2022 Investment Outlook – Asia Fixed Income: Volatility expected amid US rate hike predictions and rising commodity prices

Asia IG (By Chris Lau, Senior Portfolio Manager)

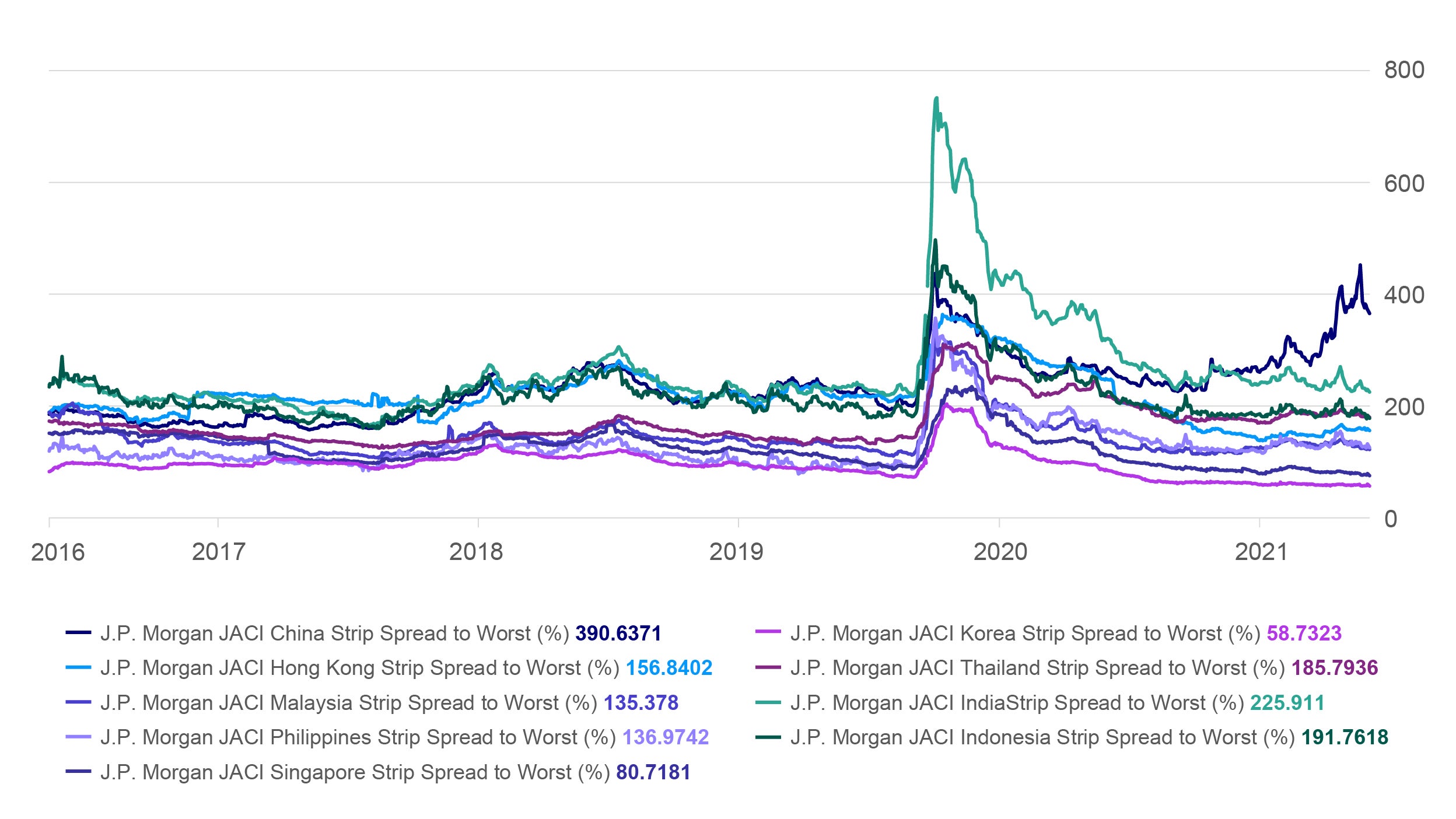

Asia investment grade (IG) is likely to remain challenging given elevated inflation/stagflation risks, a weakening macro backdrop and the brought forward rate hike expectations that are leading to higher US rates. JACI IG credit spreads are likely to remain range-bound amid higher US rates and we view Asia IG credit as largely a carry play in 2022. High energy/commodity prices and disruptions to supply chains could run for a few more months, which pose challenges to regional economies. In spite of weakening growth momentum in China, policy makers appear to be more tolerant of slower growth. Having said that, a RRR cut or targeted monetary easing still cannot be ruled out, which could potentially support the China credit market. Fund flows to Asian investment grade should remain constructive given the attractive valuation versus global investment grade. While we expect the new supply from Chinese issuers to shrink, non-China issuance should remain active in 2022 taking advantage to tap capital markets ahead of tapering. In term of country allocations, China stands out from a valuation perspective, followed by India IG, whereas Korea, Singapore and the Philippines are the most expensive and provide little buffer against potential higher US rates. Within the IG space, we prefer BBB credits and corporate perpetuals with a large coupon step-up.

Source: Bloomberg, October 2021.

Asia HY (By Gigi Guo, Credit Portfolio Manager)

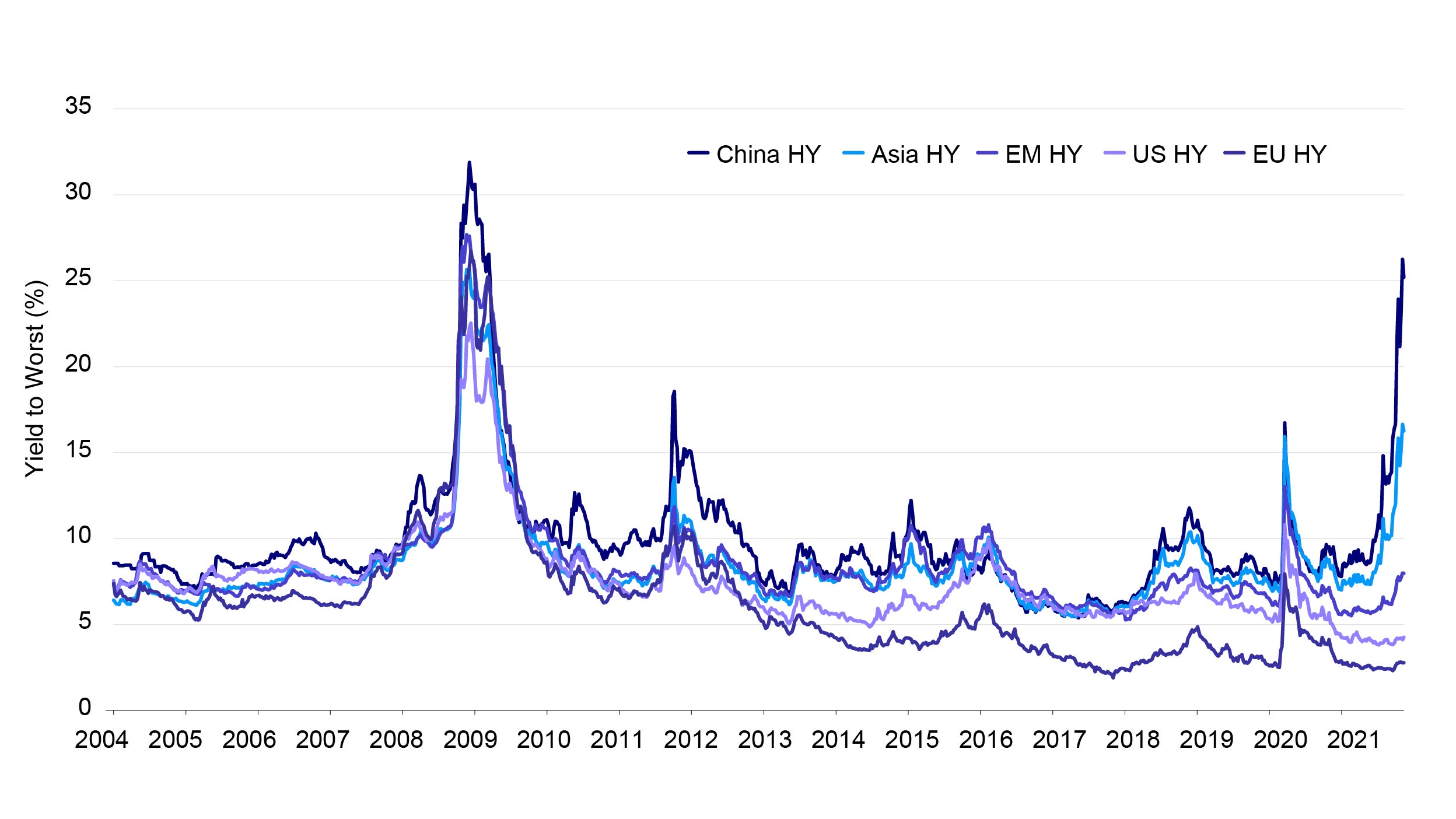

Asia high yield (HY) has delivered the worst performance YTD among all global fixed income sub asset classes. China HY, as the biggest performance contributor, had a negative return of -28.41% in the past 10 months and dragged the YTD performance of Asia HY to -16.81% for the first 10 months of 2021.1 Stricter regulation for corporates to deleverage and tighter credit conditions are the major reasons for credit deterioration and even defaults of China HY corporates, particularly China HY property developers. Coming into 2022, we expect Asia HY to stabilize with gradual valuation recovery. The fundamentals of China property developers should deteriorate further with decreasing sales and hampered housing prices and the deleveraging policy tone is unlikely to be loosened for China HY issuers, however we do expect that major China HY property developers will continue making efforts to muddle through the difficult period, adopting measures such as asset sales, equity raising, onshore debt issuance or seeking local government support. Current valuations may recover in 1H22 however we cannot rule out the probability of further defaults and volatility. The non-China HY space has benefited from the improving COVID situation, a favorable commodity cycle and friendly macro policies and hence has outperformed China HY. We expect the fundamentals of Asia ex China HY corporates to stay largely stable, however the space shows limited performance potential given the stretched valuation in many names.

Note: China HY: ICE BofA Asian Dollar High Yield Corporate China Issuer Index; Asia HY: ICE BofA Asian Dollar High Yield Corporate Index; EM HY: ICE BofA High Yield Emerging Markets Corporate Plus Index; US HY: ICE BofA US High Yield Index; EU HY: ICE BofA Euro High Yield Index. Data frequency: weekly.

Sources: Invesco, BAML, Bloomberg, as of 16 November 2021.

Asia EM (By Yifei Ding, Senior Portfolio Manager)

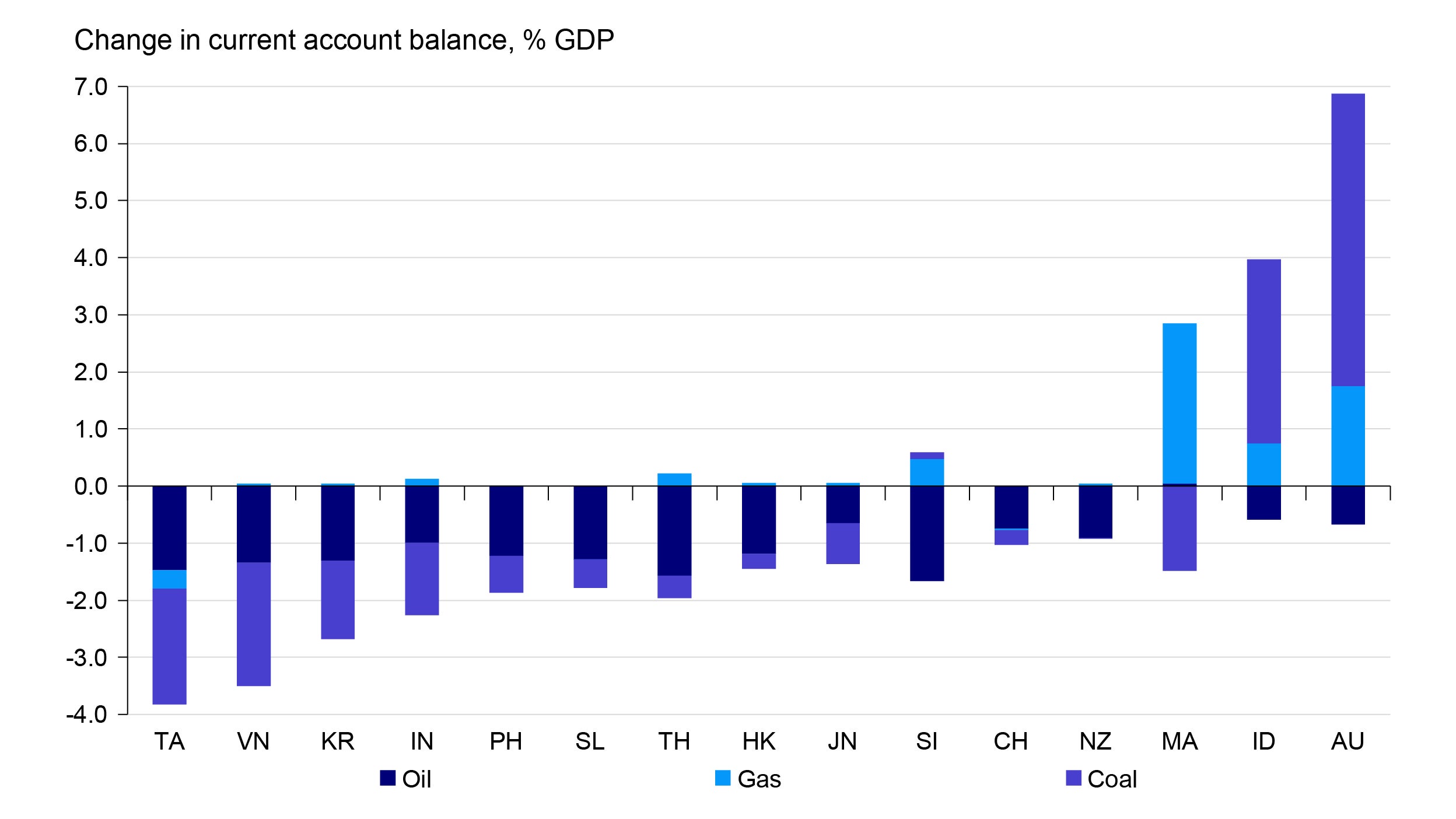

The macro-outlook for Asian emerging market countries is likely to be more challenging than current market expectations. This is mainly because international trade is not working in their favor. As commodity importers, most Asian countries are expected to suffer from high commodity prices and may see domestic inflation picking up in 2022. However, the disruption in supply chains is likely to hamper the growth in exports from the region. We expect that COVID will no longer have a significant impact on overall growth in many Asian countries as our base case. However, some economies with very low vaccination rates may still be vulnerable amid the pandemic. Among sovereign credits, India and Indonesia are in the higher beta investment grade space. We favor Indonesia over India given that the former has an overall neutral trade balance in commodity trades. Considering the more frontier countries such as Mongolia and Vietnam, we find their sovereign debts expensive in spread terms. Their rich valuations may be vulnerable to the potential rate hiking cycle in the US and major DM countries. Sovereign bonds issued by Sri Lanka are quite cheap however economic fundamentals in the country are stressed. We see much higher idiosyncratic risks in Sri Lankan sovereign bonds.

Sources: BP, Bloomberg, HSBC (NB: CH refers to mainland China). Data as at October 8, 2021.

1 Source: ICE BofA Asian Dollar High Yield Corporate China Issuer Index, ICE BofA Asian Dollar High Yield Corporate Index