Six reasons why EM local debt could now provide an attractive entry point

Overview

We highlight six conditions that we believe create an attractive entry point for EM local debt investments, and believe those conditions are intact.

Current high local interest rates, the prospect of a softer US dollar, and widespread falling inflation and monetary easing are among the factors that create an attractive backdrop for EM local debt, in our view.

Idiosyncratic differences in growth and macroeconomic performance should create a diverse and lucrative opportunity set for EM local debt in the second half of 2024.

Market pulse

Monetary easing around the world continues to boost prospects for emerging market (EM) local debt, in our view, as it unlocks idiosyncratic investment opportunities. With further monetary easing likely, we believe differences in growth and macroeconomic performance should create a diverse and lucrative opportunity set for EM local debt in the second half of 2024. We believe attractive income generation opportunities and stronger growth dynamics relative to developed markets should provide multiple tailwinds for the EM asset class.

As we approach the beginning of the US Federal Reserve (Fed) easing cycle, we believe EM central banks will be able to focus more on the domestic dynamics driving their monetary policies than the external shocks that occurred in the first half of the year. As we transition to this phase of the cycle, we expect interest rates to vary more due to domestic policies than foreign exchange rates, which will likely be more influenced by the performance of the US dollar.

Overall, we expect a favorable environment for EM local debt in the second half of 2024, as the Fed easing cycle begins and a soft landing takes hold in the US and globally. In this scenario, we would expect the US dollar to weaken as the Fed cuts rates, allowing EM currencies to offer an additional potential source of return.

Spotlight: Charting the case for EM local debt

Below, we highlight six market conditions that we believe create an attractive entry point for EM local debt investments. We believe these conditions currently hold and should lead to a positive backdrop for EM local debt in the coming months.

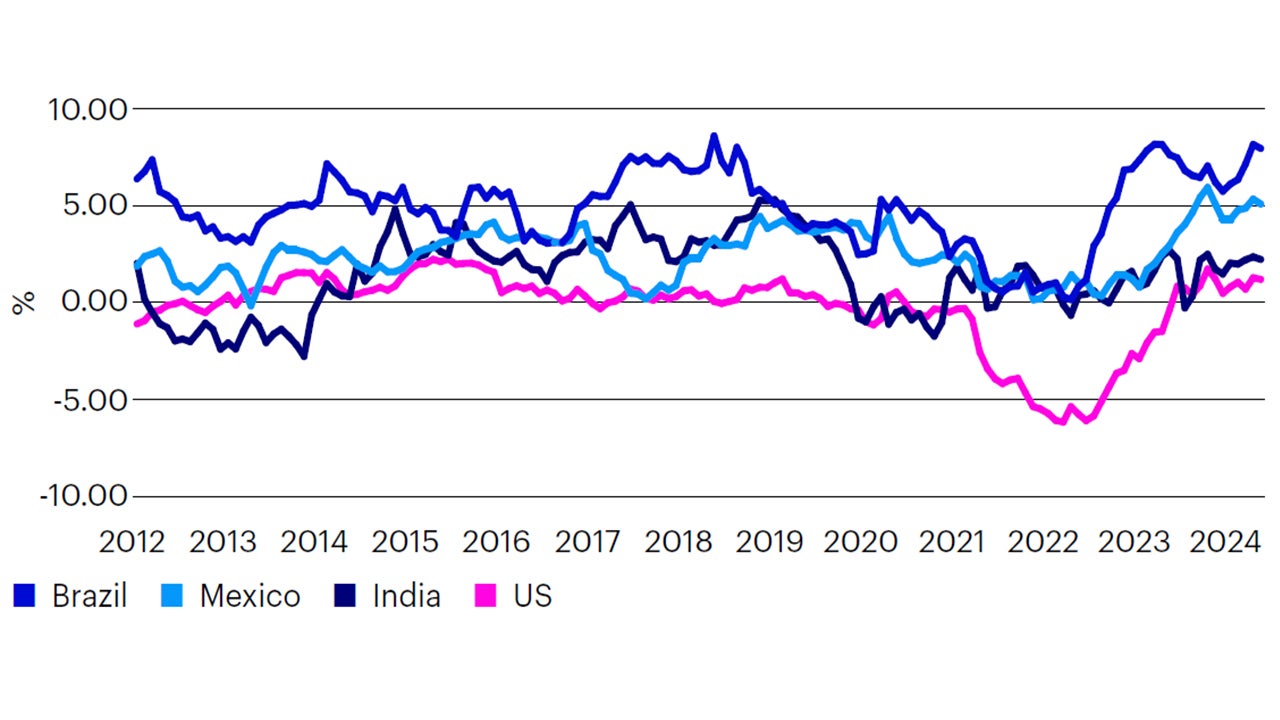

1. High EM rates and disinflation

Current or future high nominal EM interest rates, with potentially high real interest rates, present a unique opportunity for investors, in our view. High real yields can indicate a positive economic outlook and monetary tightening.

Source: Bloomberg L.P. Data from Jan. 31, 2012 to May 31, 2024.

EM central banks have followed orthodox policies by hiking rates early to control inflation. They have already started cutting rates and the European Central Bank cut rates for the first time in June.

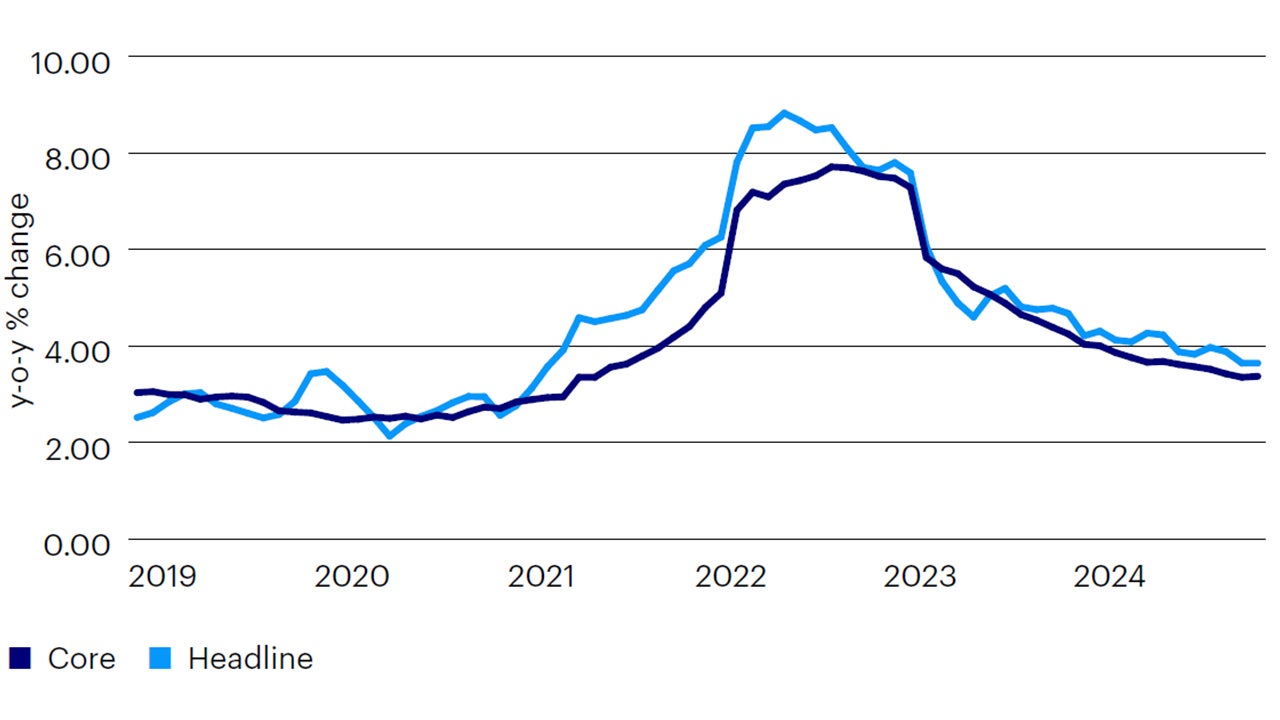

Source: National statistical agencies, J.P. Morgan. Excludes China and Turkey. Data from Dec. 31, 2019 to June 30, 2014. Forecasts thereafter.

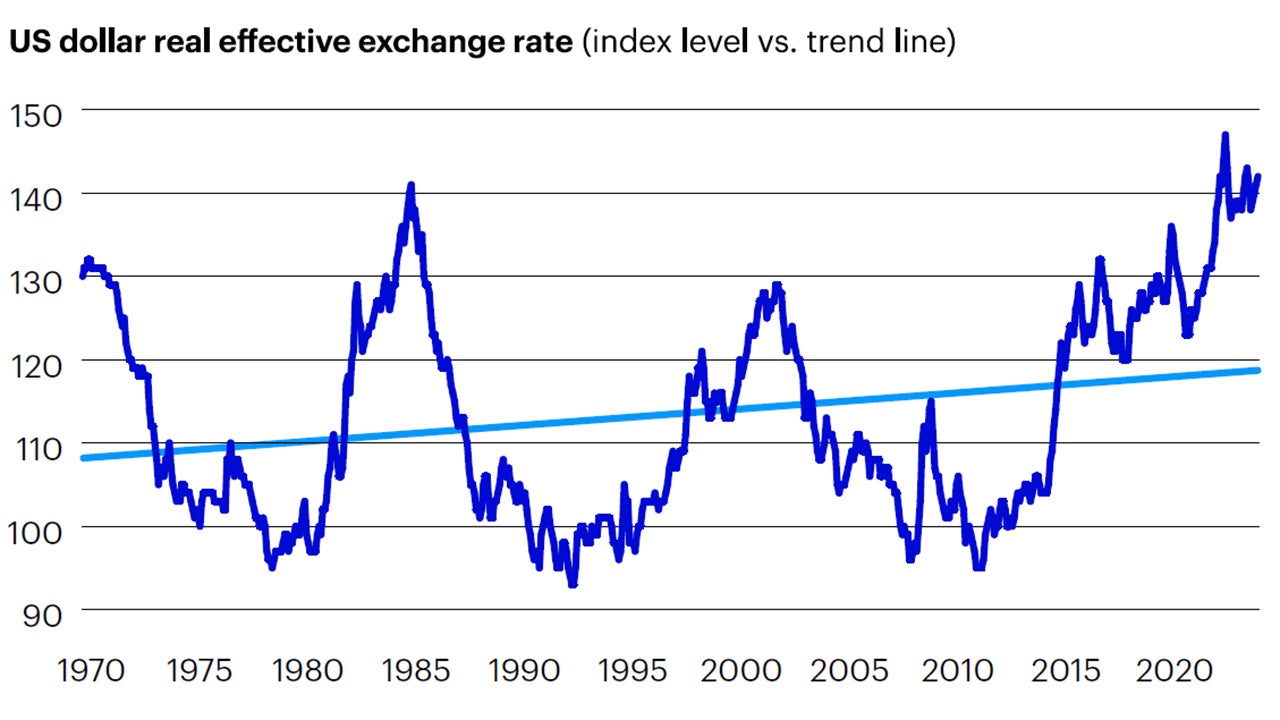

2. Weak US dollar

We expect the US dollar to begin to weaken this year as the Fed begins cutting interest rates. During periods of US dollar weakness, we expect EM currencies to outperform developed market currencies.

Source: Bank of America. Data from Jan. 31, 1970 to April 30, 2024.

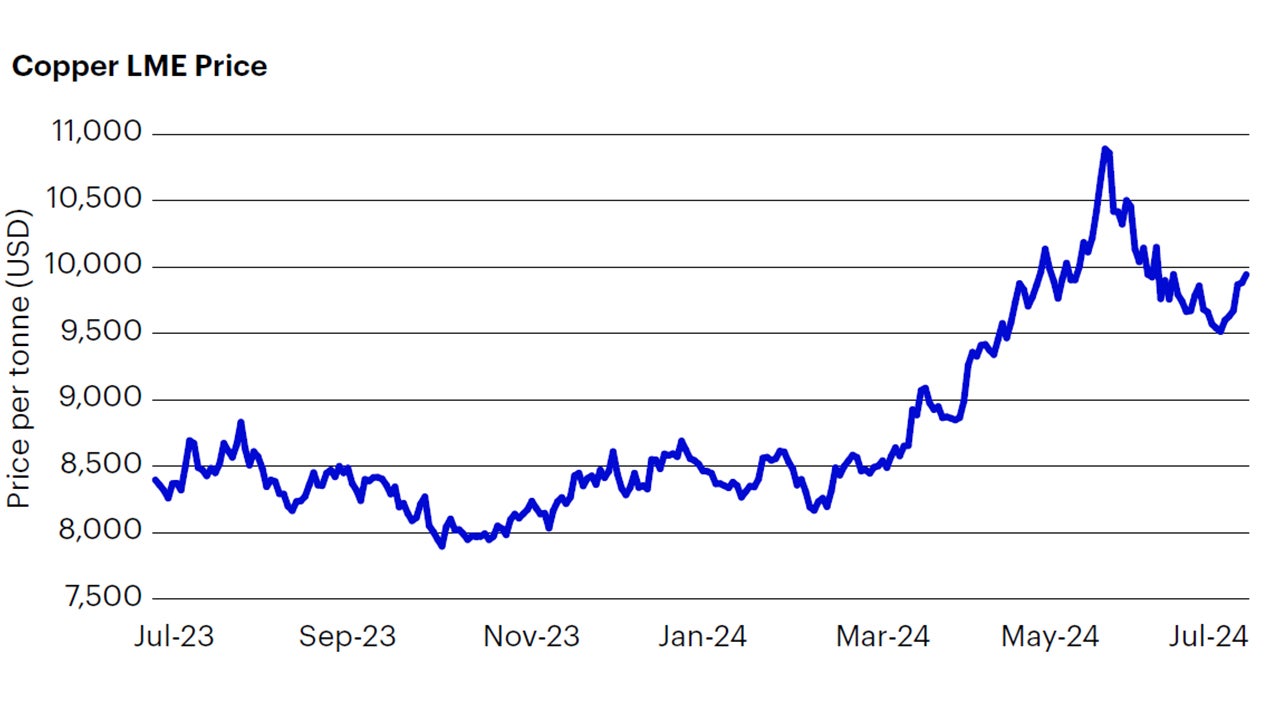

3. Stable to higher commodity prices

Commodities are essential to the economic growth of EM countries. Exporting commodities are a major source of income and have the potential to bring in substantial foreign investment. Commodity prices are still higher than pre-pandemic levels and seem to be stabilizing at elevated levels.

Source: Bloomberg L.P. Data from July 3, 2023 to July 5, 2024. LME is London Metal Exchange.

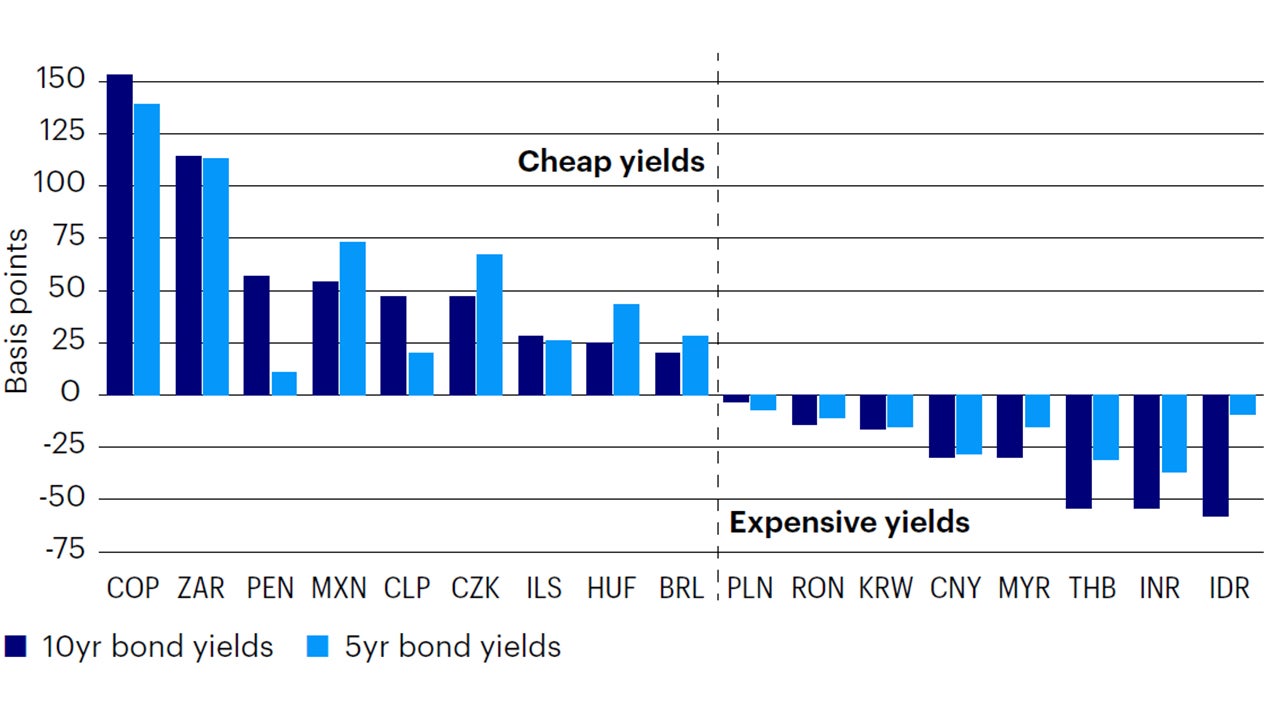

4. Attractive valuations

Increased EM yields have made EM duration more attractive, in our view, especially outside of Asia. Current differentials between developed and EM interest rates also present a potential opportunity for investors.

Source: JP Morgan, Bloomberg Finance L.P., Haver Analytics. Data as of April 6, 2024.

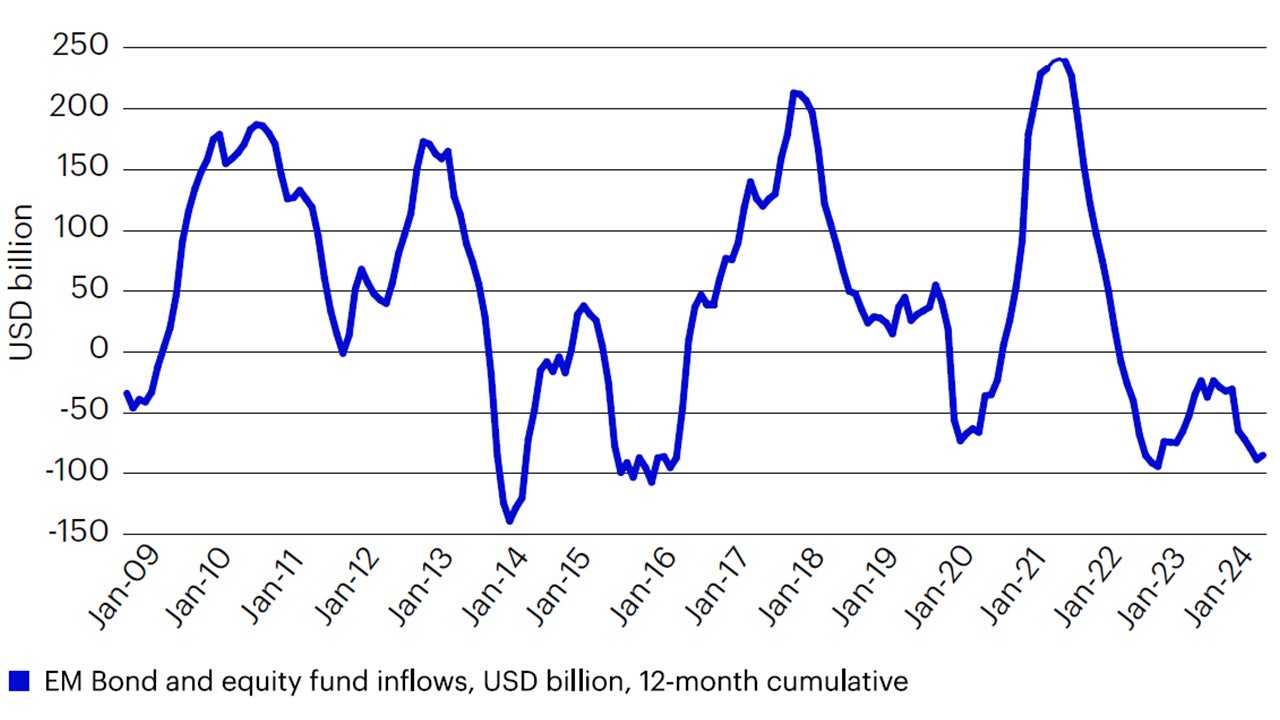

5. Extreme bearishness toward emerging market assets

We believe current bearish sentiment toward EM local bonds has created an attractive entry point for investors, in terms of valuation.

Source: J.P. Morgan, EPFR. Data from Jan. 31, 2009 to May 31, 2024.

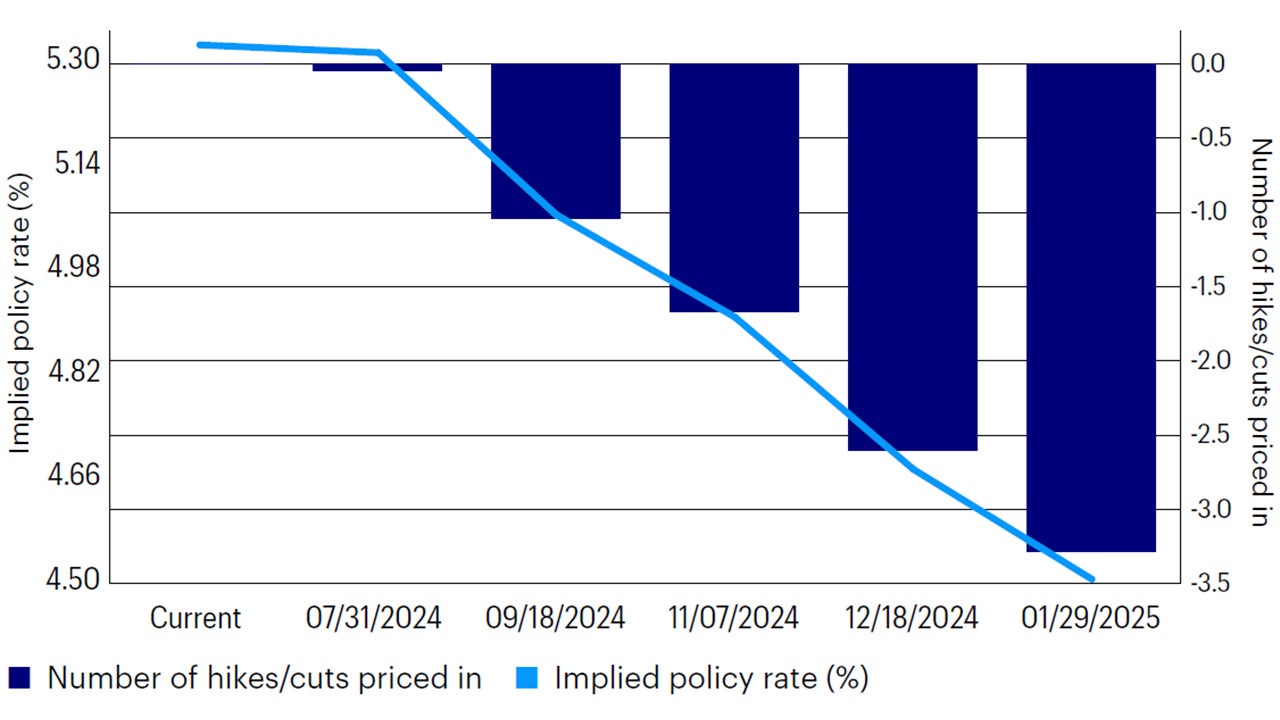

6. More predictable path for US financial conditions, especially interest rates

We believe the Fed will cut rates twice this year, which should provide room for EM central banks to cut, as most of their economies are experiencing robust growth and disinflation.

Source: Bloomberg L.P. Data as of July 24, 2024.

Conclusion

We expect EM local debt to enjoy a favorable environment in the second half of 2024. The strength and resilience of the US economy has kept many investors away from the EM asset class, resulting in outflows but leading to attractive valuations, in our view. With US inflation moderating and the labor market softening, market expectations are building that the Fed will begin cutting rates in September. We expect two Fed rate cuts this year, which should provide a tailwind for EM central banks whose economies are enjoying solid growth and falling inflation. In addition, we expect the US dollar to begin to weaken as the Fed begins reducing rates, which should benefit EM debt investors.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

Non-investment grade bonds, also called high yield bonds or junk bonds, pay higher yields but also carry more risk and a lower credit rating than an investment grade bond.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

The performance of an investment concentrated in issuers of a certain region or country is expected to be closely tied to conditions within that region and to be more volatile than more geographically diversified investments.