ETF Bringing you the world in one simple ETF

The reason many people invest is to grow their money, so they’ll have enough in the future to spend on some financial goal they have. But how do you do this? Find out more.

Invesco’s purpose is to deliver an investment experience that helps people to get more out of life. This purpose shapes our culture, how we manage our clients’ money responsibly and how we strive to contribute to global sustainability.

The United Nations Sustainable Development Goals support the application of this purpose by providing a broad agenda that applies to Invesco both as an asset manager and a corporate issuer. We are fully committed to that agenda, both through our investment stewardship practices and our corporate stewardship practices.

As a Responsible Investment firm, strong corporate social responsibility practices are part of our culture. Invesco’s commitment to Corporate Social Responsibility ensures we uphold responsible investment standards, are good stewards of the environment, celebrate diversity of thought from our colleagues, and give back to our communities.

Invesco’s Corporate Social Responsibility efforts are motivated by the belief that doing what’s right for the environment, our people and the communities we serve helps us deliver the best possible experience to clients.

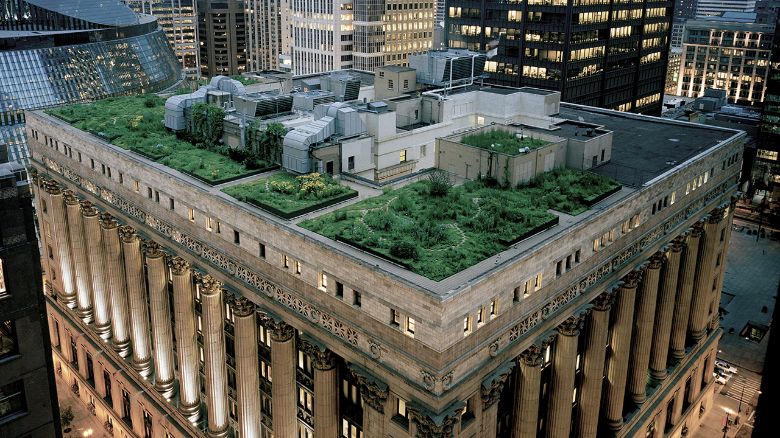

We are committed to continuous improvement in environmental management as an important part of the way we do business.

We believe that investing responsibly by incorporating environmental, social and governance (ESG) practices into our investment activities can positively impact the value we provide to clients - and help ensure a sustainable environment for future generations.

Invesco has been implementing ESG strategies for over 30 years, and we promote and advocate responsible investing through a range of industry forums such as the United Nations Principles of Responsible Investment (UNPRI). As active, long-term investors, we seek to encourage the companies in which we invest to adopt best-in-class ESG practices.

Our ESG approach is rooted in our investment strategies, products, proxy voting, active ownership, engagement and other oversight practices to ensure we are meeting the highest levels of fiduciary and corporate responsibility.

In December 2018, Invesco was awarded “Global ESG Innovation Asset Manager of The Year” at the Chief Investment Officer Insights Industry Innovation Awards.

We are extremely proud of this achievement which recognises Invesco’s commitment and innovative approach to sustainable investing. An awards spokesperson stated:

"Invesco maintains an international involvement in ESG working groups and is a signatory to the UNPRI, UK Stewardship Code, and Japan Stewardship Code. The firm has also been recognized by the Financial Reporting Council for its robust approach to ESG and is designated as a Tier 1* firm in its ranking. The result has been a significant uptick in Invesco’s ESG business and its presence as a global advocate for sustainability with the companies it invests in. Invesco is noted for its leadership on sustainability transparency reporting. As a fiduciary for its clients, Invesco has put ESG principles at the center of its investment process recognizing that sustainability is fully aligned with a robust fiduciary standard."

The reason many people invest is to grow their money, so they’ll have enough in the future to spend on some financial goal they have. But how do you do this? Find out more.

Kevin Grundy, Managing Director, Fund Management, Europe, Invesco Real Estate, discusses the broader market environments in the region and where he is finding the most compelling investment potential for value-add and opportunistic strategies.

Explore the case for the Nasdaq-100 index and how its constituents are driving innovation across the global economy.