Sustainability is essential to companies’ long-term success

Companies must be responsible corporate citizens to create long-term value for their investors.

Companies are increasingly being examined for whether they are responsible corporate citizens. It is a topic that has garnered widespread attention in the media and investment world in recent years. This focus on stewardship and ESG (Environmental, Social, and Governance) issues is nothing new, however, for us. Our Global Equities group has a 50-year history. Throughout that entire time, the investment professionals who have overseen the Invesco Global Equity Strategies and the portfolios we manage have always considered effective stewardship and proper governance as essential ingredients to companies’ success.

We believe it’s critical for companies to demonstrate responsible behaviour when it comes to their environmental, social and governance practices in order to sustain their long-term competitive advantages and deliver attractive returns to investors.

As investors, we look for companies that can support long-term value creation for our clients. We leave social activism to others. We have always believed, however, that companies can generate long-term value for our clients only if they behave as responsible corporate citizens.

Long before the initials ESG came into vogue, we evaluated companies for their environmental risk, for their ability to create engaged, motivated workforces and leadership teams and to protect the rights of their workers, customers and suppliers, as well as for their ability to install proper oversight of their leadership and business practices.

Not every company can be exceptional in every one of these categories, but we know when a company fails significantly on any of them, it can greatly hinder its business and ability to deliver returns for long-term investors.

We know that we must be effective stewards of the capital our investors entrust with us. We fully understand that we have a fiduciary responsibility to serve our investors well and we take that responsibility very seriously. Since 1969, we have been focusing on the structural trends that we think will drive growth for decades, and we believe only the companies that are managed responsibly can fully participate in the potential of these growth trends.

The details must be viewed with the big picture in mind

As ESG investing has become more prominent, there has been increasing attention paid to finding ways to quantify it. Data on matters such as a company’s carbon footprint, its product safety ratings, or the diversity of its board of directors are all useful indicators that provide additional data points one can use to evaluate a company.

However, it must be noted that there is no universally accepted, all-encompassing definition for what constitutes “good” ESG practices.

The data must be viewed with context. The temptation can too easily be to view a quantifiable score as a passing or failing grade. Companies whose scores are above a certain threshold may be considered “good” and those who fall below the passing grade are considered “bad.”

Companies are very substantially shaped by the people who lead them. A company that has had a poor environmental record in the past may have a new leadership team that is taking it in the right direction, and those positive steps may take a while to show up on the quantitative ESG scores.

Similarly, a company that falls within the “good” range might only be doing enough to earn acceptable scores, while paying lip service to a real commitment to the environmental, social and governance practices that could enable it to be a true leader in any of these categories and in its industry.

It is only through the traditional approach of fundamental, active investing – as portfolio managers and analysts investigate management teams, visit companies and talk to their competitors and industry peers – that these nuances can be discovered and understood.

On an even more granular scale, with many of the specific attributes that ESG analysts and third-party rating agencies score, there is not always consensus about what constitutes a good versus negative practice. Consider these examples.

- Dual share classes. When companies issue multiple share classes, they generally offer one type of stock to the public and another to company founders, executives, and family members. The class offered to the public may have limited voting rights, while the class offered to founders and associates may have voting rights that provide for majority control of the company. On the surface, this practice may seem bad, and the full voting-rights shares could be used in an exploitative way against the interests of general investors. But this is not always automatically the case. A dual share class can also be used for good, enabling the founders and executive team to make difficult short-term choices that general investors might resist. Having the authority to make those hard choices can enable the management team to better support the long-term health of the company.

- Attention-getting controversies. A major blemish on a company’s record – an environmental accident or a failure to protect its customers’ privacy, for example – automatically results in a negative ESG database score, perhaps for some time. But that score might not indicate how the company is emerging from the scandal. Has it taken steps to address and overcome it? Is the company being managed with a more enlightened approach now? It requires looking past the ESG score to determine that.

Focusing on companies’ stewardship, when it’s done well, isn’t simply about checking the boxes and ensuring that you’ve examined all the attributes that rating agencies score. We know what investors want to know when they ask us, “Do you consider ESG, and what is your ESG process?”

Yes, they may want assurances that their investments will reflect their personal values and beliefs, but just as importantly, they are asking, “Are you taking into account all the risk factors that could materially impact the performance of my investment?”

We employ a rigorous process for evaluating how effectively companies serve as stewards of their shareholders’ capital. We can reassure our clients by answering their fundamental question with a resounding, “Yes, we aim to closely examine every issue that presents a risk to your investments.”

We also know that sustainable investing may not always be a top priority for some investors. Some might be willing to consider companies that do not exhibit strong environmental, social and governance practices if they can realize a superior enough return or a quick, short-term gain that, in their view, warrants setting those issues aside.

For those investors, we are not the right manager. Our focus is on finding companies that support long-term value creation. From that perspective, we look for companies that are committed to sustainable practices and avoiding the risks of poor stewardship.

Case studies from our Global Equity Team’s strategies

Facebook had to take major steps to protect users’ privacy

In early 2018, a whistleblower revealed that the British consulting firm Cambridge Analytica had harvested the personal data of millions of Facebook users without their consent and used that data to aid political advertising.

It was a major scandal that called into question how the social media giant was guarding its users’ privacy. To address the issue, Facebook blocked the access that third parties could get to their user data, thereby preventing another firm from ever doing what Cambridge Analytica did.

The firm rewrote its terms of service to explain in plain English how it uses and holds data on users. The firm also hired tens of thousands of people to work on solutions regarding privacy concerns. Given that not many companies have an entire workforce of that size, the decision demonstrated the resources Facebook could commit to resolving a pressing need.

We concluded Facebook acted in an appropriate and responsible way to address the problem. In fact, they took many of the steps we would have recommended.

Supply chain management is critical for fashion retailers like boohoo

In 2020, an investigative report by The Sunday Times revealed exploitative labour practices at a supplier to the fast-fashion firm boohoo. The report revealed that some workers were paid below minimum wage and exposed to unsafe working conditions.

We recognize that supply chain management is a critical issue, particularly in the fast-fashion industry, where there is pressure to bring new trends to market quickly and inexpensively. As investors, we actively engage with companies to encourage them to implement sound labour practices and manage their supply chain effectively.

Much of the company’s growth in recent years has come through acquisitions, and some of boohoo’s supply chain issues have been with these new acquisitions. The company has committed to being more strategic and conducting more thorough audits when reviewing candidates for acquisition.

The firm has also added one more independent director to its board and hired two new sustainability officers. They significantly increased risk management staff, as well.

We believe boohoo is addressing its supply chain issues in a meaningful way and that the company’s management and governance structures have responded appropriately to reduce the risk of recurrence. We continue to closely monitor this situation.

Dr. Lal Pathlabs’ self-regulation reflects long-term commercial vision

Dr. Lal Pathlabs is one of the largest providers of diagnostic medical testing in India.

Laboratory tests underpin 70% of medical decisions in an evidence-based medical system and so we expect Dr. Lal to benefit disproportionately as India’s health care sector develops (currently India ranks very low on a measure of health care utilization or access, but an aging and increasingly affluent population will likely change this).

Dr. Lal is an example of self-regulation in an industry that is not yet ready for strong external regulation. While there is a government framework for the regulation of laboratories, its implementation has been slow.

Dr. Lal Pathlabs, however, holds itself to the highest standards of scientific integrity beyond industry norms. For example, in medical testing, the handling of the sample has a disproportionate impact on the test results.

It is an especially volatile variable in the Indian market where sample extraction frequently takes place in non-lab settings, such as the consumer’s home and where cold storage supply chains are not robust.

Dr. Lal has long enforced fastidious best practices here, although doing so has meant that the unorganized end of the market has historically undercut them on price.

We always expected that Dr. Lal’s ethical instincts would ultimately lead to commercial differentiation as India’s health care sector developed and consumer awareness and expectations increased.

Ironically, the COVID-19 crisis was a catalyst in this regard. The company believes they have gained share as consumers swiftly changed their criterion from price to reliability — where Dr. Lal, due to their corporate stewardship and long-term commercial vision, is a clear winner.

Exercising our proxies

As substantial investors in many companies, we are listened to by company management teams and can often positively influence their decisions on all aspects of their business.

We provide frank feedback to management and governing bodies of the companies, including their environmental, social and governance practices, but most importantly through a holistic discussion of the strategic direction of the business and the impact on our clients.

Where appropriate, we engage with independent directors where we can have meaningful influence and impact regarding issues that are of significant concern to our clients and to us.

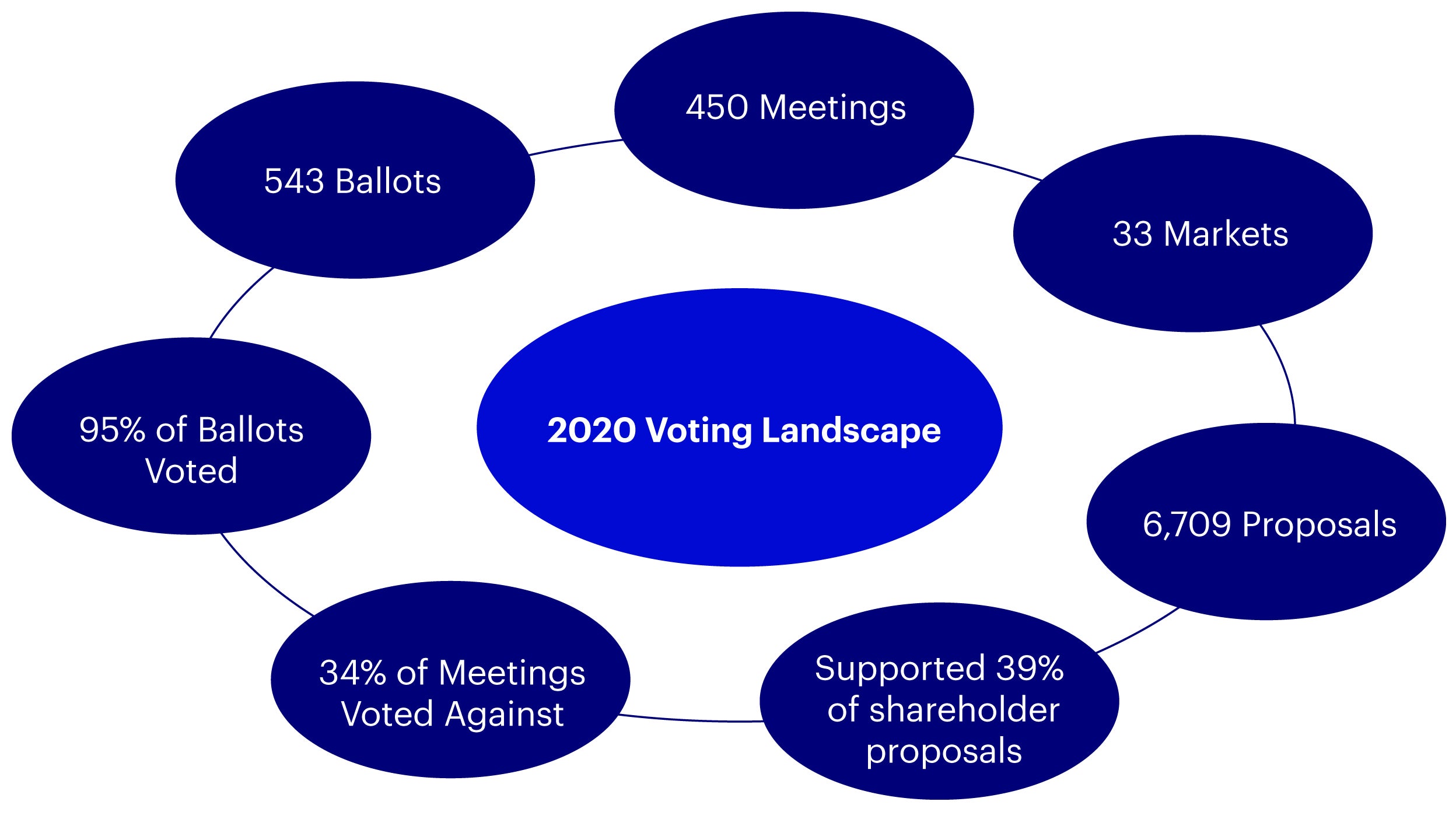

We also believe that proxy voting is another important way to advocate for better decision-making at companies. Throughout the history of the Global Equities group, we have voted in nearly 100% of the proxy votes available to us.

Unlike other asset managers, we do not always side with management or follow the recommendations of third-party sources on how to vote.

We take the process very seriously and have teams that carefully weigh the implications of each item on which we’re being asked to cast a vote. It’s another way we believe we can bring positive change to companies when the circumstances warrant outside guidance.

Related articles

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.