How are ADC drug partnerships changing China’s biotech landscape?

The global cancer biological therapeutics market was estimated at around US $107 billion in 2023 and is projected to reach roughly US $232 billion by 2033, growing at a CAGR of about 8%.1 This piece deep dives into the fast-growing antibody-drug conjugate (ADC) drug industry that is being used for cancer treatment. We look at what’s driving big pharma to partner with Chinese ADC drug developers for ADC drug out-licensing deals and what we believe the investment implications of this trend might be for the Chinese pharma and biotech market.

ADCs are gaining ground

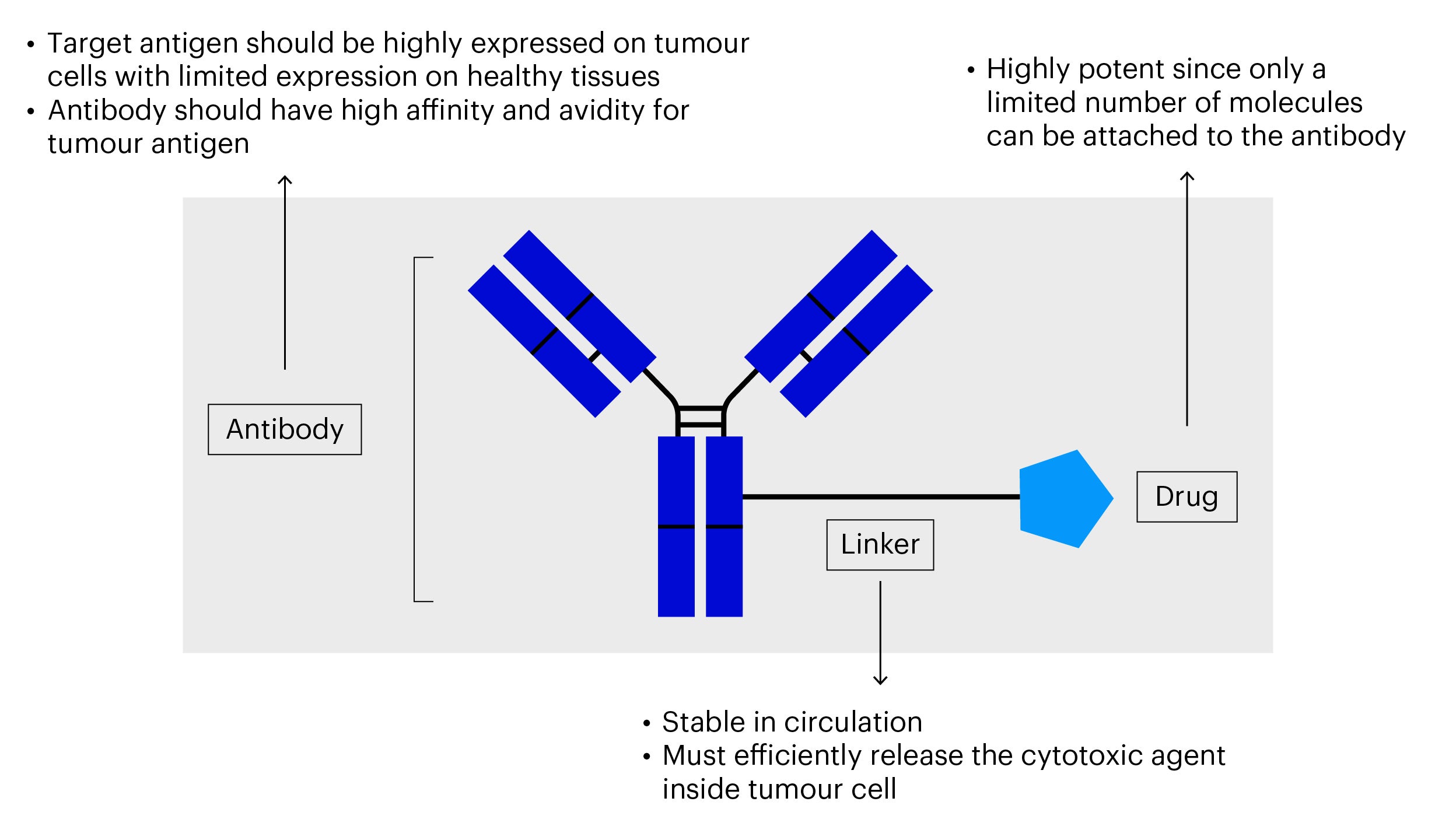

What is an antibody-drug conjugate (ADC)?

An antibody-drug conjugate is a fast-growing type of cancer therapy that involves an antibody, a chemical linker and a small molecule payload. This class of cancer therapeutics incorporates both the targeting function of antibody drugs and the cytotoxicity of chemotherapy, making it possible to target and destroy cancer cells precisely.

Source: The Lancet Oncology (2016)

What are the competitive advantages of ADC drugs compared to traditional therapies?

- Fewer side effects: ADC drugs have fewer side effects compared to chemotherapy. Traditional chemotherapy only targets cancer cells to a limited extent, often damaging healthy cells in the process. In contrast, ADCs are designed to use antibodies to selectively deliver cytotoxic drugs to cancer cells. Clinical research shows that ADCs have more controllable toxicity than traditional chemotherapy drugs, and the latest generation of ADCs has demonstrated significantly better clinical outcomes compared to chemotherapy.

- Ability to target a wider target range of tumor cells: The anti-tumor effects of ADCs primarily arise from their payloads rather than solely from antibody targeting. As a result, ADCs can potentially target a wider range of tumor cells than antibodies alone.

- Complexity of the drug makeup lowers scope for competition: ADCs have more complex structures than traditional drugs as they involve various combinations of antibodies and payloads. This complexity can reduce the direct competition among drug developers, as each ADC could have its own unique properties and applications.

Why is China becoming the global leader in ADC research and development?

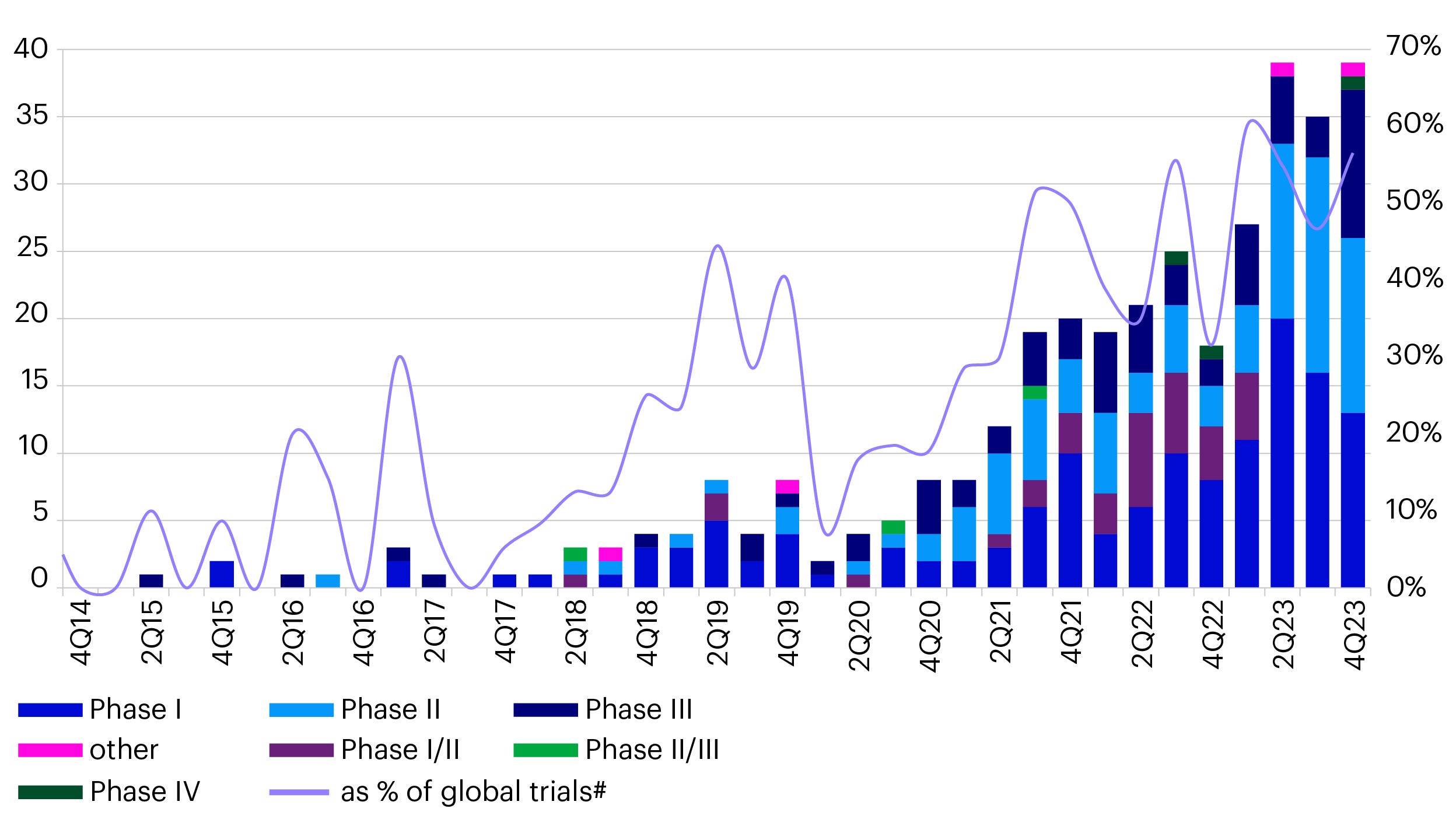

China has become the global research and development center for ADC drugs. China accounted for 60% of all newly registered global ADC clinical trials in 2023 compared to less than 20% in 2020 (Figure 2).2

Source: Pharmcube, data as of March 2024.

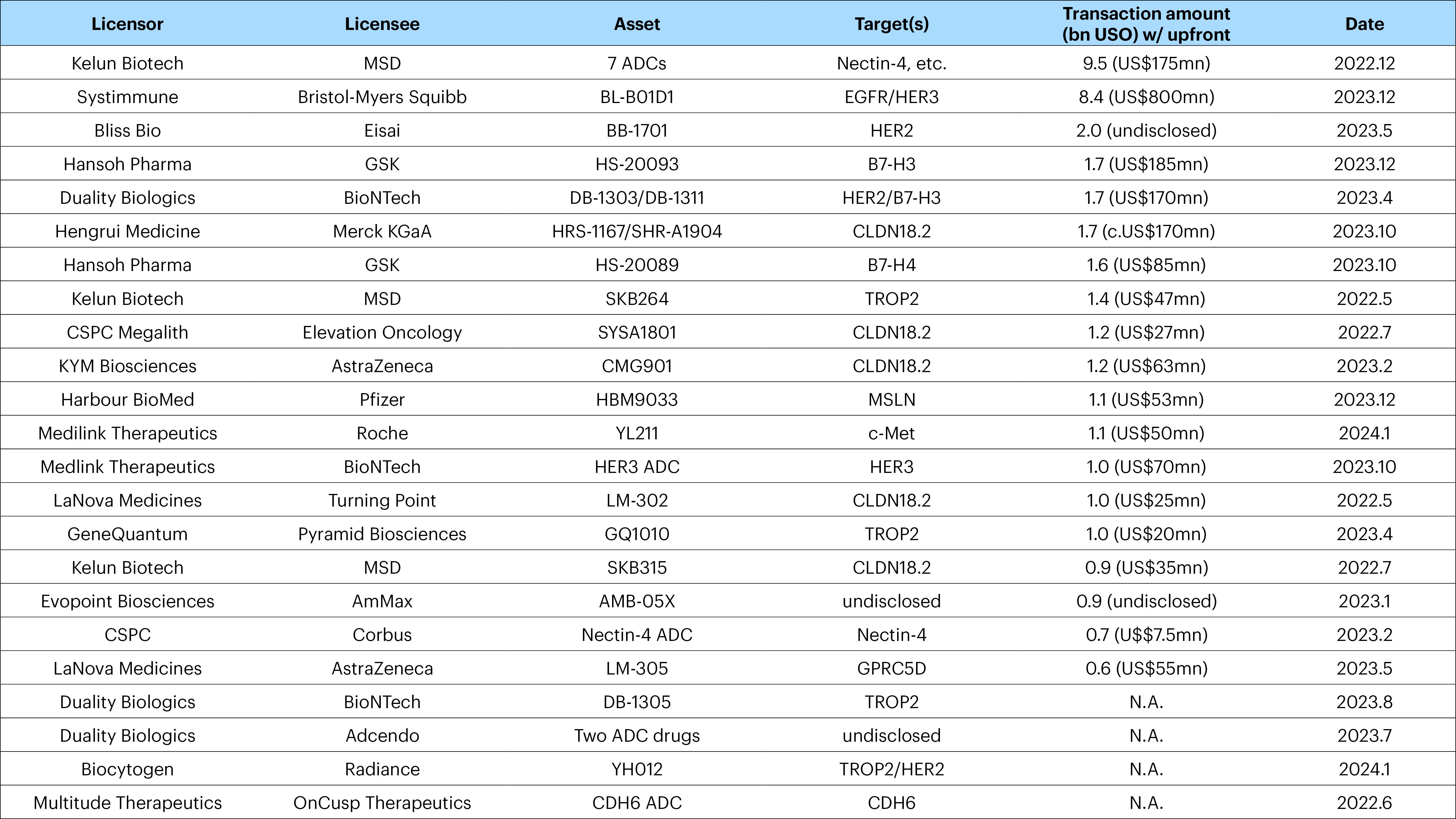

In recent years an increasing number of multinationals have signed licensing deals with Chinese ADC developers. The sizes of these deals have also been substantial (Figure 3). For example, in January 2024, Chinese biotech company Yilian Bio announced an out-licensing agreement with Roche to develop the next-generation ADC candidate YL211 for the treatment of solid tumors. Roche would provide Yilian Bio with an upfront payment of US $50 million, and potentially more than US $1 billion in future commercialization milestone payments and future royalties.3

In the same month, Biocytogen, a Chinese drug company announced a licensing agreement with American biotech firm, Radiance Biopharma. Through the agreement, Radiance can obtain a license for Biocytogen’s first-in-class fully human HER2/TROP2 bispecific ADC for the development, production, and commercialization of therapeutic products targeting a variety of major diseases.

Source: Company data. Data compiled by Goldman Sachs Global Investment Research. For illustrative purposes only. It does not represent a recommendation to buy/hold/sell the securities/industries/regions. It must not be seen as investment advice.

Why have global multinationals been signing an increasing number of licensing deals with Chinese ADC developers in recent years?

- Robust clinical trial infrastructure: China has a robust infrastructure to support clinical trials including numerous clinical trial centers and patient groups. As a result, patient enrolment for clinical trials in China occurs more quickly than in several other developed countries.

- Strong R&D capabilities: Chinese ADC developers have strong R&D capabilities in chemical drugs, catching up considerably with other markets. This is important given that the payload of ADC drugs are typically small molecule chemical drugs.

- Operational efficiencies: Chinese ADC pharmaceuticals are focusing more on optimization based on existing techniques and are therefore operating relatively efficiently. Hence these companies can go to market faster and cheaper than their peers outside of China.

- ADC drugs are seeing rapid growth: Although the concept of ADC drugs has been around for a long time, the industry has only seen rapid growth in the last decade. This has meant that there’s a relatively small technology gap between China and the European and American pharma companies that are global leaders in this space.

Investment opportunities related to ADC drugs in China’s stock market

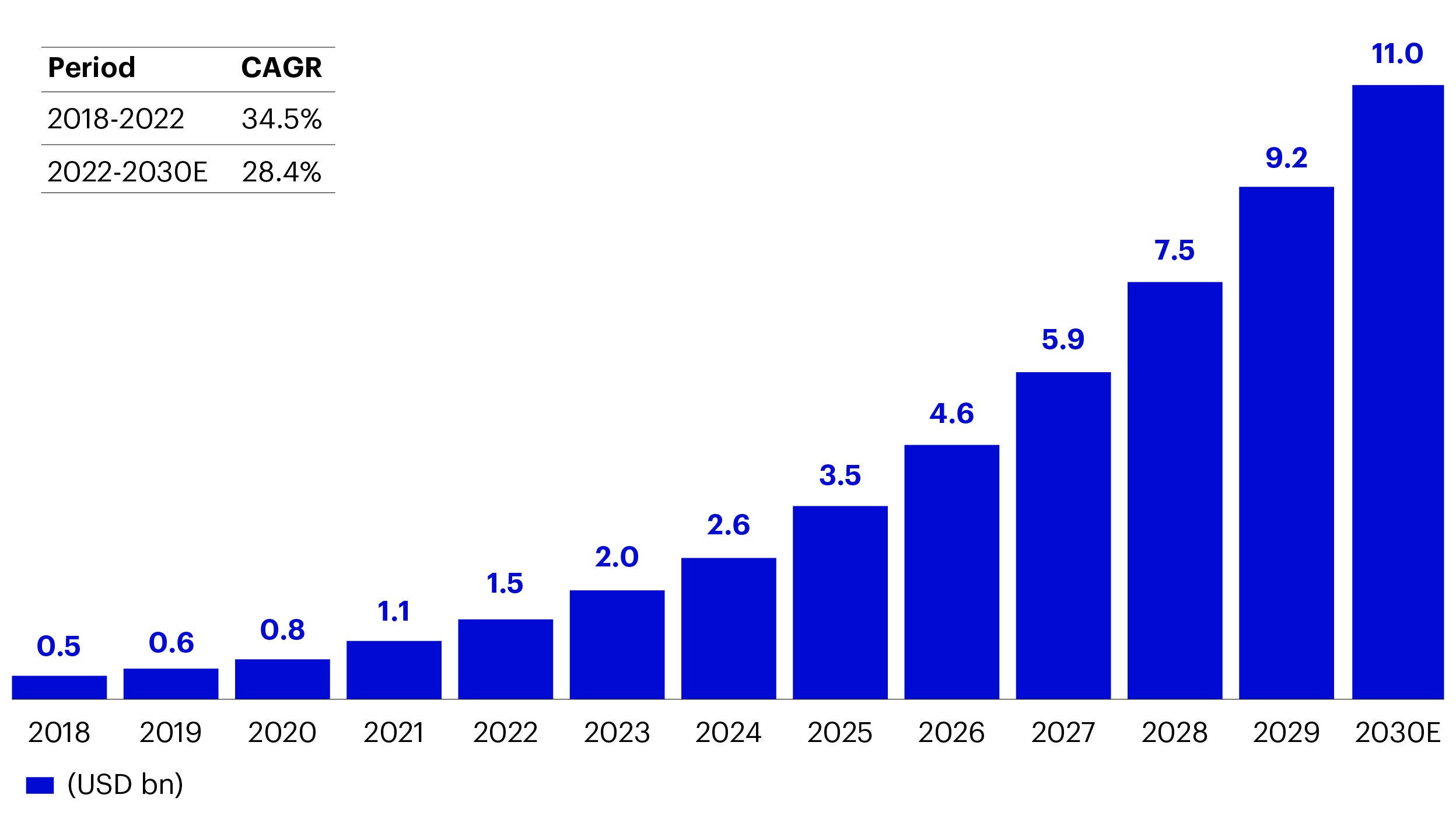

We believe ADC drugs have huge growth potential. Currently, 15 ADC drugs have been approved globally, and the global ADC market is expected to grow at a high compound annual growth rate (CAGR) of 30%, from US $7.9 billion in 2022 to $64.7 billion in 2030. The Chinese ADC market is expected to grow from 800 million yuan in 2022 to 66.2 billion yuan in 2030, with a CAGR of 72.8%.4

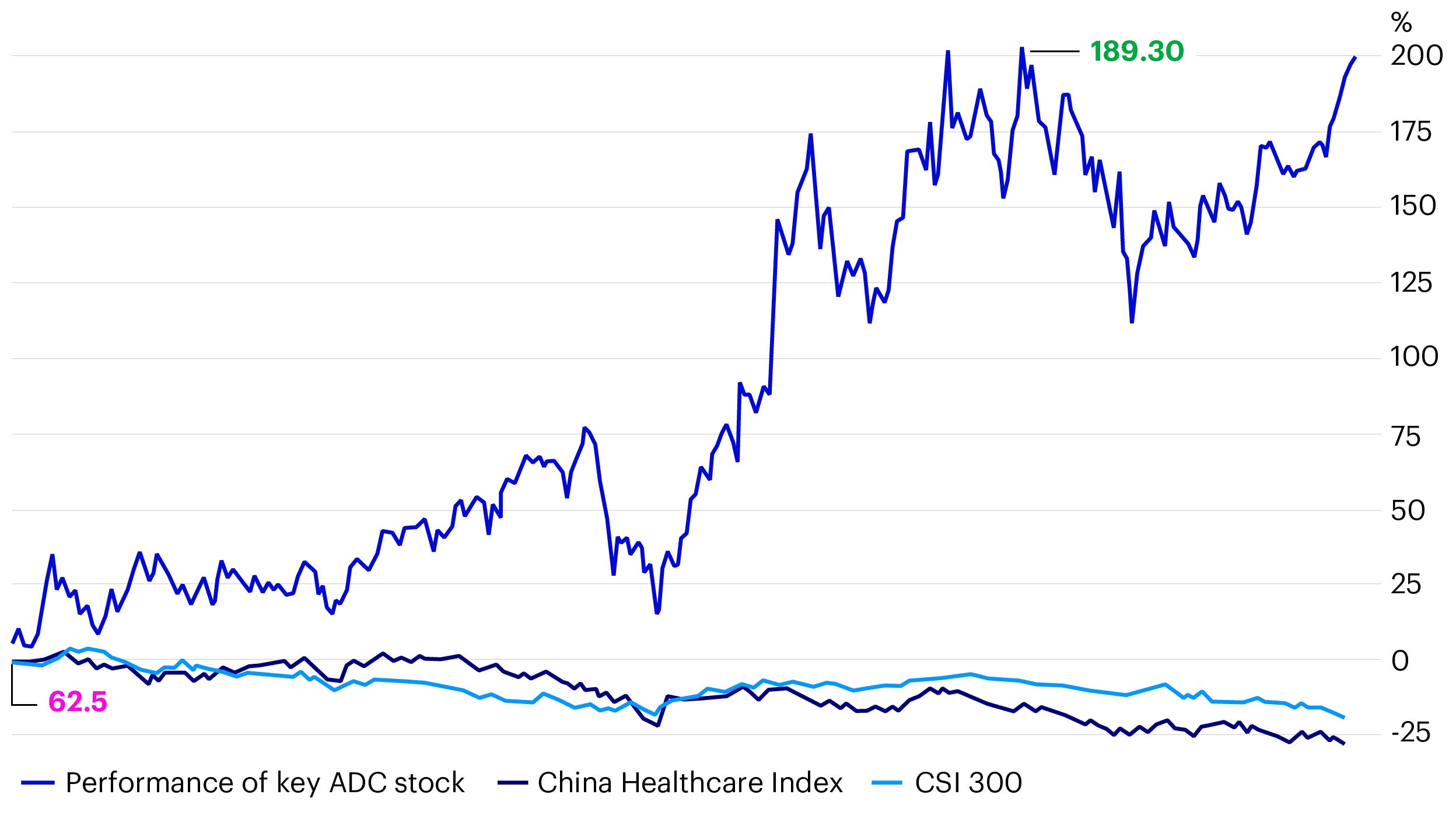

In recent years, PD-1 inhibitors (a group of anticancer drugs) have become a red ocean with fierce competition and haven’t contributed significantly to the profit of Chinese drug makers. We think the story for ADC drugs could be quite different as this industry has a lower level of competition (given the wider range of innovation possible with different combinations of antibodies and payloads). We believe Chinese innovative drug developers have the potential to reap significant profits in the coming years from ADC drugs. For example, looking specifically at the Chinese stock market, ADC stocks have started to outperform both the CSI 300 and the CSI Healthcare Index over the past year (Figure 4).

Source: Wind, data as of 17 September 2024.

We also think ADC drugs will offer China biotech companies the chance to globalize by partnering with western pharma. There are mainly three types of companies that investors are looking at when considering gaining exposure to the ADC theme.

- Domestic big pharma with ADC pipelines: Domestic pharmaceuticals have a larger amount of resources and flexibility to explore new ADC techniques. These companies also generate strong cash flow from their generic drugs business that can support the development of ADC drugs. This enables the firms to be profitable in most cases and ensures the stock prices are not as volatile as biotech players. Apart from out licensing to multinationals abroad, these companies are also capable of commercializing ADC drugs within China.

- Chinese biotech companies: China biotech companies are more focused on innovative drug development, and they look to contract research organizations (CROs) or contract development and manufacturing organizations (CDMOs) to develop ADC drugs. The firms also rely on out-licensing deals and may eventually even become a target for M&A opportunities.

- ADC CRO/CDMO companies: These companies help biotech firms develop ADC drugs. Like big pharma, CROs/CDMOs are also profitable, and their stock prices are far less volatile given that they typically execute projects with several different biotech companies. Due to the complex structure of ADC drugs, they had a higher global outsourcing rate (around 70%) compared with overall biologics (around 34%) as of end-2022.5

Source: Citi Research, Frost & Sullivan Analysis and company annual reports.

Conclusion

We are positive on Chinese pharmaceutical or biotech stocks that have strong ADC pipelines and possible licensing-out opportunities for the following reasons:

- Onshore policy support: We have been seeing more policy support for innovative drugs in China recently. At the end of July 2024, the National Medical Products Administration (NMPA) passed the Pilot Work Plan for Optimizing Review and Approval of Clinical Trials for Innovative Drugs. The work plan is targeting to shorten the clinical trial application review process for innovative drugs to within 30 workdays in pilot areas (versus the 60 workday default expiration threshold that is currently in effect). This is likely to bode well for domestic innovative pharma and biotech names.

- Higher innovative drug pricing: As innovative drugs in developed countries are priced much higher than in China, outsized licensing fees and milestone contributions could contribute significantly to Chinese ADC drug makers’ earnings.

- Lowered geopolitical risk: As compared to Chinese pharma companies selling drugs directly into the US market or being a supply chain play for innovative drugs developed by multinationals, signing out-licensing deals with external players typically involves fewer restrictions from a foreign regulatory standpoint.

We also think the recently issued policy in Shanghai supporting all-chain innovation development for the biopharma industry is encouraging and think that other local governments could follow. Given this ongoing policy support, we expect to see the acceleration of new drug or device approvals and a recovery in funding for innovative drug developers and device manufacturers in the near term.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

Footnotes

-

1

Note: CAGR period is 2024 to 2033. Source: Cancer Biological Therapy Market Size to Hit USD 232.06 Billion by 2033, June 2024, https://www.biospace.com/cancer-biological-therapy-market-size-to-hit-usd-232-06-billion-by-2033

-

2

Phamcube, data as of March 2024.

-

3

Source: Eastmoney.com, data as of January 2024.

-

4

Source: Eastmoney.com, data as of January 2024.

-

5

Source: Citi, data as of December 2023.