ETF Digital assets: Is the bitcoin bull run just getting started?

Five key factors suggest cryptocurrencies may continue their 2024 momentum and see positive performance in 2025.

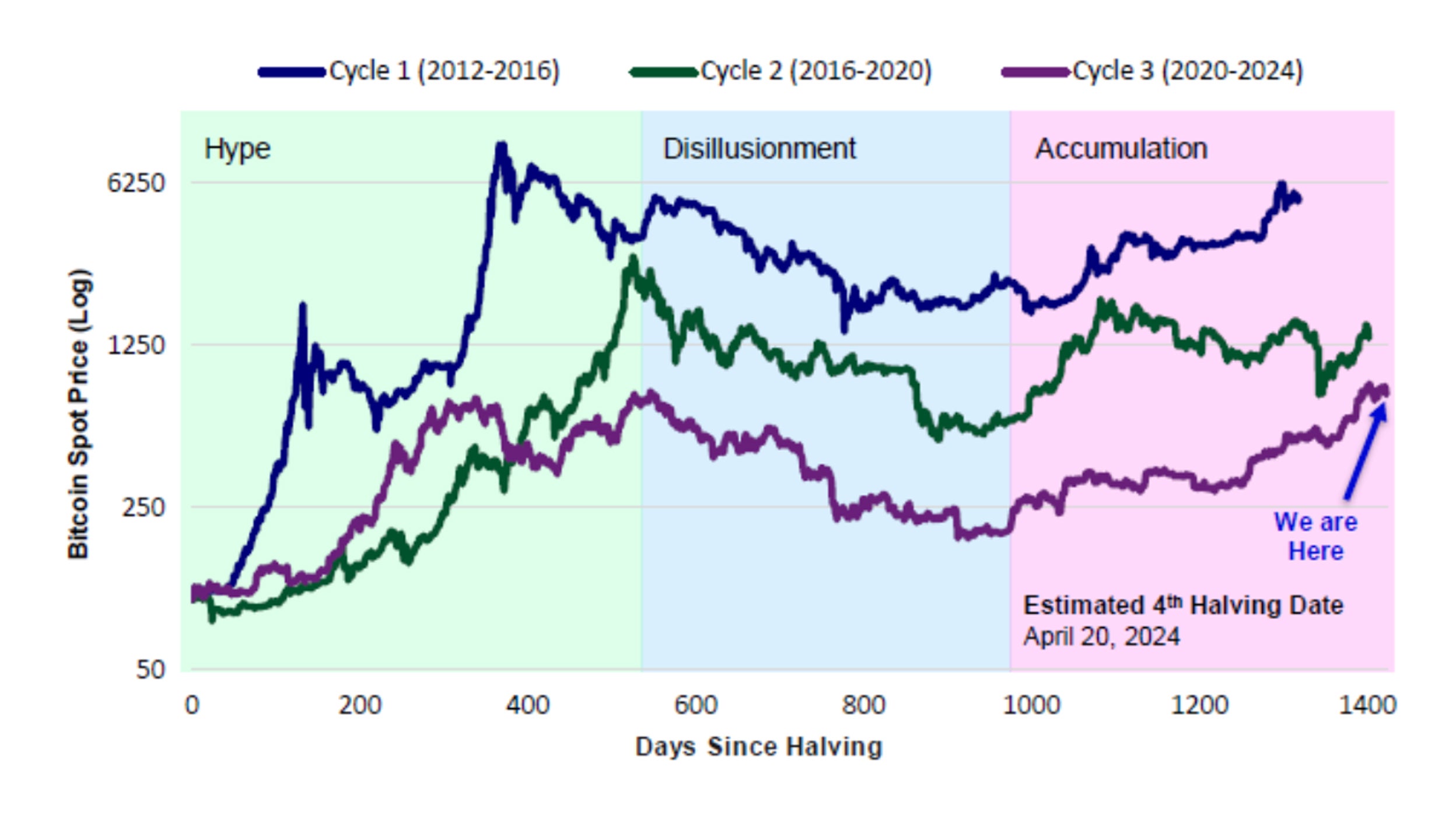

The crypto market is preparing for the next Bitcoin halving. This event is triggered by the creation of a precise number of blocks on the Bitcoin blockchain rather than a specific date on the calendar, but based on current supply patterns, it should occur on or around 20 April. What does the halving mean and what are the longer-term prospects for investors in Bitcoin?

One of the features built into the Bitcoin protocol helps manage a more orderly supply of the cryptocurrency and, in so doing, provide some protection to its value over time. Being an open blockchain, transactions are added to the chain in blocks through a process known as mining. Miners are incentivised to solve complex mathematical problems with the successful miner earning coins for their work. The “reward rate” is systematically halved after every 210,000 blocks have been mined.

The current rate is 6.25 Bitcoin rewarded per block, which will soon be cut in half to 3.125 Bitcoin. Such halving events occur roughly every four years and will continue until probably 2040, when the entire 21 million Bitcoin has been issued. With this month’s being the fourth such event, can anything be learned from the three previous events to help today’s Bitcoin investors?

Data: Invesco, Bloomberg; as at 18/04/2024

*The use of logarithm scaling compresses a wide range of values, ensures a consistent scaling of the exponential growth

As can be seen in the chart, the Bitcoin price rallied in the lead-up to each of the previous halving events (the right side of each timeline), including the one that’s just about to take place. The price rose even more strongly after each event, from a near-immediate response to the initial halving in 2012 to slightly more delayed reactions in both 2016 and 2020.

Bitcoin is trading around US$63,000 at the time of writing (16 April 2024), after reaching an all-time high of $73,750 in March. Today’s price represents a year-to-date increase of 43% and 107% in the past 12 months. Several factors have driven this spectacular price rise, starting with the Fed ending its rate-hiking cycle, followed by the launch of the first Bitcoin ETFs in the US, and now the market’s anticipation ahead of the next halving event. That the event is well-known in advance, even if the precise date is less certain, and given the market has several previous instances to analyse, you could reasonably assume that at least some of the impact of the halving is already reflected in the price.

The real question for investors is around the longer-term prospects. Bitcoin should benefit from lower interest rates and falling bond yields, as the opportunity cost of holding this non-yielding digital asset diminishes. Bitcoin may also play a key role in helping diversify a portfolio. It has shown very low correlation to equities in particular and, although it has higher volatility than traditional asset classes, a small allocation to Bitcoin could potentially improve the risk-adjusted performance profile of a typical portfolio.

Watch our recent webinar to learn more about Bitcoin, including why regular rebalancing is important for reducing volatility.

Five key factors suggest cryptocurrencies may continue their 2024 momentum and see positive performance in 2025.

While most standard equity benchmarks weight their constituents according to market capitalisation, an equal-weighted approach can sometimes make more sense. Discover more about equal-weight and how to gain broad equity exposure without the concentration risk.

Gold endured a choppy month, hitting a high of US$2,952 before ending February at US$2,858, a gain of 2.1% for the month. Geopolitics continued to play a significant role in the gold price. Discover insights into the key macro events and what we think you should be keeping your eyes on in the near term.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Views and opinions are based on current market conditions and are subject to change.

Data source: Invesco / Bloomberg as at 16 April 2024 unless otherwise stated.

This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality or investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

EMEA3515163/2024