APAC real estate investment bright spots in 2024

In this Q&A we speak to Catherine Chen, Asia Pacific Investment Strategist at Invesco Real Estate on what’s driving demand for APAC real estate and some investment bright spots in 2024.

Q: What’s driving growth in the APAC region and how do you expect this to impact demand for real estate?

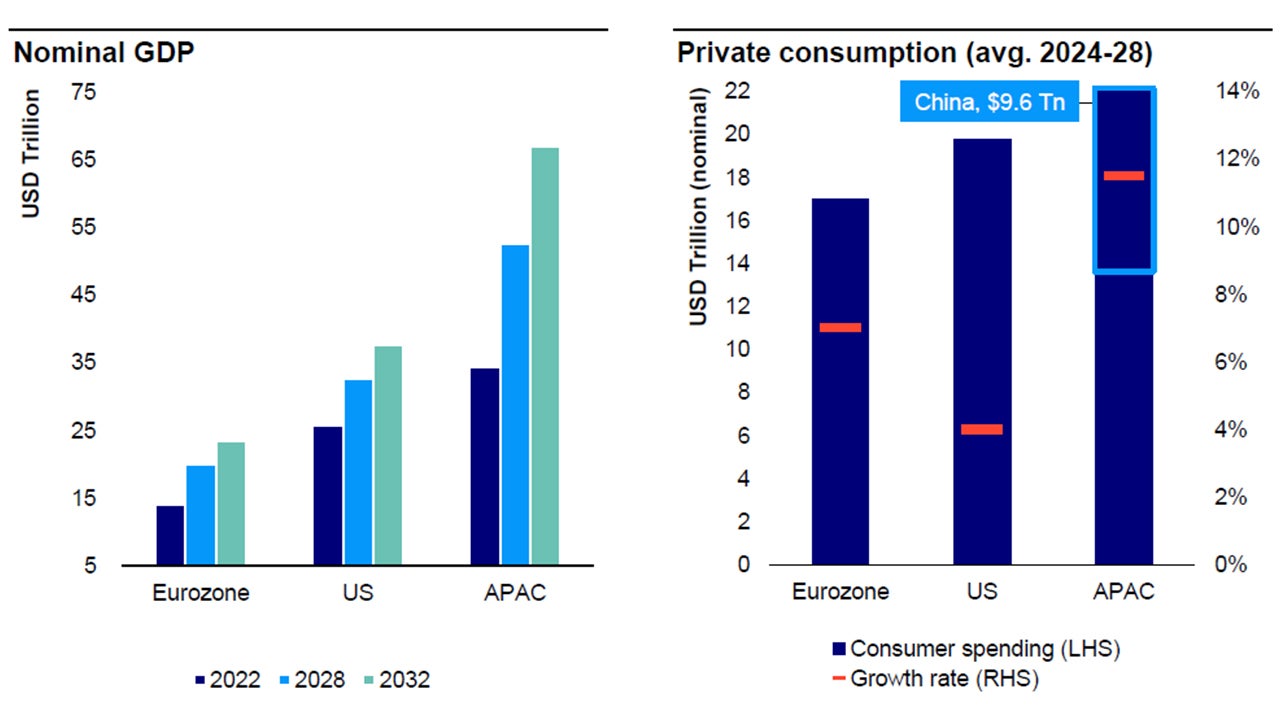

A: The APAC region contributes approximately 35% of global GDP.1 The total GDP of the APAC region is projected to reach US$67 trillion by 2032, nearly double the size of the United States' GDP by then.2

Apart from China, a significant growth driver in the APAC region stems from domestic consumption. Given its large population base, rising middle class, tech-savvy consumers and relatively higher degree of household savings, APAC is expected to see strong consumption growth going forward.

All these factors are expected to lead to growing demand for real estate across the property sectors over the long term.

Source: Oxford Economics as of October 2023.

Q: How do you anticipate China’s growth trajectory will impact the wider APAC region and global economy?

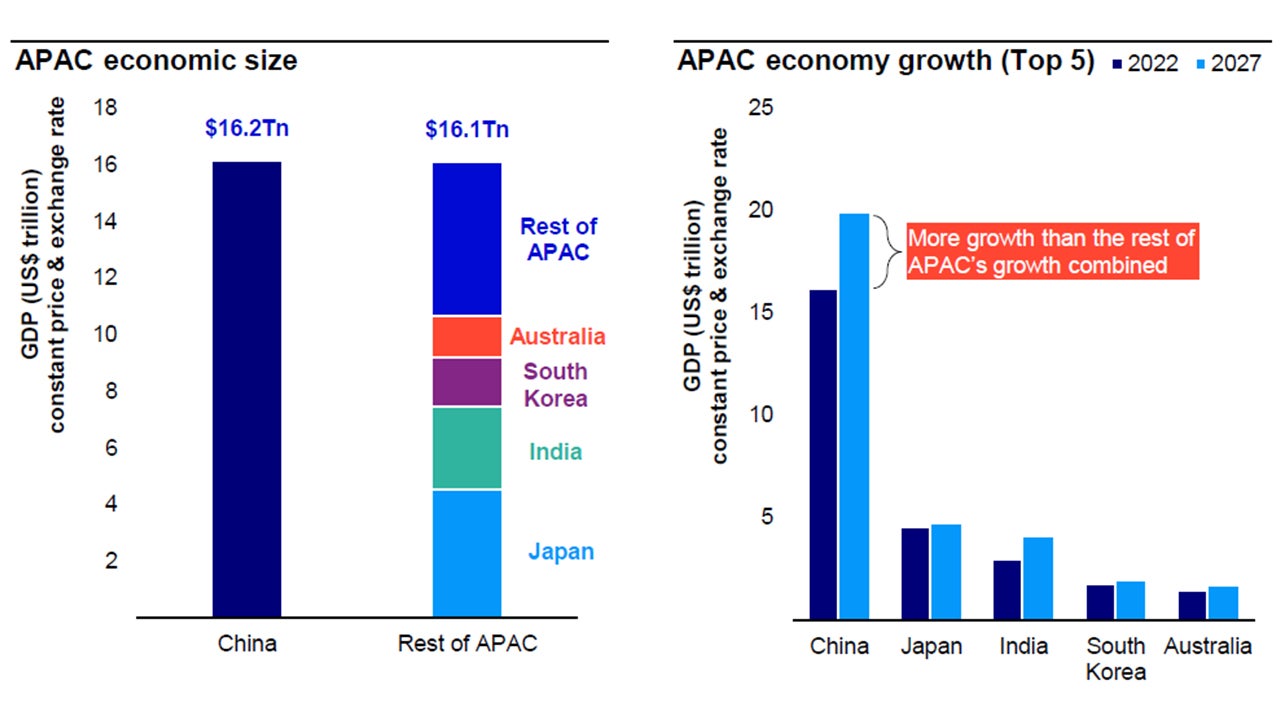

A: While China's growth rate is slowing, it continues to increase in absolute terms (around 3.5%3), with a US $3.7 trillion rise forecasted over the next five years.4 This is larger than the economic growth of the rest of APAC economies combined and is even larger than the current size of India’s economy. So, we expect the China’s economy will continue to add significantly to APAC and global demand.

Source: Oxford Economics as of October 2023. GDP represents real GDP figures, holding exchange rate constant.

Q: How do you think commercial real estate will be impacted by the realignment of trade and supply chains in the APAC region?

A: Businesses have been compelled to restructure their supply chains in recent years in the aftermath of US-China trade tensions, pandemic disruptions, and mounting geopolitical concerns. We expect this trend to gain momentum in the future.

Although we believe China may bear the brunt of these changes – South Asia, East Asia, and the Pacific are poised to be the primary beneficiaries. The anticipated trade diversion from China to other countries in the region is projected to further strengthen the growth of manufacturing sectors in Asian countries going forward.

We believe this trend will support continued demand for, and investment in, commercial real estate throughout the region. For instance, the chip sector has been picking up in Japan and South Korea, that would boost demand for logistics and the jobs created will also support demand for residential in key cities.

Q: How has APAC real estate performed compared to other regions?

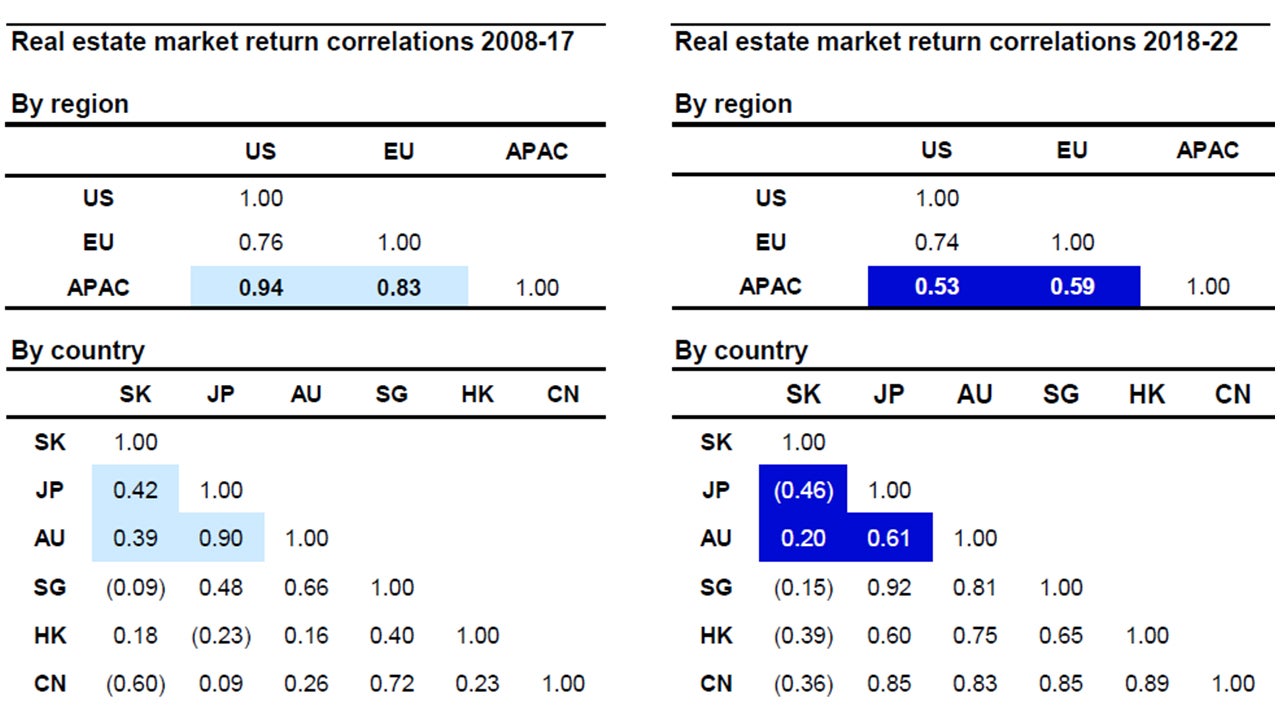

A: In the five years leading up to 2022, APAC's diversification benefits have improved considerably. Commercial real estate return correlations with major regions have fallen, compared with the period from 2008 to 2017.

In the APAC region, the return correlations among Japan, South Korea and Australia have also fallen during the period from 2018 to 2022.

At the same time, among APAC countries there are strong diversification benefits, for example, South Korea has a negative correlation with most other APAC countries.

Source: MSCI, Invesco Real Estate Research as Q4 2022. Note: MSCI APAC Index covers only Australia, China, Hong Kong, Indonesia, Japan, South Korea, Malaysia, New Zealand, Singapore, Taiwan and Thailand. The index is weighted by market size in value (USD).

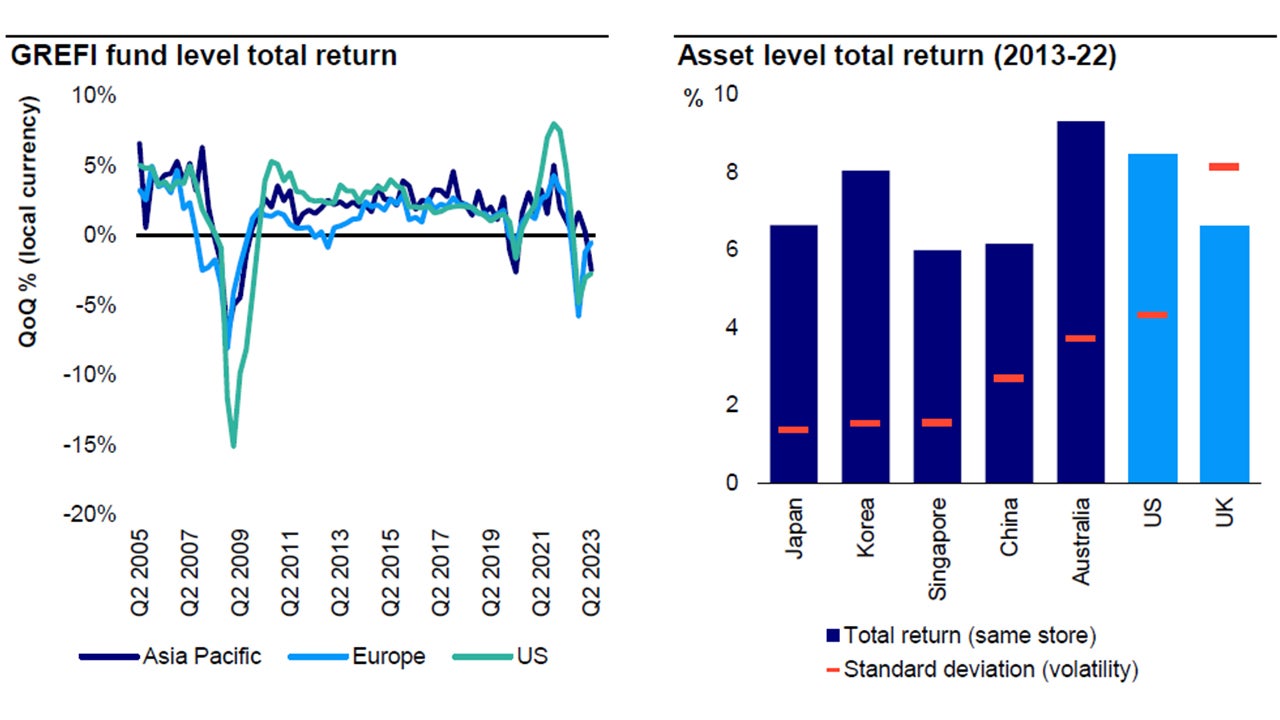

Relative to other regions, total real estate return volatility in APAC is generally lower, both at the fund level and asset level. APAC real estate returns are helped by several stronger markets and sectors – offices in Korea and Singapore, logistics in Australia and Japan, as well as Japan residential.

Source: (LHS) ANREV, INREV, NCREIF ‘Global Real Estate Fund Index Q2 2023’; (RHS) MSCI as of October 2023. Past performance does not predict future returns.

Q: Can you share how the monetary environment in the last year and half has impacted the investment landscape in the APAC region?

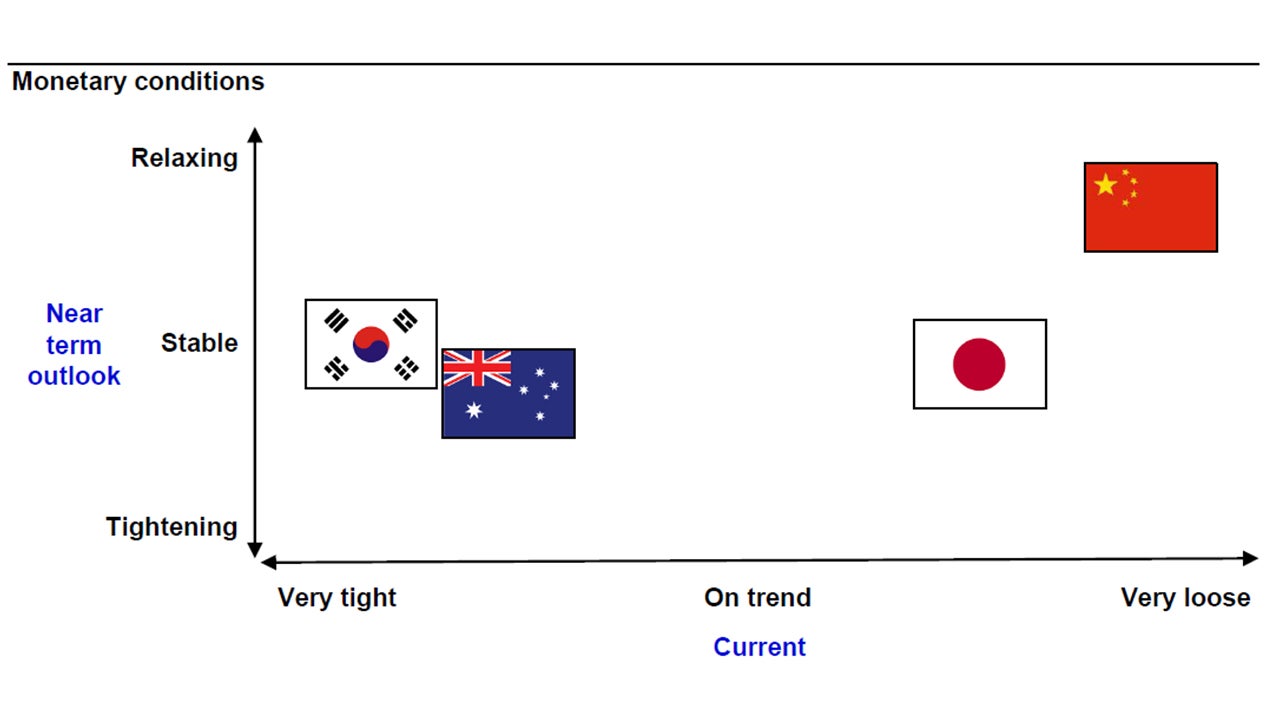

A: Monetary conditions have shifted substantially over the past two years, and we are now seeing very diverse monetary conditions among major APAC countries.

The region has its fair share of divergent policies, as central banks in Australia and South Korea are following the US Federal Reserve’s actions closely, while the Bank of Japan continues to maintain loose monetary policy.

Source: Macrobond, Invesco Real Estate as of November 2023. Note: for illustration only.

Although the wide yield differential between the US and Japan is forcing the Bank of Japan to adjust their policy, it is broadly expected to be a gradual and extremely cautious process, especially under the current macro backdrop. Even with the recent monetary policy adjustments in Japan, we expect the impact to Japan property yields have been somewhat priced in and the property income growth prospect to improve on the back of more sustainable inflation, even though short-term capital market volatility is also expected.

In Australia and South Korea, the credit markets are at the cyclical lows, and we are seeing more credit opportunities emerging lately and we expect more to come soon.

Q: What are the key APAC real estate investment themes you are focusing on at the moment?

A: We have identified three main investment themes where we see opportunities in the APAC region amid diverging secular trends, namely Japan cold storage logistics, Korea senior housing and Australia living.

1. Japan logistics - Aging cold storage facilities with tight utilization

A sizeable amount of cold storage facilities in Japan, particularly in Tokyo, are relatively old, with approximately one-third of the stock built over 30 years ago and 25% of stock in Tokyo being over 40 years old.5 These older facilities are essentially technically obsolete, especially when considering their installed cooling systems.

In major cities, most cold storage facilities are operating beyond their optimal capacity. Japan has a 106% utilization rate of cold storage.6 However, despite their outdated conditions, these facilities continue to be utilized due to the lack of available space for relocation. In the recent years, the situation has worsened, particularly in the major port areas.

2. Korea senior housing - A nascent sector underpinned by strong secular trend

Korea is the fastest ageing society among OECD countries with the elderly population expected to grow to over 20% of population by 2026. It is anticipated that the number of individuals aged 75+ will more than double by 2040.7

A senior survey report found that 78% of the elderly population aged 65 and above live alone or with their spouse,8 and there has been a considerable increase in the proportion of seniors who express a desire to live in senior housing.

By the end of 2022, senior housing penetration was only 0.1%, indicating a significant supply-demand gap of these facilities.9 To address this issue, the government is providing incentives to encourage private sector participation in this sector.

3. Australia living - Strong population growth driven by migration

Australia has the fastest growing population among the G7 countries with a population growth rate that is currently around three times that of the US.10 The growth is being driven by migration and is expected to result in a shortage of 100,000 dwellings by 2028.11 This supply differential is expected to drive demand for residential housing in the coming decade.

With contributions from Monica Uttam, Thought Leadership and Insights, Asia Pacific.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.