2022 Investment Outlook – China Equities: Riding China’s common prosperity wave over 2022

Key takeaways

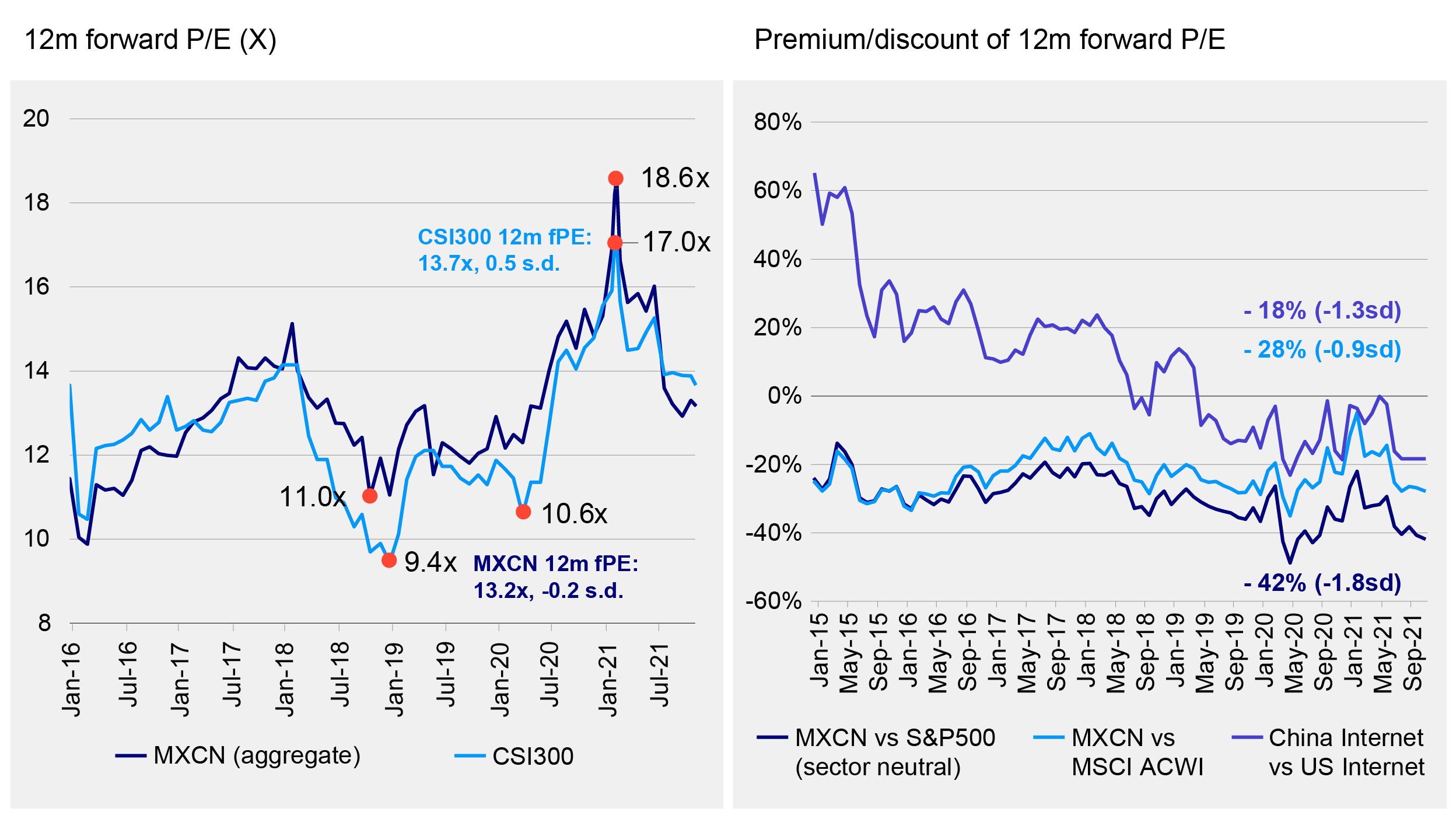

Source: MSCI, FactSet, Goldman Sachs Global Investment Research. November 2021.

Contrary to enjoying a smooth ride in 2020, the Chinese equity market experienced much more volatility in 2021.

Economic growth and corporate earnings continued to be on a solid footing, but policies initiatives, towards sectors ranging from technology to real estate and energy, sparked concerns among global investors.

We understand where these concerns are coming from. Changes are removing the comfort of certainties and leading to uncharted waters that stir up fears. As an on-the-ground long-term investor, we believe China has entered a new development era.

Policies we are seeing now are constructed to shift the economy from a growth driven one to a quality focused one that aims to promote a sustainable future. In this outlook piece, we will discuss our latest thoughts on these policies and how they will shape our investment views in 2022.

The overarching objective to achieve common prosperity

The idea of common prosperity is not entirely new and shared by many leaders preceding Xi Jinping. It is a fundamental goal of the government to provide a better life to the people.

China has achieved phenomenal growth, but it comes with consequences. Growth is imbalanced across regions, industries, and households; and people are complaining about worsening environment and burdens within housing, education, and healthcare.

Common prosperity is raised to address these issues. It is a comprehensive development concept aimed at promoting quality growth, social wellbeing, and environmental sustainability.

We believe common prosperity is the overarching objective in the country that has been guiding policy actions towards internet regulations, the property sector and China’s emission ambition.

Technology remains a key to boosting productivity

In the 14th Five Year Plan (2021-25), there is a dedicated chapter on accelerating the digital economy. It is clearly stated that China aspires to raise the share of digital economy (core sectors) to 10% of GDP in 2025.

Policymakers are aware of China’s growth challenges such as an ageing population and a declining return on investments. Any future growth will need to come from a productivity boost driven by continued innovations and technological advancements.

The technology sector comprises of mostly private enterprises. These private enterprises account for around 60% of GDP and more than 80% of urban employment and they are generally more productive than state-owned enterprises (SOEs).

Among listed firms, the average productivity gap between SOEs and private enterprises is around 20%. Beyond these hard numbers, technology is deeply embedded into everyday life, transforming the way people shop, eat, travel, and entertain.

We believe the government has no intention to undermine the sector. Its focus is targeted on the socially vulnerable (i.e. the riders, the parents, and the minors) and the financially risky (fintech and its linkage to broader financial system).

Its aim is to promote a digital environment that bolsters fair and healthy growth that cares about social wellbeing.

We believe communication regarding these regulations has become clearer in recent days and more focus will be placed on executions, presenting attractive buying opportunities to select companies that are less targeted by regulatory actions such as e-commerce, food delivery and gaming among others.

Policy directives have been consistent on balancing growth and financial stability

The property sector has recently attracted lots of news headlines. Many investors are worried about a default risk and believe this represents a tightening stance. We believe the government is walking a fine line between promoting growth and maintaining financial stability.

Tightening or easing would be an easy characterisation of this balancing act. If we look back at policy directives over the past years, from the supply side reform, to the deleveraging campaign, the government has been consistently reacting to reduce macro-level risks and avoid a sharp slowdown in growth.

There have been good results from previous efforts, evidenced by the shrinkage of shadow banking credit and slower expansion in corporate leverage. More importantly, we believe this represents a change in mindset that growth formula from the past will no longer work for the future and capital needs to be deployed in productive areas.

We expect the government to continue with its current approach to be data-dependent and to keep growth within a reasonable range.

Decarbonisation will accelerate and create new investment opportunities

China has pledged to reach carbon peak by 2030 and carbon neutrality by 2060. Such emission ambitions are leading to increased efforts in decarbonisation.

In July, China launched its national carbon emissions trading scheme (ETS) that brings together pilot schemes that has been running since 2013 by eight provinces/cities and in September pledged to stop financing new coal-power projects overseas. Investment appetites for renewables are strong as renewable power is set to account for over half of total installed capacity by 2025.

We believe decarbonisation efforts will continue to accelerate and offer investment opportunities in related areas, including renewables and electric vehicle (EV) supply chain.

We expect demand for products with an environmental/carbon focus to be on the rise as end investors are becoming increasingly aware of investment opportunities and risks associated with climate change. Our funds have historically had a low carbon footprint given our focus on the services and clean energy sectors.

China a compelling asset class

We believe policies in 2022 and beyond, branded under the broad objective of common prosperity, will continue to impact equity markets. Investors should surf through these policies and ride on tailwinds to find attractive opportunities.

The new development era will be different from the past, but we remain confident that investors will be again drawn by opportunities in China. We believe China remains a compelling asset class worthy of a standalone allocation.

It has a large domestic market with abundant opportunities and policy objectives are evolving for the new future. We have confidence that investors will be able to take advantage of opportunities if they invest for the long-term.