Economy 2021: Global Economic Outlook

What kind of economic recovery can we expect to see in 2021?

Income investors appear to be stuck between a rock and a hard place. Either accept very low (in some cases negative) yields offered by conventional sources of income … or take on more risk by moving out the maturity spectrum or investing in lower-rated securities.

Here, we look at an option that may put investors on more comfortable ground. By adding these “hybrid” alternative income products to core fixed income holdings, you could potentially gain yield without compromising the overall volatility of your portfolio:

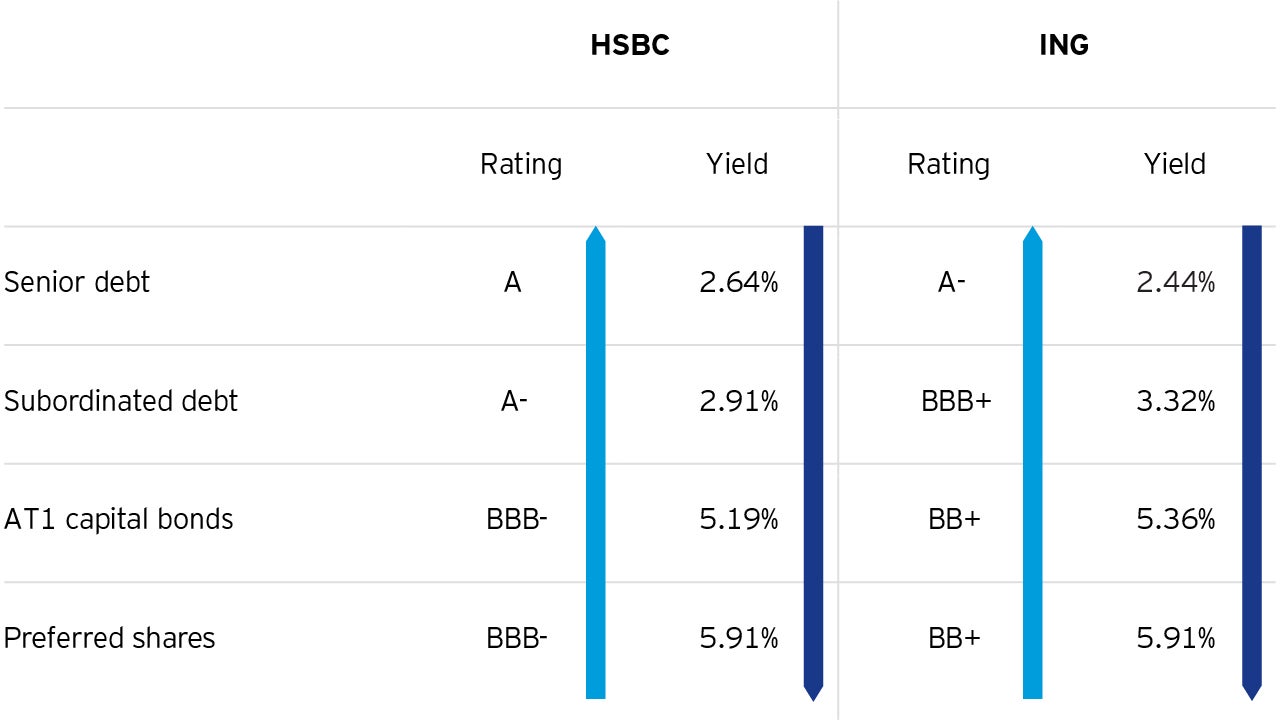

The yields offered by AT1s and Prefs are driven by the subordination of the securities within the issuer’s capital structure rather than the quality of the issuer itself.

As shown in these two examples, the AT1s and Prefs offer higher yields compared to senior debt issued by the same highly rated banks (in this case, HSBC and ING).

AT1s and Prefs are higher yielding segments of a bank’s capital structure. They offer investors yields generally found in the High Yield credit market but issued by banks and corporates often with investment grade credit ratings.

AT1s are high yielding perpetual bonds1 issued by European banks. First appearing after the 2008 financial crisis, they are designed to prevent contagion in the financial sector by acting as a readily available source of bank capital.

The bonds fall towards the bottom of the issuer's capital structure and are among the first debt instruments to absorb losses in times of financial distress. This position on the 'hierarchy of loss absorption' is what drives the higher yields during benign market conditions, where AT1 holders are compensated for assuming additional risk.

Like AT1s, Preferred shares are deeply subordinated in the capital structure and are often issued as a perpetual security with a call option, usually after five to seven years. For this analysis, we will focus on fixed-rate prefs. The other most common type, variable-rate prefs, have a fixed coupon until the first call date, and the rate then becomes floating or variable.

Prefs are primarily issued by banks and insurance companies for regulatory purposes but may also be issued by industrial and utility corporations. They are equities that exhibit bond-like characteristics such as having defined dividend or interest payments, defined par amounts and are rated by credit rating agencies. They can usually defer or skip payments without creating a default event.

1 Although AT1s are issued with no fixed maturity date, they are callable

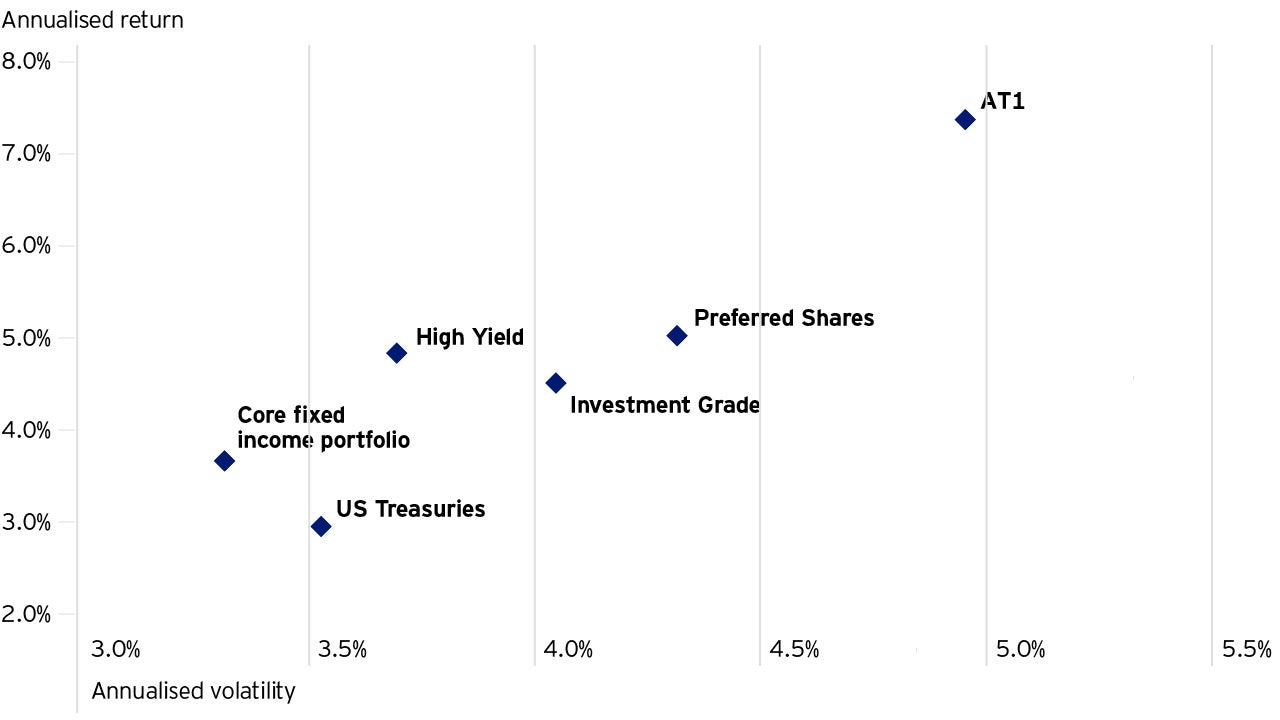

US Treasuries – often seen by investors as the “risk-free” asset class – have unsurprisingly exhibited the lowest volatility over the last five years but also the lowest returns. At the other end of the risk-return scale are AT1s, with the highest return but also the most volatility.

So, how can the inclusion of a more volatile asset improve the risk-return profile of the overall income portfolio? It is due to the correlation between the different assets.

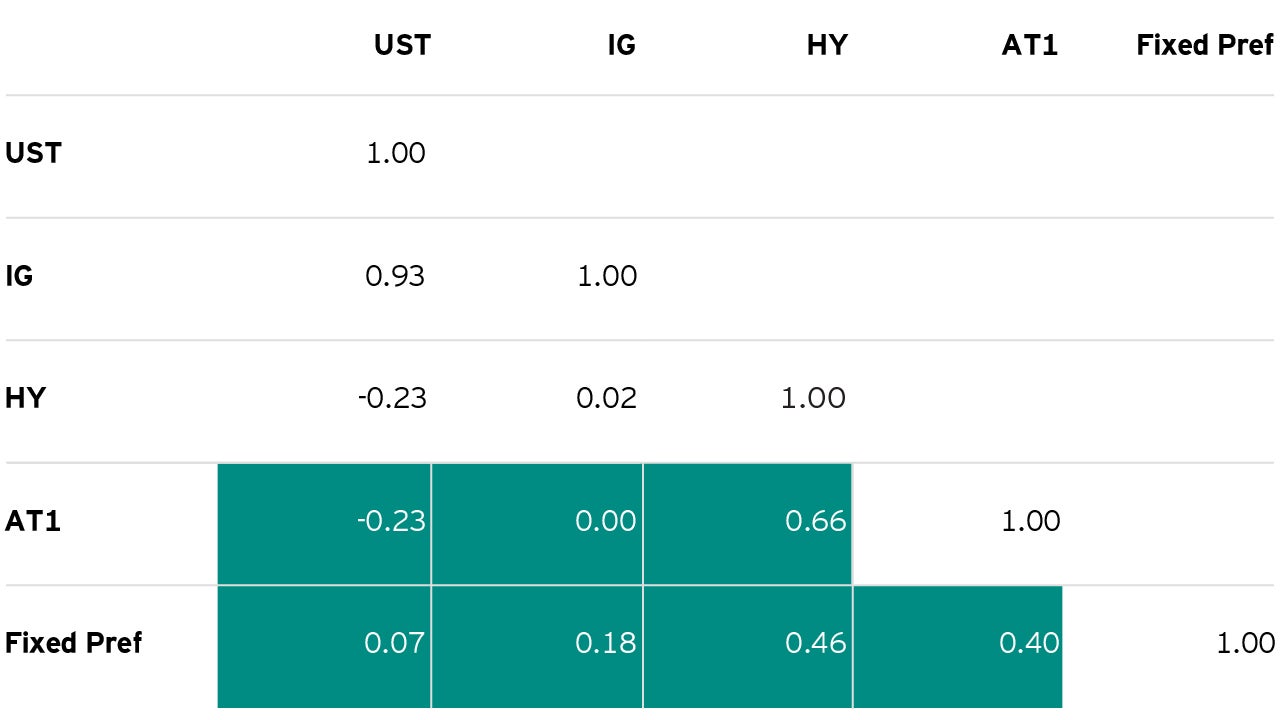

As you can see from the table below, not only do AT1s and Prefs exhibit low correlations to traditional fixed income assets such as Treasuries, investment grade and high yield credit, but they also have low correlations with each other. This could offer diversification benefits that can help spread risks within a fixed income portfolio while potentially boosting returns.

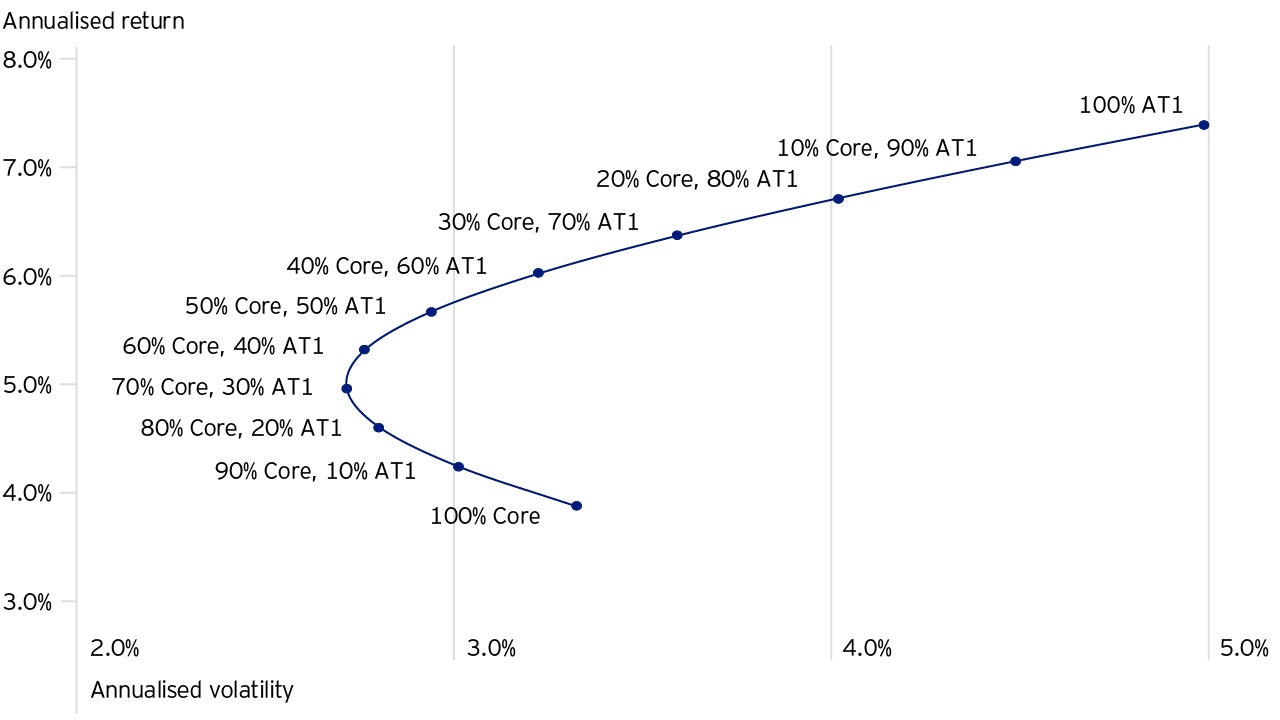

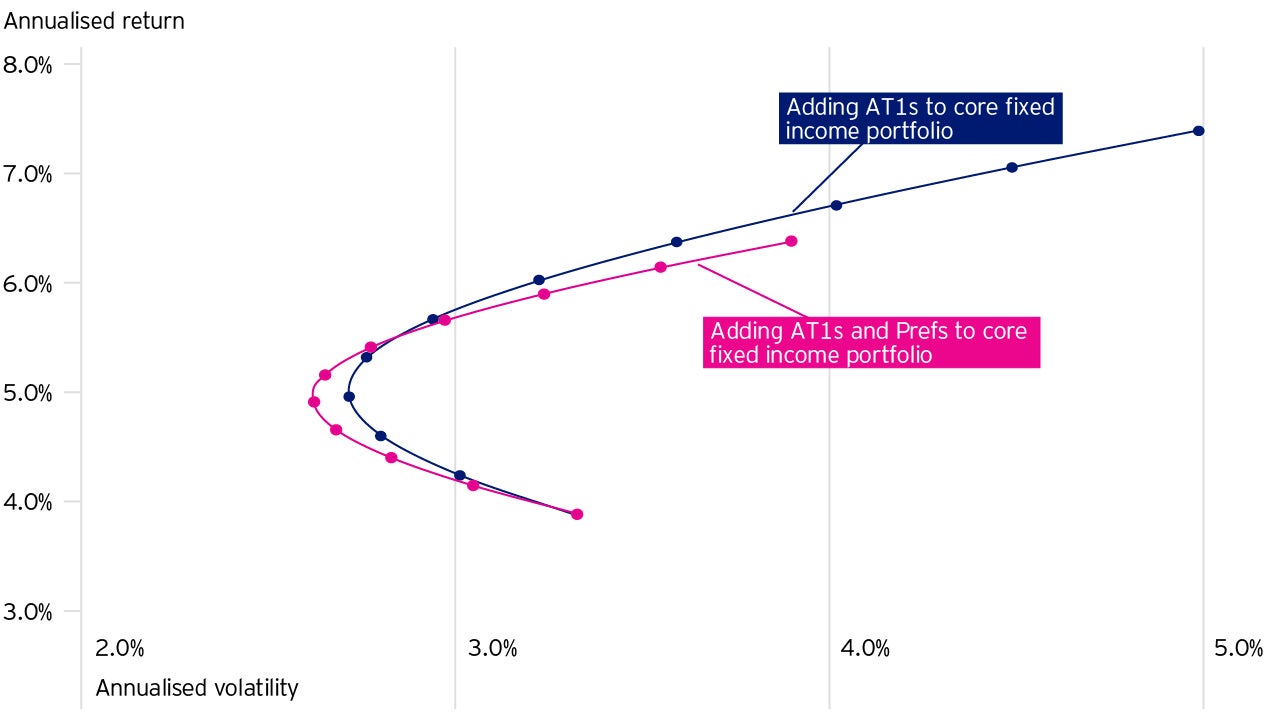

What does the addition of an allocation to AT1s do to the risk-return profile of a typical USD-denominated core fixed income portfolio*?

Due to their low correlation with core fixed income, our analysis shows that the inclusion of AT1s can not only improve the potential returns of the portfolio but an allocation of up to 60% could also reduce the volatility of returns.

We can take this analysis a step further by including fixed-rate preferred shares. Since they have a relatively low correlation with AT1s, adding an equal mix of the two hybrid securities may further improve the risk-reward profile of the overall fixed income portfolio.

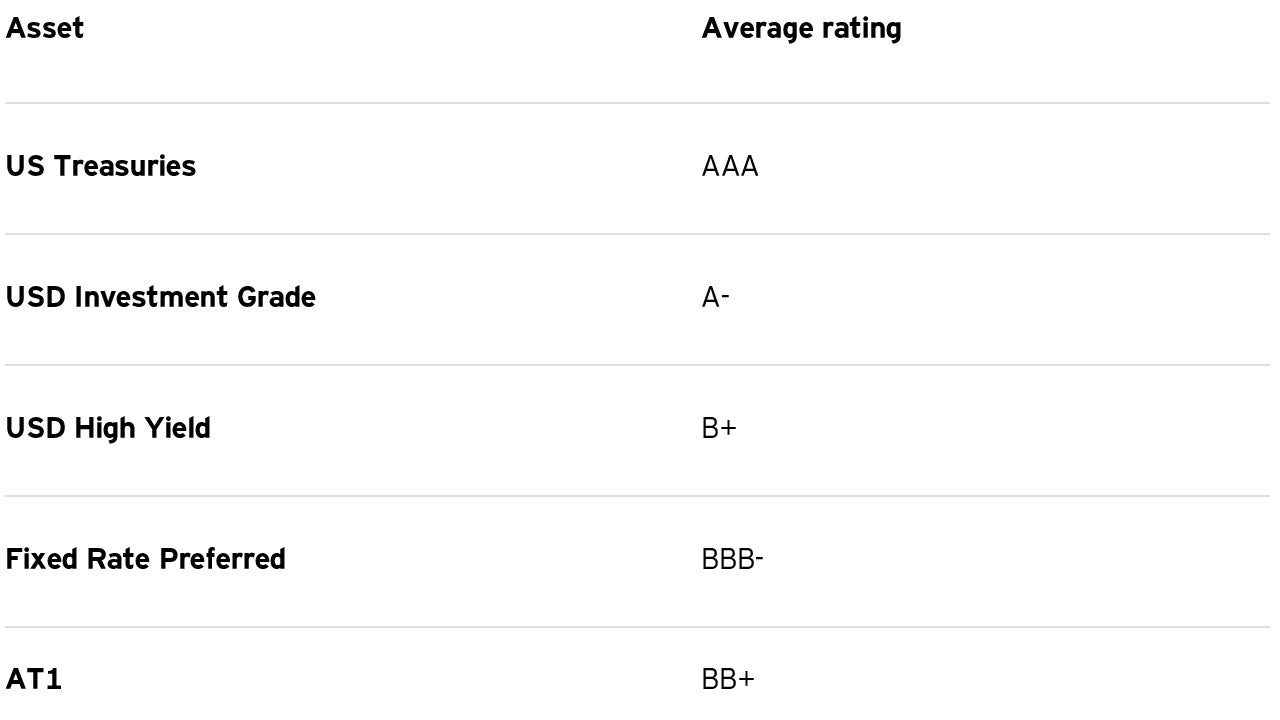

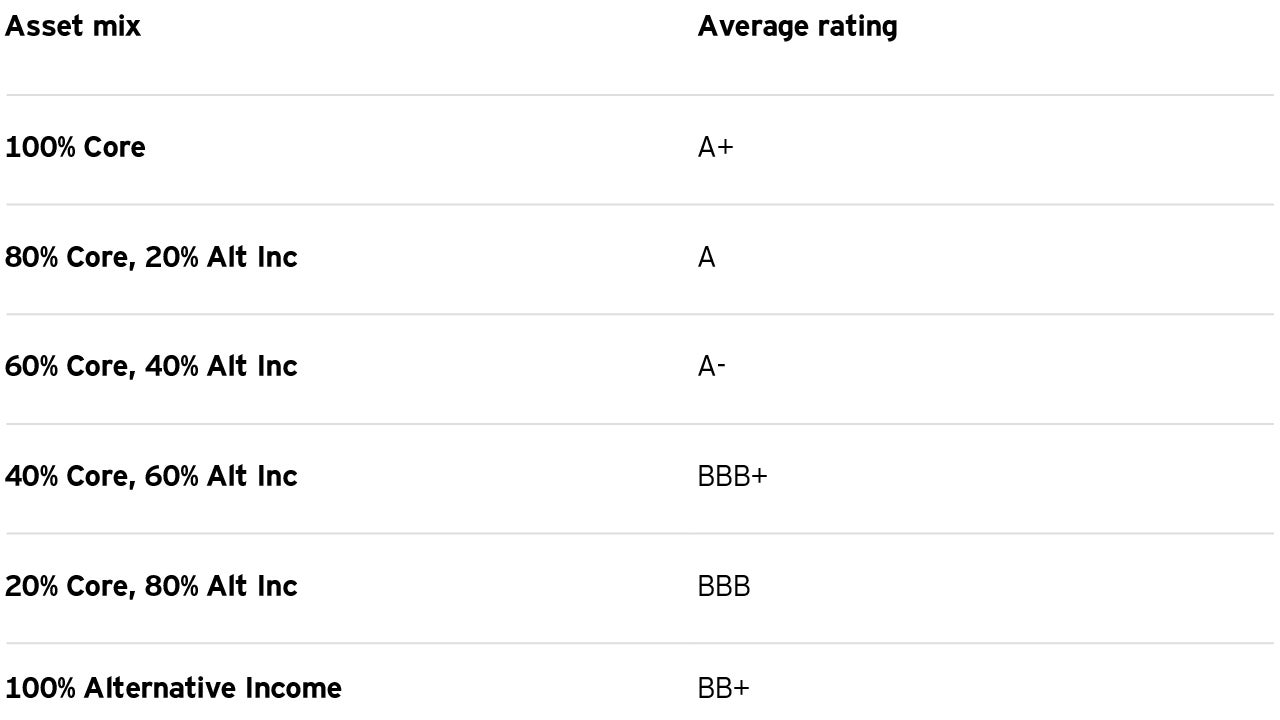

An important consideration is how the addition of alternative income products affects the credit quality of the portfolio. The following tables show the average credit rating given an equal allocation of AT1s and fixed-rate preferred shares to a core portfolio.

Selecting the most suitable allocation between any variety of assets will depend on several factors including the investment objective and risk tolerance. However, if you are looking for ways to increase overall yield without exposing your portfolio to considerably more risk, then you may want to explore alternative income products.

What kind of economic recovery can we expect to see in 2021?

This white paper addresses our short-term investment views based on our forward-looking global macro framework.

After a short, sharp recession (and more rapid rebound than we expected), the question is whether we are now at the start of a new global cycle?