Debunking mean reversion of IQS factor strategies

Summary Points

- IQS factors have shown strong returns in the recent past and we find no evidence that these are expected to mean revert.

- Instead, our analysis indicates a degree of persistence, suggesting factor momentum or continued positive returns.

- While individual factors demonstrate persistence, a multi-factor approach, combining value, momentum, and quality shows strongest persistence, highlighting the benefits of diversification.

- Our findings are robust across different investment horizons, with stronger persistence over longer periods, reinforcing the strategic advantage of long-term factor investing.

After a prolonged period of weaker performance throughout much of the past decade, predominantly due to the exceptional value drawdown, factor strategies have finally been seeing better days. IQS strategies systematically harvesting value, momentum, and quality factors are no exception, having demonstrated strong returns in the recent past. However, these strong returns have raised concerns among some investors about the potential for negative subsequent factor returns - a sort of mean reversion where returns turn abnormally low (or even negative) after consecutive positive realizations, and vice versa. Using autoregressive models across various investment horizons, we assess the properties of our factor returns and compare these to those of the market, probably the most well-known factor. Our findings challenge the expectation of such mean reversion, providing robust evidence that IQS factor strategies strong returns will persist and especially so during longer investment horizons.

Factor performance in the long run

Factor premiums, supported by extensive academic and practitioner evidence, have consistently earned positive factor premiums. IQS factor strategies, focused on value, momentum, and quality factors, exemplify this through their strong and stable performance. As illustrated in Table 1, IQS long-short factor portfolios exhibit attractive risk-return profiles, with information ratios of 1 or above. Notably, the IQS Multi-Factor strategy, which combines value, momentum, and quality with equal risk weights, achieves an IR of 2, harvesting the benefits from factor diversification.

Table 1: Performance characteristics of IQS Long-Short Factors and the MSCI World Index

The figure shows annualized returns, annualized volatilities, and information ratios (IR) for IQS Value, Momentum, Quality factors, as well as their equal risk combination, IQS Multi-Factor. The universes comprise developed markets and returns are in USD gross of fees and dividends. The sample period runs from December 1996 to April 2024.

| Return (ann.) | Volatility (ann.) | IR | |

| IQS Value | 3.9% | 4.8% | 0.82 |

| IQS Momentum | 4.3% | 4.3% | 0.99 |

| IQS Quality | 3.0% | 2.3% | 1.28 |

| IQS Multi-Factor | 3.8% | 2.0% | 1.95 |

Source: IQS

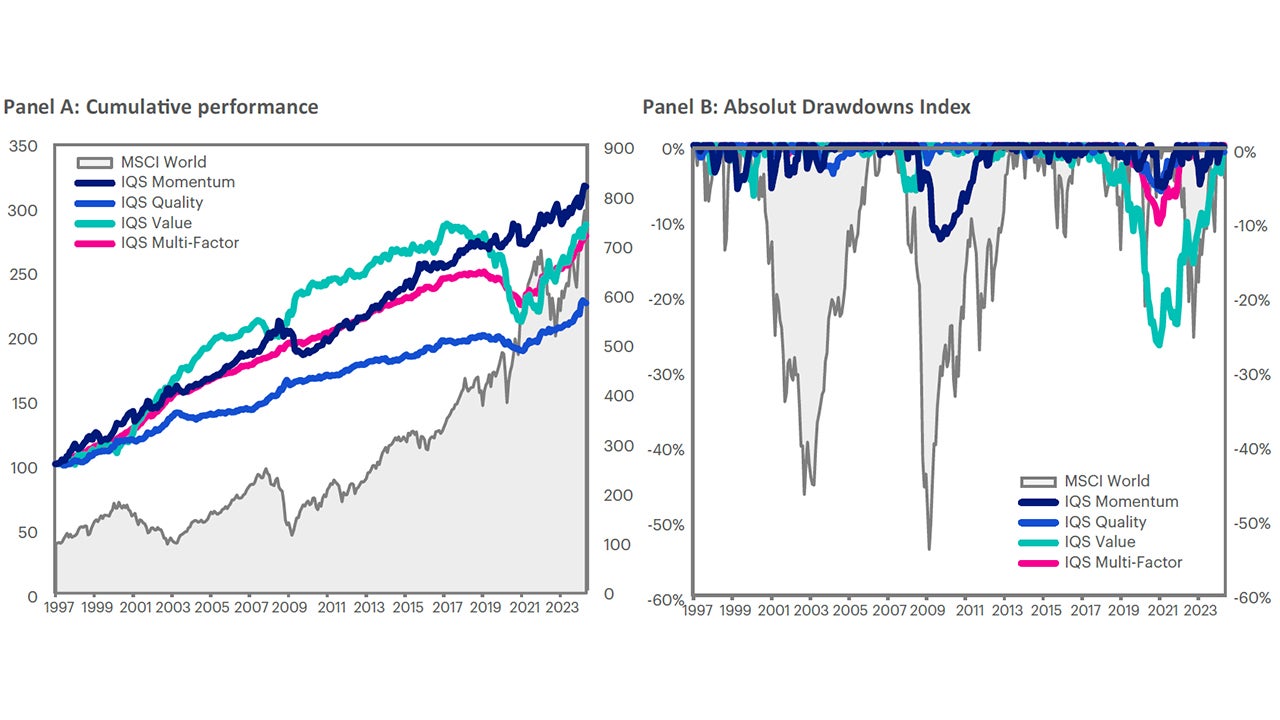

Taking a closer look at the cumulative returns for IQS factor strategies, depicted in Figure 1: Panel A, including value, momentum, and quality, we note a steady upward trajectory in cumulative returns for all factors, including their multi-factor combination. While long-short and long-only portfolios are not directly comparable, for visual comparison Figure 1: Panel A also plots the cumulative performance of the market factor, captured through the MSCI World Index. This visual comparison underscores the effectiveness of IQS factor strategies in delivering attractive risk-return profile for long-term investors.

Figure 1: Panel B below shows the drawdowns for the IQS factor strategies and the broader market with less pronounced drawdowns than the market. The multi-factor approach exhibits the smallest drawdown due to diversification benefits.

Figure 1: Cumulative performance (Panel A) and absolute drawdowns (Panel B) of IQS Long-Short Factors (left axis) and the MSCI World Index (right axis)

The figure shows cumulative performance (Panel A) and absolute drawdowns (Panel B) for IQS Value, Momentum, Quality factors, as well as, their equal risk combination (IQS Multi-Factor) and a broad market index, the MSCI World Index. The universes comprise developed markets and returns are in USD gross of fees and dividends. The sample period runs from December 1996 to April 2024.

Source: IQS, MSCI.

Performance persistence of IQS Factors

Given the recent strong recovery in factor strategies, investors are understandably questioning whether these factors are likely to mean revert. This concern arises from the well-documented phenomenon in financial markets where periods of extraordinary returns are often followed by subsequent lower or even negative returns. Such mean reversion has been observed in broader market indices, leading to speculation about whether similar patterns will occur with IQS factor strategies. To address these concerns, we employ a simple but effective approach to study return persistence using autoregressive models across various investment horizons, providing a rigorous examination of whether the recent strong performance of IQS strategies is likely to turn around or sustain their upward trajectory.

The AR(1) model regresses the annualized returns of a given period (t+1) on the returns of the previous period (t) across various horizons—monthly, quarterly, semi-annual, and annual. Specifically, we estimate the following AR(1) model using non-overlapping returns:

Rt+1 = ø X Rt + Є t

In this regression, ø indicates the degree of persistence in returns. A statistically and economically significant coefficient greater than 0 suggests momentum or a degree of persistence in returns. A negative coefficient implies mean reversion, where positive returns are followed by a period of negative returns and vice versa. Finally, if ø is zero past returns have no predictive power on future returns such as is the case for a random walk. By analyzing these coefficients across different horizons, we can assess whether the recent strong performance of IQS strategies is likely to persist over time or would subsequently mean revert. The coefficient estimates are presented in Figure 3 below.

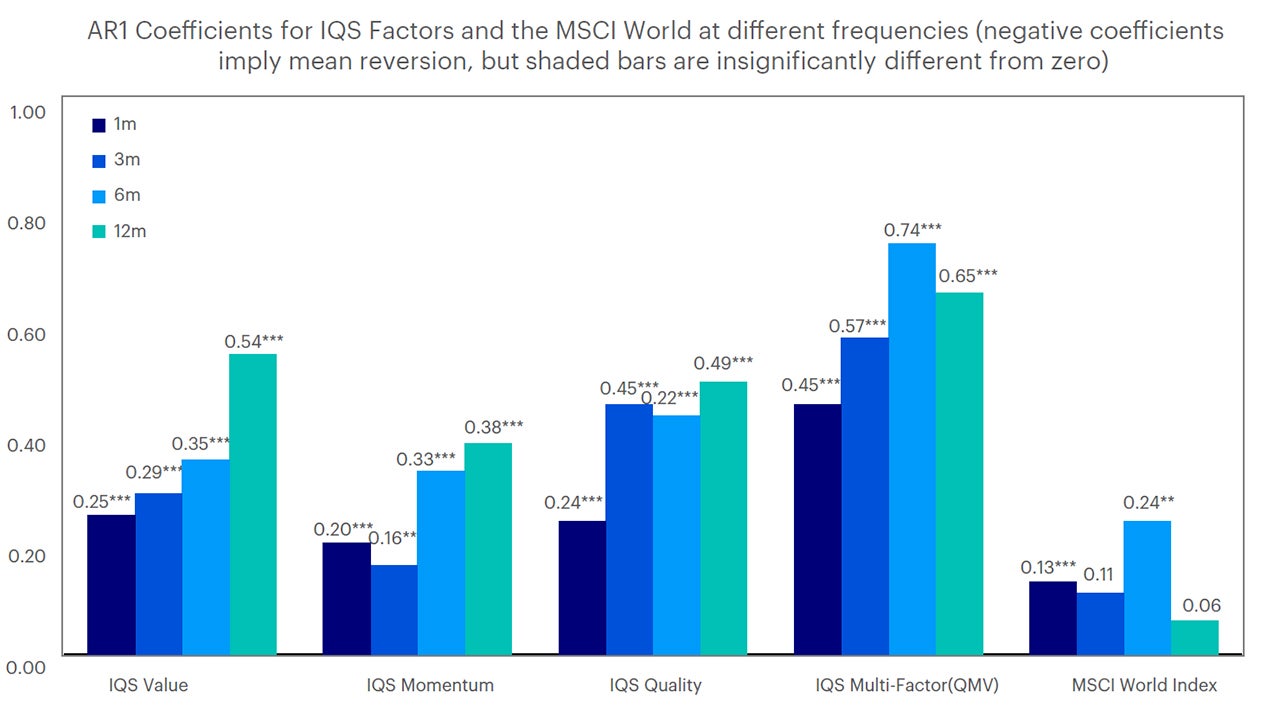

Figure 3: Performance persistence for IQS Factors and the MSCI World Index

The figure plots estimated coefficients, ø, from an AR(1) model of regressing future returns, Rt+1, on past returns, Rt, for various investment horizons of 1 month, 3 months, 6 months, and 12 months non-overlapping returns. The model is estimated for IQS Value, IQS Momentum, IQS Quality, IQS Multi-Factor, and MSCI World Index returns, respectively. The sample runs from December 1996 to April 2024 on the developed markets universe. Returns are annualized, in USD and are gross of fees and dividends. *** and ** denote statistical significance for the estimated coefficient, ø, at 1%, 5%, and 10% confidence levels, respectively.

Source: IQS, MSCI.

Our results show that the coefficients for IQS factors are all positive, indicating a degree of persistence in returns. These coefficients are statistically and economically significant for IQS factors but not as much for the market, where the coefficients for 3 months and 12 months models are insignificantly different from zero. Specifically, for IQS factors, the ø values range from 0.15 to 0.75 and is always significant, suggesting that a portion of return from one period tends to carry over to the next. For example, a ø value of 0.25 implies that 25% of the annualized return in the current period can be expected in the next period. For the market, the coefficient ranges from 0.1 to 0.25, but its statistical significance is not robust.

Based on our analysis summarized in Table 1, we don’t find evidence of mean reversion for IQS factor strategies. Instead, our evidence suggests the opposite to be true, i.e., IQS factors show a momentum pattern where strong performance persists in the future. This finding is robust across the individual factors and multi-factor combination, as well as, across different investment horizons. While there is some persistence for market returns, it is of lower magnitude and less robust across different investment horizons.

The stronger persistence observed in IQS factor strategies can be attributed to several key factors. The economic rationale behind factors such as value, momentum, and quality is well-established, providing a solid foundation for their persistent performance. Extensive academic research supports the effectiveness of these factors across different asset classes and regions, validating their robustness. Additionally, the rigorous and systematic approach at IQS to implement these strategies ensures consistency and reliability, enhancing the persistence of returns over time.

Concluding remarks

This note presents robust evidence that IQS factor strategies, driven by value, momentum, and quality factors, exhibit strong persistence in returns, challenging the expectation of mean reversion. The statistical properties of these returns, as evidenced by our AR(1) model, indicate that past performance of IQS factors significantly predicts future returns, particularly over longer investment horizons. This persistence is underpinned by a strong economic foundation and a rigorous systematic approach to harvesting persistent return drivers. Therefore, despite recent strong performance, IQS factor strategies are well-positioned to sustain their performance, offering long-term investors attractive risk-adjusted returns.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.