Equities Trailblazer China

China is likely to emerge as a dominant growth engine of the world over the next decade.

The Covid-19 crisis turned what could have been the start of a long stretch of strong economic performance in the developing world into an era of uncertainty with profound consequences that will almost assuredly strain all economies globally, including many emerging markets (EM) for years to come.

In exploring vulnerabilities both internal (fiscal and monetary policies) and external (balance of payments and debt), we seek to determine the relative potential winners and losers, while identifying what we believe are the most promising longer-term investment opportunities.

We think our long-held conviction that EM are all about China is continuing to hold true.

In our view, China’s long-term contribution to global growth is likely to become even more apparent as a result of the pandemic.

We believe it could account for about 50% of global growth over the next few years.

We are confident in our belief that China will offer investors the most appealing investment opportunity in the decade ahead.

Other Asian economies, we believe, also stack up well - notably Taiwan, South Korea and Southeast Asia.

In contrast, India’s frailties, in our view, are likely to be exposed as a result of the pandemic, as structural growth could be stressed, with even the well-run private sector banks possibly facing the pressure of a tidal wave of non-performing loans (NPLs).¹

Outside of Asia, we believe Russia’s efforts in recent years to strengthen its economy will likely enable it to ride out the storm, even in the backdrop of collapsed energy prices.

Other than Russia, we believe there is little to be sanguine about in the emerging market countries outside of Asia.

The largest economies in Latin American and Europe, the Middle East and Africa (EMEA) - that is, Brazil, Mexico, Saudi Arabia, Turkey and South Africa - face a host of varying issues, from external debt and unsustainable deficits to asset quality stress, among others.

While an understanding of the macroeconomic pressures facing EM helps to inform our investment decisions, our approach remains unchanged.

We are bottom-up investors who seek out idiosyncratic companies that have durable long-term growth, sustainable advantages and embedded real options that may be realized over time.

Clearly, we believe the opportunities for investors are likely be plentiful in China.

Europe faces numerous challenges, and the viability of the Euro cannot be ignored, while valuations in the US market currently seem, in our view, to ignore the challenges ahead.

However, valuations across EM have become inordinately cheap, in our view, and we are excited to uncover well-run companies even in the most stressed economies.

“It is the unforeseen that causes the greatest disturbances, not the expected.”

Niall Ferguson, The War of the World

In our opinion, 2020 held the promise of synchronised economic recovery in the developing world, after years of disappointment. Like others, we were confident in EM earnings and equity market returns at the beginning of the new decade.

Alas, we were wrong.

The unforeseen - the pandemic - came and caused, well, great disturbance.

The accompanying high degree of uncertainty brought with it excess volatility, which has historically not been a friend to EM investors.

Sadly, this uncertainty in the developing world is not likely to go away anytime soon.

We are forced to live in this period of heightened uncertainty.

It is a period when investors may struggle to extrapolate recent conditions into reliable financial model projections.

Simply put, the world is out of joint.

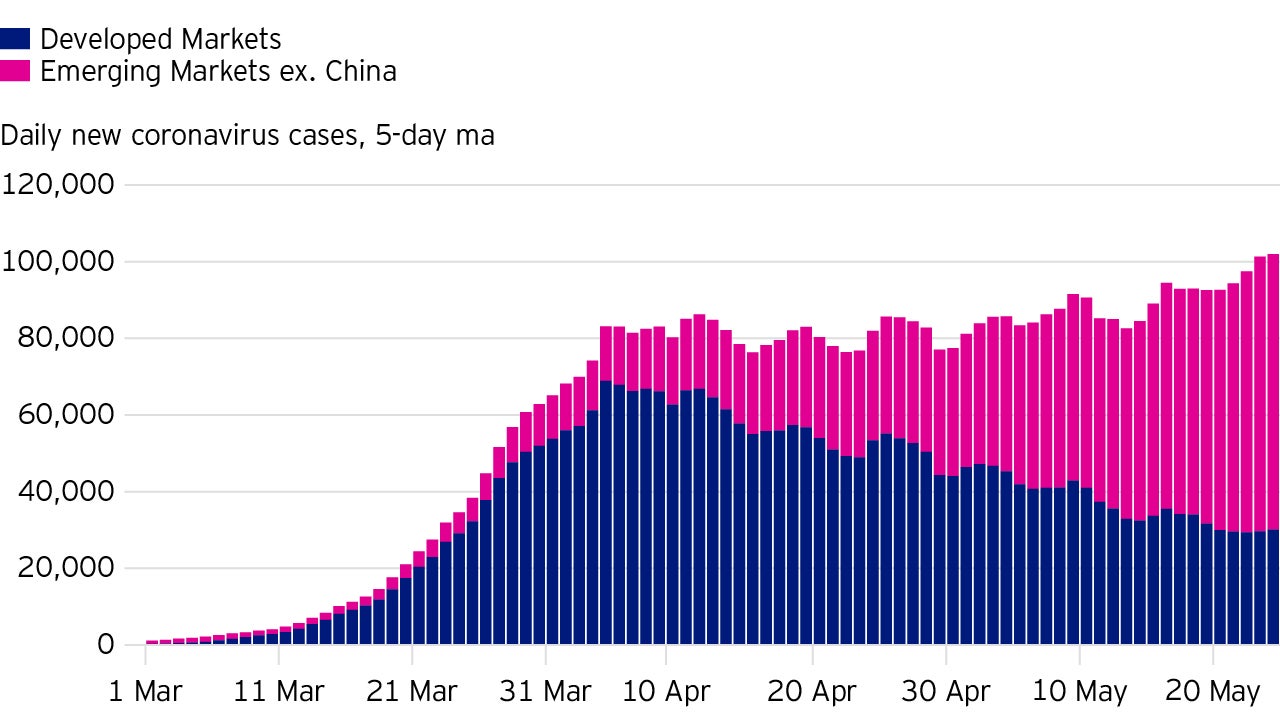

The pandemic appears to be moving from the developed to the developing world with brutality.

While the West has moved beyond the peak in new daily cases, these are still on an inexorably rising path in EM outside of China.

To make matters worse, the health care systems across much of the developing world may be, we fear, ill-equipped to face the challenge.

There will likely be much pain and human loss across Latin America, sub-Saharan Africa, and the Indian subcontinent.

For us, this is a period for existential contemplation - a time to consider with great care the many macroeconomic uncertainties across the developing world.

In our view, there are two types of risks:

The dynamics between the two could have a pronounced influence on growth prospects in the developing market world.

In our view, these factors will likely result in significant polarisation of performance across EM equity markets over the medium term.

Domestic/internal vulnerabilities include:

External vulnerabilities include:

For a more detailed look at these vulnerabilities read the next article.

1. A non-performing loan (NPL) is a loan that is in default or close to being in default. Many loans become non-performing after being in default for 90 days, but this can depend on the contract terms.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. As a large portion of the strategy is invested in less developed countries, you should be prepared to accept significantly large fluctuations in the value of the strategy. The strategy may invest in certain securities listed in China which can involve significant regulatory constraints that may affect the liquidity and/or the investment performance of the strategy. The strategy invests in a limited number of holdings and is less diversified. This may result in large fluctuations in the value of the strategy.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.