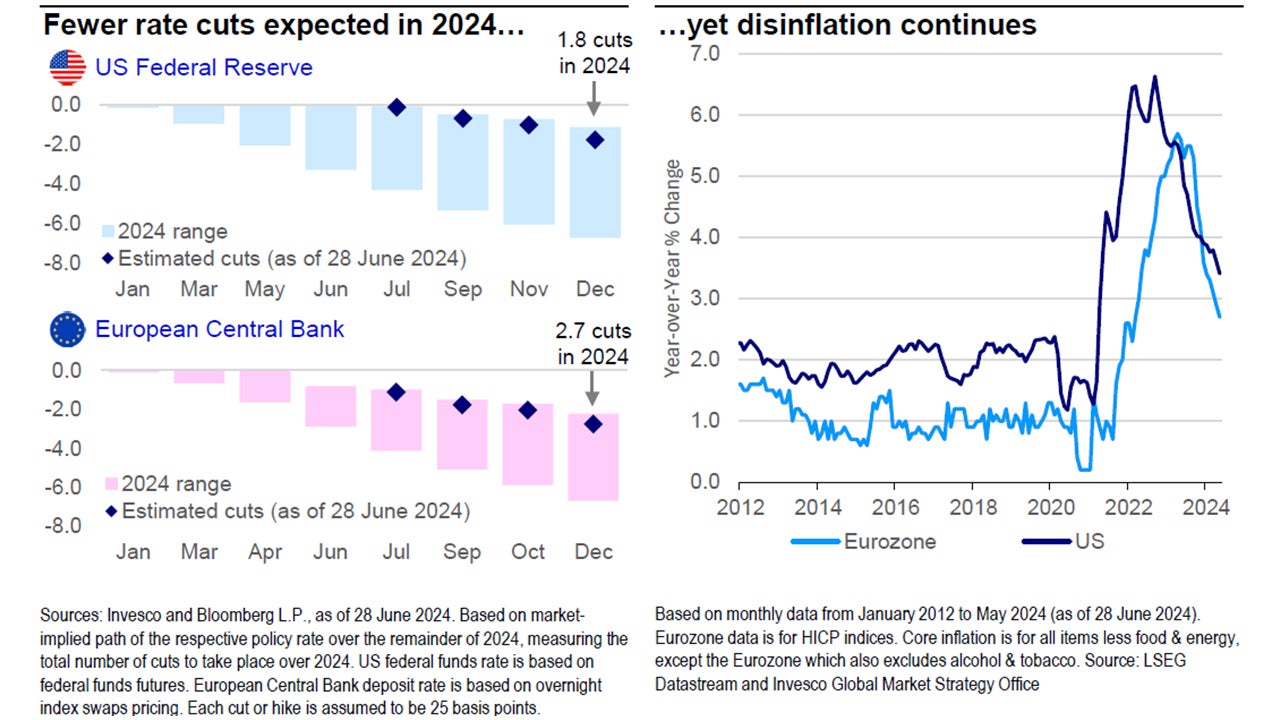

Markets welcomed 2024 with expectations of six rate cuts in 2024 from the US and eurozone, five cuts from the UK, and a belief that most major economies would see a period of slow growth. Now, markets are looking for just one or two cuts in the US, UK, and Eurozone, yet these economies appear to be undergoing a cyclical recovery. With prospects of a soft landing in sight, investors are assessing opportunities in risky assets in an environment of already-lofty valuations.

In fixed income, rates have taken a significant leg higher since their post-GFC days, the US yield curve has been inverted since mid-2022, and yet credit spreads on high yield bonds remain at their tightest levels in years. In this environment of elevated rates and tepid but resilient growth, we favor risk assets but with selective risk exposure. In particular, we see an attractive return profile in bank loans with zero duration risk, meaningful credit protections, and attractive valuations. Issuer fundamentals also remain solid (and have even improved in the latest Q1 2024 data), though some deterioration is likely as the lagged effects of restrictive monetary policy take hold.

Despite our view that disinflation should continue, we anticipate central banks are likely to keep rates “higher for longer”, well above recent history. The fundamental outlook calls for an extension of the current cycle, in our view, but credit spreads on most bonds are unlikely to rally further from here. We believe bank loans offer diversification and a bright spot for credit investors, as the floating rate nature of these assets adjusts according to market interest rate changes, offering protection from inflation and an attractive source of income. In this piece, we review bank loans in the time of higher for longer policy and interest rates.

1) Rates are expected to remain higher for longer

- Markets entered the year expecting a slew of rate cuts from major Western developed economy central banks. Today, market pricing indicates just a handful of cuts in 2024 following hotter-than-expected first-quarter inflation data.

- Disinflation appears to have slowed after a relatively rapid descent from 2022-23 highs, particularly in the US. Services inflation has especially remained well above targets. This has delayed market expectations for when central banks may begin to ease their hawkish policy stances.

- With yield curves still inverted, we expect that rates are likely to remain elevated for the foreseeable future, though central banks should begin to cut in the second half of 2024.

- Even marginally lower rates should be a boon for borrowers and may help stimulate demand for new issuances. We also anticipate lower rates to help improve debt serviceability, which can enhance credit performance.

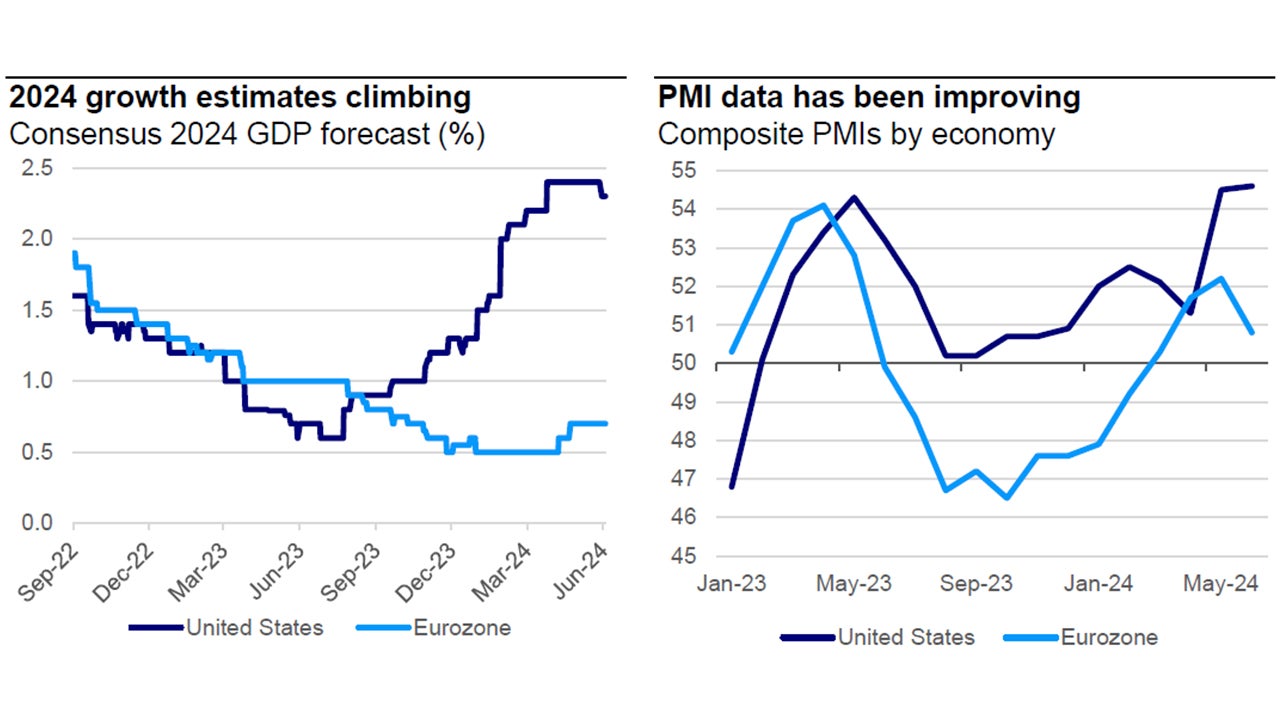

2) Despite elevated rates, US and European growth remain resilient

- In our view, the global economy remains in a soft patch, driven by a restrictive monetary policy backdrop that translates into below-trend but still resilient growth. US growth has softened from 2023’s pace, while European growth appears to be undergoing a cyclical rebound, albeit a bumpy one. Going forward, we anticipate growth in both the US and Eurozone to be further supported by rate cuts.

- US growth has been relatively more resilient despite elevated policy rates. Over the remainder of 2024 we expect growth to gravitate towards trend rates.

- In the eurozone, we anticipate relative softness in growth performance compared to the US, but at rates that are also picking up towards (low) potential growth rates.

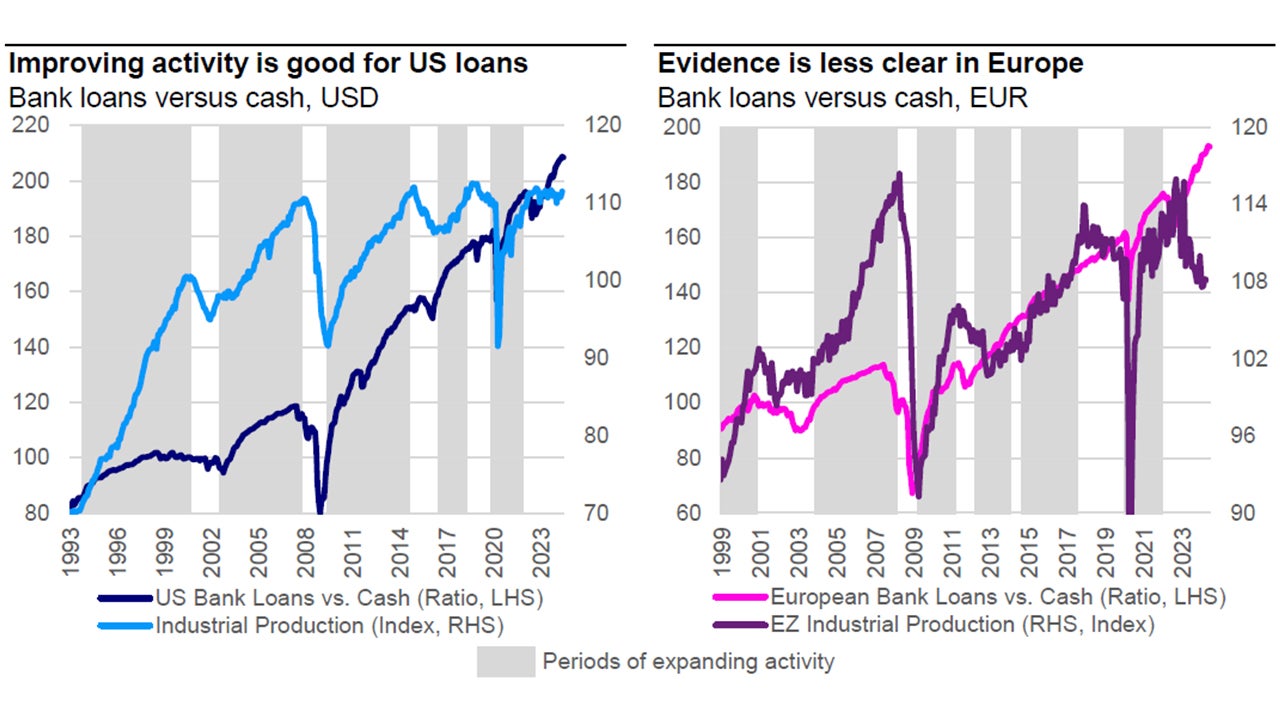

3) Solid or improving activity are good for bank loans

- Across credit assets, improving economic activity is typically good news, reducing default rates and improving debt serviceability as company fundamentals improve.

- We note that, within bank loans, US assets have historically tended to respond more to cyclical shifts in the economy, as documented in the left-side chart. In Europe, meanwhile, we find the relationship is less strong.

- Continued economic resilience in the US should help support credit risk, including bank loans performance.